Burial Insurance Market Size, Share, Trends, Growth and Forecast 2034

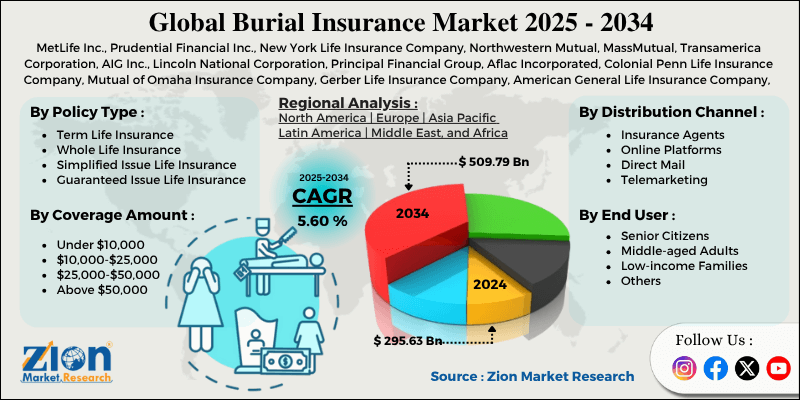

Burial Insurance Market By Policy Type (Term Life Insurance, Whole Life Insurance, Simplified Issue Life Insurance, and Guaranteed Issue Life Insurance), By Coverage Amount (Under $10,000, $10,000-$25,000, $25,000-$50,000, and Above $50,000), By Distribution Channel (Insurance Agents, Online Platforms, Direct Mail, and Telemarketing), By End-User (Senior Citizens, Middle-aged Adults, Low-income Families, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

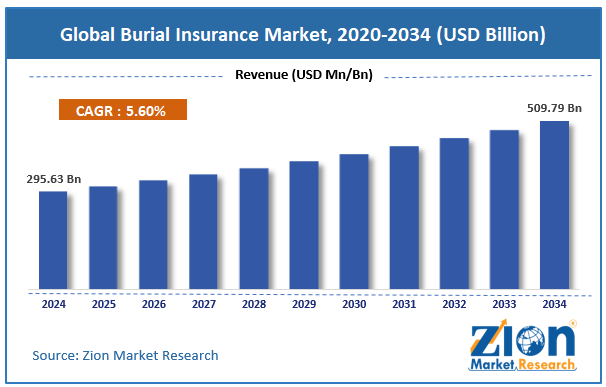

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 295.63 Billion | USD 509.79 Billion | 5.60% | 2024 |

Burial Insurance Industry Perspective:

The global burial insurance market was valued at approximately USD 295.63 billion in 2024 and is expected to reach around USD 509.79 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.60% between 2025 and 2034.

Burial Insurance Market: Overview

Burial insurance is a type of life insurance that covers funeral expenses and end-of-life costs, providing families with financial relief during difficult times. These insurance products offer guaranteed death benefits to cover funeral services, burial plots, caskets, memorial services, and other expenses, all without requiring medical exams or long waiting periods.

The burial insurance market is designed for individuals seeking affordable options with straightforward underwriting, allowing seniors and those with pre-existing conditions to obtain coverage. New burial insurance policies offer flexible payment options, immediate coverage, and transparent terms, ensuring beneficiaries receive payment quickly when needed.

The growing awareness of rising healthcare costs, increasing demand for simplified insurance products, and the expansion of digital distribution channels are expected to drive growth in the burial insurance industry over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global burial insurance market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

- In terms of revenue, the global burial insurance market size was valued at around USD 295.63 billion in 2024 and is projected to reach USD 509.79 billion by 2034.

- The burial insurance market is projected to grow significantly due to the increasing elderly population worldwide, rising funeral costs, growing awareness of end-of-life financial planning, and simplified insurance product offerings.

- Based on policy type, whole life insurance leads the segment and will continue to lead the global market.

- Based on coverage amount, policies between $10,000 and $25,000 are expected to lead the market.

- Based on the distribution channel, insurance agents are anticipated to command the largest market share.

- Based on end-users, senior citizens are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Burial Insurance Market: Growth Drivers

Aging Population Demographics and Life Expectancy Trends

The global burial insurance market is experiencing rapid growth due to the aging population worldwide and increasing life expectancy, resulting in a steady demand for end-of-life financial planning products.

As the baby boomer generation enters its retirement years, it becomes a significant market segment seeking affordable burial insurance to protect its families from unexpected funeral expenses.

Longer life expectancy means individuals have more time to plan and buy burial insurance while premiums are still manageable. Rural and urban elderly individuals alike recognize the importance of pre-planning funeral arrangements through insurance that provides benefits regardless of health changes.

Rising Funeral Costs and Financial Planning Awareness

Funeral costs are rising, and consumers are becoming increasingly aware of the financial burden associated with end-of-life care, resulting in a strong demand for burial insurance that offers predictable coverage at affordable rates. Funeral homes and memorial service providers are recommending burial insurance to their clients as a way to fund the services they want.

Financial advisors include burial insurance in retirement planning conversations to protect family savings from unexpected funeral costs. Insurance companies are running consumer education campaigns to educate consumers about burial insurance and simplify the application process.

Online platform solutions are making it easier for consumers to compare plans and purchase burial insurance conveniently from the comfort of their own homes.

Burial Insurance Market: Restraints

Limited Coverage Amounts and Policy Restrictions

Despite the growing acceptance, the burial insurance market has limitations and restrictions that do not fully meet the needs or expectations of consumers for end-of-life financial protection.

Most burial insurance policies have relatively small death benefits that do not cover the full cost of funerals in high-cost-of-living areas or for elaborate services. Waiting periods for full benefit payout can create financial holes for families who need immediate access to funeral funds.

Age restrictions and health exclusions can limit policy availability for those who need burial insurance the most. Limited product customization, a lack of transparency in policy terms, and low consumer awareness of alternative coverage options also hinder the market's ability to fully meet end-of-life financial protection needs.

Burial Insurance Market: Opportunities

Digital Marketing and Online Distribution Expansion

The burial insurance market presents opportunities through digital marketing and online distribution channels to reach a broader audience with targeted messaging and simplified enrollment. Social media advertising allows companies to reach buyers who are concerned about their parents’ end-of-life planning.

Online quote comparison tools allow consumers to compare burial insurance options and make informed purchasing decisions. Digital applications eliminate the traditional barriers of medical exams and paperwork that keep people from buying.

Mobile-friendly websites and applications enable seniors to research and purchase burial insurance independently or with the assistance of their families.

Burial Insurance Market: Challenges

Regulatory Compliance and Consumer Protection Requirements

The burial insurance industry faces operational challenges due to state regulations, consumer protection requirements, and compliance, which necessitate different product development and marketing approaches across states.

Insurance companies have to navigate complex regulatory frameworks that govern policy terms, marketing, and claims handling for burial insurance products.

Consumer protection laws require clear disclosure of policy limitations, waiting periods, and benefit restrictions that can impact customer satisfaction and retention. Regulatory changes can significantly impact profitability and necessitate system updates or policy adjustments to ensure compliance.

Burial Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Burial Insurance Market |

| Market Size in 2024 | USD 295.63 Billion |

| Market Forecast in 2034 | USD 509.79 Billion |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 213 |

| Key Companies Covered | MetLife Inc., Prudential Financial Inc., New York Life Insurance Company, Northwestern Mutual, MassMutual, Transamerica Corporation, AIG Inc., Lincoln National Corporation, Principal Financial Group, Aflac Incorporated, Colonial Penn Life Insurance Company, Mutual of Omaha Insurance Company, Gerber Life Insurance Company, American General Life Insurance Company, Banner Life Insurance Company, Foresters Financial, Liberty Mutual Insurance, State Farm Life Insurance Company, Allstate Life Insurance Company, AARP Life Insurance Program., and others. |

| Segments Covered | By Policy Type, By Coverage Amount, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Burial Insurance Market: Segmentation

The global burial insurance market is segmented into policy type, coverage amount, distribution channel, end-user, and region.

Based on policy type, the market is segregated into term life insurance, whole life insurance, simplified issue life insurance, and guaranteed issue life insurance. Whole life insurance leads the market due to its permanent coverage features, cash value accumulation benefits, and predictable premium structures that appeal to long-term financial planning needs.

Based on coverage amount, the burial insurance industry is classified into under $10,000, $10,000-$25,000, $25,000-$50,000, and above $50,000. The $10,000-$25,000 coverage range holds the largest market share due to its balance between affordable premium costs and adequate funeral expense coverage for most consumers.

Based on distribution channels, the burial insurance market is divided into insurance agents, online platforms, direct mail, and telemarketing. Insurance agents are expected to lead the market during the forecast period due to their ability to provide personalized consultation and build trust relationships with senior consumers.

Based on the end-user, the market is segmented into senior citizens, middle-aged adults, low-income families, and others. Senior citizens lead the market share due to their heightened awareness of mortality planning needs and a desire to protect their family members from the financial burdens of funerals.

Burial Insurance Market: Regional Analysis

North America to lead the market

North America is the leader in the global burial insurance market due to its established insurance industry infrastructure, high awareness of life insurance products, aging population demographics, and cultural acceptance of pre-planning funeral arrangements through insurance.

The region accounts for approximately 45% of the global market share, with the United States being the largest consumer of burial insurance products. Insurance agents, funeral homes, and financial advisors have extensive distribution networks to educate consumers and sell their products and services.

The region’s mature regulatory environment instills confidence in burial insurance products and the claims process among consumers. Marketing campaigns and consumer education initiatives have increased awareness of burial insurance benefits among the target market.

The cultural attitude towards end-of-life planning and family financial protection will continue to drive the adoption of burial insurance. The growing popularity of online insurance platforms and simplified application processes is making burial insurance more accessible to a broader range of demographics.

Europe is expected to show steady growth.

Europe is experiencing growth in the burial insurance market due to an aging population, rising healthcare costs, and increasing awareness of end-of-life financial planning across various consumer segments and cultures.

Regulatory harmonization across EU member states enables insurance product development and cross-border marketing. The established insurance industry infrastructure in the region supports the distribution of burial insurance through both traditional and digital channels.

Rising funeral service costs in Western Europe are prompting individuals to seek financial coverage options early. Cultural shifts toward personal responsibility in funeral planning are also driving interest in prepaid burial solutions.

Additionally, partnerships between insurers and funeral service providers are expanding product offerings tailored to local preferences and customs.

Recent Market Developments:

- In February 2025, Colonial Penn Life Insurance Company launched a new digital burial insurance platform featuring simplified online applications, instant coverage decisions, and integrated funeral planning resources to serve tech-savvy senior consumers and their adult children.

- In May 2025, Mutual of Omaha, recognized as the best overall burial insurance provider in 2025, offers guaranteed acceptance policies with coverage up to $25,000. The company is recognized for its strong financial stability and consistently high customer satisfaction ratings.

Burial Insurance Market: Competitive Analysis

The global burial insurance market is led by players like:

- MetLife Inc.

- Prudential Financial Inc.

- New York Life Insurance Company

- Northwestern Mutual

- MassMutual

- Transamerica Corporation

- AIG Inc.

- Lincoln National Corporation

- Principal Financial Group

- Aflac Incorporated

- Colonial Penn Life Insurance Company

- Mutual of Omaha Insurance Company

- Gerber Life Insurance Company

- American General Life Insurance Company

- Banner Life Insurance Company

- Foresters Financial

- Liberty Mutual Insurance

- State Farm Life Insurance Company

- Allstate Life Insurance Company

- AARP Life Insurance Program.

The global burial insurance market is segmented as follows:

By Policy Type

- Term Life Insurance

- Whole Life Insurance

- Simplified Issue Life Insurance

- Guaranteed Issue Life Insurance

By Coverage Amount

- Under $10,000

- $10,000-$25,000

- $25,000-$50,000

- Above $50,000

By Distribution Channel

- Insurance Agents

- Online Platforms

- Direct Mail

- Telemarketing

By End User

- Senior Citizens

- Middle-aged Adults

- Low-income Families

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Burial insurance represents a specialized form of life insurance designed specifically to cover funeral expenses and end-of-life costs, providing financial relief to families through guaranteed death benefits that help cover funeral services and related expenses.

The burial insurance market is expected to be driven by aging population demographics, rising funeral costs, increased awareness of end-of-life financial planning, simplified underwriting processes, and growing acceptance of pre-need funeral planning among consumers.

According to our study, the global burial insurance market was worth around USD 295.63 billion in 2024 and is predicted to grow to around USD 509.79 billion by 2034.

The CAGR value of the burial insurance market is expected to be around 5.60% during 2025-2034.

The global burial insurance market will register the highest revenue contribution from North America during the forecast period.

Key players in the burial insurance market include MetLife Inc., Prudential Financial Inc., New York Life Insurance Company, Northwestern Mutual, MassMutual, Transamerica Corporation, AIG Inc., Lincoln National Corporation, Principal Financial Group, Aflac Incorporated, Colonial Penn Life Insurance Company, Mutual of Omaha Insurance Company, Gerber Life Insurance Company, American General Life Insurance Company, Banner Life Insurance Company, Foresters Financial, Liberty Mutual Insurance, State Farm Life Insurance Company, Allstate Life Insurance Company, and AARP Life Insurance Program.

The report provides a comprehensive analysis of the burial insurance market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, product innovations, distribution strategies, and consumer preferences that shape the end-of-life insurance planning market ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed