Artificial Intelligence in Diagnostics Market Size, Share and Forecast 2032

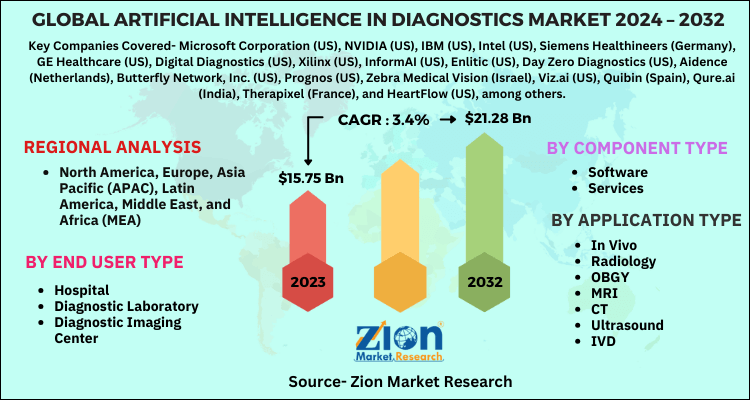

Artificial Intelligence in Diagnostics Market By Component (Software and Service), By Application (In Vivo, Radiology, OBGY, MRI, CT, Ultrasound and IVD), By End User (Hospital, Diagnostic Laboratory and Diagnostic Imaging Center): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

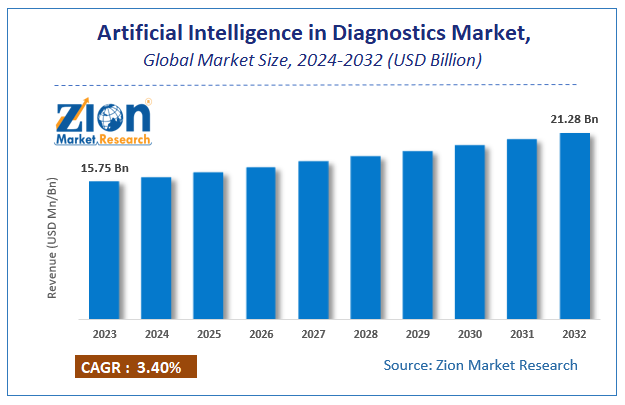

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.75 Billion | USD 21.28 Billion | 3.4% | 2023 |

Artificial Intelligence in Diagnostics Market Insights

According to Zion Market Research, the global Artificial Intelligence in Diagnostics Market was worth USD 15.75 Billion in 2023. The market is forecast to reach USD 21.28 Billion by 2032, growing at a compound annual growth rate (CAGR) of 3.4% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Artificial Intelligence in Diagnostics Market industry over the next decade.

Global Artificial Intelligence In Diagnostics Market Overview

Artificial intelligence (AI) is a type of machine learning that uses algorithms and software to perform tasks without the need for human intervention or instructions. Machine learning, natural language processing, reasoning, and perception are all examples of AI technologies. It's used in healthcare for things like estimating human cognition and analyzing complex medical and diagnostic imaging data.

The market for artificial intelligence in healthcare diagnosis is fueled by AI's ability to improve outcomes; additionally, the growing need to improve coordination between healthcare workers and patients is fueling the market growth. The growing importance of Big Data in healthcare, as well as the adoption of precision medicine and the increase in venture capital investments, are all contributing to market growth.

Artificial Intelligence in Diagnostics Market: Growth Factors

The increased adoption of AI products and services in the healthcare market is due to a growing awareness of the benefits offered by AI techniques and their broad application areas. Various leading healthcare companies are forming partnerships and collaborations with leading AI technology providers in order to develop innovative AI-based solutions for healthcare applications. These strategies allow these market players to provide advanced solutions to their customers while also bolstering their position in this fast-paced market.

The major drivers of market growth during the study period were startups developing AI-driven imaging and diagnostic solutions. China, the United States, and the United Kingdom are becoming popular centers for healthcare innovation. Healthcare AI startups in China have benefited from the government's AI-focused development strategy, which has encouraged investment and public-private partnerships.

Artificial Intelligence in Diagnostics Market: Segment Analysis

This high percentage can be attributed to the development of AI-based software for healthcare diagnosis. One of the key drivers is the growing demand for AI-powered and cloud-based augmented diagnostic solutions that aid in improving diagnostic precision when interpreting medical images of patients. Furthermore, the implementation of more advanced AI software in diagnostics involving a combination of multiple data sources such as MRI, CT, genomics, and proteomics, as well as patient data that aids in successfully diagnosing disease and assessing its progression, is expected to drive the artificial intelligence in the diagnostics industry.

Epilepsy, Alzheimer's disease, Parkinson's disease, ischemic brain stroke, and multiple sclerosis are among the neurological disorders for which AI diagnostics can provide early detection and precise diagnosis. Radiological imaging diagnosis, on the other hand, is critical in clinical patient management. Due to its high-end performance in image recognition, machine/deep learning with Convolutional Neural Networks (CNNs) has recently gained a lot of attention. In Vivo, Radiology, OBGY, MRI, CT, Ultrasound, and IVD forms the application type segment.

The AI in the medical diagnostics market is divided into hospitals, diagnostic imaging centers, diagnostic laboratories, and other end users, depending on the end user. In 2020, the hospital's segment held the largest share of the market, accounting for 65.3% of the total. The rising number of diagnostic imaging procedures performed in hospitals, as well as hospitals' growing desire to automate and digitize radiology patient workflow, can be attributed to this segment's large share. In hospitals, there is a growing adoption of minimally invasive procedures to improve patient care quality, as well as a growing adoption of advanced imaging modalities to improve workflow efficiency. Diagnostic Laboratory and Diagnostic Imaging Centers among others form the segment.

Artificial Intelligence in Diagnostics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Artificial Intelligence in Diagnostics Market |

| Market Size in 2023 | USD 15.75 Billion |

| Market Forecast in 2032 | USD 21.28 Billion |

| Growth Rate | CAGR of 3.4% |

| Number of Pages | 145 |

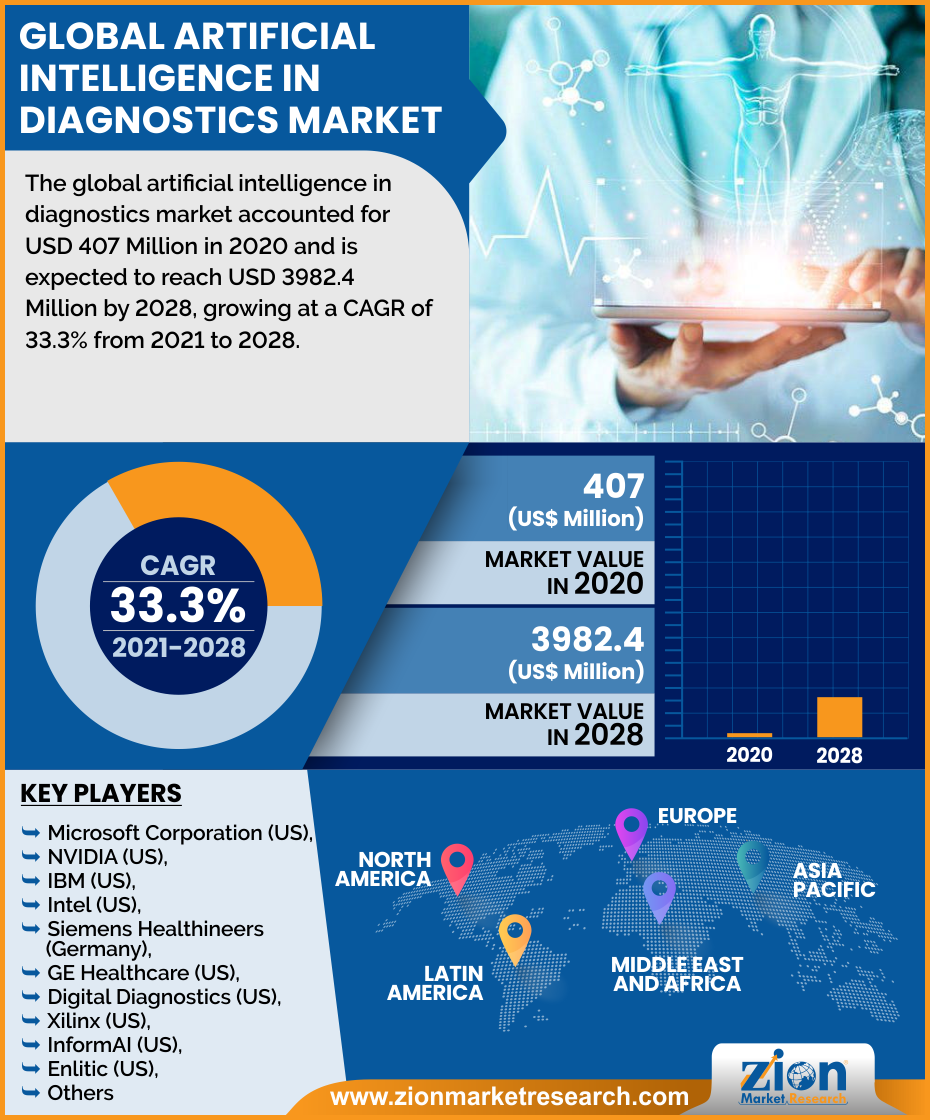

| Key Companies Covered | Microsoft Corporation (US), NVIDIA (US), IBM (US), Intel (US), Siemens Healthineers (Germany), GE Healthcare (US), Digital Diagnostics (US), Xilinx (US), InformAI (US), Enlitic (US), Day Zero Diagnostics (US), Aidence (Netherlands), Butterfly Network, Inc. (US), Prognos (US), Zebra Medical Vision (Israel), Viz.ai (US), Quibin (Spain), Qure.ai (India), Therapixel (France), and HeartFlow (US), among others. |

| Segments Covered | By Component Type, By Application Type, By End-User and By Region. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Artificial Intelligence in Diagnostics Market: Regional Analysis

This is due to the increasing use of healthcare IT solutions in medical diagnosis, the presence of a well-established healthcare sector, and ample funding for AI-based diagnosis software development. In North America, the United States leads the market for artificial intelligence in diagnostics. This is due to the increased development and deployment of innovative and advanced medical diagnosis software, as well as the presence of a large number of players in the country operating across segments such as mobile and network operations.

During the forecast period, Asia Pacific is expected to be the most lucrative market, with a significant growth rate of 38.9% CAGR. Increased government initiatives encouraging healthcare providers and other healthcare organizations to adopt AI-based diagnostic technologies, as well as increased investments by nonprofit organizations and private companies, have improved clinical outcomes. Furthermore, increased government spending on healthcare is fueling market growth in the Asia Pacific, which is driving demand for e-diagnostic services in the healthcare sector.

Key Market Players & Competitive Landscape

- Microsoft Corporation (US)

- NVIDIA (US)

- IBM (US)

- Intel (US)

- Siemens Healthineers (Germany)

- GE Healthcare (US)

- Digital Diagnostics (US)

- Xilinx (US)

- InformAI (US)

- Enlitic (US)

- Day Zero Diagnostics (US)

- Aidence (Netherlands)

- Butterfly Network

- Prognos (US)

- Zebra Medical Vision (Israel)

- Viz.ai (US)

- Quibin (Spain)

- Qure.ai (India)

- Therapixel (France)

- HeartFlow (US)

The global artificial intelligence in the diagnostics market is segmented as follows:

By Component Type

- Software

- Services

By Application Type

- In Vivo

- Radiology

- OBGY

- MRI

- CT

- Ultrasound

- IVD

By End User Type

- Hospital

- Diagnostic Laboratory

- Diagnostic Imaging Center

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to Zion Market Research, the global Artificial Intelligence in Diagnostics Market was worth USD 15.75 Billion in 2023. The market is forecast to reach USD 21.28 Billion by 2032.

What will be the size of the global artificial intelligence in diagnostics market Size in 2024-2032?

According to Zion Market Research, the global Artificial Intelligence in Diagnostics Market a compound annual growth rate (CAGR) of 3.4% during the forecast period 2024-2032.

Growing demand for low-cost diagnostic techniques, effective & efficient report analysis, and quick diagnostic data generation are some of the key factors driving the artificial intelligence in diagnostics market growth.

North America held a share of over 42.36% in the global artificial intelligence in diagnostics market. This is due to the region's growing adoption of healthcare IT solutions for medical diagnosis, as well as the presence of a well-established healthcare sector and ample funding for AI-based diagnosis software development.

Some of key players artificial intelligence in diagnostics market include Microsoft Corporation (US), NVIDIA (US), IBM (US), Intel (US), Siemens Healthineers (Germany), GE Healthcare (US), Digital Diagnostics (US), Xilinx (US), InformAI (US), Enlitic (US), Zebra Medical Vision (Israel), Viz.ai (US), Quibin (Spain), Qure.ai (India), Therapixel (France), and HeartFlow (US), among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed