Global Anti-counterfeit Pharmaceutical Packaging Market Size, Share - Forecast 2034

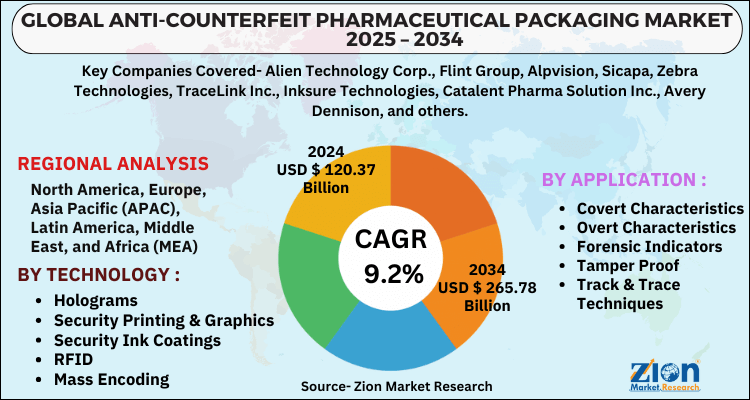

Anti-counterfeit Pharmaceutical Packaging Market By Technology (Holograms, Security Printing & Graphics, Security Ink Coatings, RFID, Mass Encoding, & Others), By Application (Covert Characteristics, Overt Characteristics, Forensic Indicators, Tamper Proof, Track & Trace Techniques, & Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

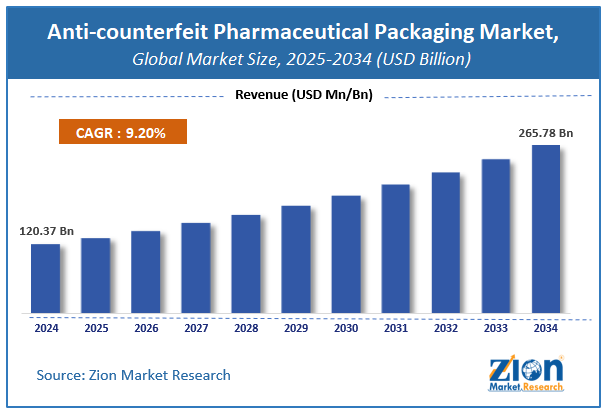

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 120.37 Billion | USD 265.78 Billion | 9.2% | 2024 |

Anti-counterfeit Pharmaceutical Packaging Market Size

The global anti-counterfeit pharmaceutical packaging market size was worth around USD 120.37 Billion in 2024 and is predicted to grow to around USD 265.78 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.2% between 2025 and 2034.

The report analyzes the global anti-counterfeit pharmaceutical packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the anti-counterfeit pharmaceutical packaging industry.

Anti-counterfeit Pharmaceutical Packaging Market: Overview

Fake medications, like counterfeit goods, are a global problem, with the largest fraud company in the world worth more than $260 billion per year. Anti-counterfeit pharmaceutical packaging has been introduced to the market as a result, thereby maintaining quality, originality, and security. These packages guarantee that the customer is buying authentic medical goods.

In 2016, the worldwide worth of counterfeit drugs was estimated to be between USD 70 and $260 billion, posing a serious threat to people's health all over the world. The rising markets, which are also major drug importers, are the ones that are most affected by this trade.

China, India, South Korea, Brazil, and Turkey have all adopted steps to improve the pharmaceutical industry's supplier safety. Silicon dioxide-based tags are used because they are generally recognized as safe (GRAS) and suitable for human consumption, according to US regulators.

Key Insights

- As per the analysis shared by our research analyst, the global anti-counterfeit pharmaceutical packaging market is estimated to grow annually at a CAGR of around 9.2% over the forecast period (2025-2034).

- Regarding revenue, the global anti-counterfeit pharmaceutical packaging market size was valued at around USD 120.37 Billion in 2024 and is projected to reach USD 265.78 Billion by 2034.

- The anti-counterfeit pharmaceutical packaging market is projected to grow at a significant rate due to increasing adoption of track-and-trace technologies, rising concerns over drug safety, stringent government regulations, and growing pharmaceutical industry demand for secure packaging solutions.

- Based on Technology, the Holograms segment is expected to lead the global market.

- On the basis of Application, the Covert Characteristics segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Anti-counterfeit Pharmaceutical Packaging Market: Growth Drivers

Increased need for safe drugs to affect the global market positively

The rise of anti-counterfeit pharmaceutical packaging may be related to the increasing need for secure pharmaceutical medication packaging as a result of the expanding number of counterfeit products, which can compromise pharma businesses' reputations as well as patients' health. According to surveys, one out of every ten medical items sold in poor nations is fake or poor. The market for anti-counterfeit pharmaceutical packaging is expected to increase as more policies and regulations for anti-counterfeiting packaging are implemented to tamper evident or counterfeit packaged original and trademark medications.

Anti-counterfeit Pharmaceutical Packaging Market: Restraints

High setup costs to restrain the global market growth

Anti-counterfeit packaging requires a high starting cost of development, which discourages the adoption of anti-counterfeit choices, reducing product demand. Furthermore, without proper customer awareness, many existing solutions are easy to replicate restricting business development.

Anti-counterfeit Pharmaceutical Packaging Market: Opportunities

Introduction of edible micro tags to boost market opportunities

A US-based business created a new technology called "micro tag" which is an edible packaging alternative used to identify, authenticate, protect brands, and ensure the purity of medications. Each tag has a unique identifier that can only be detected with the company's specialized equipment. The anti-counterfeit pharmaceutical packaging industry continues to benefit from technical improvements. Over the forecast period, all of these developments and innovations are expected to aid in the revolution of the global anti-counterfeit pharmaceutical packaging market.

Anti-counterfeit Pharmaceutical Packaging Market: Challenges

The booming market for fake drugs and lack of information among customers pose a major threat

Customers' understanding of using these devices to assess an item's inventiveness is a challenge for anti-counterfeit packaging manufacturers. Customers need to be informed about technology so that counterfeit pharmaceutical product sales can be prevented. Developing these solutions costs a lot of money, putting pressure on the sector's growth.

Anti-counterfeit Pharmaceutical Packaging Market: Segmentation Analysis

The global anti-counterfeit pharmaceutical packaging market is segmented based on Technology, Application, and region.

Based on Technology, the global anti-counterfeit pharmaceutical packaging market is divided into Holograms, Security Printing & Graphics, Security Ink Coatings, RFID, Mass Encoding, & Others.

On the basis of Application, the global anti-counterfeit pharmaceutical packaging market is bifurcated into Covert Characteristics, Overt Characteristics, Forensic Indicators, Tamper Proof, Track & Trace Techniques, & Others.

Anti-counterfeit Pharmaceutical Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Anti-counterfeit Pharmaceutical Packaging Market |

| Market Size in 2024 | USD 120.37 Billion |

| Market Forecast in 2034 | USD 265.78 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 180 |

| Key Companies Covered | Alien Technology Corp., Flint Group, Alpvision, Sicapa, Zebra Technologies, TraceLink Inc., Inksure Technologies, Catalent Pharma Solution Inc., Avery Dennison, and others. |

| Segments Covered | By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments

- In 2021, Avery Dennison Corporation purchased Vestcom for USD 1.47 billion increasing its share in the branded labeling market, and improving its position and hold in the market.

- In May 2020, SICPA Industries changed the market landscape and increased competition by launching new varieties of product safety labels, and its assistive technical support that can be used by franchisers in customer service, supply chain management, and enforcement activities.

Anti-counterfeit Pharmaceutical Packaging Market: Regional Landscape

North America to lead the global market in the forecast period

North America is the world's greatest pharmaceutical and biologics research hub, exporting biopharmaceutical goods to all corners of the globe. Additionally, firms are investing heavily in exploration, which is expected to drive the anti-counterfeit pharmaceutical packaging market in the region forward.

The surge is attributed to strict anti-counterfeiting legislation, with new drugs requiring a statewide tracking system for all prescription medications. Moreover, the United States' leadership in the global anti-counterfeit pharmaceutical packaging market might be ascribed to notable producers' rising demand for innovative and pricey technology such as RFID.

In the United States, regulatory agencies have adopted regulations requiring identification and transparency as fundamental ways to ensure the protection of public health and reduce risk, which is fueling the need for anti-counterfeit pharmaceutical packaging. On an identical basis, Europe is ranked second. Belgium, Denmark, and Germany are the major European countries to lead the anti-counterfeit pharmaceutical packaging industry. With improvements in the healthcare system, Asia Pacific is likely to gain traction in the anti-counterfeit pharmaceutical packaging industry.

Anti-counterfeit Pharmaceutical Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the anti-counterfeit pharmaceutical packaging market on a global and regional basis.

The global anti-counterfeit pharmaceutical packaging market is dominated by players like:

- Alien Technology Corp.

- Flint Group

- Alpvision

- Sicapa

- Zebra Technologies

- TraceLink Inc.

- Inksure Technologies

- Catalent Pharma Solution Inc.

- Avery Dennison

The global anti-counterfeit pharmaceutical packaging market is segmented as follows;

By Technology

- Holograms

- Security Printing & Graphics

- Security Ink Coatings

- RFID

- Mass Encoding

- & Others

By Application

- Covert Characteristics

- Overt Characteristics

- Forensic Indicators

- Tamper Proof

- Track & Trace Techniques

- & Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global anti-counterfeit pharmaceutical packaging market is expected to grow due to rising counterfeit drug concerns, stringent regulatory requirements, advancements in track-and-trace technologies, and increasing demand for secure and tamper-evident packaging solutions.

According to a study, the global anti-counterfeit pharmaceutical packaging market size was worth around USD 120.37 Billion in 2024 and is expected to reach USD 265.78 Billion by 2034.

The global anti-counterfeit pharmaceutical packaging market is expected to grow at a CAGR of 9.2% during the forecast period.

North America is expected to dominate the anti-counterfeit pharmaceutical packaging market over the forecast period.

Leading players in the global anti-counterfeit pharmaceutical packaging market include Alien Technology Corp., Flint Group, Alpvision, Sicapa, Zebra Technologies, TraceLink Inc., Inksure Technologies, Catalent Pharma Solution Inc., Avery Dennison, among others.

The report explores crucial aspects of the anti-counterfeit pharmaceutical packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed