CATV System Market Size, Growth, Global Trends, Forecast 2034

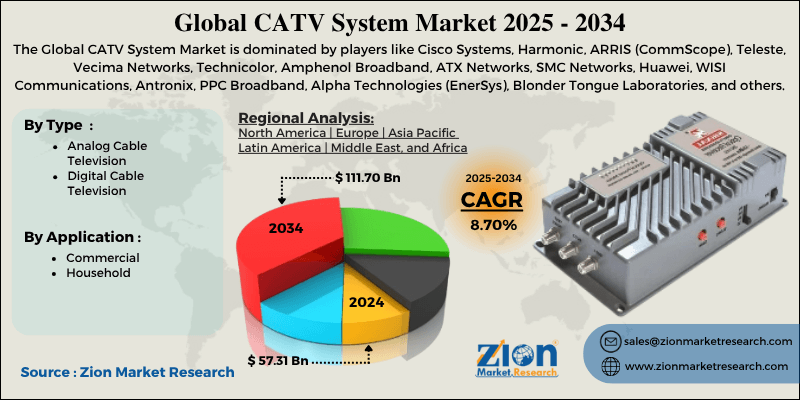

CATV System Market By Type (Analog Cable Television, Digital Cable Television), By Application (Commercial, Household), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

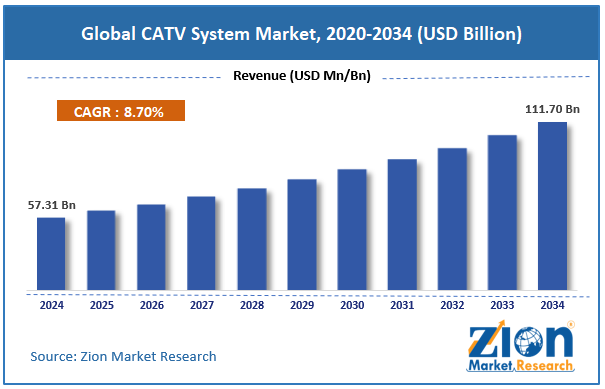

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 57.31 Billion | USD 111.70 Billion | 8.70% | 2024 |

CATV System Industry Perspective:

The global CATV system market size was around USD 57.31 billion in 2024 and is projected to reach USD 111.70 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.70% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global CATV system market is estimated to grow annually at a CAGR of around 8.70% over the forecast period (2025-2034)

- In terms of revenue, the global CATV system market size was valued at around USD 57.31 billion in 2024 and is projected to reach USD 111.70 billion by 2034.

- The CATV system market is projected to grow significantly owing to the expansion of broadband and internet-based services, rising urbanization and residential connectivity needs, and the deployment of fiber-to-the-home (FTTH) and hybrid networks.

- Based on type, the digital cable television segment is expected to lead the market, while the analog cable television segment is expected to grow considerably.

- Based on application, the household segment is the dominating segment, while the commercial segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

CATV System Market: Overview

A CATV (Community Antenna Television) system is a wired broadcast distribution network that delivers internet, multiple TV channels, and, at times, VoIP services to commercial users and homes via hybrid fiber-coaxial or coaxial infrastructure. The advanced CATV systems use digital headends, DOCSIS-based cable modems, and encryption to support high-speed data transmission, interactive services, and video-on-demand over a shared physical network. The global CATV system market is projected to witness substantial growth driven by digital TV & HD/4K transition, broadband & DOCSIS upgrades, and OTT & VOD integration within cable plans. Cable operators are shifting from analog to MPEG-4/HEVC digital streams to meet regulatory mandates and consumer QoE expectations. Digital multiplexing enables the distribution of more channels and provides encrypted content with enhanced compression efficiency. This sustains demand for novel headend units, conditional access, STBs, and encoders.

Moreover, households are demanding stable gigabit broadband for streaming, cloud usage, and gaming. Cable MSOs upgrade HFC networks to DOCSIS 3.1/4.0 to deliver higher throughput without complete fiber rebuilds. This keeps the CATV infrastructure economically relevant in the broadband world. Furthermore, cable platforms now embed Prime, Netflix, and local OTT apps into STBs to retain video ARPU. Hybrid UI/EPG integration delays cord-cutting and enhances engagement. This fuels backend investments in DRM, middleware, and app hosting.

Although drivers exist, the global market is challenged by factors such as cord-cutting, OTT displacement, and a legacy OPEX burden. In Europe and North America, many users cancel cable in favor of streaming. As linear subscriptions decline, the historic revenue anchor of CATV drops. This deteriorates long-term business confidence in video-led investments. Likewise, aging coax needs frequent physical maintenance, service-truck rollouts, and leakage fixes. These recurring costs erode MSO margins and crowd out capex budgets. The cost burden slows network evolution.

Even so, the global CATV system industry is well-positioned to addressable Ad insertion and hospitality & campus IPTC over coax. Operators can insert household-level or zip-coded ads with digital pipes. This creates incremental ad revenue independent of subscription ARPU. Advertisers favor deterministic last-mile targeting. Additionally, institutional sites and hotels adopt IPTV overlays on coax for controlled delivery. Hybrid deployments avoid speed rollout and rewiring. This opens new B2B monetization clusters for system vendors.

CATV System Market Dynamics

Growth Drivers

How is sports & election-year broadcasting propelling the growth of the global CATV system market?

Sports rights remain pay-TV’s most substantial moat; Super Bowl L VIII drew 123M viewers, overwhelmingly through CATV carriers. Election cycles in the United States (2024-24) and India 2024 lift news-channel carriage and ad-insertion spend on CATV platforms. Political ad spending in the 2024 US election cycle surpassed $12 billion, with cable and broadcast networks receiving the largest share. Local news relevance keeps cable tiers valuable, where OTT lacks live civic coverage. Pay-TV operators continue to outbid streamers for regional/local sports rights in 2025. Such broadcasting fuels the global CATV system market.

How does cable build-out drive the CATV system market for rural broadband & public subsidy flows?

Rural broadband subsidies are indirectly sustaining CATV infrastructure rollouts. US BEAD is funneling $42.5 billion toward last-mile builds through 2027, with cable operators among the largest awardees. Public programs favor 'already-provisioned' duct/HFC corridors where incremental upgrades are reasonably priced compared to new fiber trenching. Latin America also experienced Brazil, Chile, and Mexico declare advancement grants tied to mixed fiber-coax builds in 2024-25. These flows extend the CATV network's relevance in underserved areas.

Restraints

Regulatory pressure on carriage fees & must-carry rules negatively impacts the market

Governments progressively intervene in carriage pricing, blackout disputes, and must-offer to protect consumer affordability. In India, TRAI's 2024 tariff interventions controlled MRP hikes on popular bouquets, capping the upside of CATV. The European Union is reviewing 'zero-rating of public channels' policies that decrease monetization latitude for cable operators. In the United States, the 2024 Disney-Charter dispute triggered Congressional scrutiny of blackouts affecting voters during an election cycle. Regulatory asymmetry favors public interest over operator economics.

Opportunities

How is enterprise & B2B linear distribution creating promising avenues for industry growth?

Beyond financial floors, homes, airports, betting halls, command centers, and port terminals, many other systems still subscribe to deterministic multichannel feeds. These customers pay sticker multi-site SLAs with low churn elasticities. 2024 London Stock Exchange building upgrades and 2025 FAA tower media refresh bids specified cable/linear redundancy. OTT cannot meet SLA-grade latency and predictability for B2B critical rooms. This B2B corridor plays a key role in floor-to-unit erosion in consumer lanes, impacting the progress of the CATV system industry.

How do government-funded rural build-outs that sustain HFC/Coax ROI offer advantageous conditions for CATV system market development?

Subsidy regimes are financing last-mile advancements that comprise cable footprints. Public scoring usually favors ‘’incremental upgrade versus fresh fiber trenching, keeping HFC live in cost-sensitive regions. Latin America (Chile, Brazil) and ASEAN (Malaysia, 2024 MCMC Universal Service Fund) have declared cable-eligible awards. This creates protected CAPEX cycles even amid dropping video economics. Subsidy-uplifted footprints later cross-sell broadband + addressable ads.

Challenges

Structural cord-cutting, compressing the video base, restricts the market growth

US pay-TV homes dropped below 60M in 2924, the first time in two decades. Europe experienced a 3-2% year-over-year loss despite premium tiering. Every million disconnections erodes cross-sell leverage for ads and broadband bundles. January 2025 operator earnings reaffirmed 'structural decline' language. As hours migrate to CTV apps, linear reach weakens, degrading ad yield and compounding the decline.

CATV System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | CATV System Market |

| Market Size in 2024 | USD 57.31 Billion |

| Market Forecast in 2034 | USD 111.70 Billion |

| Growth Rate | CAGR of 8.70% |

| Number of Pages | 215 |

| Key Companies Covered | Cisco Systems, Harmonic, ARRIS (CommScope), Teleste, Vecima Networks, Technicolor, Amphenol Broadband, ATX Networks, SMC Networks, Huawei, WISI Communications, Antronix, PPC Broadband, Alpha Technologies (EnerSys), Blonder Tongue Laboratories, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

CATV System Market: Segmentation

The global CATV system market is segmented based on type, application, and region.

Based on type, the global CATV system industry is divided into analog cable television and digital cable television. The digital cable television segment holds a dominant share, as most operators have migrated to digital transmission to meet regulatory mandates and enhance bandwidth efficiency. Digital systems support HD/4K, multiplexing, and encrypted delivery, allowing more revenue per MHz. They also incorporate OTT applications, VOD, and addressable advertising, boosting operator ARPU. With DOCSIS and virtual headends, digital CATV remains the commercial backbone of cable networks.

Conversely, the analog cable television segment held a second-leading share, having a shrinking industry contribution YoY. Analog cable persists mainly in small-scale networks and low-ARPU rural areas, where capital expenditure conversion is still deferred. It is comparatively commercially weak. Content providers and regulatory push are phasing out analog feeds worldwide.

Based on application, the global CATV system market is segmented into commercial and household. The household segment accounted for the largest share of the market, as residential users constitute the most extensive subscriber base for broadcast TV and bundled triple-play services. Cable is still the default access layer for mass-market video delivery and affordable broadband in semi-urban and urban clusters. Incorporation of OTT apps into STBs and subsidized broadband plans further locks in residential demand. Hence, a majority of capex and subscriber revenues are household-led.

On the other hand, the commercial segment ranked second. It comprises campuses, hotels, government buildings, gated communities, and hospitals. Centralized distribution, controlled content rights, and curated channels make CATV the most suitable for these closed environments. Demand is steady for IPTV-over-coax hybrids and hospitality headends, but volumes are structurally smaller than for home users. Therefore, the segment contributes meaningfully but remains secondary to the residential scale.

CATV System Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is likely to sustain its leadership in the CATV system market due to the most extensive digital cable penetration & ARPU base, strong broadband upgrade cycle under DOCSIS 3.1/4.0, and heavy CAPEX spending by Top MSOs. North America holds the highest digital cable penetration rates, with cable TV subscriptions still surpassing 75-80+ million households in the United States alone. ARPU is also the highest worldwide, with the United States cable video+internet ARPU averaging USD 110-135 per month, nearly 2-3x that of Latin America and Asia Pacific. High-paying subscribers make the region the largest revenue pool.

Moreover, United States MSOs, such as Charter, Cox, and Comcast, are actively transitioning to DOCSIS 3.1/4.0 for gigabit broadband. As of 2024, more than 85% of U.S. cable homes can access 1 Gbps speeds without requiring fiber rebuilds, thanks to upgraded HFC networks. This keeps the CATV infrastructure centrally relevant in the broadband stack.

Furthermore, the top 5 US cable operators continuously invest multi-billion-dollar annual CAPEX in network expansion. Comcast alone reported USD 9.5-10.2 billion in capex (2023-24) for headend, CPE upgrades, and access. That scale of reinvestment keeps North America structurally ahead of other regions.

Asia Pacific continues to hold the second-highest share in the CATV system industry, driven by a government-mandated digitalization wave, cost-sensitive consumers favoring HFC over FTTH, and growth in first-time and rural TV access. Multiple Asia-Pacific regions, including Vietnam, Indonesia, China, and India, have legally mandated analog switch-offs and digital migrations. India completed Phase-IV digitization by 2023-24, covering rural areas and pushing tens of millions of new STB installations. These mass compliance programs created multi-year CATV upgrade CAPEX cycles. Full-fiber rollouts remain capex-restrained in low-income and tier-2/3 geographies.

Operators extend the life of CATV through HFC upgrade paths instead of immediate FTTH overbuilds. This preserves demand for nodes, amplifiers, CAS, DOCSIS, and STBs in the Asia Pacific. Additionally, in most regions of SEA, India, and inland China, CATV provides first-time multichannel access rather than replacement. Growing electrification and urban spillover increase the addressable CATV footprint yearly. Even slow ARPU areas contribute to large-volume-driven shipments.

CATV System Market: Competitive Analysis

The leading players in the global CATV system market are:

- Cisco Systems

- Harmonic

- ARRIS (CommScope)

- Teleste

- Vecima Networks

- Technicolor

- Amphenol Broadband

- ATX Networks

- SMC Networks

- Huawei

- WISI Communications

- Antronix

- PPC Broadband

- Alpha Technologies (EnerSys)

- Blonder Tongue Laboratories

CATV System Market: Key Market Trends

Addressable & programmatic advertising on cable pipes:

Operators are inserting targeted ads at the zip code and household levels using digital CATV infrastructure. This offers new revenue beyond subscription ARPU and competes with digital ads. Brands are moving budgets to cable-based deterministic ad inventory.

Bundling of OTT apps inside cable STBs:

Cable boxes now ship with Prime, Netflix, local OTT apps, and Disney+ integrated into the UI. This slows cord-cutting and raises service stickiness without losing users to pure OTT. Hybrid EPG+streaming navigation is becoming the new normal in CATV UI design.

Virtualized & cloud-based headend adoption:

MSOs are replacing physical IRDs, multiplexers, and CAS with virtualized/cloud headends (vHE). This reduces capex, accelerates rollout, and enables centralized multi-city control. Cloud orchestration is becoming the standard framework direction.

The global CATV system market is segmented as follows:

By Type

- Analog Cable Television

- Digital Cable Television

By Application

- Commercial

- Household

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A CATV (Community Antenna Television) system is a wired broadcast distribution network that delivers internet, multiple TV channels, and, at times, VoIP services to commercial users and homes via hybrid fiber-coaxial or coaxial infrastructure. The advanced CATV systems use digital headends, DOCSIS-based cable modems, and encryption to support high-speed data transmission, interactive services, and video-on-demand over a shared physical network.

The global CATV system market is projected to grow due to rising demand for digital and HD video content, government initiatives to expand rural telecommunications access, and technological advancements in set-top boxes and headend equipment.

According to a study, the global CATV system market size was around USD 57.31 billion in 2024 and is expected to grow to around USD 111.70 billion by 2034.

The CATV system market is expected to grow at a CAGR of 8.70% from 2025 to 2034.

AI-based signal optimization, DOCSIS 4.0 upgrades, fiber-deep/hybrid FTTH architectures, IP-video convergence, and edge cloudization are the key emerging trends shaping the CATV system market.

Technological advancements such as DOCSIS 4.0, cloud-based video delivery, fiber-deep networks, and AI-driven network orchestration are expanding service capabilities and accelerating CATV system upgrades.

North America is expected to lead the global CATV system market during the forecast period.

The key players profiled in the global CATV system market include Cisco Systems, Harmonic, ARRIS (CommScope), Teleste, Vecima Networks, Technicolor, Amphenol Broadband, ATX Networks, SMC Networks, Huawei, WISI Communications, Antronix, PPC Broadband, Alpha Technologies (EnerSys), and Blonder Tongue Laboratories.

Stakeholders should integrate IP and cloud-video delivery, invest in fiber-deep upgrades, form strategic OTT/telecom partnerships, adopt AI-driven network management, and diversify into bundled service models to stay competitive.

The report examines key aspects of the CATV system market, including a detailed analysis of current growth factors and restraints, as well as future growth opportunities and challenges.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed