Automotive Heads-Up Display (HUD) Market Size, Share, Analysis, Trends, Growth, 2032

Automotive Heads-Up Display (HUD) Market By Product (Combiner-projected HUD’s and Windshield-projected HUD’s) By End-User (Mid-size Cars and Premium Cars): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

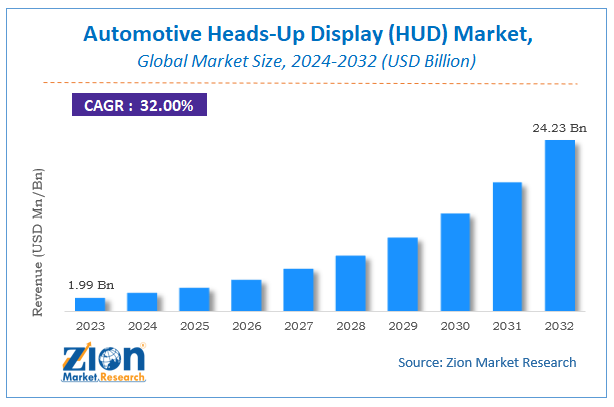

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.99 Billion | USD 24.23 Billion | 32% | 2023 |

Automotive Heads-Up Display (HUD) Market Insights

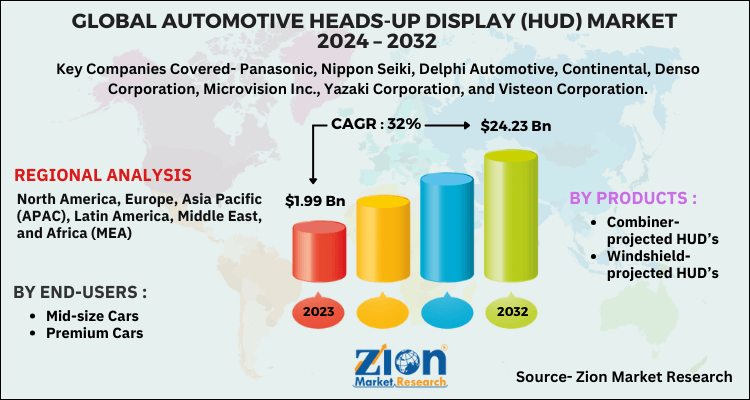

According to Zion Market Research, the global Automotive Heads-Up Display (HUD) Market was worth USD 1.99 Billion in 2023. The market is forecast to reach USD 24.23 Billion by 2032, growing at a compound annual growth rate (CAGR) of 32% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Automotive Heads-Up Display (HUD) Market industry over the next decade.

Automotive Heads-Up Display (HUD) Market: Overview

An automotive heads-up display market also called auto-HUD is a transparent display that shows exact data in an automobile when users need it, without using any human work. The crucial data shows HUD including navigation signals, warning signals, and speed, among others without looking down into the instrument cluster. This data shows the driver in order to reduce road accidents or crashes.

The giant players in the industry are developing and launching new technologies for HUDs used in vehicles to enable the driver to find navigation, send messages, and play music. For instance, Continental AG is working on developing HUDs for sports cars.

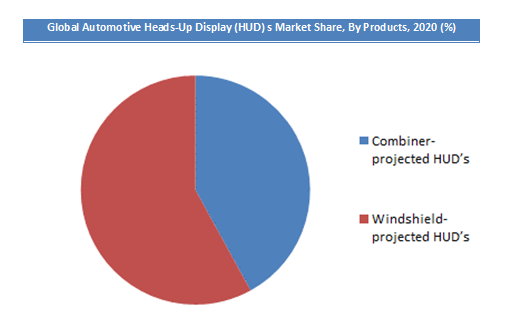

There are two types of HUDs used in vehicles: windshield and combiner HUDs. Windshield HUDs are mostly used in passenger vehicles. These HUDs are easier to integrate into passenger cars owing to the curvature in the passenger car windshield.

To know more about this report, Request For Customization.

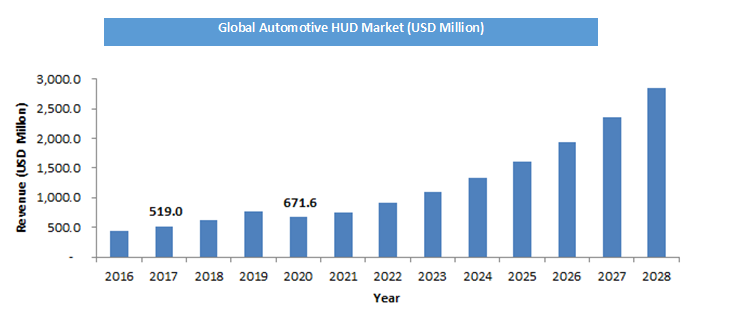

Automotive Heads-Up Display (HUD) Market: COVID-19 Impact Analysis

The global Automotive Heads-Up Display (HUD) market has witnessed a slight decline in production, due to reduced demand and supply chain bottlenecks and to ensure the safety of its employees in all the regions. Retail sales of vehicles across the region are also likely to suffer due to subdued consumer sentiment because of the rising infections and curbs. The automotive industry in the U.S remains fragile, vehicles sales decline by 5-10%, whereas China's vehicle sales continue their fast recovery. Europe automotive shows a decline of 8- 12% Y-o-Y.

The restrictions imposed by various nations to contain COVID had stopped production resulting in disruption across the whole supply chain. However, the global markets are slowly opening to their full potential, and theirs a surge in demand for auto parts of vehicles. The market would remain bullish in the upcoming year. The significant decrease in the global Automotive Heads-Up Display (HUD) s market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Automotive Heads-Up Display (HUD) Market: Growth Factors

The automotive industry across the globe is rapidly increasing owing to the increasing disposable revenue in the developing as well as the developed regions.

China is the biggest hub of the manufacturing sector, and the biggest manufacturer of mid-size cars all over the world, and this makes it one of the biggest noteworthy mid-size cars markets indirectly boosting the automotive heads-up display market.

Moreover, with an augmenting number of installations of cars, the requirement for mid-size vehicles and premium vehicles is anticipated to elevate. In addition to this, the entry of the new key players and innovation in the technology in the global automotive heads-up display market is anticipated to reduce the cost of heads-up displays.

For instance, in March 2018, Refreshed Mazda 6 sedan was launched with an enhanced head-up display. This, in return, is hoped to elevate the requirement for the automotive heads-up display market.

High installation costs are anticipated to hold the development of the automotive heads-up display market.

Automotive Heads-Up Display (HUD) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Heads-Up Display (HUD) Market |

| Market Size in 2023 | USD 1.99 Billion |

| Market Forecast in 2032 | USD 24.23 Billion |

| Growth Rate | CAGR of 32% |

| Number of Pages | 110 |

| Key Companies Covered | Panasonic, Nippon Seiki, Delphi Automotive, Continental, Denso Corporation, Microvision Inc., Yazaki Corporation, and Visteon Corporation |

| Segments Covered | By Products, By End-Users and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Automotive Heads-Up Display (HUD) Market: Competitive Landscape

Some of the major players in the global Automotive Heads-Up Display (HUD) s market include

- Panasonic, Nippon Seiki

- Delphi Automotive

- Continental

- Denso Corporation

- Microvision Inc.

- Yazaki Corporation

- Visteon Corporation.

The global Automotive Heads-Up Display (HUD) s Market is segmented as follows:

By Products

- Combiner-projected HUD’s

- Windshield-projected HUD’s

By End-Users

- Mid-size Cars

- Premium Cars

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Automotive Heads-Up Display (HUD) s Market was valued at USD 1.99 Billion in 2023.

The global Automotive Heads-Up Display (HUD) s Market is expected to reach USD 24.23 Billion by 2032, growing at a CAGR of 32% between 2024 to 2032.

Some of the key factors driving the global Automotive Heads-Up Display (HUD) s Market growth are increasing incidence of road accidents and rising awareness among populace.

Asia Pacific region held a substantial share of the Automotive Heads-Up Display (HUD) s Market in 2023. This is attributable to the owing to the huge requirement from up-and-coming nations such as India and China.

Some of the major players of global Automotive Heads-Up Display (HUD) s market includes Panasonic, Nippon Seiki, Delphi Automotive, Continental, Denso Corporation, Microvision Inc., Yazaki Corporation, and Visteon Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed