Antimicrobial Hospital Textile Market Size, Share, Analysis, Trends, Growth, 2032

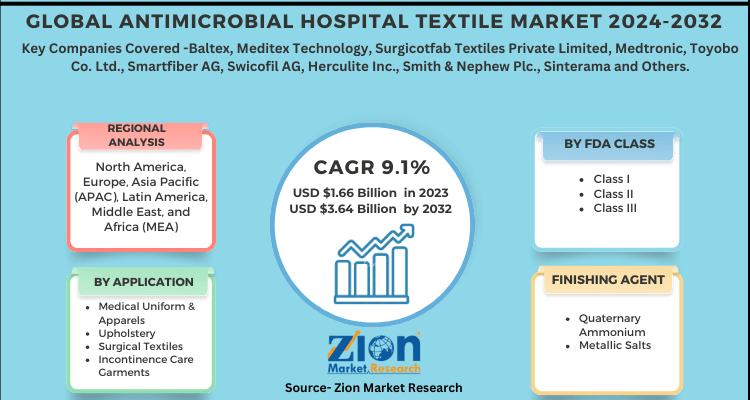

Global Antimicrobial Hospital Textile Market By Application (Medical Uniform & Apparels, Upholstery, Surgical Textiles, Incontinence Care Garments, Wound Treatment, and Others), By FDA Class (Class I, Class II and Class III), By Finishing Agent (Quaternary Ammonium, Metallic Salts and Others): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.66 Billion | USD 3.64 Billion | 9.1% | 2023 |

Global Antimicrobial Hospital Textile Market Insights

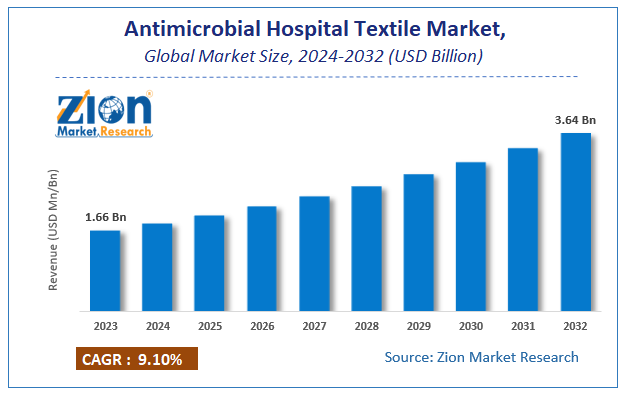

According to a report from Zion Market Research, the global Antimicrobial Hospital Textile Market was valued at USD 1.66 Billion in 2023 and is projected to hit USD 3.64 Billion by 2032, with a compound annual growth rate (CAGR) of 9.1% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Global Antimicrobial Hospital Textile Market industry over the next decade.

Antimicrobial Hospital Textile Market: Overview

Antimicrobial textiles are fibre substrates that have been treated with antimicrobial agents. They extend the life of consumer goods and increase their efficiency. The industry is expected to expand as demand for antimicrobial sportswear grows, as does public concern about health and hygiene. Antimicrobial textiles demand development is hampered by raw material price fluctuations and strict environmental regulations in industrialised regions. Over the projected era, however, the growth of the healthcare sector in emerging regions is expected to augment the growth for major companies.

Within technical textiles, hospital textile is a significant product group. Technical textiles are non-commodity textiles that are mostly found in non-apparel applications such as industrial textiles, hospital textiles, sport textiles, and geotextiles.

Antimicrobial Hospital Textile Market: COVID-19 Impact Analysis

COVID-19 has caused havoc in a variety of sectors. The demand for different goods has greatly decreased as a result of the disruption. Owing to federal restrictions or a lack of demand, manufacturing plants are forced to close. In this pandemic scenario, demand for antimicrobial hospital items such as mattresses, gloves, socks, surgical supplies & wipes, sheets & blankets has risen dramatically. Despite this, suppliers are having trouble obtaining raw materials for the manufacturing of various antimicrobial hospital items. The increase in antimicrobial hospital supplies is insufficient to cover the output volume deficit caused by the COVID-19 pandemic.

To deter the dissemination of COVID-19 across the world, export operations have been significantly decreased or entirely halted. As a result, trade by air, sea, and land was halted for almost three months around the world. Both of these trends have reduced demand for a variety of goods across markets, but demand for antimicrobial hospital textiles has skyrocketed.

Antimicrobial Hospital Textile Market: Growth Factors

One of the major growth drivers for the Global Antimicrobial Hospital Textile Market is the Growing consumer awareness about hygiene in emerging market. Due to increasing awareness of the possible risks of microorganisms on textiles as well as on the buyer of textiles, owing to increasing literacy rates and public awareness campaigns. The demand for antimicrobial hospital textiles is increasing as people become more conscious of hygiene, their disposable income rises, their lifestyles change, their health concerns intensify, and pollution levels rise. Antimicrobial hospital textiles are becoming more popular as the healthcare sector expands.

Another factor of growth in this market is Rising demand for antimicrobial sportswear and apparel. Due to the increasing awareness of fitness and wellness, global demand for sportswear and apparel continues to increase. This increase can be due to a variety of causes, including increased health literacy, increasing disposable incomes, and advances in wireless technology. Demand will rise as a result of the promotion of a healthy and more physically active lifestyle. Both of these factors would contribute to the antimicrobial textiles market's growth over the projected period.

Global Antimicrobial Hospital Textile Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Global Antimicrobial Hospital Textile Market |

| Market Size in 2023 | USD 1.66 Billion |

| Market Forecast in 2032 | USD 3.64 Billion |

| Growth Rate | CAGR of 9.1% |

| Number of Pages | 120 |

| Key Companies Covered | Baltex, Meditex Technology, Surgicotfab Textiles Private Limited, Medtronic, Toyobo Co. Ltd., Smartfiber AG, Swicofil AG, Herculite Inc., Smith & Nephew Plc., Sinterama and Others. |

| Segments Covered | By Application, By FDA Class, By Finishing Agent and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Application Segment Analysis Preview

Upholstery segment dominates the market of the antimicrobial medical textiles, due to its widespread use in hospitals and clinics It includes Bottom sheets, pillowcases, shower & modesty curtains, thermal blankets. Since these materials are used often, they are subject to a lot of wear and tear. This will boost interest in this market even further. Suits, tops, hats, caps, masks, patient gowns, precaution gowns, jackets, and other items are included in the medical uniform & apparels section. A big growth driver in this segment will be the jobs in the medical sector and an increase in the number of patients.

Finishing Agent Segment Analysis Preview

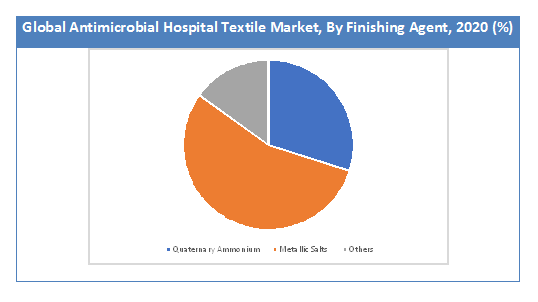

Metallic salts-based products has the largest share in the market accounting for more than 55% of global sales in 2020. Due to their superior properties, which led to increased use in food manufacturing. Manufacturers favour silver metallic salts because of their ease of use and ability to have an excellent antimicrobial finish. Since triclosan has been classified as a hazardous chemical, demand is projected to decline over the forecast period. The antimicrobial properties of the quaternary ammonium compound help to expand its application reach by performing a variety of actions such as bacterial cell destruction, protein denaturation, and cell multiplication inhibition,

Regional Segment Analysis Preview

The Global Antimicrobial Hospital Textile Market is divided into five regions: North America, Europe, Asia Pacific, Latin America, and Middle East Africa.

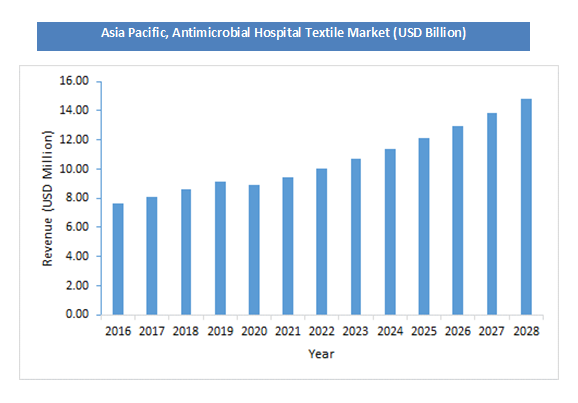

In terms of sales, Asia-Pacific is projected to be the fastest growing country. During the forecast period, it is projected to rise at a CAGR of 9.20%. This is due to an increase in demand for hospital textiles in the country as the healthcare industry expands. The market for high-quality cloth in the area is projected to boost the demand for antimicrobial hospital textiles, with textile being amongst the main industries in countries like China and India. China, India, and Indonesia, among other APAC emerging economies, will play a significant role in the development of the antimicrobial hospital textiles industry.

In North America and Europe, improved medical infrastructure is likely to result in increased demand for antimicrobial medical textiles. Countries like Germany, the United States, and the United Kingdom fuel demand in these areas. The growing use of implantable products in North America is projected to drive the medical textiles industry, owing to deficiencies in conventional opioid therapies and a variety of other chronic disorders. Furthermore, ongoing biotechnology advances will result in the commercialization of new and improved drugs, boosting consumer development in the field.

Key Market Players and Competitive Landscape

Some of the prominent players operating in the Global Antimicrobial Hospital Textile Market are

- Baltex

- Meditex Technology

- Surgicotfab Textiles Private Limited

- Medtronic

- Toyobo Co. Ltd.

- Smartfiber AG

- Swicofil AG

- Herculite Inc.

- Smith & Nephew Plc.

- Sinterama

- and Others.

The main players in this industry are working to extend their global business presence. Companies have been raising their investments in emerging countries in order to take advantage of lower trade barriers. Silver processing is widely used in antimicrobial medical textiles. To increase retail sales, suppliers are entering into distribution arrangements with healthcare chains.

The Global Antimicrobial Hospital Textile Market is segmented as follows:-

By Application

- Medical Uniform & Apparels

- Upholstery

- Surgical Textiles

- Incontinence Care Garments

- Wound Treatment

- Others

FDA Class

- Class I

- Class II

- Class III

Finishing Agent

- Quaternary Ammonium

- Metallic Salts

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Antimicrobial Hospital Textile Market was valued at USD 1.66 Billion in 2023.

The Global Antimicrobial Hospital Textile Market is expected to reach USD 3.64 Billion by 2032, growing at a CAGR of 9.1% between 2024 to 2032.

Growing consumer awareness about hygiene in emerging market and Rising demand for antimicrobial sportswear and apparel are the major key factors driving the Global Antimicrobial Hospital Textile Market growth.

Asia-Pacific is projected to be the fastest growing country in Global Antimicrobial Hospital Textile Market. During the forecast period, it is projected to rise at a CAGR of 9.20%

Some of the prominent players operating in the Global Antimicrobial Hospital Textile Market are Baltex, Meditex Technology, Surgicotfab Textiles Private Limited, Medtronic, Toyobo Co. Ltd., Smartfiber AG, Swicofil AG, Herculite Inc., Smith & Nephew Plc., Sinterama and Others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed