Cellulose Acetate Market Size, Share Report, Analysis, Trends, Growth 2032

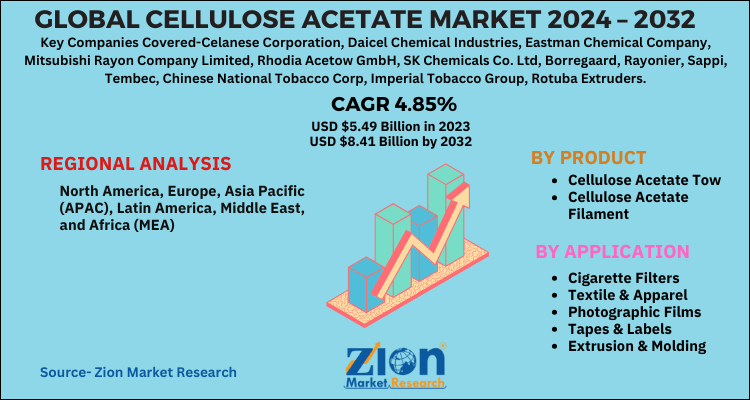

Cellulose Acetate Market: By Product (Cellulose Acetate Tow, Cellulose Acetate Filament), By Application (Cigarette Filters, Textile & Apparel, Photographic Films, Tapes & Labels, Extrusion & Molding, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.49 Billion | USD 8.41 Billion | 4.85% | 2023 |

Cellulose Acetate Market Insights

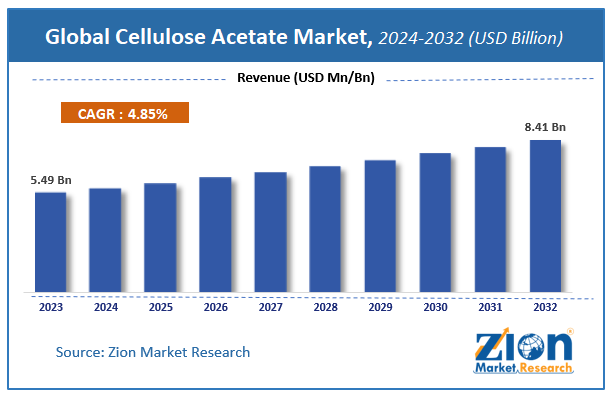

According to Zion Market Research, the global Cellulose Acetate Market was worth USD 5.49 Billion in 2023. The market is forecast to reach USD 8.41 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.85% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Cellulose Acetate Market industry over the next decade.

Cellulose Acetate Market Overview

The global Cellulose Acetate market is a compound that is used for a broader range of applications. For instance, it is widely used in photography as a film glass. Scientifically, it is an insoluble and nontoxic biodegradable material. Partially, cellulose acetate contains acetyl content. It is mostly employed as a semipermeable coating on medicinal drugs and tablets.

Cellulose acetate is obtained by acetylation of cellulose with acetic acid by using sulfuric acid as the catalyst. It is a non-flammable thermoplastic polymer, which is obtained from wood pulp. Cellulose acetate is available in the various forms such as granules of fiber and powder. Cellulose acetate is extensively used in photography as a film base, and provide coatings, and as a frame material for eyeglasses. Cigarette filters, textile & apparel, photographic films, tapes & labels and extrusion & molding are the other application areas in which cellulose acetate is used.

Cellulose Acetate Market Growth Factors:

The exponential demand for cellulose acetate from the textile and cigarette manufacturing industry is the major driving factor for the cellulose acetate market. Several research institutions are tying up with several key players for developing effective cigarette filters from cellulose acetate. Also, biodegradable plastic is being asked for, which in turn is driving the usage of cellulose acetate plastic in matured markets like Europe and North America. However, the Asia-Pacific is expected to be the flag bearer on this count in the next decade with the increasing applications of cellulose acetate in tapes & labels.

Increasing high consumption of cigarette worldwide is the key driver for cellulose acetate market. Increasing demand from textile & apparel industry coupled with growing demand for cellulose acetate is expected to drive the market growth in the years to come. Increasing disposable income and shift towards modern lifestyle of consumers in developing countries are expected to increase demand for cigarettes, textiles, and plastics which simultaneously affect the market positively. However, increasing health awareness regarding cigarette consumption is expected to hamper the market growth in the years to come.

Cellulose Acetate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cellulose Acetate Market |

| Market Size in 2023 | USD 5.49 Billion |

| Market Forecast in 2032 | USD 8.41 Billion |

| Growth Rate | CAGR of 4.85% |

| Number of Pages | 184 |

| Key Companies Covered | Celanese Corporation, Daicel Chemical Industries, Eastman Chemical Company, Mitsubishi Rayon Company Limited, Rhodia Acetow GmbH, SK Chemicals Co. Ltd, Borregaard, Rayonier, Sappi, Tembec, Chinese National Tobacco Corp, Imperial Tobacco Group, Rotuba Extruders, Philip Morris International, Acordis Acetate and Primester |

| Segments Covered | By Type, By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Product Segment Analysis Preview:

Cellulose acetate tow and cellulose acetate filament are the key product segments of the cellulose acetate market. Cellulose tow held a significant market share in 2019 owing to heightened demand and consumption. Cellulose acetate tow is a key component in the manufacturing of cigarette filters, water purification media, and extruded plastics. Cellulose acetate filament is expected to grow in the coming years owing to high demand.

Application Segment Analysis Preview:

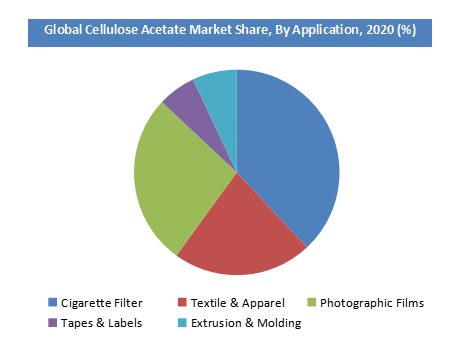

On the basis of applications segment, the cellulose acetate market is segmented into cigarette filters, textile & apparel, photographic films, tapes & labels, extrusion & molding, and others. Cigarette filters stood out as the leading application segment and accounted for over 80% of the market share in the past few years. Besides, it is anticipated to account for a higher share in the near future due to its functionality. Textile & Apparel accounted for a second leading position in the global market as the popularity is likely to increase in the production of velvet fabrics.

To know more about this report, request a sample copy.

Regional Segment Analysis Preview:

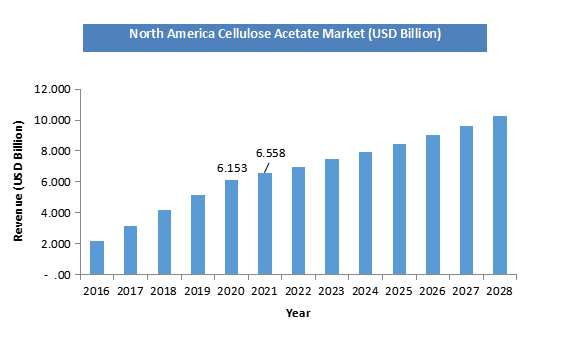

The Asia Pacific is likely to account for a significant market share owing to its high dominance in the past few years. The presence of key players and significant growth in the textiles and cigarette industries is anticipated to propel the market growth in the coming years. Europe is the second leading market for cellulose acetate in the forecast period. The demand is likely to grow due to the constant pace of production and the presence of distribution channels.

To know more about this report, Request For Customization.

Key Market Players and Competitive Landscape:

Some of the key players in the cellulose acetate market are

- Celanese Corporation

- Daicel Chemical Industries

- Eastman Chemical Company

- Mitsubishi Rayon Company Limited

- Rhodia Acetow GmbH

- SK Chemicals Co. Ltd

- Borregaard

- Rayonier

- Sappi

- Tembec

- Chinese National Tobacco Corp

- Imperial Tobacco Group

- Rotuba Extruders

- Philip Morris International

- Acordis Acetate

- and Primester.

The Global Cellulose Acetate Market is segmented into,

By Product

- Cellulose Acetate Tow

- Cellulose Acetate Filament

By Application

- Cigarette Filters

- Textile & Apparel

- Photographic Films

- Tapes & Labels

- Extrusion & Molding

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global cellulose acetate market was valued at $ 5.49 Billion in 2023.

The global cellulose acetate market is expected to reach $ 8.41 Billion by 2032, with CAGR of around 4.85% from 2024 to 2032.

Some of the key factors driving the global cellulose acetate market growth comprise The exponential demand for cellulose acetate from textile and cigarette manufacturing industry is the major driving factor for cellulose acetate market.

Asia Pacific held a substantial share of the cellulose acetate market in 2023. This is attributable to the presence of top companies. China is world’s largest manufacturer and the consumer of cellulose acetate owing it to the large population and the raw material available.

Some of the major companies operating in global cellulose acetate market are Celanese Corporation, Daicel Chemical Industries, Eastman Chemical Company, Mitsubishi Rayon Company Limited, Rhodia Acetow GmbH, SK Chemicals Co. Ltd, Borregaard, Rayonier, Sappi, Tembec, Chinese National Tobacco Corp, Imperial Tobacco Group, Rotuba Extruders, Philip Morris International, Acordis Acetate and Primester.

List of Contents

Market InsightsMarket OverviewMarket Growth Factors:Report ScopeProduct Segment Analysis Preview:Application Segment Analysis Preview:To know more about this report, request a sample copy.Regional Segment Analysis Preview:To know more about this report, Request For Customization.Key Market Players and Competitive Landscape:The Global Market is segmented into,RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed