Bike and Scooter Rental Market Size, Share, Trends, Growth 2032

Bike and Scooter Rental Market By Propulsion (Electric, Gasoline, and Pedal), By Service (Subscription-Based and Pay As You Go), By Vehicle (Scooter and Bike), By Operational Model (Station-Based and Dockless), and By Region - Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

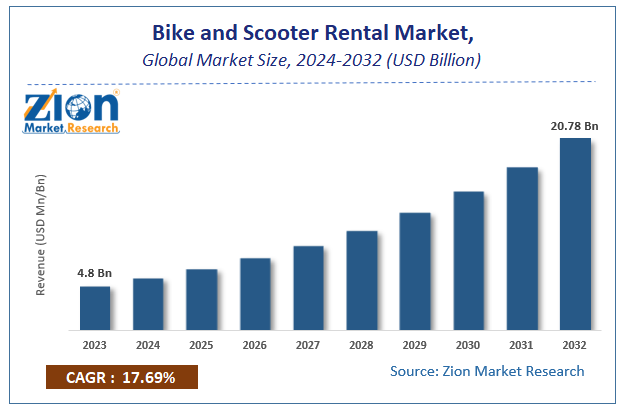

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.8 Billion | USD 20.78 Billion | 17.69% | 2023 |

Bike and Scooter Rental Market Insights

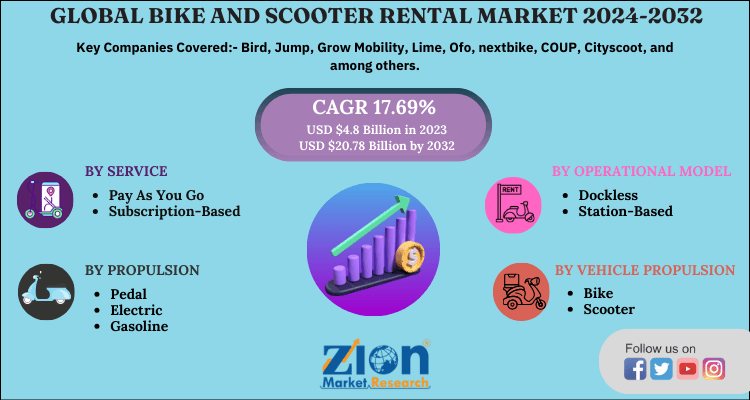

According to a report from Zion Market Research, the global Bike and Scooter Rental Market was valued at USD 4.8 Billion in 2023 and is projected to hit USD 20.78 Billion by 2032, with a compound annual growth rate (CAGR) of 17.69% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Bike and Scooter Rental industry over the next decade.

The report offers valuation and analysis of surface protection tapes market on a global as well as regional level. The study offers an in-depth assessment of the market competition, inhibitions, sales forecasts, emerging trends, and industry-validated information. The report provides historical data from 2018 to 2022 along with a forecast from 2024 to 2032 based on revenue (USD Billion).

Bike and Scooter Rental Market Key Growth Drivers

Massive demand for ridesharing activities across the globe is likely to define the growth of the bike and scooter rental industry over the forecast timeline. Apart from this, favorable economics of shared micromobility has ensured lower break-even points for the players in the bike and scooter rental industry. This will further prompt the expansion of the market over the forthcoming years. Moreover, shared micromobility, which is defined as shared e-bikes and e-scooters, is anticipated to transform the growth of the automotive sector in the U.S., China, and Europe.

Furthermore, shared micromobility is predicted to offer huge growth prospects to the transportation sector in cities and urban areas due to its ability to address critical transport issues of the urban populace. In addition to this, shared micromobility holds a key to reducing vehicle footprint and minimizing road congestion or traffic jams. All these aspects are anticipated to enlarge the scope of the bike and scooter rental industry over the ensuing years.

Apparently, few of the start-ups, as well as established players in the industry, have claimed significant positive unit economics metrics. Research analysts have predicted that there will be nearly over 200 shared micromobility trips by 2030. All these aspects will create lucrative growth opportunities for the bike and scooter rental market over the forecast period. Today, bikes can be located and unlocked through the use of smartphone Operational Model s and this is likely to upsurge the growth of the bike and scooter rental industry over the forecast timeframe.

Bike and Scooter Rental Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bike and Scooter Rental Market |

| Market Size in 2023 | USD 4.8 Billion |

| Market Forecast in 2032 | USD 20.78 Billion |

| Growth Rate | CAGR of 17.69% |

| Number of Pages | 110 |

| Key Companies Covered | Bird, Jump, Grow Mobility, Lime, Ofo, nextbike, COUP, Cityscoot, and among others |

| Segments Covered | By Service, By Propulsion, By Operational Model, By Vehicle Propulsion, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bike and Scooter Rental Market Key Players

Our research study focuses on the recent transformations observed in the industry along with the strategic plans & moves adopted by the market players to expand their regional presence as well as the business. Let us discuss the strategic moves made by a few of the reputed brands in the bike and scooter rental industry.

Ofo: In the first week of February 2020, a China-based bike sharing firm Ofo added ecommerce features on its app. According to the company sources, the new 4.0 version of the app focuses on four key areas including cash back & discount offerings through ecommerce services and deposit-free bike rental services.

Grab Holdings Inc.: In February 2020, a Singapore-based ridesharing firm Grab announced the acquisition of Bento, a leading B2B Robo-Advisor & Digital Wealth Technology Provider Based in Asia, for increasing its financial service offerings. For the record, Bento is likely to be renamed as Grab Invest. However, Grab has revealed that the acquisition will enable it to expand its service portfolio through wealth management & investment service offerings to the end-users, merchant partners, and driver partners.

Key players profiled in the report include:

- Bird

- Jump

- Grow Mobility

- Lime

- Ofo

- nextbike

- COUP

- Cityscoot

The global bike and scooter rental market is segmented as follows:

By Service

- Pay As You Go

- Subscription-Based

By Propulsion

- Pedal

- Electric

- Gasoline

By Operational Model

- Dockless

- Station-Based

By Vehicle Propulsion

- Bike

- Scooter

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Bike and scooter rental is a shared mobility service that allows users to rent electric scooters or bicycles for brief periods. This service is typically accessed and operated through a mobile application or kiosk. These services are typically provided in urban areas, enabling individuals to utilize bikes or scooters on-demand for convenient transportation over short distances.

Bike and scooter rentals provide a convenient, eco-friendly solution to circumvent traffic congestion and reduce commuting times in crowded urban areas as cities become more densely populated.

According to a report from Zion Market Research, the global Bike and Scooter Rental Market was valued at USD 4.8 Billion in 2023 and is projected to hit USD 20.78 Billion by 2032.

According to a report from Zion Market Research, the global Bike and Scooter Rental Market a compound annual growth rate (CAGR) of 17.69% during the forecast period 2024-2032.

North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA)

Bird, Jump, Grow Mobility, Lime, Ofo, nextbike, COUP, Cityscoot, and among others

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed