Antiseptics and Disinfectants Market Size, Share, Trends, Growth and Forecast 2032

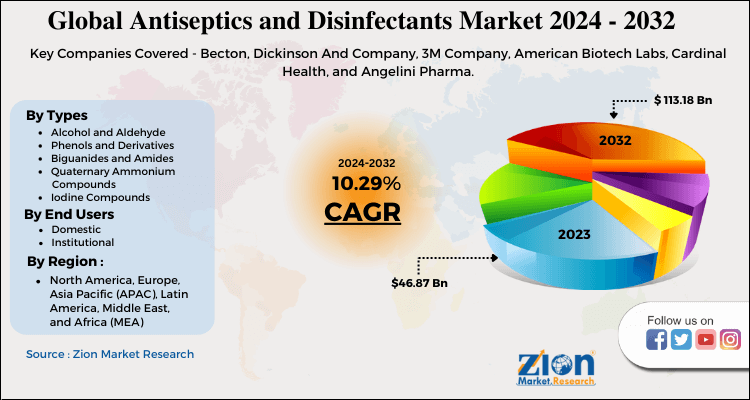

Antiseptics and Disinfectants Market By Type (Alcohol and Aldehyde and Phenols and Derivatives, Biguanides and Amides, Quaternary Ammonium Compounds, Iodine Compounds, and Others) By End User (Domestic and Institutional): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

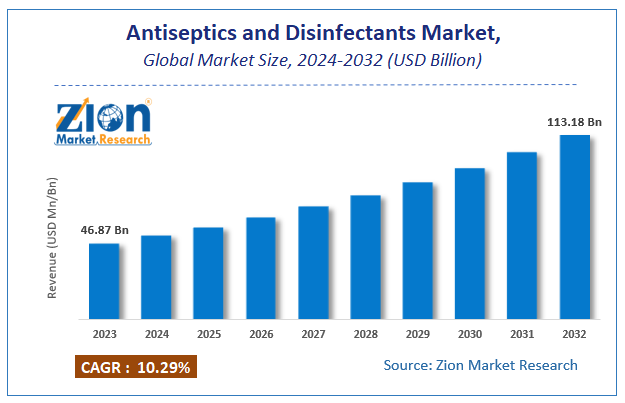

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 46.87 Billion | USD 113.18 Billion | 10.29% | 2023 |

Antiseptics and Disinfectants Market Insights

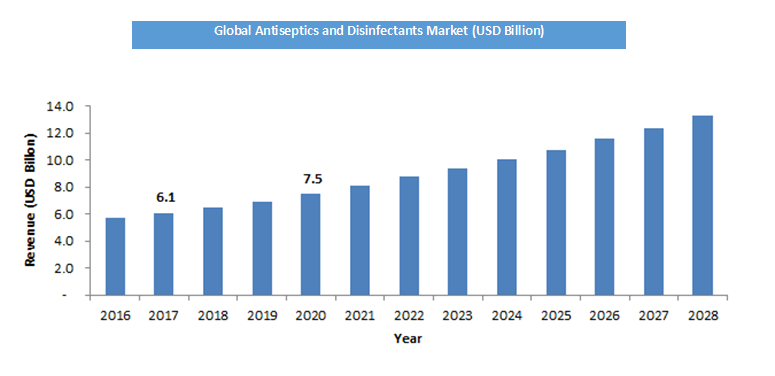

Zion Market Research has published a report on the global Antiseptics and Disinfectants Market, estimating its value at USD 46.87 Billion in 2023, with projections indicating that it will reach USD 113.18 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 10.29% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Antiseptics and Disinfectants Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Antiseptics and Disinfectants Market: Overview

Antiseptics and disinfectants are the chemical products which is killing or inhibiting the growth of microbes. An antiseptic is applied live tissue such as skin, while disinfectants are applied to nonliving surfaces, such as countertops and handrails.

Increasing cases of Healthcare-associated infections (HAIs) owing to the lack of sanitation and precaution is a major factor augmenting the market growth over the forecast period. According to the CDC report in 2018, around 1.7 million cases of HAIs and around 99,000 associated deaths are reported each year in American hospitals. As per the report by European Centre for Disease Prevention and Control (ECDC) in 2018, prevalence of HAIs in European countries was around 7.1%. It also reported that around 4,131,000 patients suffer from HAIs in Europe each year.

The Antiseptics and Disinfectants products also used to eliminate bacteria and microbes before they can enter patient’s body. Such solutions are required in hospitals to maintain the proper hygiene and sanitation.

Key players in the market are continuously working on research and better distribution system have established their position in the market.

Antiseptics and Disinfectants Market: COVID-19 Impact Analysis

The pandemic has had the most impact on the manufacturing, logistics, and the travel & tourism industries. The virus outbreak enforced the governments of various countries to impose lockdown to reduce the spread of the virus. Thus, various companies are experiencing a down time, and has driven some companies to work remotely away from the office premise, leading to low productivity and ultimately low income.

The change in the forecast is primarily impacted by increased in usage of products and the increase in demand for the products in the pandemic. The retail prices of products is expected to grow, which will be evident in the period between 2021 and 2022, thereby supporting the recovery of the market.

Antiseptics and Disinfectants Market: Growth Factors

Growing awareness about healthcare & fitness activities is anticipated to support antiseptics and disinfectants market growth,” says the author of this study. Apart from this, the growing trend of youth to prevent flu, viral, and bacterial infections are projected to steer the product demand.

Mounting awareness pertaining to benefits of antiseptics and disinfectants for annihilating deadly disease ailments are forecast to spur the demand for antiseptics and disinfectants. Furthermore, the rise in the number of surgeries, disposable incomes, and healthcare expenditure in developing as well as developed countries are predicted to boost the progress of antiseptics and disinfectants market.

Improvement in healthcare quality in some of the developing countries is expected to push the market growth. However, strict legislation, as well as the matured market of developed countries, can impede the development of antiseptics and disinfectants market.

Antiseptics and Disinfectants Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Antiseptics and Disinfectants Market |

| Market Size in 2023 | USD 46.87 Billion |

| Market Forecast in 2032 | USD 113.18 Billion |

| Growth Rate | CAGR of 10.29% |

| Number of Pages | 110 |

| Key Companies Covered | Becton, Dickinson And Company, 3M Company, American Biotech Labs, Cardinal Health, and Angelini Pharma. |

| Segments Covered | By Products,By Application,and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

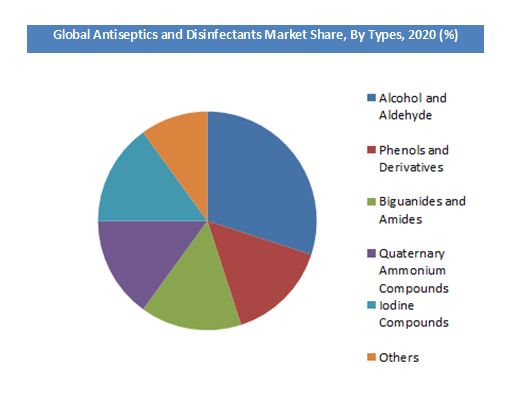

Types Segment Analysis Preview

Alcohol and Aldehyde hold the major share in the Antiseptics and Disinfectants market. In 2023, Alcohol and Aldehyde segment is likely added up for noteworthy share of the Antiseptics and Disinfectants market in terms of volume and value due to the pandemic. This is attributed to the rising demand for products in hospitals and clinics generally protects against contamination

End Users Segment Analysis Preview

Based on end users, the market is segmented into domestic and international. Domestic segment is likely to hold the major share in the market.

Key Market Players & Competitive Landscape

- Becton

- Dickinson And Company

- 3M Company

- American Biotech Labs

- Cardinal Health

- and Angelini Pharma

The global Antiseptics and Disinfectants Market is segmented as follows:

By Types

- Alcohol and Aldehyde

- Phenols and Derivatives

- Biguanides and Amides

- Quaternary Ammonium Compounds

- Iodine Compounds

- Others

By End Users

- Domestic

- Institutional

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Antiseptics and Disinfectants Market size was USD 46.87 Billion in 2023.

The global Antiseptics and Disinfectants Market size is expected to reach USD 113.18 Billion by 2032, growing at a CAGR of 10.29% between 2024 to 2032.

Some of the key factors driving the global Antiseptics and Disinfectants Market growth are rising Incidence of Hospital-Acquired Infection, growing Geriatric Population and Subsequent Growth in the Prevalence of Chronic Diseases, and increasing Number of Surgical Procedures.

North America dominated the antiseptics and disinfectants market in terms of revenue and is likely to continue its dominant position in the years ahead, states the market study. Presence of reputed hospitals and rising geriatric population is expected to further drive the antiseptics and disinfectants market regional growth.

Some of the major players of global Antiseptics and Disinfectants market includes North America dominated the antiseptics and disinfectants market in terms of revenue and is likely to continue its dominant position in the years ahead, states the market study. Presence of reputed hospitals and rising geriatric population is expected to further drive the antiseptics and disinfectants market regional growth.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed