Global Aquaponics Market Size, Share, Growth Analysis Report - Forecast 2034

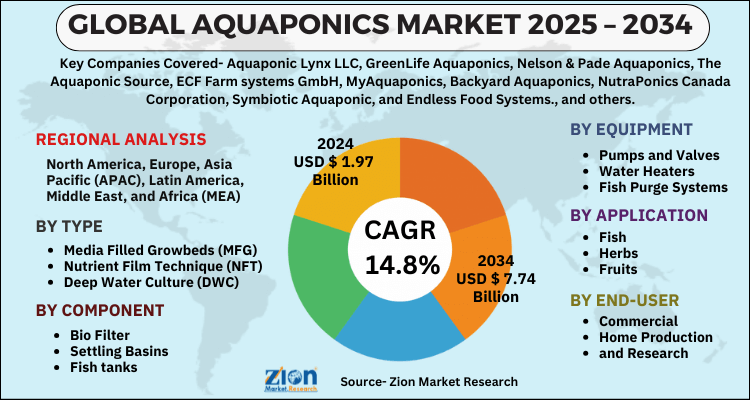

Aquaponics Market By Type (Media Filled Growbeds (MFG), Nutrient Film Technique (NFT), Deep Water Culture (DWC), and Others), By Component (Bio Filter, Settling Basins, Fish tanks, Soil-free plant beds, Rearing Tanks, Aquaponic Produce, and Others), Equipment (Pumps and Valves, Water Heaters, Fish Purge Systems, Aeration Systems, Water Quality Testing, and Others), Application (Fish, Herbs, Fruits, and Vegetables), End-User (Commercial, Home Production, and Research), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.97 Billion | USD 7.74 Billion | 14.8% | 2024 |

Aquaponics Market: Industry Perspective

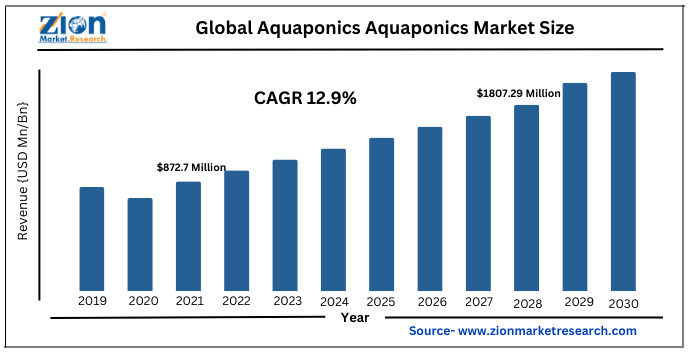

The global aquaponics market size was worth around USD 1.97 Billion in 2024 and is predicted to grow to around USD 7.74 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 14.8% between 2025 and 2034. The report analyzes the global aquaponics market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the aquaponics industry.

Aquaponics Market: Overview

Aquaponics is a food-production method that combines aquaculture (the breeding of aquatic animals in tanks) and hydroponics (the growing of plants in water), in which nutrient-rich aquaculture water is delivered to hydroponically grown plants, where nitrifying bacteria convert ammonia to nitrates. Because all aquaponic systems are based on contemporary hydroponic and aquaculture farming techniques, the size, complexity, and types of foods grown in an aquaponic system can differ just as much as any other system found in a different agricultural field.

Aquaponics stands for raising aquatic plants and aquatic animals together in a symbiotic environment. It is a sustainable form of farming plants and fish together in a beneficial way. Fish waste contains a lot of nitrates and ammonia which are beneficial for the plant. Nitrates and ammonia are good fertilizers for the plant. But nitrates and ammonia are harmful to fishes if it remains in water in large quantity. Plants in aquaponics can consume all the nitrates and ammonia and purify the water.

Because aquaponics is free of artificial fertilizers and crop protection chemicals, and fish waste serves as the principal nutrition for plants, the demand for organically grown crops has huge potential and an unexplored market for emerging aquaponic farms and aquaponic system vendors.

Key Insights

- As per the analysis shared by our research analyst, the global aquaponics market is estimated to grow annually at a CAGR of around 14.8% over the forecast period (2025-2034).

- Regarding revenue, the global aquaponics market size was valued at around USD 1.97 Billion in 2024 and is projected to reach USD 7.74 Billion by 2034.

- The aquaponics market is projected to grow at a significant rate due to sustainable agriculture practices and organic food production trends.

- Based on Type, the Media Filled Growbeds (MFG) segment is expected to lead the global market.

- On the basis of Component, the Bio Filter segment is growing at a high rate and will continue to dominate the global market.

- Based on the Equipment, the Pumps and Valves segment is projected to swipe the largest market share.

- By Application, the Fish segment is expected to dominate the global market.

- In terms of End-User, the Commercial segment is anticipated to command the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Aquaponics Market: Growth Drivers

Free from any interference of harmful fertilizers or pesticides

There are no toxic fertilizers or pesticides present in the aquaponics culture's produce. The World Bank's Fertilizer Price Index is forecasting an upward trend. The fish waster, which grows in water solvents, is a wonderful natural fertilizer for these veggies. This also helps to cut down on the costs of using fertilizers in large-scale production. Furthermore, no expensive equipment is used, implying that the market is profitable in the long run.

Growing population and increasing demand for food are expected to impact positively the global aquaponics market. Moreover growing demand for vegetables and organic fruits is expected to drive the demand for aquaponics in near future. Improvement in the adoption of new urban farming methods and demand for off-season availability of fruits & vegetables is expected to fuel the market growth over the years to come. In addition, low cost of production, time, lower transportation & storage cost of food and higher margins are other beneficial factors for the aquaponics market growth. However, high price of initial system setup & installation and unavailability of skilled labor required for aquaponics is expected to hinder the market growth within the forecast period. Nonetheless, technological advancement in farming and innovative steps towards environmental sustainability offer a vast opportunity for the industry participants in aquaponics market.

Aquaponics Market: Restraints

Competition from hydroponics and vertical farming

Agricultural techniques such as hydroponics and vertical farming are causing a surge in the use of sustainable agricultural methods. This is offering a significant hurdle to the market's expected growth over the forecast period, which ends in 2028.

Aquaponics Market: Segmentation Analysis

The global aquaponics market is segmented based on Type, Component, Equipment, Application, End-User, and region.

Based on Type, the global aquaponics market is divided into Media Filled Growbeds (MFG), Nutrient Film Technique (NFT), Deep Water Culture (DWC), and Others.

On the basis of Component, the global aquaponics market is bifurcated into Bio Filter, Settling Basins, Fish tanks, Soil-free plant beds, Rearing Tanks, Aquaponic Produce, and Others.

By Equipment, the global aquaponics market is split into Pumps and Valves, Water Heaters, Fish Purge Systems, Aeration Systems, Water Quality Testing, and Others.

In terms of Application, the global aquaponics market is categorized into Fish, Herbs, Fruits, and Vegetables.

By End-User, the global Aquaponics market is divided into Commercial, Home Production, and Research.

Recent Developments

- April 2021- France-based indoor farming company Les Nouvelles Fermes raised EUR 2 million (approximately USD 2.4 million) in its first round of funding by the investors from IRDI, the Banque des Territoires, Crédit Agricole Aquitaine and the CIC. The company has plans to build the largest aquaponic farm in Europe, with this funding.

- 2019- Superior Fresh, the Midwest's premier aquaponic produce provider, has increased the size of its greenhouses from 6 to 13 acres and the size of its aquaculture facility from 40,000 to 100,000 square feet.

Aquaponics Market: Regional Landscape

Because of the increasing use of modern farming techniques and the growing demand for organic food, the North American area has the largest market share in the worldwide aquaponics industry. The Asia-Pacific region has the second-largest market share in the aquaponics industry, thanks to ongoing technological advancements. Furthermore, increased demand for improved agricultural productivity in countries such as China and India drives the business. The European region has the third-largest market share in the aquaponics market due to the presence of a well-established infrastructure. Furthermore, easy technical process adoption was followed by an increase in per capita income. Due to rising demand for low operating costs combined with high yields, the aquaponics industry is expanding in Latin America, the Middle East, and Africa.

Aquaponics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aquaponics Market |

| Market Size in 2024 | USD 1.97 Billion |

| Market Forecast in 2034 | USD 7.74 Billion |

| Growth Rate | CAGR of 14.8% |

| Number of Pages | 157 |

| Key Companies Covered | Aquaponic Lynx LLC, GreenLife Aquaponics, Nelson & Pade Aquaponics, The Aquaponic Source, ECF Farm systems GmbH, MyAquaponics, Backyard Aquaponics, NutraPonics Canada Corporation, Symbiotic Aquaponic, and Endless Food Systems., and others. |

| Segments Covered | By Type, By Component, By Equipment, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Aquaponics Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the aquaponics market on a global and regional basis.

The global aquaponics market is dominated by players like:

- Aquaponic Lynx LLC

- GreenLife Aquaponics

- Nelson & Pade Aquaponics

- The Aquaponic Source

- ECF Farm systems GmbH

- MyAquaponics

- Backyard Aquaponics

- NutraPonics Canada Corporation

- Symbiotic Aquaponic

- and Endless Food Systems.

The global aquaponics market is segmented as follows;

By Type

- Media Filled Growbeds (MFG)

- Nutrient Film Technique (NFT)

- Deep Water Culture (DWC)

- and Others

By Component

- Bio Filter

- Settling Basins

- Fish tanks

- Soil-free plant beds

- Rearing Tanks

- Aquaponic Produce

- and Others

By Equipment

- Pumps and Valves

- Water Heaters

- Fish Purge Systems

- Aeration Systems

- Water Quality Testing

- and Others

By Application

- Fish

- Herbs

- Fruits

- and Vegetables

By End-User

- Commercial

- Home Production

- and Research

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global aquaponics market is expected to grow due to increasing adoption of sustainable farming techniques, rising demand for organic food, and advancements in aquaculture and hydroponic farming technologies.

According to a study, the global aquaponics market size was worth around USD 1.97 Billion in 2024 and is expected to reach USD 7.74 Billion by 2034.

The global aquaponics market is expected to grow at a CAGR of 14.8% during the forecast period.

North America is expected to dominate the aquaponics market over the forecast period.

Leading players in the global aquaponics market include Aquaponic Lynx LLC, GreenLife Aquaponics, Nelson & Pade Aquaponics, The Aquaponic Source, ECF Farm systems GmbH, MyAquaponics, Backyard Aquaponics, NutraPonics Canada Corporation, Symbiotic Aquaponic, and Endless Food Systems., among others.

The report explores crucial aspects of the aquaponics market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed