Automatic Filament Winding Machines Market Size, Share, Trends, Growth 2034

Automatic Filament Winding Machines Market By Winding Machines Type (Continuous Winding Machines, Intermittent Winding Machines), By Application (Pressure Vessels, Pipes and Tanks), By End-User Industries (Aerospace And Defense, Automotive), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

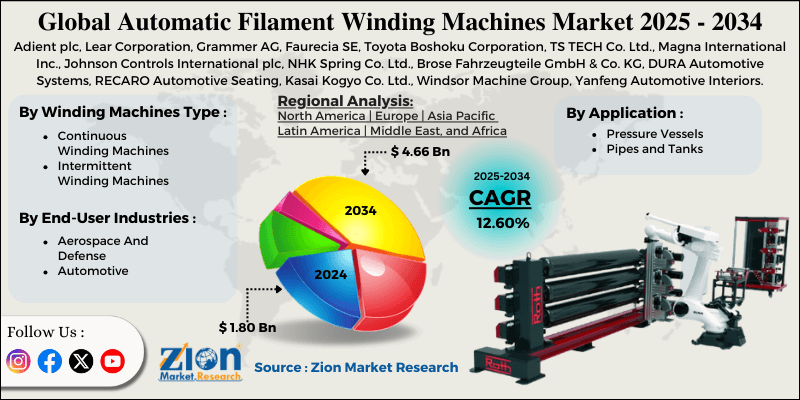

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.80 Billion | USD 4.66 Billion | 12.60% | 2024 |

Automatic Filament Winding Machines Industry Perspective:

What will be the size of the automatic filament winding machines market from 2025 to 2034?

The global automatic filament winding machines market size was around USD 1.80 billion in 2024 and is projected to reach USD 4.66 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automatic filament winding machines market is estimated to grow annually at a CAGR of around 12.60% over the forecast period (2025-2034)

- In terms of revenue, the global automatic filament winding machines market size was valued at around USD 1.80 billion in 2024 and is projected to reach USD 4.66 billion by 2034.

- The automatic filament winding machines market is projected to grow significantly, driven by the expansion of the wind energy sector, increased infrastructure projects, and heightened precision and efficiency requirements.

- Based on winding machine type, the continuous winding machines segment is expected to lead the market, while the intermittent winding machines segment is expected to grow considerably.

- Based on application, the pipes and tanks segment is the largest, while the pressure vessels segment is projected to record sizeable revenue over the forecast period.

- Based on end-user industry, the aerospace and defense segment is expected to lead the market, followed by the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automatic Filament Winding Machines Market: Overview

Automatic filament winding machines are advanced manufacturing systems that produce high-strength composite parts by accurately winding continuous fibers, such as aramid, carbon, or glass, impregnated with resin, onto a rotating mold. These machines, controlled by computer software or CNC, promise accurate fiber placement, consistent stiffness, and repeatable quality. The global automatic filament winding machines market is projected to grow substantially, driven by demand for high-strength, lightweight materials, the expansion of the renewable energy sector, and industrial automation trends. Industries like automotive and aerospace steadily demand materials that reduce weight while maintaining structural strength. Filament-wound composites meet these needs resourcefully. This fuels demand for automated winding machines.

Moreover, wind energy and hydrogen rely on composite components, such as pressure vessels and blades. Automatic filament winding enables consistent, large-scale production. Growth of renewable infrastructure augments machine adoption. Furthermore, manufacturers are adopting automation to enhance accuracy, productivity, and repeatability. Automatic filament winding machines reduce labor dependency and human error. This aligns with worldwide smart manufacturing initiatives.

Although drivers exist, the global market is challenged by factors such as technical complexity, variations in raw material costs, and limited awareness. Operating advanced winding machines requires training and skilled personnel. Lack of specialization may reduce machine utilization efficacy. This is a notable barrier in emerging nations. Carbon fibers and advanced resins experience repeated price volatility. Growing material costs raise overall production expenses, thus impacting return on investment. Likewise, several developing markets lack awareness of the benefits of filament winding. Conventional manufacturing techniques are still widely used, slowing industry penetration.

Even so, the global automatic filament winding machine industry is well-positioned due to the expansion of EVs, hydrogen storage, and pressure vessels, as well as Industry 4.0 integration. EVs need lightweight structural and battery components. Filament winding supports effective composite manufacturing. Hence, the growth of electric vehicles creates new avenues for demand. Hydrogen energy systems rely on high-pressure composite tanks. Automatic filament winding promises safety compliance and strength. This industry offers robust growth potential. Additionally, smart manufacturing allows real-time monitoring and predictive maintenance. Integrating digital technologies improves machine value, thus appealing to advanced manufacturers.

Automatic Filament Winding Machines Market: Dynamics

Growth Drivers

How are technological advancements and automation integration driving the automatic filament winding machines market?

Automation and digitalization are transforming filament winding machines into connected, smarter systems with real-time monitoring, adaptive control, and predictive analytics. These improvements help manufacturers achieve tighter tolerances and elevated quality while decreasing operator reliance and waste. Integration with Industry 4.0 architectures enables seamless data exchange and process optimization in production lines. As smart features become industry standards rather than luxuries, demand for automated machines continues to increase.

How is the automatic filament winding machines market fueled by the automotive industry’s shift to lightweight components?

The automotive sector’s shift toward lightweight materials, driven by range targets and electric-vehicle performance requirements, is accelerating the adoption of filament-winding machines. Electric vehicle battery enclosures, reinforcements, and drive shafts increasingly use composite parts that are difficult to produce without automated winding. As manufacturers adopt mass-production capabilities without sacrificing part quality, automatic systems are becoming increasingly crucial. This inclination fuels diversified use cases and boosts predictions for the automatic filament winding machines market.

Restraints

Competitive pressure from alternative processes unfavorably impacts the market progress

Alternative composite fabrication techniques, such as automated tape laying, hand lay-up, or pull-winding, compete with filament for some product types. In applications where these techniques are believed to be less expensive, faster, or easier to implement, buyers may choose filament winding over other methods. This competitive landscape constrains growth, particularly in segments where the benefits of filament winding are not fully realized. Hence, some potential industry segments remain under-penetrated.

Opportunities

How does customization for specialized industrial applications offer advantages for the development of the automatic filament winding machine market?

Industries such as aerospace propulsion, advanced electronics, and medical devices increasingly require complex composite structures that conventional manufacturing cannot produce effectively. Filament winding’s precision and adaptability make it suitable for these specialized needs. Machine manufacturers can invest in this by offering custom configurations, advanced tooling designs, and multi-axis systems. These high-margin, niche applications are expected to become growth hotspots for the automatic filament winding machines industry.

Challenges

Quality control and inspection bottlenecks restrict the market growth

Filament winding produces highly technical composite parts that require rigorous quality validation, including fiber-orientation checks, mechanical testing, and void analysis. Integrating non-destructive inspection (NDI) techniques into the winding process remains challenging and is typically conducted separately from manufacturing lines. Ensuring consistent quality without slowing production demands requires advanced sensors, analysis tools, and automation. The challenge of inline inspection limits throughput enhancements and adds complexity to manufacturing workflows.

Automatic Filament Winding Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automatic Filament Winding Machines Market |

| Market Size in 2024 | USD 1.80 Billion |

| Market Forecast in 2034 | USD 4.66 Billion |

| Growth Rate | CAGR of 12.60% |

| Number of Pages | 217 |

| Key Companies Covered | Adient plc, Lear Corporation, Grammer AG, Faurecia SE, Toyota Boshoku Corporation, TS TECH Co. Ltd., Magna International Inc., Johnson Controls International plc, NHK Spring Co. Ltd., Brose Fahrzeugteile GmbH & Co. KG, DURA Automotive Systems, RECARO Automotive Seating, Kasai Kogyo Co. Ltd., Windsor Machine Group, Yanfeng Automotive Interiors, and others. |

| Segments Covered | By Winding Machines Type, By Application, By End-User Industries, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automatic Filament Winding Machines Market: Segmentation

The global automatic filament winding machines market is segmented by winding machine type, application, end-user industry, and region.

Based on winding machine type, the global automatic filament winding machines industry is divided into continuous and intermittent winding machines. The continuous winding machines segment dominates the market with nearly 60-70% market share and production volume. This growth is backed by their broad use in manufacturing continuous, long composite products, such as cylindrical structures and pipes, where high efficiency and throughput are crucial. These machines are paramount for large-scale composite production lines and are widely preferred for high-volume, simpler applications.

On the other hand, the intermittent winding machines segment registers 30-40% of the market. They are commonly used to produce complex components, high-pressure parts, and specialized composite structures, such as detailed aerospace components and pressure vessels. While they account for a smaller share, they are crucial for applications that require greater precision and flexibility.

Based on application, the global automatic filament winding machines market is segmented into pressure vessels and pipes, and tanks. The pipes and tanks segment holds nearly 40-45% market share. This growth is supported by the broader adoption of filament-winding technology for manufacturing composite pipes and storage tanks for chemical processing, water, oil & gas infrastructure, and wastewater. These application areas demand large volumes and wide industrial utility, thus fueling elevated demand.

Conversely, the pressure vessels segment captures approximately 20-30% of the market share due to their use in high-pressure storage of liquids and gases (e.g., hydrogen, industrial gases, and compressed natural gas). They represent a smaller share than the wider tanks and pipes category.

Based on end-user industries, the global market is segmented into aerospace and defense and automotive. The aerospace and defense segment holds a 35-40% market share due to stringent requirements for high-performing, lightweight composite components used in missiles, rockets, aircraft, and associated structural components.

However, the automotive segment is the fastest-growing, with a 25-30% market share. This steady growth is backed by manufacturers' growing adoption of composite materials to enhance fuel efficiency and EV performance and to reduce weight. This makes it a leading market for filament winding machines after aerospace and defense.

Automatic Filament Winding Machines Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Automatic Filament Winding Machines Market?

Asia Pacific is likely to sustain its leadership in the automatic filament winding machine market, with an 11.7% CAGR, driven by rapid industrial growth, strong demand in the aerospace and automotive sectors, and infrastructure and renewable energy expansion. Asia Pacific is home to the world's fastest-growing industrial sectors, with nations such as Japan, South Korea, China, and India expanding manufacturing in aerospace, automotive, infrastructure, and energy. This growth increases the demand for automated filament winding machines in multiple industries. High production volumes and large-scale manufacturing capabilities offer the region a clear market benefit. Moreover, the automotive industry in the region is steadily adopting lightweight composite components to enhance EV performance and fuel efficiency.

At the same time, aerospace programs need precision-wound, high-performance parts for rockets, aircraft, and defense equipment. The combined demand from the aerospace and automotive sectors fuels significant adoption of automotive filament winding machines. Also, the region is investing in infrastructure projects, including water storage tanks, pipelines, and chemical plants, which use composite materials produced by filament winding. Renewable energy projects, mainly hydrogen storage systems and wind turbines, also rely on large composite components. These industries need automated machinery for effective, high-quality production, further driving market growth.

Europe continues to secure the second-highest share, with a nearly 8.2% CAGR, in the automatic filament winding machines industry, owing to an established industrial base, an advanced defense and aerospace sector, and a focus on renewable energy and infrastructure. Europe has a long-standing industrial ecosystem with robust manufacturing capabilities across aerospace, automotive, and industrial machinery. This well-developed base fuels steady demand for automated composite production solutions, such as filament winding machines. Stable industrial output supports a consistent regional share of industry and the adoption of advanced equipment. The European defense and aerospace industries are well-established, with major suppliers and OEMs producing precision composite parts. These industries need high-class and reliable winding machines for structurally demanding components. Strong demand from aircraft structures, defense systems, and space programs amplifies machine adoption.

Additionally, Europe leads in renewable energy deployment, particularly offshore wind and hydrogen infrastructure, which rely on large filament-wound composite structures. Investments in green energy systems and infrastructure augment demand for tanks, pipes, and pressure vessels with automated winding. This trend strengthens the regional machine industry.

Automatic Filament Winding Machines Market: Competitive Analysis

The leading players in the global automatic filament winding machines market are:

- Murata Machinery Ltd.

- GTI Composite

- Ingersoll Machine Tools

- Magnum Venus Products (MVP)

- Pultrex

- Advanced Composites Inc.

- Cygnet Texkimp

- Autonational Composite Machinery

- Mikrosam

- Vem Technologies S.r.l.

- Matrasur Composites

- Engineering Technology Corp. (Toray)

- Roth Composite Machinery

- X-Winder LLC

- and Beijing Vidatech

Automatic Filament Winding Machines Market: Key Market Trends

Smart manufacturing & IoT integration:

Filament winding machines are being equipped with data analytics, IoT sensors, and connectivity features that enable predictive maintenance, real-time monitoring, and remote control. This digital transformation improves operational efficiency and decreases downtime. Smart capabilities help manufacturers optimize quality and performance in production complex composite parts.

Customization & flexible machine designs:

Machine makers are developing more flexible and modular systems that can be easily reconfigured for diverse materials, shapes, and production runs. Improved material customization and compatibility help meet diverse industry needs, from automotive to aerospace. This flexibility supports faster deployment and better ROI for manufacturers.

The global automatic filament winding machines market is segmented as follows:

By Winding Machines Type

- Continuous Winding Machines

- Intermittent Winding Machines

By Application

- Pressure Vessels

- Pipes and Tanks

By End-User Industries

- Aerospace And Defense

- Automotive

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Which country is a significant contributor to the global automatic filament winding machines market?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed