Global Amorphous Polyethylene Terephthalate Market Size, Share, Growth Analysis Report - Forecast 2034

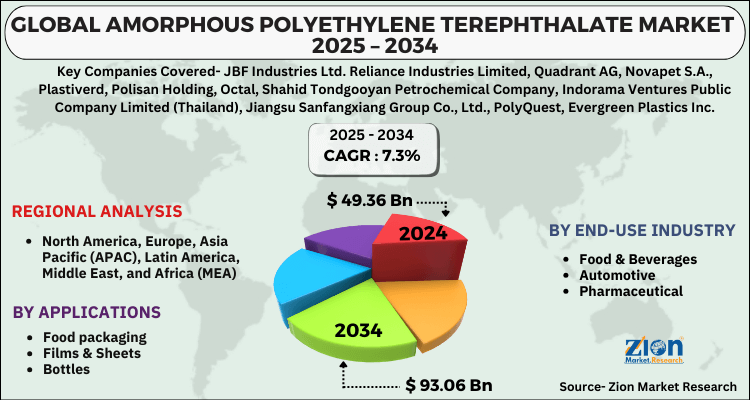

Amorphous Polyethylene Terephthalate Market By Applications (Food packaging, Films & Sheets, Bottles, and Others), By End-use Industry (Food & Beverages, Automotive, Pharmaceutical, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

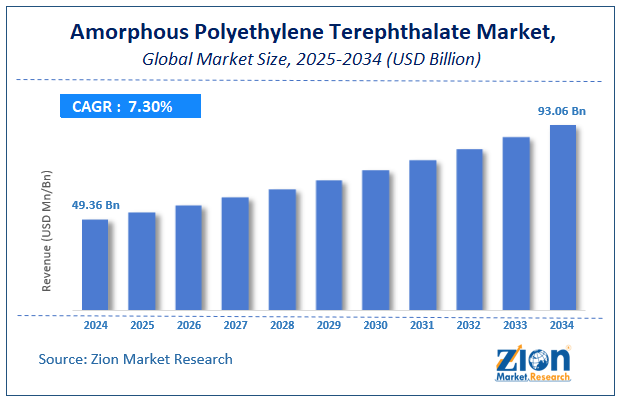

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 49.36 Billion | USD 93.06 Billion | 7.3% | 2024 |

Amorphous Polyethylene Terephthalate Market Size

The global amorphous polyethylene terephthalate market size was worth around USD 49.36 Billion in 2024 and is predicted to grow to around USD 93.06 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.3% between 2025 and 2034.

The report analyzes the global amorphous polyethylene terephthalate market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the amorphous polyethylene terephthalate industry.

Amorphous Polyethylene Terephthalate Market: Overview

Amorphous polyethylene terephthalates hold good mechanical and chemical properties. It is a semi-crystalline polymer obtained from the crystallization process of PET. Amorphous PET possesses high strength, stiffness, clear visibility, and low creep characteristics due to which it has been extensively used in food packaging, manufacturing of bottles, making films & sheets, automotive industry, and others.

Key Insights

- As per the analysis shared by our research analyst, the global amorphous polyethylene terephthalate market is estimated to grow annually at a CAGR of around 7.3% over the forecast period (2025-2034).

- Regarding revenue, the global amorphous polyethylene terephthalate market size was valued at around USD 49.36 Billion in 2024 and is projected to reach USD 93.06 Billion by 2034.

- The amorphous polyethylene terephthalate market is projected to grow at a significant rate due to rising demand for sustainable and recyclable packaging, growth in the food and beverage industry, and increasing preference for lightweight and durable materials.

- Based on Applications, the Food packaging segment is expected to lead the global market.

- On the basis of End-use Industry, the Food & Beverages segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia-Pacific is predicted to dominate the global market during the forecast period.

Amorphous Polyethylene Terephthalate Market: Growth Drivers

Robust shift for sustainability likely to spur market growth

Government initiatives on growing plastic waste and support for amorphous PET-based plastic have enhanced the performance of the amorphous PET market. In addition, PET is the most commonly used plastic on the earth. According to data revealed by Plastic Ingenuity, almost every recycling program in the US accepts PET materials. The Life Cycle Inventory Study reported in 2010 that “for every pound of amorphous PET flake used, energy use is reduced by 84%; greenhouse gas emissions by 71%. This may act as one of the key drivers responsible for the growth of the market during the forecast period. Furthermore, the growing young population across the globe, increase in the demand for various clothing, and rise in fashion consciousness among people have led them to opt for moisture barriers based on amorphous PET which is used as a fiber for making various types of clothes.

Amorphous Polyethylene Terephthalate Market: Restraints

High production cost to hamper market expansion

Fluctuations in the prices of raw materials for amorphous polyethylene terephthalate production have hampered the market. In addition, cut breaks in the import and export of PET-based plastic in regions such as North America, Europe, and others are expected to dampen the market in upcoming years. Moreover, higher lead time and tooling costs involved in injection molding technology and recycling process for amorphous PET are likely to act as restrain for the global amorphous polyethylene terephthalate market during the forecast period.

Amorphous Polyethylene Terephthalate Market: Opportunities

Robust demand from packaging industry to bring up growth avenues for market

The growing population across the globe, increase in the number of working women, and rising demand for ready-to-eat packaged food have given way to the amorphous PET industry. Amorphous PET-based plastics are extensively used in the manufacturing of plastic containers owing to their transparency and good physical properties. This is projected to propel the growth of the global amorphous PET market in the upcoming years. In addition, the growing food and beverages industry across the world is driving the potential sales of the amorphous PET market. For instance, according to an article published by IBIS World, in the year August 2022, the industry revenue is expected to fall at a compound annual rate of 0.9% over the five years through 2022-23 to £935.4 million. This factor will increase the potential sales of the amorphous PET market in forthcoming years.

Amorphous Polyethylene Terephthalate Market: Challenges

Fluctuations in the prices of raw material

Amorphous polyethylene terephthalate is comparatively more expensive than conventional polymers. In addition, the availability of alternative cost-effective plastics is expected to act as a challenging factor for the amorphous polyethylene terephthalate market. However, the stringent government norms and regulation on the plastic ban is expected to hamper the overall market growth. Durability of amorphous PET material is expected to increase environmental pollution. On the other hand, manufacturers are switching to the alternative substitute for amorphous PET due to government programs for sustainable and plastic-free environment.

Amorphous Polyethylene Terephthalate Market: Segmentation Analysis

The global amorphous polyethylene terephthalate market is segmented based on application, end-use industry, and region.

Based on application, the amorphous PET market is segmented into, food packaging, films & sheets, bottles, and others. The food packaging segment is dominating during the forecast period and accounted for 48.65% of the total market share. The factors such as a rapid shift in lifestyle, the busy schedule of people, and growing trends of ready-to-eat packed food have escalated the demand for various types of amorphous PET products, where it is extensively used as protecting and covering material while carrying out food during transportation.

Based on the end-use industry, the global amorphous PET market is categorized into, food & beverages, automotive, pharmaceutical, and others. The food and beverages sector is dominating during the forecast period and accounted for 36.65% of the total market share. This is attributed to the fact that the growing unorganized retail industry, hotels, restaurants, cloud kitchens, and others have enhanced the performance of the amorphous PET market. Furthermore, data published by DARAT Consulting, in March 2021, the food and beverage market was estimated at US$30.12 billion in 2015 and is expected to reach US$142 billion by 2020, with a compounded annual growth rate (CAGR) of 36.34%. This factor will offer remunerative opportunities for amorphous PET where it will be widely used to prepare plastic wraps, films, bottles, jars, parcel boxes, and among others.

Amorphous Polyethylene Terephthalate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Amorphous Polyethylene Terephthalate Market |

| Market Size in 2024 | USD 49.36 Billion |

| Market Forecast in 2034 | USD 93.06 Billion |

| Growth Rate | CAGR of 7.3% |

| Number of Pages | 205 |

| Key Companies Covered | JBF Industries Ltd. Reliance Industries Limited, Quadrant AG, Novapet S.A., Plastiverd, Polisan Holding, Octal, Shahid Tondgooyan Petrochemical Company, Indorama Ventures Public Company Limited (Thailand), Jiangsu Sanfangxiang Group Co., Ltd., PolyQuest, Evergreen Plastics Inc., Phoenix Technologies, Libolon, Biffa and DAK Americas, and others. |

| Segments Covered | By Applications, By End-use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Developments:

- In September 2021, Biffa acquired the recycling asset of Virdor Waste Management Ltd. This strategic acquisition has widened Biffa’s recycling asset.

- In June 2021, Indorama Ventures has acquired CarboonLite Holdings’ facility based out of Texas to increase its PET recycling capability. This strategic acquisition is expected to increase the overall company’s growth in the market.

- In January 2022, Indorama Ventures Public Company Limited entered into a strategic acquisition where it stated that it will acquire Ngoc Nghia Industry – Service – Trading Joint Stock Company's shares (NN). NN is a leading manufacturer and supplier of PET packaging materials to the beverage and non-beverage industries. This strategic acquisition will enhance Indorama’s product portfolio for PET.

- In January 2022, Alpek, S.A.B. de C.V., entered into a strategic agreement to acquire OCTAL Holding SAOC ("Octal") from OCTAL Holding SAOC. This strategic acquisition will strengthen Alpek’s product portfolio for PET in upcoming years.

Amorphous Polyethylene Terephthalate Market: Regional Analysis

Asia-Pacific to lead owing to higher technology adoption rate during the forecast period

The global amorphous polyethylene terephthalate market growth is expected to be driven by Asia Pacific and accounts for 43.67% of the total market share. This region is also anticipated to maintain its dominance throughout the forecast period. Countries such as China, Japan, India, and others have significant contributions to the growth of the recycled PET market in the region. Key factors for the growth of fiber, consumer goods, bottle-to-bottle production, food and beverages, and other end-use industry has surged the demand for amorphous PET. Furthermore, the healthcare sector is one of the booming sectors in India. For instance, according to a report published by NITI Aayog in the year March 2021, India’s healthcare industry has been growing at a Compound Annual Growth Rate (CAGR) of around 22% since 2016. At this rate, it is expected to reach USD 372 billion in 2022. These factors together increase the usage of amorphous PET in the growing healthcare industry for manufacturing and packaging various healthcare products such as various surgical containers, medical bottles, saline bottles, syringes, and many others.

Moreover, China has a dynamic market for the food & beverages sector owing to the rise in the population, growing recycling PET plants, rise in import and export trade, and increased demand for food have enhanced the market growth. According to data published by the Ministry of Environment, Forest and Climate Change, the government notifies the Plastic Waste Management Amendment Rules, 2021, prohibiting identified single-use plastic items by 2022. This regulation act as one of the supporting factor for the growth of the recycled PET market during the forecast period.

North America, Europe, and the Middle East region show positive growth during the forecast period. Growing pharmaceutical and food & beverages industries in the countries such as the U.S., Germany, the UK, Spain, and others have surged the demand for amorphous polyethylene terephthalates. In addition, the LAMEA region has a good presence in the petrochemical industry and chemical manufacturing units due to which the amorphous polyethylene terephthalate market has good scope in the LMAEA region.

Amorphous Polyethylene Terephthalate Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the amorphous polyethylene terephthalate market on a global and regional basis.

The global amorphous polyethylene terephthalate market is dominated by players like:

- JBF Industries Ltd. Reliance Industries Limited

- Quadrant AG

- Novapet S.A.

- Plastiverd

- Polisan Holding

- Octal

- Shahid Tondgooyan Petrochemical Company

- Indorama Ventures Public Company Limited (Thailand)

- Jiangsu Sanfangxiang Group Co.

- Ltd.

- PolyQuest

- Evergreen Plastics Inc.

- Phoenix Technologies

- Libolon

- Biffa and DAK Americas

The global amorphous polyethylene terephthalate market is segmented as follows;

By Applications

- Food packaging

- Films & Sheets

- Bottles

- and Others

By End-use Industry

- Food & Beverages

- Automotive

- Pharmaceutical

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global amorphous polyethylene terephthalate market is expected to grow due to increasing demand for sustainable and recyclable packaging, growing use in the food and beverage industry, rising adoption in pharmaceuticals, and advancements in polymer technology.

According to a study, the global amorphous polyethylene terephthalate market size was worth around USD 49.36 Billion in 2024 and is expected to reach USD 93.06 Billion by 2034.

The global amorphous polyethylene terephthalate market is expected to grow at a CAGR of 7.3% during the forecast period.

Asia-Pacific is expected to dominate the amorphous polyethylene terephthalate market over the forecast period.

Leading players in the global amorphous polyethylene terephthalate market include JBF Industries Ltd. Reliance Industries Limited, Quadrant AG, Novapet S.A., Plastiverd, Polisan Holding, Octal, Shahid Tondgooyan Petrochemical Company, Indorama Ventures Public Company Limited (Thailand), Jiangsu Sanfangxiang Group Co., Ltd., PolyQuest, Evergreen Plastics Inc., Phoenix Technologies, Libolon, Biffa and DAK Americas, among others.

The report explores crucial aspects of the amorphous polyethylene terephthalate market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed