Automated Flagger Assistance Device (AFAD) Market Size, Share 2034

Automated Flagger Assistance Device (AFAD) Market By Type (Portable AFADs, Fixed AFADs), By Application (Urban Roads, Highways), By End-User Industry (Construction, Road Maintenance), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

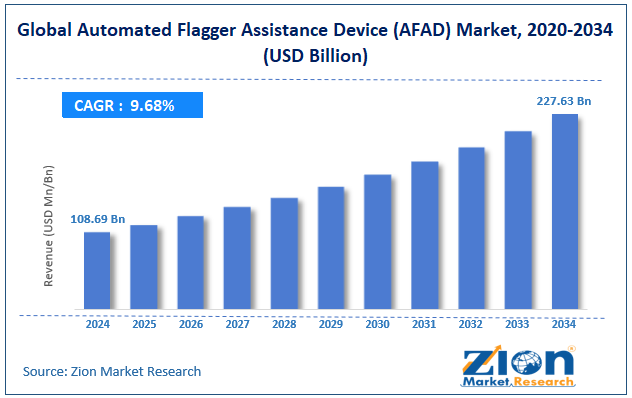

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 108.69 Billion | USD 227.63 Billion | 9.68% | 2024 |

Automated Flagger Assistance Device (AFAD) Industry Perspective:

What will be the size of the automated flagger assistance device microscope market from 2025 to 2034?

The global automated flagger assistance device (AFAD) market size was approximately USD 108.69 billion in 2024 and is projected to reach USD 227.63 billion by 2034, with a compound annual growth rate (CAGR) of approximately 9.68% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automated flagger assistance device (AFAD) market is estimated to grow annually at a CAGR of around 9.68% over the forecast period (2025-2034)

- In terms of revenue, the global automated flagger assistance device (AFAD) market size was valued at around USD 108.69 billion in 2024 and is projected to reach USD 227.63 billion by 2034.

- The automated flagger assistance device (AFAD) market is projected to grow significantly, driven by rising focus on worker safety and traffic management, technological advancements in sensors and automation, and the growing emphasis on reducing labor costs.

- Based on type, the portable AFADs segment is expected to lead the market, while the fixed AFADs segment is expected to grow considerably.

- Based on application, the highways segment is the dominating segment, while the urban roads segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user industry, the construction segment is expected to lead the market, followed by the road maintenance segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Automated Flagger Assistance Device (AFAD) Market: Overview

An automated flagger assistance device is a traffic control device for roadwork areas that safely manages vehicle flow without requiring flaggers to be visible to live traffic. It uses movable arms, gates, or lights that are controlled remotely to signal drivers to proceed or stop, functioning similarly to a human flagger. The global automated flagger assistance device (AFAD) market is projected to witness substantial growth driven by growing emphasis on worker safety, regulatory compliance and safety standards, and infrastructure development. AFADs reduce the risk of injuries by allowing traffic control without direct human exposure. This protects flaggers in high-traffic construction zones. Safety advancements fuel broader adoption.

Moreover, stringent safety regulations need reliable traffic management in work zones. AFADs businesses meet safety and legal standards effectively. Compliance pressures encourage investment in automated solutions. Furthermore, expanding road networks and maintenance projects augment the demand for traffic management tools. AFADs provide efficient, consistent control on busy construction sites. Infrastructure growth backs industry growth.

Although drivers exist, the global market faces challenges, including high upfront investment costs, a lack of regulatory standardization, and operational constraints. Advanced AFADs are high-priced, restricting access for small contractors. High upfront costs slow adoption in budget-constrained projects. Investment remains a major barrier. Different economies have diverse certification and approval procedures. This makes global deployment time-consuming and complicated. Inconsistent standards slow the industry's expansion. Likewise, AFADs may not handle complicated intersections or high pedestrian areas efficiently. Human judgment is still needed, sometimes. Technical limits reduce versatility.

Even so, the global automated flagger assistance device (AFAD) industry is well-positioned due to the integration of smart cities and connected infrastructure, predictive technologies and AI, and eco-friendly AFAD designs. AFADs can be incorporated into IoT-based traffic systems. This allows adaptive control and real-time monitoring. Connected infrastructure drives safety and efficiency. Integrating AI enhances traffic flow prediction and safety analytics. Modern sensors improve operational intelligence. AI integration creates more effective and smarter AFAD systems. Solar-powered, energy-efficient units attract eco-conscious buyers. Sustainable designs support environmental regulations. Green technology raises industry attractiveness.

Automated Flagger Assistance Device (AFAD) Market: Dynamics

Growth Drivers

How are environmental and operational efficiency benefits driving growth in the automated flagger assistance device market?

AFADs contribute to operational efficiency by reducing setup time, site congestion, and labor requirements. Energy-efficient, solar-powered units minimize environmental impact, enabling speedy deployment and easy relocation between sites, saving resources and time. By improving traffic flow and reducing emissions from idling vehicles in work zones, AFADs support eco-friendly infrastructure management. Their environmental and operational advantages further improve adoption across the private and public sectors, thereby fueling the automated flagger assistance device (AFAD) market.

How is smart traffic integration and technological improvements fueling the automated flagger assistance device market?

Improvements in AFAD technology, comprising IoT connectivity, advanced sensor systems, and GPS tracking, are improving operational efficiency. Modern AFADs integrate with smart city traffic management networks, enabling real-time adjustments and centralized monitoring of traffic flow. New devices also feature remote control, solar power, and cloud-based data tracking, enhancing sustainability and reliability. Continuous R&D ensures AFADs are safer, better-suited, and more user-friendly across different work zones. These technological advancements make automated systems more appealing than conventional manual flagging.

Restraints

Maintenance and operational complexity unfavorably impact the market progress

AFADs need periodic maintenance, technical expertise, and software updates to function accurately. Failure to properly maintain the devices can reduce reliability and increase downtime in work zones. Small contractors or municipalities may have inefficient maintenance personnel. Operational complexity may hamper some buyers from replacing conventional manual flaggers. This factor restricts the speed of industry penetration in regions with limited technical support infrastructure.

Opportunities

How do Public-Private Partnerships (PPPs) for infrastructure projects offer advantageous conditions for the automated flagger assistance device market development?

Rising focus on sustainability in transport planning and construction supports AFAD adoption. Solar-powered units reduce carbon footprint and support green initiatives. Effective traffic management with AFADs reduces vehicle idling and emissions in work zones. Environmental regulations steadily favor low-impact construction solutions. This eco-friendly aspect offers a strong opportunity to position the automated flagger assistance device (AFAD) industry.

Challenges

Limited after-sales support in remote areas restricts the market growth

AFAD deployment in underdeveloped or rural regions can be hindered by the lack of technical support. Maintenance, spare parts, and repairs may not be readily available. Delayed service decreases reliability and dampens adoption. Ensuring a consistent support infrastructure is crucial for market growth. Lack of after-sales networks remains a persistent challenge in several developing regions.

Automated Flagger Assistance Device (AFAD) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automated Flagger Assistance Device (AFAD) Market |

| Market Size in 2024 | USD 108.69 Billion |

| Market Forecast in 2034 | USD 227.63 Billion |

| Growth Rate | CAGR of 9.68% |

| Number of Pages | 213 |

| Key Companies Covered | Verra Mobility, Humboldt Scientific, Solar Traffic Systems, Channel Guard, RoadSafe Traffic Systems, Addco, Remote Traffic Solutions, Traffic Safety Corporation, TrafFix Devices, Econolite, Wanco, Safety Flag Company, International Road Dynamics, Traffic Safety Systems, Safety Flagging, and others. |

| Segments Covered | By Type, By Application, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automated Flagger Assistance Device (AFAD) Market: Segmentation

The global automated flagger assistance device (AFAD) market is segmented based on type, application, end-user industry, and region.

Based on type, the global automated flagger assistance device (AFAD) industry is divided into portable AFADs and fixed AFADs. The portable AFADs segment held nearly 60% share of the market due to their mobility and flexibility. They can be quickly deployed and repositioned in changing or short-term work zones. Their ease of transport makes them ideal for construction, emergency traffic control, and maintenance. This versatility fuels their market rank.

Conversely, the fixed AFADs segment captures 40% of the market share, as they are widely preferred for long-duration or high-traffic infrastructure projects. They provide stable, continuous traffic control and withstand harsh conditions for prolonged use. Though less mobile, their durability and reliability make them valuable for major roadworks. Their steady adoption secures the second rank in the market.

Based on application, the global automated flagger assistance device (AFAD) market is segmented into urban roads and highways. The highways segment accounted for nearly 55% of the market share due to extensive roadwork and maintenance projects. Long stretches of high-speed traffic impose stringent safety requirements that support automated flagging. AFADs help manage flow and protect workers on express routes and on busy intercity routes. Their efficiency in large, high-risk zones drives significant adoption in highway applications.

However, the urban roads segment accounts for 45% of the market, driven by dense traffic and frequent short-term projects. AFADs support traffic control where patterns and space change often. Utility works and municipal infrastructure upgrades drive the demand in city environments. Though smaller than highways, urban applications are a growing segment.

Based on end-user industry, the global market is segmented into construction and road maintenance. The construction segment accounts for nearly 60% of the market, driven by extensive infrastructure projects and road construction globally. AFADs improve site safety and simplify traffic control in major construction zones. Their efficiency and portability make them crucial for managing equipment and crews. High construction activity sustains the leading adoption of AFAD solutions.

Nevertheless, the road maintenance segment accounts for 40% of the market, as agencies repair and upgrade pavements, utilities, and bridges. AFADs safely manage intermittent work zones and traffic flow on active roadways. Their use in recurring maintenance tasks reduces risk and enhances scheduling.

Automated Flagger Assistance Device (AFAD) Market: Regional Analysis

What enables North America to have a strong foothold in the global Automated Flagger Assistance Device (AFAD) Market?

North America is likely to sustain its leadership, with approximately 7.5-8.0% CAGR in the automated flagger assistance device (AFAD) market, driven by strong market share & infrastructure investment, strict safety regulations, a compliance culture, and early adoption of advanced technologies. North America registers a 38-41% share of the market due to major investments in smart traffic systems and road construction, and maintenance in Canada and the United States. Well-developed transportation networks create high recurring demand for advanced traffic control solutions. Strict worker safety and traffic management regulations by agencies such as the Federal Highway Administration and OSHA facilitate broader AFAD adoption. Regulatory mandates promote or require automated solutions in high-risk work zones to protect road workers. This compliance culture amplifies purchases and long-term use of AFADs.

Furthermore, North America’s traffic and construction sectors are fast adopters of digital and automation technologies, comprising IoT-enabled AFADs and remote control. The region’s sophisticated ecosystem backs advancement and integration into large smart infrastructure projects. This early adoption of technology improves efficiency and drives regional dominance.

Europe, though second in overall automated flagger assistance device (AFAD) industry size, is projected to secure a substantial share, with a nearly 8.0-8.5% CAGR, driven by ongoing infrastructure development, safety mandates, and smart mobility integration. Europe is significantly investing in upgrading roads, urban transport networks, and bridges. Modernization projects augment the need for effective traffic management solutions. AFADs are broadly adopted for safety during construction and maintenance activities. Stringent European safety regulations require the protection of road workers in active traffic zones. Compliance with these mandates fuels broader adoption of automated traffic control devices.

AFADs help reduce accidents and meet legal standards effectively. European cities are adopting smart traffic systems and connected infrastructure. AFADs can be incorporated into IoT-based traffic management for real-time monitoring. This improves urban mobility and backs smart transport initiatives.

Automated Flagger Assistance Device (AFAD) Market: Competitive Analysis

The leading players in the global automated flagger assistance device (AFAD) market are:

- Verra Mobility

- Humboldt Scientific

- Solar Traffic Systems

- Channel Guard

- RoadSafe Traffic Systems

- Addco

- Remote Traffic Solutions

- Traffic Safety Corporation

- TrafFix Devices

- Econolite

- Wanco

- Safety Flag Company

- International Road Dynamics

- Traffic Safety Systems

- Safety Flagging

Automated Flagger Assistance Device (AFAD) Market: Key Market Trends

Rising adoption of solar‑powered and eco‑friendly units:

There is a surging demand for environmentally sustainable, solar-powered AFAD solutions that reduce reliance on fuel generators and lower operating costs. Solar AFADs offer extended autonomy and support green procurement policies and ESG/CSR objectives. This trend backs long-term cost savings and environmental goals.

Growing use in diverse applications beyond roadworks:

AFADs are currently deployed for utility work, event traffic control, urban maintenance, and emergency responses, where traffic management is in high demand. This growth beyond traditional road construction raises the overall addressable industry. Their scalability across diverse operational environments drives adoption across sectors.

The global automated flagger assistance device (AFAD) market is segmented as follows:

By Type

- Portable AFADs

- Fixed AFADs

By Application

- Urban Roads

- Highways

By End-User Industry

- Construction

- Road Maintenance

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Which are the major players driving growth in the automated flagger assistance device (AFAD) market?

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed