CNC Controller Market Size, Growth, Global Trends, Forecast 2034

CNC Controller Market By Component (Hardware, Software, and Services), By Machine Type (Machine Center and Turning Center), By Axis Type (Two-axis, Three-axis, Four-axis, Five-axis, and Multi-axis), By Industry Vertical (Aerospace, Metals & Mining, Automotive, Medical Devices, Semiconductor & Electronics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

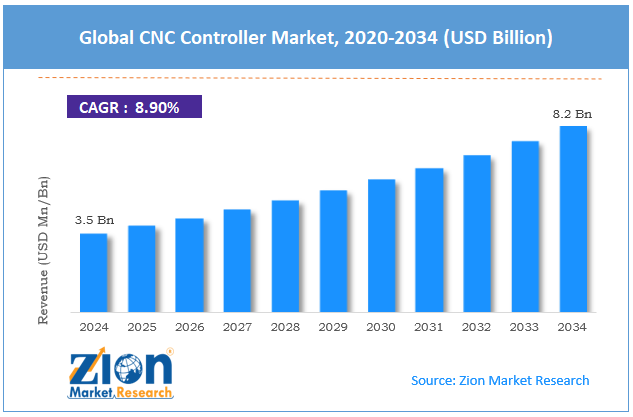

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.5 Billion | USD 8.2 Billion | 8.9% | 2024 |

CNC Controller Industry Perspective:

What will be the size of the global CNC controller market during the forecast period?

The global CNC controller market size was worth around USD 3.5 billion in 2024 and is predicted to grow to around USD 8.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.9% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global CNC controller market is estimated to grow annually at a CAGR of around 8.9% over the forecast period (2025-2034).

- In terms of revenue, the global CNC controller market size was valued at around USD 3.5 billion in 2024 and is projected to reach USD 8.2 billion by 2034.

- The advent of Industry 4.0 and the integration of smart manufacturing are expected to drive the CNC controller market.

- Based on the component, the hardware is expected to capture the highest revenue share over the projected period.

- Based on the machine type, the turning center is expected to hold the largest market share over the projected period.

- Based on the axis type, the three-axis segment is expected to capture a prominent revenue share over the analysis period.

- Based on the industry vertical, the automotive industry holds a prominent market share.

- Based on region, in 2024, the Asia Pacific region had the largest market share, exceeding 35%.

CNC Controller Market: Overview

A CNC (Computer Numerical Control) controller is an electrical device that instructs CNC machine tools on how to operate by translating programmed instructions into the machine's precise movements. The CNC machine uses G-code programming to control its operation through its main processing unit, which interprets machine commands to determine operating conditions such as position, speed, feed rate, as well as tool changes. CNC controllers coordinate motor, drive, and feedback systems to perform machining operations, including milling, turning, drilling, and grinding, with high precision, repeatability, and automated operation. All current CNC controllers offer advanced capabilities, including multi-axis control, real-time monitoring, a user-friendly interface, smart manufacturing connectivity, and CAD/CAM software compatibility. The automotive, aerospace, electronics, and industrial manufacturing sectors rely on these features to produce products with both speed and precision.

CNC Controller Market: Dynamics

Growth Drivers

Does the integration of Industry 4.0 and smart factories drive the growth of the CNC controller market?

The main reason the CNC controller market is growing is Industry 4.0, which is transforming factories into fully connected systems with automated manufacturing processes. CNC controllers are critical components of Industry 4.0 systems, enabling communication with a wide range of systems, including sensors, business software, robotics, and cloud platforms. The solution enables users to share data during remote diagnostics and predictive maintenance, resulting in improved performance and reduced downtime for equipment. Smart factories can perform multi-axis machining, manage automated equipment, and integrate with CAD/CAM and ERP applications through advanced CNC controllers. The market for advanced CNC controllers is growing rapidly as the automotive, aerospace, electronics, and heavy machinery industries adopt digital transformation to enhance operational efficiency, product accuracy, and flexibility.

Restraints

High initial investment & capital costs hamper the industry growth

The CNC controller market is facing increasing challenges as small and medium-sized enterprises (SMEs) struggle with large initial investments and ongoing capital costs. One needs to spend a lot of money up front on advanced CNC controllers and multi-axis machines that work with them, as well as software licenses, integration systems, and installation services. Businesses have to pay for new equipment, infrastructure improvements, training programs, and system changes, all of which add to the cost of implementation. Manufacturers need a lot of money to keep their businesses running in markets where costs matter. This makes it difficult to introduce automation because it requires substantial funding. The CNC controller market is growing more slowly, as many companies still use traditional and semi-automated methods that are more efficient over time.

Opportunities

Do innovative product launches offer a development opportunity for the CNC controller market?

There is a significant opportunity for growth in the CNC controller market through new product introductions. Manufacturers can meet the changing needs of the business by continually developing new concepts, such as AI-enabled controllers, high-speed multi-axis systems, touchscreen HMIs, cloud-connected platforms, and built-in predictive maintenance capabilities. These new technologies enhance machining precision, reduce downtime, improve the user experience, and facilitate integration with Industry 4.0 ecosystems. As production settings become more complex and require greater flexibility, new controllers enable companies to update outdated systems, streamline workflows, and boost efficiency.

For instance, in March 2024, FANUC America Corporation has launched its newest integrated PLC/CNC motion controller, Power Motion i-MODEL A Plus (PMi-A Plus). Users worldwide trust FANUC's control and servo technology, which delivers reliable performance and support for CNC machine tools. The PMi-A Plus system allows users to control all motion equipment through FANUC controls.

Challenges

Why does the shortage of skilled workforce pose a major challenge to the CNC controller industry’s growth?

The CNC controller sector is struggling to grow because there aren't enough skilled workers. Current CNC systems require specific technical skills to operate, program, and maintain the equipment. Modern CNC controllers enable multi-axis programming, CAD/CAM integration, and digital interfaces and monitoring systems, which sometimes use Internet of Things (IoT) technologies. The new features require manufacturers to provide their operators and technicians with proper training before they can use the features. The system results in manufacturing problems, which include low productivity and high error rates. Companies might avoid investing in modern CNC controller systems when they lack the necessary skills to operate them.

The process of training new employees consumes both financial and temporal resources, resulting in increased operational expenses and extended time before the business recovers its initial investment. The skills gap between workers and technological advancement impedes the rapid diffusion of automation in developing countries. The shortage of skilled programmers, engineers, and maintenance workers hinders industry growth, as precision manufacturing and smart factory integration require strong expertise.

CNC Controller Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | CNC Controller Market |

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2034 | USD 8.2 Billion |

| Growth Rate | CAGR of 8.9% |

| Number of Pages | 220 |

| Key Companies Covered | Siemens AG, DMG Mori Co Ltd., Mitsubishi Electric Corporation, Bosch Rexroth AG, Fagor Automation Corporation, Hurco Companies Inc, Wuhan Huzhong Numerical Control Co. Ltd, Okuma Corporation, FANUC Corporation, Delta Electronics Inc., HNC Electric Ltd., Newker CNC-Technology Co. Ltd., WMT CNC INDUSTRIAL CO. LTD, Luna, OSAI CNC, Syntec Technology Inc, Haas Automation Inc, and others. |

| Segments Covered | By Component, By Machine Type, By Axis Type, By Industry Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

CNC Controller Market: Segmentation

Component Insights

What factor drives the hardware segment into a dominant position in the CNC controller market?

The hardware is expected to capture the highest revenue share over the projected period. Business has grown due to greater demand for high-precision machining solutions that work across a wide range of manufacturing sectors. The automotive, aerospace, medical device, and electronics industries need controller technology that is reliable and capable of handling multiple axes, evaluating data quickly, and providing rapid feedback. As they build new factories and replace old equipment, manufacturers buy more powerful controllers with higher-performance processing units, more durable hardware, better motion control systems, and stronger user interfaces.

Machine Type Insights

Why does turning center hold the largest share in the CNC controller market?

The turning center is expected to hold the largest market share over the projected period. The segment's growth is driven by the continuous product expansion by key market players. For instance, Mitsubishi Electric India Pvt Ltd has launched its new M80LA Computer Numerical Control system, which employs advanced technologies to help factories in India operate more smoothly and intelligently. The company introduced its new M80LA turning system, which uses multi-axis and multi-system controls to keep up with the ever-changing needs of modern production.

Axis Type Insights

Why does the three-axis segment dominate the CNC controller industry?

The three-axis segment is expected to account for a significant share of revenue over the analysis period. The design remains the primary choice for multiple traditional machining methods that require standard machine operations. Three-axis CNC machines provide small- and medium-sized manufacturers with an economical, easy-to-operate solution that enables precise control during standard milling, drilling, and cutting processes. Three-axis controllers are the preferred choice for various industries, including automotive component production, metal fabrication, and general engineering, because they support high-volume machining operations that do not require advanced multi-axis operation.

Industry Vertical Insights

Why does the automotive segment dominate the CNC controller market?

The automotive industry holds a prominent market share. The demand for advanced machining technologies has increased because vehicle manufacturers need to produce more vehicles while maintaining higher quality standards and achieving precise results. The CNC controllers enable automation of engine component fabrication, transmission part production, chassis element manufacturing, and other complex assembly processes that need high accuracy and consistent results. The automotive industry has seen increased demand for specialized CNC machining systems, as electric vehicles require specialized manufacturing processes for their powertrains and battery components.

Regional Insights

Why does the Asia Pacific hold the largest share in the CNC controller market?

In 2024, the Asia Pacific region had the largest market share, exceeding 35%. The region is growing because China, Japan, and India are becoming more industrialized and making more goods. Countries need CNC machines because they receive significant government funding for their electronics, aerospace, and automotive industries. The government programs "Made in China 2025" and "Make in India" encourage firms to grow by providing benefits. The sector's growth trajectory is sustained by major CNC controller manufacturers in the region and ongoing technological progress.

CNC Controller Market: Competitive Analysis

The global CNC controller market is dominated by players like:

- Siemens AG

- DMG Mori Co Ltd.

- Mitsubishi Electric Corporation

- Bosch Rexroth AG

- Fagor Automation Corporation

- Hurco Companies Inc

- Wuhan Huzhong Numerical Control Co. Ltd

- Okuma Corporation

- FANUC Corporation

- Delta Electronics Inc.

- HNC Electric Ltd.

- Newker CNC-Technology Co. Ltd.

- WMT CNC INDUSTRIAL CO. LTD

- Luna

- OSAI CNC

- Syntec Technology Inc

- Haas Automation Inc

The global CNC controller market is segmented as follows:

By Component

- Hardware

- Software

- Services

By Machine Type

- Machine Center

- Turning Center

By Axis Type

- Two-axis

- Three-axis,

- Four-axis

- Five-axis

- Multi-axis

By Industry Vertical

- Aerospace

- Metals & Mining

- Automotive

- Medical Devices

- Semiconductor & Electronics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed