Branded Generics Market Size, Share, Trends, Growth and Forecast 2032

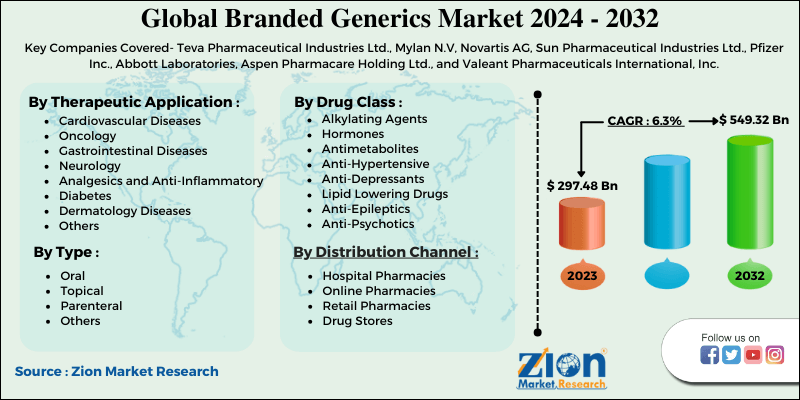

Branded Generics Market by Therapeutic Application (Cardiovascular Diseases, Oncology, Diabetes, Gastrointestinal Diseases, Neurology, Analgesics and Anti-Inflammatory, Dermatology Diseases, Others) by Drug Class (Alkylating Agents, Hormones, Antimetabolites, Anti-Hypertensive, Anti-Depressants, Lipid Lowering Drugs, Anti-Epileptics, Anti-Psychotics, Others) by Formulation Type (Oral, Topical, Parenteral, Others) by Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies, Drug Stores): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

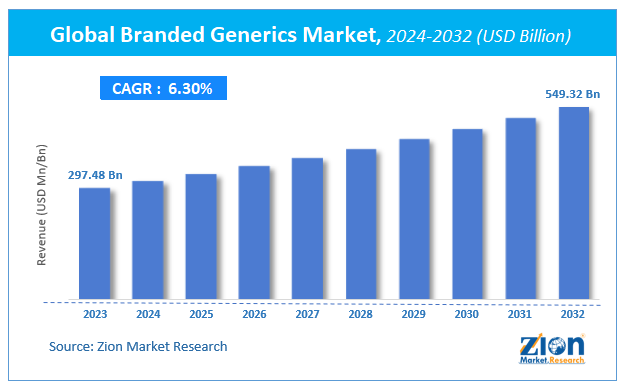

| USD 297.48 Billion | USD 549.32 Billion | 6.3% | 2023 |

Branded Generics Market Insights

According to Zion Market Research, the global Branded Generics Market was worth USD 297.48 Billion in 2023. The market is forecast to reach USD 549.32 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.3% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Branded Generics Market industry over the next decade.

Global Branded Generics Market: Overview

Branded generics are generic medicines that have a proprietary brand name. They may be sold in the same way as generic drugs. Ordinary generic medicines are usually identified by their chemical names. Trimox is a patented drug that is also available as ‘amoxicillin’ which is its generic name. Branded generics, on the other hand, are granted names in order to increase market awareness and loyalty. Cryselle, for example, is a branded generic birth control pill. To increase the probability of patients requesting it by name, it is referred to as Cryselle rather than its chemical name (Ethinyl estradiol and norgestrel).

Some branded generics are created as novel dosage forms of off-patent medicines, filling a dosage gap and providing customers with a name that is usually much easier to recall than its generic name. Branded generics constitute a small but lucrative segment of the pharmaceutical industry.

Branded Generics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Branded Generics Market |

| Market Size in 2023 | USD 297.48 Billion |

| Market Forecast in 2032 | USD 549.32 Billion |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 110 |

| Key Companies Covered | Teva Pharmaceutical Industries Ltd., Mylan N.V, Novartis AG, Sun Pharmaceutical Industries Ltd., Pfizer Inc., Abbott Laboratories, Aspen Pharmacare Holding Ltd., and Valeant Pharmaceuticals International, Inc. |

| Segments Covered | By Type, By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

It's common to mix up branded generics and licensed generics, but they're not the same thing. After branded drug patents expire, branded generics must go through the same FDA approval process as other generics. Authorized generics, on the other hand, are produced by branded drug manufacturers under the same New Drug Approval (NDA) authorization as the actual branded drug, and they can be marketed before drug patents expire. In terms of cost, both branded generics and licensed generics are more expensive than standard generics but less expensive than branded drug/medicine with unexpired drug patents.

In the United States, branded generics receive more than unbranded generics, although they account for a small proportion of total generic prescriptions. Branded generics were 13 times more costly than unbranded generics in 2018 and accounted for 21% of all generic drugs. In other words, they represent a limited but profitable segment of the overall generic market.

Preferred branded generics can differ from supplier to supplier and pharmacy to pharmacy. While manufacturers do not advertise or promote branded generics, they do build relationships with retailers that favour these drugs over unbranded generics.

Branded generics are becoming more common in low- and middle-income countries, which can complicate market differentiation in terms of product and price. In the past, Pharmacy Benefit Management Managers (PBMs) in the United States have been accused of deliberately misclassifying medications in order to obtain brand rates for generics or higher rebates for specific generic products.

To ensure cost savings, formulary managers must regularly monitor the medications on their formularies. Branded generics, like generics, offer alternatives to branded medications and often result in cost savings. However, there is some disagreement between formulary managers and PBMs about how PBMs avoid revenue disclosures. Some pharmacy benefit consultants claim that branded generics are one way for PBMs to hide sales.

Global Branded Generics Market: Growth Factors

Off-invoice discounts would drive growth in the global branded generics market over the forecast period. Because of higher discounts offered by players, demand for branded generic drugs is expected to be strong in established markets such as the United States. In recent years, the global branded generics market has expanded at an unprecedented rate. Several intrinsic and extrinsic dynamics relating to licensing, production, and distribution characterize the pharmaceutical industry. The principle of patenting is highly useful in the pharmaceutical industry. Drugs patented to a specific company grant the entity legal rights to sell the product in the pharmaceutical industry. Furthermore, by patenting their products, pharmaceutical companies will remain unaffected by the emergence of numerous rivals in the industry. However, the idea of branded generics has grown in the pharmaceutical industry in recent years. Since branded generics can be off-patient, many pharmaceutical firms will bid to sell these drugs on the market.

Global Branded Generics Market: Segmentation

Cardiac arrests, hypertension, and diabetes account for a large proportion of all global fatalities. There has been an increase in the demand for antihypertensive drugs from all over the world. This necessitates the availability of low-cost medicines, and branded generics have proved to be a practical alternative.

Despite the fact that oral formulations account for more than half of the branded generics industry sales, “Parenteral Formulation” may escort to a new part in the near future. Parenteral formulation adoption is expected to rise at a rapid pace during the forecast period.

The demand for branded generic lipid-lowering drugs is increasing as obesity is growing at an exponential pace. According to the Centers for Disee Control anasd Prevention (CDC), the number of obese citizens in the United States has almost doubled in the last decade. Market participants are eager to move to a lipid-lowering mode in order to promote weight loss. One such lipid-lowering medicine is generic Atorvastatin. Similarly, others will join the fray during the forecast era.

Global Branded Generics Market: Regional Analysis

By Geography, the branded generics market is segmented into North America, Europe, Latin America, Asia Pacific, and Middle East and Africa.

Latin America has emerged as a top priority for the pharmaceutical industry. The barriers to entry are smaller than in China and Russia. Significant disparities in healthcare systems, intellectual property structures, and emerging middle-class income, on the other hand, necessitate a country-by-country evaluation of attractiveness. The top six Latin American pharmaceuticals markets – Brazil, Mexico, Venezuela, Argentina, Colombia, and Chile – account for 80% of the industry, but their economic conditions vary greatly. Brazil and Mexico are the most stable and sought-after prospects, but they also necessitate significant investment.

As a result, some multinational corporations have shifted their attention to medium-sized countries such as Columbia, which they are primarily entering through Mergers and Acquisitions (M&A). However, an industry consensus on the attractiveness of markets such as Colombia, Venezuela, and Argentina are yet to emerge, and several multinationals are still analyzing the potential. Local businesses in Argentina, for example, can be extremely competitive and profitable, whereas multinational corporations struggle. As in all emerging markets, the secret to success is fully understanding local rules and customizing the approach to local needs while capturing regional synergies.

China's pharmaceutical industry is highly fragmented, with over 4,000 drug producers. Market access is complicated and skewed in favor of local players. Many global generics players have entered China, either alone or through joint ventures, but these moves appear to be small-scale experiments to see what approach would be fruitful. China is a highly profitable market for originators. The overall field force for the top ten global prescription drug firms has risen massively compared to the past, though at lower productivity levels. Global generics firms, on the other hand, are struggling. Slow registrations, trouble winning highly competitive provincial tenders, and hospital listing criteria all make it difficult for them to gain market share. All these factors are heavily contributing to the growth of branded generics in these countries.

Global Branded Generics Market: Competitive Players

The major players in the global branded generics market include-

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Abbott Laboratories

- Aspen Pharmacare Holding Ltd.

- Valeant Pharmaceuticals International

- among others.

The report segment of global branded generics market are as follows:

Global Branded Generics Market: Therapeutic Application Segment Analysis

-

Cardiovascular Diseases

- Oncology

- Gastrointestinal Diseases

- Neurology

- Analgesics and Anti-Inflammatory

- Diabetes

- Dermatology Diseases

- Others

Global Branded Generics Market: Drug Class Segment Analysis

- Alkylating Agents

- Hormones

- Antimetabolites

- Anti-Hypertensive

- Anti-Depressants

- Lipid Lowering Drugs

- Anti-Epileptics

- Anti-Psychotics

- Others

Global Branded Generics Market: Formulation Type Segment Analysis

- Oral

- Topical

- Parenteral

- Others

Global Branded Generics Market: Distribution Channel Segment Analysis

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Drug Stores

Global Branded Generics Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Off-invoice discounts would drive growth in the global branded generics market over the forecast period. Because of higher discounts offered by players, demand for branded generic drugs is expected to be strong in established markets such as the United States. In recent years, the global branded generics market has expanded at an unprecedented rate. Several intrinsic and extrinsic dynamics relating to licencing, production, and distribution characterise the pharmaceutical industry. The principle of patenting is highly useful in the pharmaceutical industry. Drugs patented to a specific company grant the entity legal rights to sell the product in the pharmaceutical industry. Furthermore, by patenting their products, pharmaceutical companies will remain unaffected by the emergence of numerous rivals in the industry. However, the idea of branded generics has grown in the pharmaceutical industry in recent years. Since branded generics can be off-patient, many pharmaceutical firms will bid to sell these drugs on the market.

Branded Generics Market was worth USD 297.48 Billion in 2023. The market is forecast to reach USD 549.32 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.3% during the forecast period 2024-2032

Latin America has emerged as a top priority for the pharmaceutical industry. The barriers to entry are smaller than in China and Russia. Significant disparities in healthcare systems, intellectual property structures, and emerging middle-class income, on the other hand, necessitate a country-by-country evaluation of attractiveness. The top six Latin American pharmaceuticals markets – Brazil, Mexico, Venezuela, Argentina, Colombia, and Chile – account for 80% of the industry, but their economic conditions vary greatly. Brazil and Mexico are the most stable and sought-after prospects, but they also necessitate significant investment. As a result, some multinational corporations have shifted their attention to medium-sized countries such as Columbia, which they are primarily entering through Mergers and Acquisitions (M&A). However, an industry consensus on the attractiveness of markets such as Colombia, Venezuela, and Argentina are yet to emerge, and several multinationals are still analysing the potential. Local businesses in Argentina, for example, can be extremely competitive and profitable, whereas multinational corporations struggle. As in all emerging markets, the secret to success is fully understanding local rules and customising the approach to local needs while capturing regional synergies.

The major players in the global branded generics market include Teva Pharmaceutical Industries Ltd., Mylan N.V, Novartis AG, Sun Pharmaceutical Industries Ltd., Pfizer Inc., Abbott Laboratories, Aspen Pharmacare Holding Ltd., and Valeant Pharmaceuticals International, Inc. among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed