Bone Grafts and Substitutes Market Size, Share, Trends, and Forecast 2032

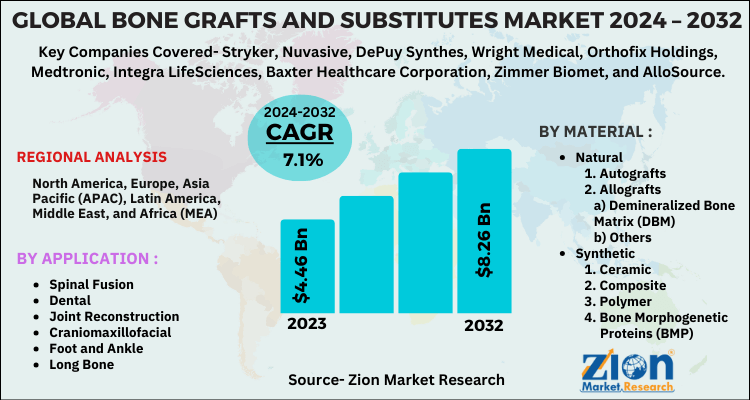

Bone Grafts and Substitutes Market By Material (Natural And Synthetic), By Application (Spinal Fusion, Dental, Joint Reconstruction, Craniomaxillofacial, Foot And Ankle, And Long Bone), By Region - Global And Regional Industry Overview, market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024-2032

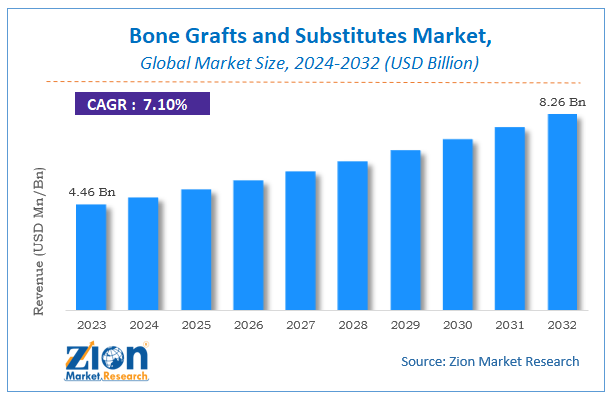

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.46 Billion | USD 8.26 Billion | 7.1% | 2023 |

Bone Grafts and Substitutes Market Size

The global bone grafts and substitutes market size was worth around USD 4.46 billion in 2023 and is predicted to grow to around USD 8.26 billion by 2032 with a compound annual growth rate (CAGR) of roughly 7.1% between 2024 and 2032.

The study provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD billion). The report covers a forecast and an analysis of the bone grafts and substitutes market on a global and regional level.

Bone Grafts and Substitutes Market: Overview

The significance of bone transplant is confirmed by the frequency of its use nowadays. Medical specialists perform bone transplant surgeries at least 10 times more frequently than other organ transplantation procedure. More than 2 million bone grafting procedures are performed globally every year, which is the second most common tissue transplantation after blood transfusion. Bone grafting is among the most popular surgical methods that enhances the process of bone regeneration in orthopedic treatments. The fundamental properties of bone graft are osteogenesis, osteoinduction, osteoconduction, and structural support.

The rapid advancements witnessed in the technology and product developments are fueling the growth of the global bone grafts and substitutes market. Moreover, the increasing number of musculoskeletal conditions like osteoarthritis, rheumatoid arthritis, and psoriatic arthritis is another leading factor likely to further stimulate the global bone grafts and substitutes market over the forecast timeframe. However, ethical issues and high cost of surgeries related to bone grafting procedures may hinder the global bone grafts and substitutes market growth.

Bone Grafts and Substitutes Market: Segmentation

The study provides a decisive view of the bone grafts and substitutes market by segmenting it on the basis of material, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

Based on material, the market for bone grafts and substitutes is classified into natural and synthetic. The natural material type segment is further classified into autografts and allografts (demineralized bone matrix and others). The synthetic segment is categorized into ceramic, composite, polymer and bone morphogenetic proteins. The synthetic segment is anticipated to register significant growth over the forecast time period, owing to the growing preference for synthetic bone grafts and to overcome the limitations of natural grafts.

Based on application, the market for bone grafts and substitutes is classified into dental, spinal fusion, craniomaxillofacial, joint reconstruction, foot and ankle, and long bone. The spinal fusion segment is anticipated to dominate the market and the joint reconstruction segment is anticipated to register the highest CAGR over the forthcoming years.

Bone Grafts and Substitutes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bone Grafts and Substitutes Market |

| Market Size in 2023 | USD 4.46 Billion |

| Market Forecast in 2032 | USD 8.26 Billion |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 110 |

| Key Companies Covered | Stryker, Nuvasive, DePuy Synthes, Wright Medical, Orthofix Holdings, Medtronic, Integra LifeSciences, Baxter Healthcare Corporation, Zimmer Biomet, and AlloSource |

| Segments Covered | By Material, By Application, By End-User Analysis and By region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bone Grafts and Substitutes Market: Regional Analysis

By region, North America is projected to lead the global bone grafts and substitutes market in the years ahead. The U.S., in particular, is leading the global market by creating huge product demand, owing to a high prevalence of trauma-related injuries and orthopedic diseases. Rising occurrences of osteoarthritis have led to an increase in the demand for bone grafts and substitutes, which are used for treatment and transplantation. This is also driving the North American bone grafts and substitutes market. Developing healthcare infrastructure, a large population base, and rising prevalence of spinal disorders are driving the Asia Pacific bone grafts and substitutes market. Additionally, the increasing medical tourism and growing awareness among the regional population about bone grafts and substitutes will further boost this regional market over the estimated time period.

Bone Grafts and Substitutes Market: Competitive Players

Some key players in the global bone grafts and substitutes market are:

- Stryker

- Nuvasive

- DePuy Synthes

- Wright Medical

- Orthofix Holdings

- Medtronic

- Integra LifeSciences

- Baxter Healthcare Corporation

- Zimmer Biomet

- AlloSource

This report segments the global bone grafts and substitutes market into:

Global Bone Grafts and Substitutes Market: Material Analysis

- Natural

- Autografts

- Allografts

- Demineralized Bone Matrix (DBM)

- Others

- Synthetic

- Ceramic

- Composite

- Polymer

- Bone Morphogenetic Proteins (BMP)

Global Bone Grafts and Substitutes Market: Application Analysis

- Spinal Fusion

- Dental

- Joint Reconstruction

- Craniomaxillofacial

- Foot and Ankle

- Long Bone

Global Bone Grafts and Substitutes Market: Regional Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Bone grafts and substitutes are materials used in medical procedures to replace missing bone or to facilitate bone healing and regeneration.

According to study, the Bone Grafts and Substitutes market size was worth around USD 4.46 billion in 2023 and is predicted to grow to around USD 8.26 billion by 2032.

The CAGR value of Bone Grafts and Substitutes market is expected to be around 7.1% during 2024-2032.

North America has been leading the Bone Grafts and Substitutes market and is anticipated to continue on the dominant position in the years to come.

The Bone Grafts and Substitutes market is led by players like Stryker, Nuvasive, DePuy Synthes, Wright Medical, Orthofix Holdings, Medtronic, Integra LifeSciences, Baxter Healthcare Corporation, Zimmer Biomet, and AlloSource.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed