Global Cellulosic Ethanol Market Size, Share, Growth Analysis Report - Forecast 2034

Cellulosic Ethanol Market By Feedstock (Agricultural Residue (Corn Stover, Wheat Straw, Sugarcane Bagasse), Forest Residue (Wood Chips, Sawdust, Bark), Energy Crops (Switchgrass, Miscanthus), Municipal Solid Waste (MSW), Woody Biomass, Non-Woody Biomass, Others), By Application (Gasoline, Detergent), End-Use (Transportation (Automotive), Industrial, Power Generation, Chemical, Others), Production Process (Enzymatic Hydrolysis, Acid Hydrolysis, Thermochemical Conversion), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.69 Billion | USD 14.94 Billion | 15% | 2024 |

Cellulosic Ethanol Market: Industry Perspective

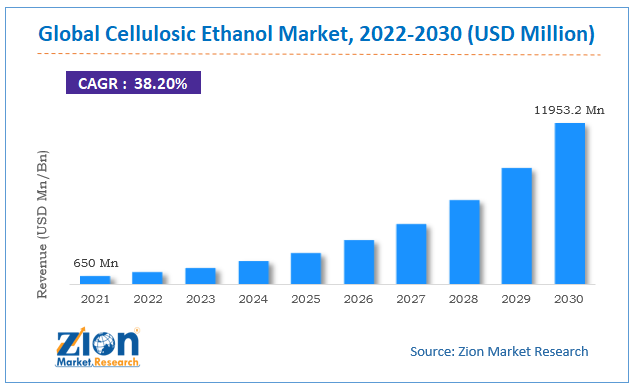

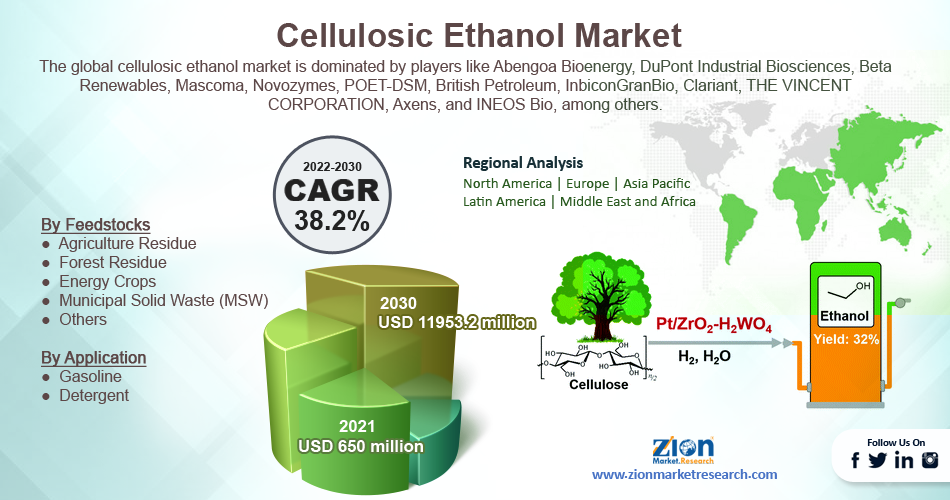

The global cellulosic ethanol market size was worth around USD 3.69 Billion in 2024 and is predicted to grow to around USD 14.94 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 15% between 2025 and 2034.

The report analyzes the global cellulosic ethanol market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cellulosic ethanol industry.

Cellulosic Ethanol Market: Overview

Cellulosic ethanol is a biofuel that is made from plant, grass, and wood waste. Cellulose, like hemicelluloses and lignin, is a plant material derived from lignocellulose. Cellulosic materials utilized in the manufacturing of ethanol include Panicum virgatum, wood chips, and various byproducts of trees.

When compared to other sources such as corn and sugar cane, ethanol synthesis from lignocellulose has the benefit of ample raw materials. Another aspect driving cellulosic ethanol production towards lignocellulose is the amount of processing time required to give microorganisms with sugar monomers that create ethanol. Switchgrass and miscanthus have recently been explored as potential source materials for ethanol production due to their high productivity per acre.

Key Insights

- As per the analysis shared by our research analyst, the global cellulosic ethanol market is estimated to grow annually at a CAGR of around 15% over the forecast period (2025-2034).

- Regarding revenue, the global cellulosic ethanol market size was valued at around USD 3.69 Billion in 2024 and is projected to reach USD 14.94 Billion by 2034.

- The cellulosic ethanol market is projected to grow at a significant rate due to increasing focus on renewable energy, government incentives for biofuels, and technological advancements in biomass conversion processes.

- Based on Feedstock, the Agricultural Residue (Corn Stover segment is expected to lead the global market.

- On the basis of Application, the Gasoline segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-Use, the Transportation (Automotive) segment is projected to swipe the largest market share.

- By Production Process, the Enzymatic Hydrolysis segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Cellulosic Ethanol Market: Growth Drivers

Increasing government initiatives to drive the market growth

Several reasons, including rising urbanization, rising energy consumption, and increased environmental concerns, are projected to accelerate global cellulosic ethanol use. Aside from that, bioethanol's lower carbon footprint compared to conventional fuels, as well as government backing - both policy and tariffs - are expected to drive its acceptance as a transportation fuel across different locations. Various legislation for clean air (clean air act) and GHG (greenhouse gas) reduction, among other things, are expected to play a significant role in the industry's growth.

The European Union sponsored the Bioethanol for Sustainable Transportation (BEST) initiative, which includes six countries, to develop bioethanol vehicles. The government has introduced the "Pradhan Mantri JI-VAN Yojana" to help fund integrated bio-ethanol projects that employ lignocellulosic biomass and other renewable feedstocks, according to the Ministry of Petroleum and Natural Gas. From 2018-19 to 2023-24, this scheme would provide financial support to twelve integrated bioethanol facilities using lignocellulosic biomass and other renewable feedstock, with a total financial investment of Rs 1969.50 crore, as well as support to ten 2G technology demonstration projects. These government initiatives are expected to boost demand for the global cellulosic ethanol market.

Cellulosic Ethanol Market: Restraints

Lack of infrastructure limits the market growth

Cellulosic ethanol cannot be carried through pipes; instead, it must be transported by vehicle, which could pose a problem for the infrastructure used to distribute it. Geographical areas suitable for the production of feedstock and the demand for ethanol may vary, necessitating the installation of substantial infrastructures, such as road and rail networks. Furthermore, more money is required for processing and storage, especially in the preliminary stage. Thus, a lack of infrastructure restrains market expansion.

Cellulosic Ethanol Market: Opportunities

Increasing research and development activities

The increased research activity for sustainable bioethanol production systems is a key trend in the bioethanol sector. Bioethanol production from plant waste that can be utilized to produce second-generation bioethanol (SGB) is being widely researched. Several projects have been launched to successfully replace gasoline and diesel with bioethanol. Scientists at Kanazawa University's Institute of Science and Engineering, for example, developed novel solvent combinations in August 2021 to break down the strong structure of plant cellulose to manufacture bioethanol. These novel solvents work under moderate circumstances, have lesser toxicity, and are more environmentally friendly than existing solvents. Furthermore, the NILE (New Improvements for Lignocellulosic Ethanol) project brings together 21 industrial and scientific entities from 11 member countries to pursue bioethanol manufacturing research.

Cellulosic Ethanol Market: Challenges

Increasing electric vehicle market

The global cellulosic ethanol market is expected to be constrained in the near future as the use of electric vehicles increases. Sales of electric vehicles have increased in recent years, and this trend is predicted to continue during the forecast period. According to the International Energy Agency, the worldwide electric vehicle stock topped ten million units in 2020, a 43% increase from 2019. The global electric vehicle market is booming. As a result, the demand for fossil and bioethanol fuels would fall. As a result, the bioethanol market is expected to be stifled in the near future as the use of electric vehicles grows.

Cellulosic Ethanol Market: Segmentation

The global cellulosic ethanol market is segmented based on feedstocks, applications, and region

Based on Feedstock, the global cellulosic ethanol market is divided into Agricultural Residue (Corn Stover, Wheat Straw, Sugarcane Bagasse), Forest Residue (Wood Chips, Sawdust, Bark), Energy Crops (Switchgrass, Miscanthus), Municipal Solid Waste (MSW), Woody Biomass, Non-Woody Biomass, Others.

On the basis of Application, the global cellulosic ethanol market is bifurcated into Gasoline, Detergent.

By End-Use, the global cellulosic ethanol market is split into Transportation (Automotive), Industrial, Power Generation, Chemical, Others.

In terms of Production Process, the global cellulosic ethanol market is categorized into Enzymatic Hydrolysis, Acid Hydrolysis, Thermochemical Conversion.

Cellulosic Ethanol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cellulosic Ethanol Market |

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2034 | USD 14.94 Billion |

| Growth Rate | CAGR of 15% |

| Number of Pages | 193 |

| Key Companies Covered | Abengoa Bioenergy, DuPont Industrial Biosciences, Beta Renewables, Mascoma, Novozymes, POET-DSM, British Petroleum, Inbicon, GranBio, INEOS Bio, Raízen Energia, Alliance Bio-Products Inc., Aemetis Inc., Enerkem Inc., Iogen Corporation, Praj Industries, BlueFire Renewables Inc., Borregaard ASA, Clariant International Ltd., Etip Bioenergy, and others. |

| Segments Covered | By Feedstock, By Application, By End-Use, By Production Process, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In June 2022, Clariant, a focused, sustainable, and innovative specialty chemical company, announced that it has produced the first commercial cellulosic ethanol at its sunliquid® production plant in Podari, Romania. The entire offtake is contracted with a multi-year agreement to Shell, a leading global energy company. Over the last six months, the plant underwent a thorough commissioning process resulting in the successful start of production. Approximately 50,000 tons of second-generation biofuels will be derived from 250,000 tons of locally sourced agricultural residues. The cellulosic ethanol produced at this plant can be applied as a drop-in solution for fuel blending but also offers further downstream application opportunities for sustainable aviation fuel and bio-based chemicals.

- In June 2021, POET, a US-based biofuel company, acquired the bioethanol assets from Flint Hills Resources for an undisclosed amount. This acquisition would bring even more plant-based, high-quality biofuels and bioproducts to the customers and expand the company’s production capacity by 40%.

Cellulosic Ethanol Market: Regional Analysis

North America held the largest market share in 2025

North America held the largest global cellulosic ethanol market share of more than 35% in 2021 and is expected to continue this pattern over the forecast period. The growth in the region is attributed to the increasing demand for clean biofuel and the cheap availability of feedstocks. The United States is the largest producer of bioethanol globally, followed by Brazil, China, India, and Canada. It is also the largest consumer of bioethanol. For instance, according to US Energy Information Administration, In 2021, U.S. fuel ethanol production (as measured by renewable fuels and oxygenate plant net production of fuel ethanol) equaled about 15 billion gallons (0.4 billion barrels). Moreover, the rising number of vehicles in the North American region also fuels market expansion. For instance, as per secondary analysis,

The total number of automobiles produced in North America in 2021 was around 1,34,27,869 units, up from 1,33,74,404 units in 2020. E15 is compatible with approximately 93% of the country's 263 million registered autos. Furthermore, around 22 million flex-fuel vehicles (FFVs) in the United States can run on ethanol blends up to E85. Thus, this is expected to boost the growth of the cellulosic ethanol market during the forecast period.

On the other hand, Europe is expected to hold a significant market share over the forecast period owing to the increased environmental concerns and increasing government initiatives in the region. For instance, according to the International Energy Agency, The "Fit for 55" package in the European Union contains a proposal for a transport GHG intensity requirement that would double the existing renewable energy target for transport of 14% by 2030. (European Commission, 2021b).

A projected 2% SAF blending mandate by 2025 under the ReFuelEU Aviation effort (European Commission 2021d) and a 2% GHG improvement for shipping under FuelEU Maritime are also included in the package (European Commission, 2021e). Therefore, government support is expected to flourish the market expansion in the region.

Cellulosic Ethanol Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the cellulosic ethanol market on a global and regional basis.

The global cellulosic ethanol market is dominated by players like:

- Abengoa Bioenergy

- DuPont Industrial Biosciences

- Beta Renewables

- Mascoma

- Novozymes

- POET-DSM

- British Petroleum

- Inbicon

- GranBio

- INEOS Bio

- Raízen Energia

- Alliance Bio-Products Inc.

- Aemetis Inc.

- Enerkem Inc.

- Iogen Corporation

- Praj Industries

- BlueFire Renewables Inc.

- Borregaard ASA

- Clariant International Ltd.

- Etip Bioenergy

The global cellulosic ethanol market is segmented as follows;

By Feedstock

- Agricultural Residue (Corn Stover

- Wheat Straw

- Sugarcane Bagasse)

- Forest Residue (Wood Chips

- Sawdust

- Bark)

- Energy Crops (Switchgrass

- Miscanthus)

- Municipal Solid Waste (MSW)

- Wo

By Application

- Gasoline

- Detergent

By End-Use

- Transportation (Automotive)

- Industrial

- Power Generation

- Chemical

- Others

By Production Process

- Enzymatic Hydrolysis

- Acid Hydrolysis

- Thermochemical Conversion

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global cellulosic ethanol market is expected to grow due to the push for renewable fuels, government mandates for biofuel blending, and advances in biomass conversion technologies.

According to a study, the global cellulosic ethanol market size was worth around USD 3.69 Billion in 2024 and is expected to reach USD 14.94 Billion by 2034.

The global cellulosic ethanol market is expected to grow at a CAGR of 15% during the forecast period.

North America is expected to dominate the cellulosic ethanol market over the forecast period.

Leading players in the global cellulosic ethanol market include Abengoa Bioenergy, DuPont Industrial Biosciences, Beta Renewables, Mascoma, Novozymes, POET-DSM, British Petroleum, Inbicon, GranBio, INEOS Bio, Raízen Energia, Alliance Bio-Products Inc., Aemetis Inc., Enerkem Inc., Iogen Corporation, Praj Industries, BlueFire Renewables Inc., Borregaard ASA, Clariant International Ltd., Etip Bioenergy, among others.

The report explores crucial aspects of the cellulosic ethanol market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed