Cannabis-based Alcoholic Beverages Market Size, Share, Analysis, Trends, Growth, 2032

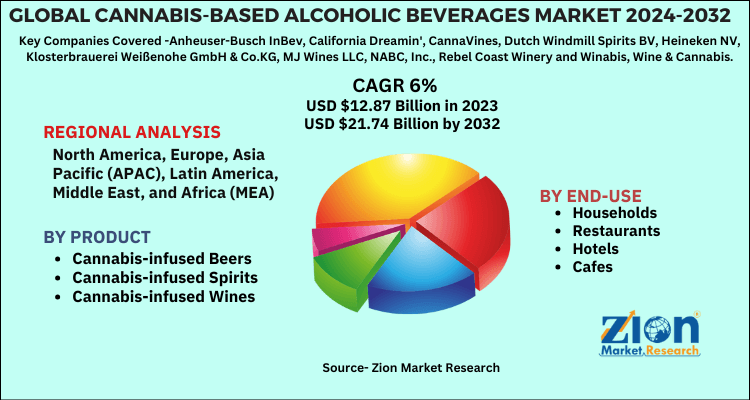

Cannabis-based Alcoholic Beverages Market by Product (Cannabis-infused Beers, Cannabis-infused Spirits, Cannabis-infused Wines), by End Use (Households, Restaurants, Hotels, Cafes): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

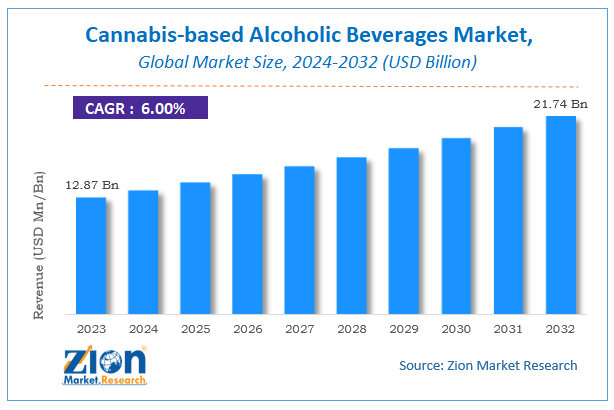

| USD 12.87 Billion | USD 21.74 Billion | 6% | 2023 |

Cannabis-based Alcoholic Beverages Market Insights

According to a report from Zion Market Research, the global Cannabis-based Alcoholic Beverages Market was valued at USD 12.87 Billion in 2023 and is projected to hit USD 21.74 Billion by 2032, with a compound annual growth rate (CAGR) of 6% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Cannabis-based Alcoholic Beverages Market industry over the next decade.

Cannabis-based Alcoholic Beverages Market: Overview

Cannabis is a famous plant which is famous for its various medicinal benefits. Infusions of cannabis flower, hemp seeds, CBD, and cannabis terpenes into alcoholic beverages like gin, whiskey, vodka, absinthe, beer, and wine produce cannabis-based alcoholic beverages. Many alcoholic beverage companies are incorporating Tetrahydrocannabinol (THC) and Cannabidiol (CBD) into a variety of beverages, including margaritas, cider, and soda.

Cannabis-based Alcoholic Beverages Market: COVID-19 Impact Analysis

The COVID outbreak has negatively impacted the cannabis-based alcoholic beverages market. This is due to the lockdown and social distancing rules being imposed by various nation across different nations. With the regulated time period of the market, reducing eating out trend, market closure across states and the fear of consuming cold resulting to health issues has hampered the market to a large impact. The same goes with food service sector, dairy, bakery, beverages servings are facing major fallback due to imposed lockdown.

Cannabis-based Alcoholic Beverages Market: Growth Factors

The global cannabis-based alcoholic beverages market is driven by the rising popularity of cannabis in medical treatments and can help in curing cancer, insomnia, chronic pain, neurological diseases which is fueling its growth. Also, with the rising craze amongst youngsters, the flavored alcoholic beverages are pretty famous and in-demand is one of the major growth factors. The growth of cannabis-based alcoholic beverages can also be observed due to the salutary rules and regulations for the consumption of cannabis in various developed nations such as U.S. and Canada as they play a major role in the growth. For example, cannabis is legalized in U.S. and Canada. Due to its medical application, it is extensively being used in India and Europe making it legal and boosting the production and sales across the globe. Also, with the increase in numbers of bars, clubs, lounges, pubs have pushed the sales of cannabis product cross the globe.

Cannabis-based Alcoholic Beverages Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cannabis-based Alcoholic Beverages Market |

| Market Size in 2023 | USD 12.87 Billion |

| Market Forecast in 2032 | USD 21.74 Billion |

| Growth Rate | CAGR of 6% |

| Number of Pages | 140 |

| Key Companies Covered | Anheuser-Busch InBev, California Dreamin', CannaVines, Dutch Windmill Spirits BV, Heineken NV, Klosterbrauerei Weißenohe GmbH & Co.KG, MJ Wines LLC, NABC, Inc., Rebel Coast Winery and Winabis, Wine & Cannabis |

| Segments Covered | By Type, By end-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Product Segment Analysis Preview

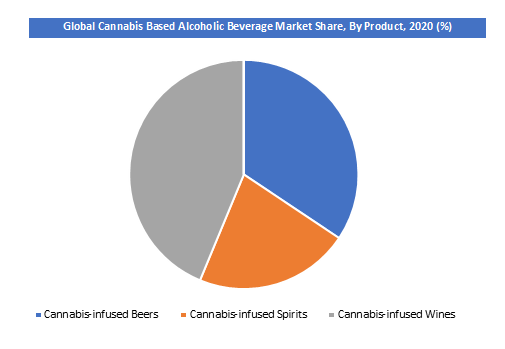

The most famous, prominent and consumed cannabis based alcoholic beverage is cannabis-based wine. It is due to the rising popularity amongst the millennials. Cannabis-based wine is a symbol of status and also good for health. The market players grabbed the opportunity and advertising CBD-infused wine as a health drink with low alcoholic content with various health benefits. This has fueled the sales of CBD- infused wine. For instance, Cannawine, which is one of the largest CBD infused wine producer and distributor claims it to give the soothing effect and make the mind fresh and relax. Cannabis-infused Beers and Cannabis-infused Spirits forms the other types in the product segment.

End-Use Segment Analysis Preview

Restaurants holds the largest share in the market. This is due to the growing demand for the cannabis based alcoholic beverage amongst youngsters. Due to its low alcoholic content and health factors, it is allowed to be sold in the restaurants. The favorable rules and regulations applied by the government is also making it easily available for the consumption in the restaurants. Households, Hotels and Cafes forms the other types of end-use segment.

Regional Analysis Preview

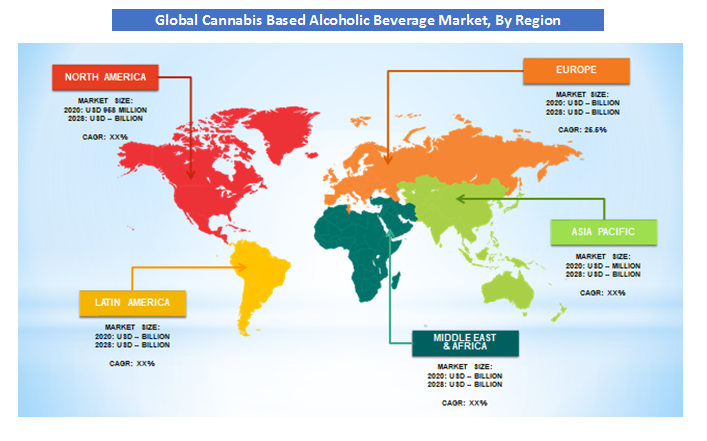

North America held the largest market share of 73.4% in 2020. This is attributable to the increased consumption and craze amongst the youngsters for the cannabis- based alcoholic beverages. Also, there was popularity of these beverages in the population. The flexibility in the rules and regulation for the alcoholic beverages has attributed to the phenomenal growth in the sector. For legal marijuana, there is a lot of information and technical exchange. Another notable driving factor that has bolstered the market's growth is public and private investments in R&D for a safer form of consuming cannabis in recent years. The number of businesses operating in this market has increased dramatically. The variety and quantity of products delivered to end-users increases as the number of companies operating in the industry grows. As a result of the variety in the products, the market is boosted even more.

Europe held the significant growth of 25.5% CAGR during the forecast period. The number of CBD users in the United Kingdom increased from 125,000 in 2016 to 250,000 in 2017, according to the Cannabis Trade Association. In addition, businesses in the region are launching new products to keep up with the growing trend of wellness beverages. CBD Ultra and Cloud 9 Brewing in Manchester, for example, have released the UK's first CBD Session IPA beer brewed with Cannabis Sativa extract.

Cannabis-based Alcoholic Beverages Market: Competitive Landscape

Some of key players in cannabis-based alcoholic beverages market are

- Anheuser-Busch InBev

- California Dreamin'

- CannaVines

- Dutch Windmill Spirits BV

- Heineken NV

- Klosterbrauerei Weißenohe GmbH & Co.KG

- MJ Wines LLC

- NABC Inc.

- Rebel Coast Winery and Winabis

- Wine & Cannabis

- among others.

There is a humongous amount of money being invested in the R&D of cannabis. There is extensive investment done by the big conglomerates in the production and supply chain of raw materials. Product launches, product approvals, and other organic growth strategies such as patents and events are being prioritized by a number of companies. Acquisitions, as well as partnerships and collaborations, were seen as inorganic growth strategies in the market. These activities have paved the way for market players to expand their business and customer base. With the rising demand for cannabis-based alcoholic beverages in the global market, market payers in the cannabis-based alcoholic beverages market are expected to benefit from lucrative growth opportunities in the future. A list of a few companies involved in the cannabis-based alcoholic beverages market is provided below.

The global cannabis-based alcoholic beverages market is segmented as follows:

By Product

- Cannabis-infused Beers

- Cannabis-infused Spirits

- Cannabis-infused Wines

By End-Use

- Households

- Restaurants

- Hotels

- Cafes

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global cannabis-based alcoholic beverages market was valued at USD 12.87 Billion in 2023.

The global cannabis-based alcoholic beverages market is expected to reach USD 21.74 Billion by 2032, growing at a CAGR of 6% between 2024 to 2032.

Legalization of the cannabis for medical purpose across the globe, increased consumption of the low alcoholic content beverages are the drivers in cannabis-based alcoholic beverages market growth.

North America held a share of over 72.20% in the global cannabis-based alcoholic beverages market in 2023. This is attributable to the increased consumption and craze amongst the youngsters for the cannabis- based alcoholic beverages.

Some of key players cannabis-based alcoholic beverages market include Anheuser-Busch InBev, California Dreamin', CannaVines, Dutch Windmill Spirits BV, Heineken NV, Klosterbrauerei Weißenohe GmbH & Co.KG, MJ Wines LLC, NABC, Inc., Rebel Coast Winery and Winabis, Wine & Cannabis, among others.

List of Contents

Market InsightsMarket: Overview Market: COVID-19 Impact Analysis Market: Growth FactorsReport ScopeProduct Segment Analysis PreviewEnd-Use Segment Analysis PreviewRegional Analysis Preview Market: Competitive LandscapeThe global cannabis-based alcoholic beverages market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed