Cerium Foil Market Size, Share, Trends, Growth and Forecast 2034

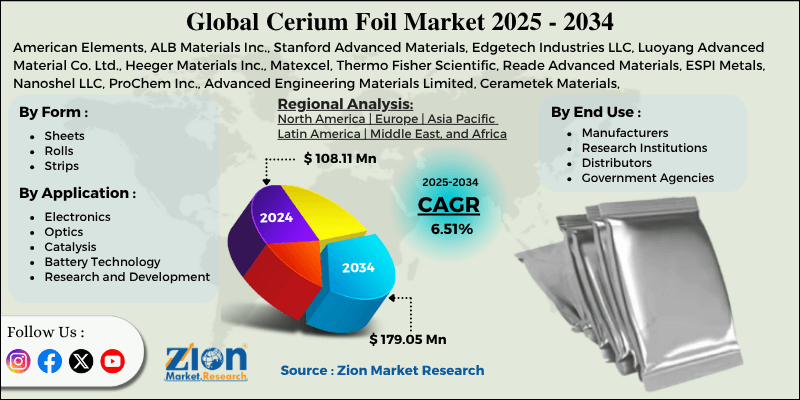

Cerium Foil Market By Form (Sheets, Rolls, Strips), By Application (Electronics, Optics, Catalysis, Battery Technology, Research and Development, and Others), By End-Use (Manufacturers, Research Institutions, Distributors, Government Agencies, Contractors), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

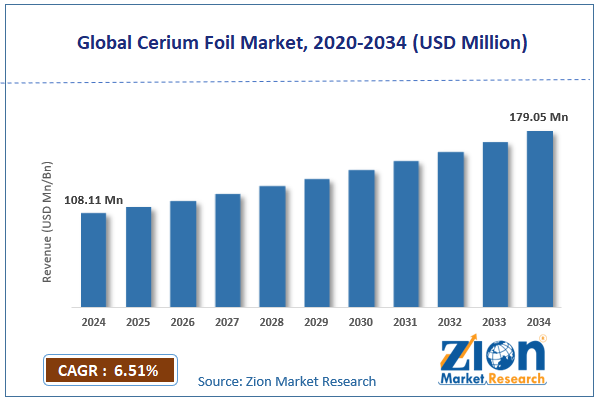

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 108.11 Million | USD 179.05 Million | 6.51% | 2024 |

Cerium Foil Industry Perspective:

The global cerium foil market size was approximately USD 108.11 million in 2024 and is projected to reach around USD 179.05 million by 2034, with a compound annual growth rate (CAGR) of approximately 6.51% between 2025 and 2034.

Cerium Foil Market: Overview

Cerium foil refers to a thin sheet made of cerium, a rare earth metal recognized for its high affinity and optimal reactivity with oxygen. It has primary applications in specialized industrial settings and research laboratories due to its exceptional physical and chemical properties, including its role as a getter material in electronics and vacuum tubes.

The global cerium foil market is projected to experience substantial growth, driven by rising demand for advanced materials, the expansion of the electronics industry, and increasing use in glass polishing and metal alloys. Cerium foil is largely used in scientific research for chemical reactivity. With the rising investments in quantum computing, nanomaterials, and rare earth trials, the global demand is increasing in government and academically funded research laboratories.

Cerium's ability to work as a getter for several gases, including oxygen, makes its foil version important in electronic manufacturing. This growth of sensitive semiconductor devices and ultra-high vacuum systems is fueling the adoption of cerium foil. In addition, cerium is a vital ingredient in high-quality glass polishing powders and mischmetal alloys. Cerium foil, despite its low volume, benefits from the universal uptrend in the demand for cerium-based products in these industries.

Nevertheless, the global market faces limitations due to its high reactivity, complex handling, and restricted global supply of cerium. Cerium foil is highly reactive with moisture and oxygen, which complicates transportation, processing, and storage. This restricts its large-scale commercialization. Despite cerium being comparatively abundant among rare earths, its high purity and refined nature are not widely available. This limits the availability of cerium foil and raises the costs.

Still, the global cerium foil industry benefits from several favorable factors, including integration in fuel cell technology and hydrogen storage, use in superconductors and quantum research, and growing investments in rare earth supply chains. Cerium foil is a promising material in solid oxide fuel cells and hydrogen absorption systems.

As hydrogen energy becomes the majority, it opens up new markets. As frontier technologies evolve, the demand for low-impurity and high-reactivity materials, such as cerium foil, is projected to grow in quantum device research and development, as well as in superconducting magnets.

Economies are increasingly investing in rare earth independence to decrease dependency on China. Cerium foil may benefit from refining technologies and novel processing plants worldwide.

Key Insights:

- As per the analysis shared by our research analyst, the global cerium foil market is estimated to grow annually at a CAGR of around 6.51% over the forecast period (2025-2034)

- In terms of revenue, the global cerium foil market size was valued at around USD 108.11 million in 2024 and is projected to reach USD 179.05 million by 2034.

- The cerium foil market is projected to grow significantly due to its increasing applications in various industries, the expansion of the aerospace and defense sectors, and advancements in rare earth metal processing.

- Based on form, the sheets segment is expected to lead the market, while the rolls segment is expected to grow considerably.

- Based on application, the research and development is the dominant segment, while the electronics segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-use, the research institutions segment is expected to lead the market, followed by the manufacturers segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Cerium Foil Market: Growth Drivers

The surging use of corrosion-resistant layers and advanced coatings boosts market growth

Cerium foil is progressively used for surface coatings and treatments in the marine, automotive, and construction sectors, primarily as an environmentally friendly corrosion inhibitor. It offers a safer alternative to hexavalent chromium, which is banned in several regions due to its carcinogenic effects.

The worldwide anti-corrosion coatings industry is anticipated to exceed $42 billion by 2027, driven by growing demand for high-performance and sustainable alternatives. Cerium's passivation features enhance its suitability for surface foil applications where thin protective layers are required, such as on ships, pipelines, and wind turbine blades.

Environmental regulations favoring cerium-based catalysts over substitutes fuel the market growth

Cerium foil has extensive applications in the fabrication of automotive catalytic converters due to its high release capacity and strong oxygen storage capabilities. With stricter global regulations for emissions, such as the U.S. EPA's Tier 4 standards and the European Union's Euro 7, the automotive industry is moving toward more efficient catalyst materials. These norms ultimately impact the progress of the global cerium foil market.

The European Commission sanctioned cerium as a vital raw material owing to its role in sustainable mobility solutions. This policy move is fueling research and development investments in the production of cerium foil, mainly for use in selective catalytic reduction systems and advanced diesel particulate filters.

Cerium Foil Market: Restraints

Substitution risk and restricted end-use applications unfavorably impact market progress

Cerium has comparatively lower-margin applications, unlike other rare earth elements like dysprosium or neodymium. Its application in foil form is limited to specialized industries, such as hydrogen storage research, nuclear materials, and optics. This increases the industry's vulnerability to changes in technological preferences.

This constricts the addressable market and restricts demand expansion beyond academic or niche uses.

Cerium Foil Market: Opportunities

The development of conversion layers and eco-friendly coatings positively impacts market growth

Strict ecological regulations banning hazardous chemicals like chromium VI in coatings have created opportunities for cerium-based substitutes, thereby fueling their demand. Cerium foil is largely used in the manufacturing of corrosion-resistant layers and conversion coatings in the marine, automotive, and aerospace industries. These applications notably fuel the global cerium foil industry.

The chrome replacement technologies market is projected to surpass $6.5 billion by 2028, with cerium solutions gaining a notable share due to their high adhesion strength, compatibility with steel and aluminum substrates, and non-toxicity.

Cerium Foil Market: Challenges

Challenges with storage, handling, and transportation limit the market growth

Cerium metal is highly reactive in the form of foil. It oxidizes immediately when exposed to moisture or air and is highly flammable under specific conditions. This increases its challenges for storage and transportation, especially for bulk logistics and international shipping.

A small warehouse fire in Hamburg, Germany, occurred in October 2024 due to the improper storage of cerium foil. This prompted renewed scrutiny of logistics compliance in the European Union.

Cerium Foil Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cerium Foil Market |

| Market Size in 2024 | USD 108.11 Million |

| Market Forecast in 2034 | USD 179.05 Million |

| Growth Rate | CAGR of 6.51% |

| Number of Pages | 213 |

| Key Companies Covered | American Elements, ALB Materials Inc., Stanford Advanced Materials, Edgetech Industries LLC, Luoyang Advanced Material Co. Ltd., Heeger Materials Inc., Matexcel, Thermo Fisher Scientific, Reade Advanced Materials, ESPI Metals, Nanoshel LLC, ProChem Inc., Advanced Engineering Materials Limited, Cerametek Materials, SkySpring Nanomaterials Inc., and others. |

| Segments Covered | By Form, By Application, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cerium Foil Market: Segmentation

The global cerium foil market is segmented by form, application, end-use, and region.

Based on form, the global cerium foil industry is divided into sheets, rolls, and strips. The sheet category accounted for a substantial share of the market due to its compatibility with vacuum-based and custom fabrication processes. It is broadly used due to its ease of handling and suitability for industrial and laboratory applications. Sheets are highly demanded in semiconductor labs, research institutions, and metal processing, where manageable dimensions and high surface uniformity are vital. Their rigid and flat form allows for material testing and experimental setups.

Based on application, the global cerium foil market is segmented as electronics, optics, catalysis, battery technology, research and development, and others. The research and development segment captured a noticeable share of the market due to its high reactivity, unique chemical behavior, and oxygen-gettering features. These properties make them ideal for experimental use in nuclear physics, materials science, and studies of rare-earth chemistry.

Government laboratories, universities, and advanced research institutes in Europe, the United States, Japan, and China primarily utilize cerium foil for synthesizing novel materials, studying reactivity in controlled environments, and evaluating catalytic behavior. Its use here benefits from increasing funding in scientific infrastructure and rare earth innovation globally.

Based on end-use, the global market is segmented into manufacturers, research institutions, distributors, government agencies, and contractors. The research institutions segment registered a substantial share of the market. National laboratories, universities, and advanced R&D centers often use cerium foil in experimental research, comprising catalysis, chemistry, material science, and vacuum systems.

The demand is fueled by the material's unique chemical purity and reactivity, which are essential in controlled research environments. Economies such as Germany, Japan, China, and the United States are the leading contributors, backed by substantial investments in rare earth exploration and scientific innovation.

Cerium Foil Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific held a dominant position in the cerium foil market due to its dominance in rare earth mining and processing, as well as the rapid growth of the semiconductor and electronics industries, and increasing automotive initiatives and clean energy projects. The Asia Pacific, especially China, leads as the major producer of rare earth elements, comprising cerium. The region has a well-developed, vertically integrated, and extensive REE supply chain, allowing for large-scale and efficient production of cerium foil. This local access to raw materials promises a continuous supply for downstream applications and advantages.

The region leads the global semiconductor and electronics industry, accounting for 70% of the semiconductor manufacturing supply. Cerium foil is widely used in vacuum deposition systems, cleanroom equipment, and advanced material layering, contributing to this growth. Nations such as Japan, Taiwan, and South Korea are investing in fab facilities and R&D to produce high-purity foil.

In addition, APAC is a global leader in the adoption of EVs and clean energy solutions, both of which use cerium-based elements. China's EV industry accounted for 58% of global sales in 2024, driving demand for fuel cell materials and catalytic converters that include cerium.

Although a smaller component of cerium foil, it plays a crucial role in energy-related research and development, as well as in high-performance prototypes.

North America dominates the global cerium foil industry as the second-largest region, driven by the presence of semiconductor facilities and advanced manufacturing facilities, the growing use in the aerospace and defense sectors, and the development of the supply chain for active rare earths.

North America houses superior semiconductor, aerospace, and fab manufacturing units, where materials like cerium are vital. Cerium foil serves as a material testing and getter application in these sensitive setups.

NASA and the United States Department of Defense support the use of rare earth materials, which include cerium, for satellites, advanced weapon systems, and space exploration tools. Cerium foil is used in specialized sensors, electronic systems, and propulsion research, where chemical stability and precision are paramount.

In response to China's dominance in rare earths, the United States is accelerating its local mining and processing capabilities. Such localized access to cerium enables a continuous supply for downstream industrial use and foil production.

Cerium Foil Market: Competitive Analysis

The key players in the global cerium foil market are:

- American Elements

- ALB Materials Inc.

- Stanford Advanced Materials

- Edgetech Industries LLC

- Luoyang Advanced Material Co. Ltd.

- Heeger Materials Inc.

- Matexcel

- Thermo Fisher Scientific

- Reade Advanced Materials

- ESPI Metals

- Nanoshel LLC

- ProChem Inc.

- Advanced Engineering Materials Limited

- Cerametek Materials

- SkySpring Nanomaterials Inc.

Cerium Foil Market: Key Market Trends

Surging adoption of clean energy technologies:

Cerium foil is widely used in hydrogen storage and fuel cell research due to its high reactivity and oxygen-adsorbing characteristics. The inclination towards renewable energy is fueling experimental demand for cerium-grounded materials.

Increasing demand in semiconductor manufacturing:

With the universal semiconductor market expanding, cerium foil holds applications in deposition systems and vacuum environments. Its stability and purity make it highly suitable for high-tech electronics processing.

The global cerium foil market is segmented as follows:

By Form

- Sheets

- Rolls

- Strips

By Application

- Electronics

- Optics

- Catalysis

- Battery Technology

- Research and Development

- Others

By End Use

- Manufacturers

- Research Institutions

- Distributors

- Government Agencies

- Contractors

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Cerium foil refers to a thin sheet made of cerium, a rare earth metal recognized for its high affinity and optimal reactivity with oxygen. It has primary applications in specialized industrial settings and research laboratories due to its exceptional physical and chemical properties, including its role as a getter material in electronics and vacuum tubes.

The global cerium foil market is projected to grow due to expansion in the electronics sector, mounting adoption in catalytic converters, and increasing use in glass polishing and metal alloys.

According to study, the global cerium foil market size was worth around USD 108.11 million in 2024 and is predicted to grow to around USD 179.05 million by 2034.

The CAGR value of the cerium foil market is expected to be approximately 6.51% from 2025 to 2034.

Asia Pacific is expected to lead the global cerium foil market during the forecast period.

The key players profiled in the global cerium foil market include American Elements, ALB Materials Inc., Stanford Advanced Materials, Edgetech Industries LLC, Luoyang Advanced Material Co., Ltd., Heeger Materials Inc., Matexcel, Thermo Fisher Scientific, Reade Advanced Materials, ESPI Metals, Nanoshel LLC, ProChem, Inc., Advanced Engineering Materials Limited, Cerametek Materials, and SkySpring Nanomaterials, Inc.

The report examines key aspects of the cerium foil market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed