Global China Hyaluronidase Market Size, Share, Growth Analysis Report - Forecast 2034

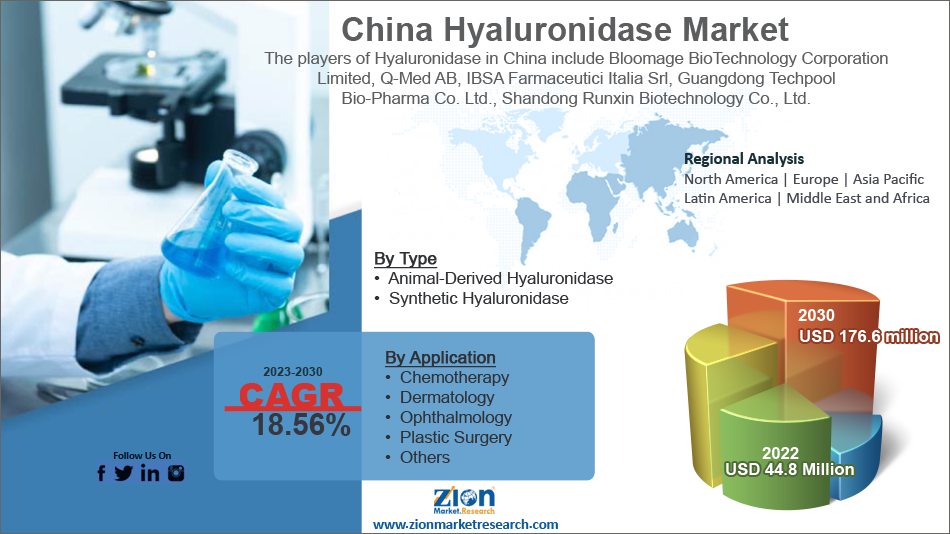

China Hyaluronidase Market By Type (Animal-Derived Hyaluronidase, Synthetic Hyaluronidase), By Application (Chemotherapy, Dermatology, Ophthalmology, Plastic Surgery, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 300.12 Million | USD 992.05 Million | 12.7% | 2024 |

China Hyaluronidase Market: Industry Perspective

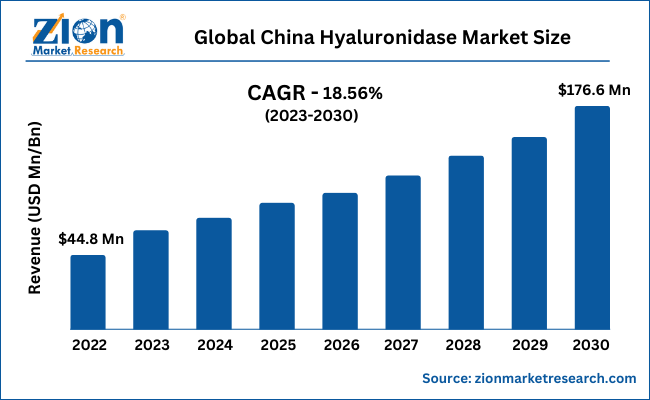

The global China hyaluronidase market size was worth around USD 300.12 Million in 2024 and is predicted to grow to around USD 992.05 Million by 2034 with a compound annual growth rate (CAGR) of roughly 12.7% between 2025 and 2034. The report analyzes the global China hyaluronidase market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the China hyaluronidase industry.

The market report offers remarkable insights into the essential drivers, opportunities, constraints, and challenges impacting the global China hyaluronidase industry.

China Hyaluronidase Market: Overview

The demand for Chinese hyaluronic acid-based dermal fillers is anticipated to rise at the highest growth rate during the forecast period. Due to its large market size, expanding population, and sedentary lifestyle, China's market has both medium to long-term potential.

In China, the overall sales of hyaluronic acid raw materials broke the record at about 430 metric tons in 2018, accounting for more than 80% of the worldwide sales volume. The demand for hyaluronic acid, which is widely used in treatments to maintain moisture in the skin, is also continuously growing as the cosmetic surgery industry in China is booming.

One fact behind China's escalating cosmetic surgery industry is the growth of the middle class in Chinese society. The rise in the buying power of more than 350 million Chinese lifted the level of living standards of citizens to allow them to aspire to other extravagances and standards of life. The procedure is no longer limited to enhancing the appearance of people with disfigured faces arising from incidents and injuries; for naturally good-looking people, it is now like having the "icing on the cake".

In contrast to other dermal fillers, sodium hyaluronic acid filler (HA filler) is the most mature commodity in China. Such a product has a higher rate in the beauty field. Moreover, hyaluronic acid is also one of the compositions in the human body and thus it also has good biocompatibility. HA filler is also generally used in the field of medicine and medical devices; it has been widely known for its protection and efficacy.

In recent decades, so many more international companies are preparing to import HA filler into the Chinese market, with many foreign companies already successfully opening their markets and welcoming clinics and beauty salons. For current HA fillers, comb purification or biological fermentation filtration is their key raw material, they are colorless and cross-linked. The HA filler market is showing a dramatic increase and in the following decades, there will be great market rivalry.

Key Insights

- As per the analysis shared by our research analyst, the global China hyaluronidase market is estimated to grow annually at a CAGR of around 12.7% over the forecast period (2025-2034).

- Regarding revenue, the global China hyaluronidase market size was valued at around USD 300.12 Million in 2024 and is projected to reach USD 992.05 Million by 2034.

- The China hyaluronidase market is projected to grow at a significant rate due to rising awareness about the benefits of hyaluronidase in various medical applications, increasing demand for aesthetic and cosmetic procedures, and growing prevalence of skin-related conditions and chronic diseases requiring its use for drug delivery and other therapeutic purposes.

- Based on Type, the Animal-Derived Hyaluronidase segment is expected to lead the global market.

- On the basis of Application, the Chemotherapy segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

China Hyaluronidase Market: Dynamics

Key Growth Drivers:

The China hyaluronidase market is being propelled by a rapid rise in aesthetic procedures (especially hyaluronic acid filler use and the need for safe corrective treatments), increasing adoption of subcutaneous drug delivery platforms that use hyaluronidase to improve absorption, and expanding clinical applications across ophthalmology, orthopedics and assisted-reproductive technologies — all supported by rising disposable incomes, urbanization, and growing patient awareness in China.

Restraints:

Market expansion is constrained by regulatory and quality-control hurdles (lengthy approvals and strict safety standards), pricing and reimbursement pressures for branded biologicals versus lower-cost alternatives, and concerns about adverse events or improper use in cosmetic settings that raise liability and clinician-training requirements—factors that slow adoption and increase the cost of market entry.

Opportunities:

Significant opportunities exist in China for locally produced recombinant/synthetic hyaluronidase (reducing cost and improving supply security), partnerships with pharma for co-formulated subcutaneous biologics, expansion into tier-2/3 cities as aesthetic services decentralize, and growth in hospital/clinic use for therapeutic indications (ophthalmic surgery, oncology supportive care, ART), creating windows for product innovation and market penetration.

Challenges:

Key challenges include competitive pressure from global and local manufacturers (including biosimilars and alternative enzymes), fragmented distribution and variable clinical practice standards across provinces, supply-chain vulnerabilities for enzyme sourcing, and the need for large-scale clinician education to ensure appropriate, safe use—all of which complicate scaling and consistent quality assurance in the China market.

China Hyaluronidase Market: Segmentation

The China hyaluronidase market is segmented based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on type, the market is bifurcated into Animal-Derived Hyaluronidase and Synthetic Hyaluronidase. The animal-derived hyaluronidase segment held the largest market share in 2022 and is further projected to grow exponentially during the forecast period. The animal-derived hyaluronidase segment of the market has been growing steadily in recent years. This is due to the established use of animal-derived hyaluronidase in medical settings and its efficacy in treating a range of conditions.

In addition, animal-derived hyaluronidase has a longer shelf life and is more stable than synthetic hyaluronidase, which makes it a preferred choice for certain applications. The growing demand for aesthetic treatments has also contributed to the growth of the animal-derived hyaluronidase market, as it is used to dissolve dermal fillers. Furthermore, the increasing prevalence of chronic diseases such as cancer and the need for rapid drug delivery has created new opportunities for the use of animal-derived hyaluronidase. With ongoing research and development, this segment of the market is expected to continue to grow in the future.

Based on application, the market is segmented into Chemotherapy, Dermatology, Ophthalmology, Plastic Surgery, and others. The Dermatology segment held the largest market share in 2022 and is further projected to grow exponentially during the forecast period. The dermatology segment of the China hyaluronidase market has been experiencing significant growth in recent years. This is due to the increasing demand for aesthetic treatments and the use of hyaluronidase to dissolve dermal fillers. Hyaluronidase is used to reverse the effects of hyaluronic acid-based fillers and to treat complications such as overfilling, nodules, and bumps.

The procedure is minimally invasive and provides immediate results, making it a popular choice for patients. Furthermore, the high prevalence of skin conditions such as acne, eczema, and psoriasis has also contributed to the growth of this segment of the market. With ongoing technological advancements and increasing awareness about the benefits of hyaluronidase, the dermatology segment of the China hyaluronidase market is expected to continue to grow in the future.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

China Hyaluronidase Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | China Hyaluronidase Market |

| Market Size in 2024 | USD 300.12 Million |

| Market Forecast in 2034 | USD 992.05 Million |

| Growth Rate | CAGR of 12.7% |

| Number of Pages | 230 |

| Key Companies Covered | Bloomage BioTechnology Corporation Limited, Q-Med AB, IBSA Farmaceutici Italia Srl, Guangdong Techpool Bio-Pharma Co. Ltd., Shandong Runxin Biotechnology Co., Ltd., China Resources Double-Crane Pharmaceutical Co., Ltd., Jiangsu Wanbang Biopharmaceuticals Co., Ltd., Lanzhou Institute of Biological Products Co. Ltd., Shanghai Sunflower Group Co., Ltd., Hangzhou Huadong Medicine Group Sanxing Pharmaceutical Co., Ltd., LifeTech Scientific Corporation, Shanghai Jingfeng Pharmaceutical Co., Ltd., Sichuan Kelun Pharmaceutical Co., Ltd., Hebei Changshan Biochemical Pharmaceutical Co., Ltd., Changzhou Institute of Pharmaceutical Research Co. Ltd., Henan Lingrui Pharmaceutical Co., Ltd., Shenzhen Techdow Pharmaceutical Co., Ltd., Wuhan Wuyao Pharmaceutical Co., Ltd., Zhejiang Haizheng Pharmaceuticals Co. Ltd., and Tonghua Dongbao Pharmaceutical Co., Ltd, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

China Hyaluronidase Market: Regional Analysis

The Chinese economy is very much a Research & Development (R&D) economy, which is the key driver of China's business growth. Rising disposable personal income and affecting average income combined with changing consumer preferences in the Chinese population are some of the major factors driving the growth of the business. In addition, the significant presence of the middle-aged population is also among the major factors contributing to the growth of the Chinese market.

In terms of revenue and consumption value, China is the second-largest cosmetics market in the world after the United States. It is also one of the fastest-growing and most promising business sectors in China. The beauty and personal care market is facing a booming demand for higher quality, luxury, powerful brand items, owing to increasing disposable income, urbanization, and social media influence. China's retail trade in cosmetics held almost 300 billion yuan in 2019 and is further projected to exceed nearly 400 billion yuan by 2023.

Another dynamic that drives a high number of Chinese people to use cosmetic surgery is the power of Korean culture. This is because of the Korean Wave's rising success through Korean dramas and TV programs that have become a sensation in China. Since cosmetic surgery in Korea is widespread, the Chinese people have been strongly influenced by television characters with their jaw in V line, unbridled eyes, and notable cheekbones. All these factors are expected to drive the hyaluronidase market in China

China Hyaluronidase Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the China hyaluronidase market on a global and regional basis.

Some of the players of Hyaluronidase in China include:

- Bloomage BioTechnology Corporation Limited

- Q-Med AB

- IBSA Farmaceutici Italia Srl

- Guangdong Techpool Bio-Pharma Co. Ltd.

- Shandong Runxin Biotechnology Co. Ltd.

- China Resources Double-Crane Pharmaceutical Co. Ltd.

- Jiangsu Wanbang Biopharmaceuticals Co. Ltd.

- Lanzhou Institute of Biological Products Co. Ltd.

- Shanghai Sunflower Group Co. Ltd.

- Hangzhou Huadong Medicine Group Sanxing Pharmaceutical Co. Ltd.

- LifeTech Scientific Corporation

- Shanghai Jingfeng Pharmaceutical Co. Ltd.

- Sichuan Kelun Pharmaceutical Co. Ltd.

- Hebei Changshan Biochemical Pharmaceutical Co. Ltd.

- Changzhou Institute of Pharmaceutical Research Co. Ltd.

- Henan Lingrui Pharmaceutical Co. Ltd.

- Shenzhen Techdow Pharmaceutical Co. Ltd.

- Wuhan Wuyao Pharmaceutical Co. Ltd.

- Zhejiang Haizheng Pharmaceuticals Co. Ltd.

- Tonghua Dongbao Pharmaceutical Co. Ltd.

The China hyaluronidase market report is segmented as follows:

By Type

- Animal-Derived Hyaluronidase

- Synthetic Hyaluronidase

By Application

- Chemotherapy

- Dermatology

- Ophthalmology

- Plastic Surgery

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Hyaluronidase is an enzyme that breaks down hyaluronic acid, a substance found in the body's tissues, to facilitate the spread of other injected drugs. It is used in medicine to improve the absorption and distribution of drugs and in cosmetic procedures to dissolve unwanted fillers and improve their appearance.

The global China hyaluronidase market is expected to grow due to increasing demand for cosmetic procedures, rising prevalence of skin disorders, and growing applications in medical fields such as ophthalmology and plastic surgery.

According to a study, the global China hyaluronidase market size was worth around USD 300.12 Million in 2024 and is expected to reach USD 992.05 Million by 2034.

The global China hyaluronidase market is expected to grow at a CAGR of 12.7% during the forecast period.

Asia-Pacific is expected to dominate the China hyaluronidase market over the forecast period.

Leading players in the global China hyaluronidase market include Bloomage BioTechnology Corporation Limited, Q-Med AB, IBSA Farmaceutici Italia Srl, Guangdong Techpool Bio-Pharma Co. Ltd., Shandong Runxin Biotechnology Co., Ltd., China Resources Double-Crane Pharmaceutical Co., Ltd., Jiangsu Wanbang Biopharmaceuticals Co., Ltd., Lanzhou Institute of Biological Products Co. Ltd., Shanghai Sunflower Group Co., Ltd., Hangzhou Huadong Medicine Group Sanxing Pharmaceutical Co., Ltd., LifeTech Scientific Corporation, Shanghai Jingfeng Pharmaceutical Co., Ltd., Sichuan Kelun Pharmaceutical Co., Ltd., Hebei Changshan Biochemical Pharmaceutical Co., Ltd., Changzhou Institute of Pharmaceutical Research Co. Ltd., Henan Lingrui Pharmaceutical Co., Ltd., Shenzhen Techdow Pharmaceutical Co., Ltd., Wuhan Wuyao Pharmaceutical Co., Ltd., Zhejiang Haizheng Pharmaceuticals Co. Ltd., and Tonghua Dongbao Pharmaceutical Co., Ltd, among others.

The report explores crucial aspects of the China hyaluronidase market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed