Biostimulants Market Trend, Share, Growth, Size Analysis, and Forecast 2032

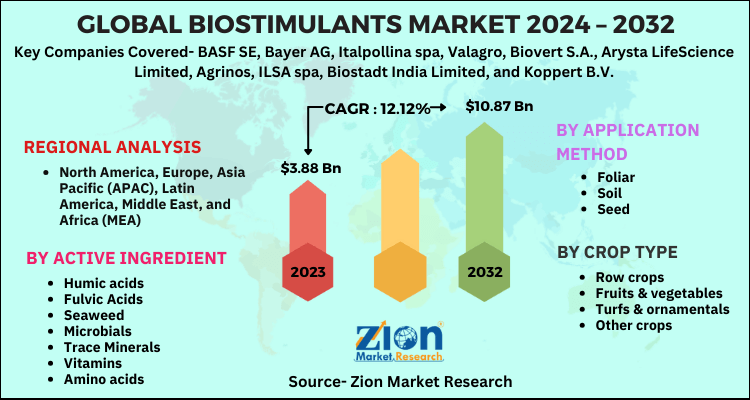

Biostimulants Market By Active Ingredient (Humic Acids, Fulvic Acids, Seaweed, Microbials, Trace Minerals, Vitamins, And Amino Acids), By Application Method (Foliar, Soil, And Seed), By Crop Type (Row Crops, Fruits & Vegetables, Turfs & Ornamentals, Other Crops) - Global Industry Perspective, Comprehensive Analysis, And Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.88 Billion | USD 10.87 Billion | 12.12% | 2023 |

Biostimulants Market Size

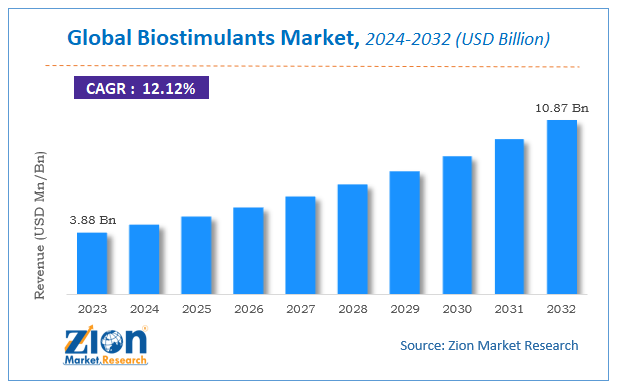

According to Zion Market Research, the global Biostimulants Market was worth USD 3.88 Billion in 2023. The market is forecast to reach USD 10.87 Billion by 2032, growing at a compound annual growth rate (CAGR) of 12.12% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Biostimulants Market industry over the next decade.

Biostimulants Market: Overview

Biostimulants are bioactive ingredients that contain compounds or microbes that have a natural effect on plant metabolism, stimulating plant function and thus increasing agricultural yields. Biostimulants have emerged as cutting-edge technological innovations that provide a competitive alternative to plant protection products with the potential to transform the agricultural industry into one that is more sustainable. Biostimulants boost plant vigour at important stages of crop growth, allowing them to reach their full potential. They may not have a direct impact on biotic tension, unlike biocontrol materials. Crops are more able to tolerate harsh weather conditions including drought and temperature fluctuations thanks to biostimulants. Agricultural production and yields are increasing due to use of biostimulants. Biostimulants boosts nutrient supply, water storage capability, metabolism, and chlorophyll quality.

The growing understanding of the nutritional benefits of biostimulants and their use on broad-acre crops has expanded the biostimulants market's potential for expansion. The organic food industry, which is expanding at a phenomenal rate, is the main factor of the biostimulant market's development.

COVID-19 Impact Analysis

The global Biostimulants market has witnessed a slight decline in the sales for short term due to the lockdown enforcement placed by governments in order to contain COVID spreading. As a result, supply and demand have been negatively impacted, resulting in lower demand for market goods. The majority of biostimulant plants and industries were permitted to operate because they were considered necessary to the economy. Hence, businesses were able to continue producing goods. The pandemic did, however, have an effect on consumer trends, with demand for certain crops declining as a consequence of the pandemic. However, the global markets are slowly opening to their full potential and theirs a surge in demand of Biostimulants as the demand for organic food is increasing in the aftermath of the pandemic. The market would remain bullish in upcoming year.

The significant decrease in the global Biostimulants market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Biostimulants Market: Growth Factors

The growing understanding of the nutritional benefits of biostimulants and their use on broad-acre crops has expanded the biostimulants market's potential for growth. The organic food industry, which is expanding at a phenomenal rate, is the main factor of the biostimulant market's development. The implementation of sustainable agriculture to protect the environment from harmful effects is another important factor driving market expansion. The industry is expected to rise due to increased demand for high crop yield and quality. Farmers' lack of knowledge and understanding, on the other hand, may stifle market expansion. Farseeing government assistance for biostimulants, continuous creation and production of innovative bio-based products, and an increase in disposable income and spending to fuel market expansion may create new opportunities for the biostimulant market's key players.

Biostimulants Market: Segmentation

The global biostimulants market is classified on the basis of active ingredient, application method, crop type, and region.

On the basis of active ingredient, the market is divided as fulvic acids, seaweed, trace minerals, humic acids, amino acids, and vitamins.

By application method, the worldwide biostimulants market is segmented into foliar, soil, and seed. Foliar application method segment accounted for the largest market share in 2015 and is anticipated to lead the global biostimulants market within the forecast period.

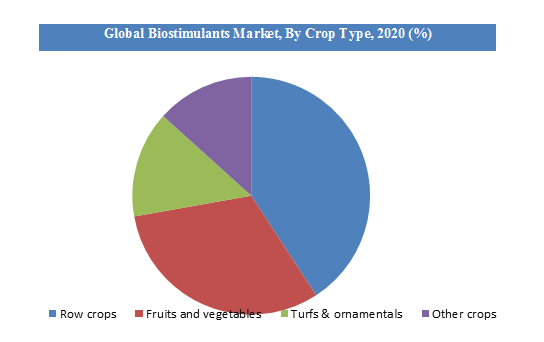

On the basis of crop type, the market is segmented into row crops, fruits & vegetables, turfs & ornamentals, other crops. Row crops segment accounted for the largest market share in 2015, followed by fruits & vegetable segment.

Biostimulants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biostimulants Market |

| Market Size in 2023 | USD 3.88 Billion |

| Market Forecast in 2032 | USD 10.87 Billion |

| Growth Rate | CAGR of 12.12% |

| Number of Pages | 150 |

| Key Companies Covered | BASF SE, Bayer AG, Italpollina spa, Valagro, Biovert S.A., Arysta LifeScience Limited, Agrinos, ILSA spa, Biostadt India Limited, and Koppert B.V. |

| Segments Covered | By Active Ingredient, By Application Method, By Crop type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Biostimulants Market: Regional Analysis

Geographically, the worldwide biostimulants market has been classified into North America, Latin America, Europe, Europe, Asia-Pacific, and the Middle East & Africa. Europe dominated the global biostimulant market in 2015. The market in Europe is expected to remain dominant throughout the forecast period. Asia Pacific and Latin America are expected to boost demand for biostimulants products over the coming years due to technological advancements happening in these regions coupled with rising awareness about organic products.

Biostimulants Market: Competitive Players

- BASF SE

- Bayer AG

- Italpollina spa

- Valagro

- Biovert S.A.

- Arysta LifeScience Limited

- Agrinos

- ILSA spa

- Biostadt India Limited

- Koppert B.V.

The global Biostimulants Market is segmented as follows:

By Active Ingredient

- Humic acids

- Fulvic Acids

- Seaweed

- Microbials

- Trace Minerals

- Vitamins

- Amino acids

By Application Method

- Foliar

- Soil

- Seed

By Crop type

- Row crops

- Fruits & vegetables

- Turfs & ornamentals

- Other crops

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Biostimulants are natural or synthetic substances applied to plants, seeds, or soil to enhance plant growth, yield, and stress tolerance. They work by stimulating biological processes, improving nutrient uptake, and promoting overall plant health without being fertilizers or pesticides.

According to study, the Biostimulants Market size was worth around USD 3.88 billion in 2023 and is predicted to grow to around USD 10.87 billion by 2032.

The CAGR value of Biostimulants Market is expected to be around 12.12% during 2024-2032.

Europe has been leading the Biostimulants Market and is anticipated to continue on the dominant position in the years to come.

The Biostimulants Market is led by players like BASF SE, Bayer AG, Italpollina spa, Valagro, Biovert S.A., Arysta LifeScience Limited, Agrinos, ILSA spa, Biostadt India Limited, and Koppert B.V.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed