Alternative Sweetener Market Size, Share, Trends and Forecast, 2034

Alternative Sweetener Market By Type (Stevia, Sorbitol, Xylitol, Mannitol, Erythritol, Sweet proteins and Other types), By Application (Bakery products, Confectioneries & gums, Spreads, Beverages, Dairy products, Frozen desserts, Tabletop sweeteners, Pharmaceutical products and Other applications), By End-use sector (Food & beverages, Pharmaceutical, Direct sales and Other end-use sectors), and By Region - Global Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecasts 2025 - 2034

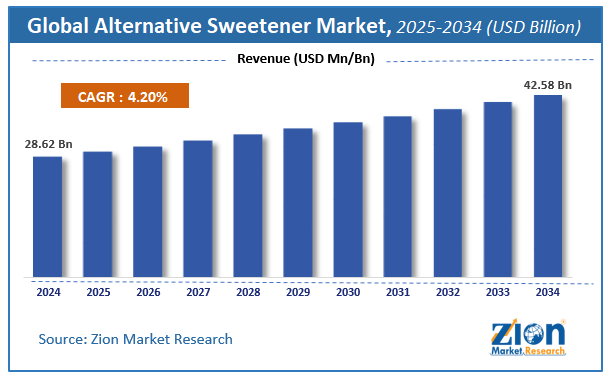

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 28.62 Billion | USD 42.58 Billion | 4.2% | 2024 |

Alternative Sweetener Industry Perspective:

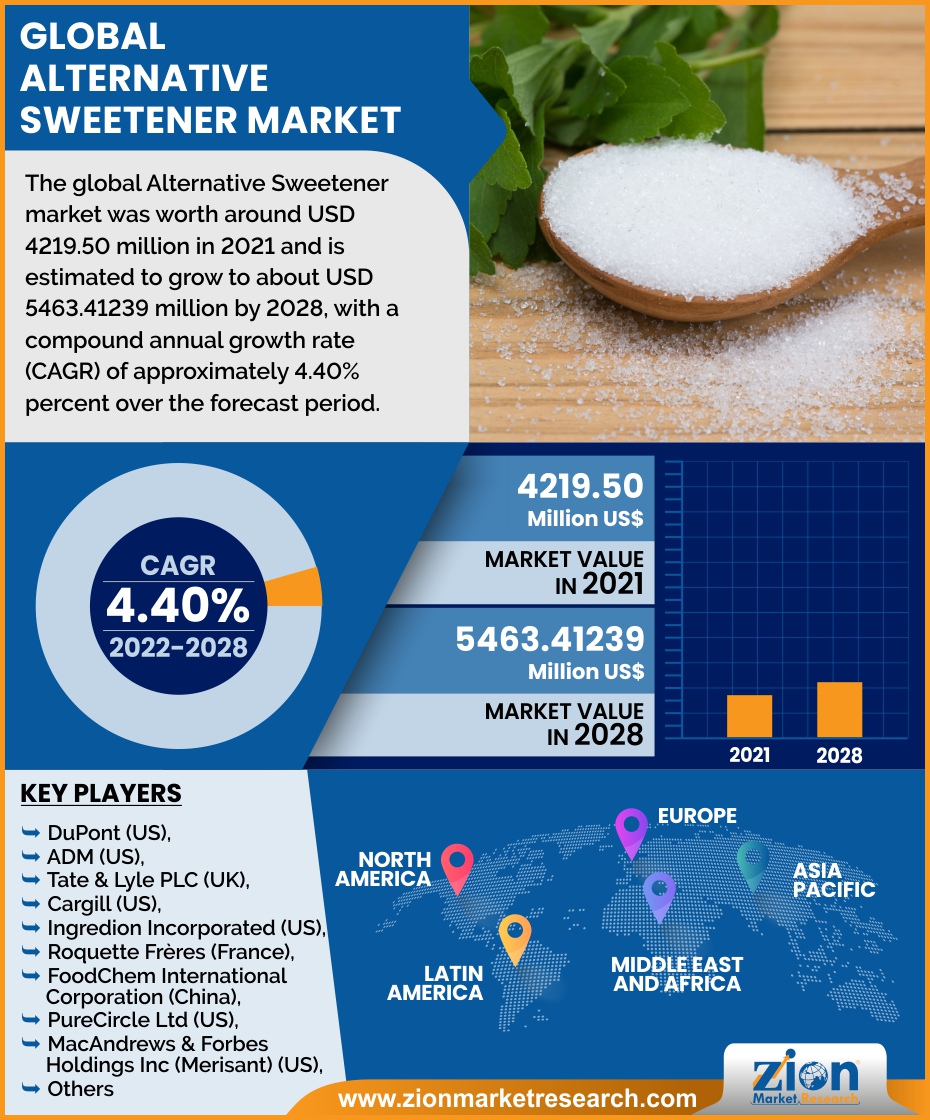

The global alternative sweetener market size was worth around USD 28.62 Billion in 2024 and is predicted to grow to around USD 42.58 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 4.2% between 2025 and 2034. The report analyzes the Alternative Sweetener market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Alternative Sweetener market.

Global Alternative Sweetener Market: Overview

Alternative sweetener is a group of carbohydrates, which is of potential use as a replacement for the typical dietary sugars. The alternative sweetener is also known as an artificial sweetener, non-sugar sweetener, or sugar substitute. It is generally classified into two groups such as nutritive sweetener and nonnutritive sweetener. Artificial sweeteners add a taste of sweetness without any calories and hence are considered as an attractive substitute to table sugar.

Artificial sweeteners are generally used in different types of processed foods, including soft drinks, candy, baked goods, dairy products, puddings, and canned foods. It is also popularly used in home cooking. Artificial sweeteners play an important role in the improvement of food appearance, texture, color, and taste. The artificial sweeteners approved by the FDA include aspartame, potassium, saccharin, sucralose, neotame, and acesulfame. Alternative sweeteners are also helpful in preventing dental decay and controlling blood sugar.

As a result of ongoing advances and new uses in the food sector, such as developments in dairy products and baked goods, the worldwide alternative sweeteners market has developed considerably. Alternative sweeteners provide benefits such as sweetness, low cost, taste, nutrition, bulkiness, preservation qualities, heat resistance, and blending capabilities. Furthermore, rising health concerns, as well as an increase in the prevalence of diabetes and obesity, are driving the growth of the alternative sweeteners market. Furthermore, market growth is being driven by an increase in demand for low-calorie sweeteners and an increase in the obese population, particularly in developing countries. Consumers, for example, use stevia extract, a sweetener derived from the leaves of the stevia bush, as well as monk fruit extract. Sugar has been replaced as a food additive by alternative sweeteners in order to avoid health problems.

Key Insights

- As per the analysis shared by our research analyst, the global alternative sweetener market is estimated to grow annually at a CAGR of around 4.2% over the forecast period (2025-2034).

- Regarding revenue, the global alternative sweetener market size was valued at around USD 28.62 Billion in 2024 and is projected to reach USD 42.58 Billion by 2034.

- The alternative sweetener market is projected to grow at a significant rate due to increasing consumer awareness of health and wellness, rising prevalence of diabetes and obesity, and the growing demand for low-calorie and sugar-free food and beverage products.

- Based on Type, the Stevia segment is expected to lead the global market.

- On the basis of Application, the Bakery products segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-use sector, the Food & beverages segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Alternative Sweetener Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Alternative Sweetener Market |

| Market Size in 2024 | USD 28.62 Billion |

| Market Forecast in 2034 | USD 42.58 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 180 |

| Key Companies Covered | DuPont (US), ADM (US), Tate & Lyle PLC (UK), Cargill (US), Ingredion Incorporated (US), Roquette Frères (France), FoodChem International Corporation (China), PureCircle Ltd (US), MacAndrews & Forbes Holdings Inc (Merisant) (US), Ecogreen Oleochemicals Pvt, and others. |

| Segments Covered | By Type, By Application, By End-use sector, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Alternative Sweetener Market: Growth Drivers

Driver: Increased consumer health consciousness to stimulate demand for healthier food options

Consumers are becoming more aware of their nutritional needs as they have easy access to near-infinite information. As a result, consumers have become more conscious of making healthier food and beverage choices. Because of rising health concerns, they are increasingly demanding healthier, lower-calorie foods and beverages. As people's health conditions worsen, there is a greater demand for low-calorie food and beverage products to help them maintain a healthy diet. Most health-conscious consumers prefer sugar alternatives because they have less calories than real sugar. Sugar substitute consumption contributes to the health advantages received by health-conscious customers.

Restraint: Compliance with international quality standards and regulations for sugar substitutes

Food safety regulations are overseen by international organizations like the National Food Safety and Quality Service (SENASA), the Canadian Food Inspection Agency (CFIA), the United States Food and Drug Administration (FDA), the World Health Organization (WHO), and the Committee on the Environment, Public Health, and Food Safety (CEPHFS) (EU). These organizations have direct or indirect control over the food processing industry's use of a variety of chemicals and materials. Health and safety inspections are performed on sugar alternatives. Regulations governing the use of sweeteners as a food ingredient stifle global growth in the sweeteners industry.

Opportunity: Increased investment in R&D activities by manufacturers in order to develop newer and better products.

To achieve a greater market, share than their competitors, manufacturers are progressively spending on the research and development of innovative sugar replacements. To minimize the calorie content of their final goods, several food and beverage firms are replacing sugar alternatives with normal sugars. In developed economies, sugar alternatives are in high demand. The fundamental cause for the enormous expansion of the sugar replacement market is a shift in consumer attitudes toward the use of sugar alternatives.

Challenge: Product labeling and commercial concerns

International food safety and quality regulatory bodies are tightening food safety regulations. Apart from food testing and certification, these international regulatory bodies compel manufacturers to follow food labeling rules and regulations. Most governments are taking steps to implement the food labeling law in their respective countries. The stringent regulations imposed by regulatory bodies regarding testing, certification, usage, production, and labeling pose a challenge for manufacturers.

Global Alternative Sweetener Market: Segmentation

The global Alternative Sweetener market is segregated based on Type, Application and End-use sector.

By type, the market is classified into Stevia, Sorbitol, Xylitol, Mannitol, Erythritol, Sweet proteins and Other types. This category had a significant share in 2021 and is expected to maintain its dominance throughout the forecast period. The stevia segment is expected to grow the fastest in the global market in 2021. Steviol glycosides, which are naturally present in the stevia leaf, are the sweet-tasting components of stevia. Stevia sweeteners do not add carbohydrates or calories to the food or beverage to which they are added. It also has no effect on blood glucose levels or insulin response. As a result of substituting stevia for sugar, people with diabetes can eat a wider variety of foods and stick to a healthy meal plan. Stevia also contains a variety of sterols and antioxidant compounds.

By application, the market is divided into Bakery products, Confectioneries & gums, Spreads, Beverages, Dairy products, Frozen desserts, Tabletop sweeteners, Pharmaceutical products, and Other Applications. In terms of value, the beverage segment accounted for a significant share of the global market in 2021. Sugar substitutes are now preferred in beverages such as diet carbonated drinks, flavored water, and others. The growing consumer base for beverage products provides an impetus for the development of new sugar substitutes and products, driving the market growth during the forecast period.

Recent Developments

- In July 2020, Tate & Lyle introduced VANTAGE sweetener solution design tools. It is a collection of new and innovative sweetener solution design tools, as well as an education program, for creating sugar-reduced food and drinks with low-calorie sweeteners.

Regional Landscape

Natural sweeteners are in high demand in North America, owing primarily to the healthy food trend. The growing awareness of the negative effects of excessive sugar consumption is the primary driver of market growth. As a result, more opportunities for low-calorie sweeteners emerge, particularly in bakery, beverage, and dairy applications. The beverage industry is the most important, followed by the bakery, confectionery, and dairy industries.

During the forecast period, the Asia Pacific market is expected to grow at the fastest rate in the global market. The Asia Pacific sugar substitutes market is expanding due to changes in customer lifestyles and an increase in health consciousness among them. This region's market is undergoing a dramatic transformation as a result of diet diversification, rapid urbanization, and liberal trade policies in the food sector.

Alternative Sweetener Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the alternative sweetener market on a global and regional basis.

Some of the main competitors dominating the global alternative sweetener market include –

- DuPont (US)

- ADM (US)

- Tate & Lyle PLC (UK)

- Cargill (US)

- Ingredion Incorporated (US)

- Roquette Frères (France)

- FoodChem International Corporation (China)

- PureCircle Ltd (US)

- MacAndrews & Forbes Holdings Inc (Merisant) (US)

- Ecogreen Oleochemicals Pvt Ltd (Indonesia)

- Pyure Brands LLC (US)

- Stevia Hub India (India)

- Suminter India Organics (India)

- Stevia Biotech Pvt Ltd (India)

- The Real Stevia Company (Sweden)

- Sweetly Stevia USA (UK)

- XiliNat (Mexico)

- Fooditive B.V. (Netherlands)

- Saganà Association (Switzerland)

- Hearthside Food Solutions LLC (US).

Alternative sweetener Market is segmented as follows:

Alternative sweetener Market, By Type

- Stevia

- Sorbitol

- Xylitol

- Mannitol

- Erythritol

- Sweet proteins

- Other types

By Application

- Bakery products

- Confectioneries & gums

- Spreads

- Beverages

- Dairy products

- Frozen desserts

- Tabletop sweeteners

- Pharmaceutical products

- Other applications

By End-use sector

- Food & beverages

- Pharmaceutical

- Direct sales

- Other end-use sectors

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global alternative sweetener market is expected to grow due to growing adoption in the food and beverage industry, increasing demand for low-calorie and sugar-free products, rising health consciousness and diabetes prevalence, and advancements in natural and artificial sweetener formulations.

According to a study, the global alternative sweetener market size was worth around USD 28.62 Billion in 2024 and is expected to reach USD 42.58 Billion by 2034.

The global alternative sweetener market is expected to grow at a CAGR of 4.2% during the forecast period.

North America is expected to dominate the alternative sweetener market over the forecast period.

Leading players in the global alternative sweetener market include DuPont (US), ADM (US), Tate & Lyle PLC (UK), Cargill (US), Ingredion Incorporated (US), Roquette Frères (France), FoodChem International Corporation (China), PureCircle Ltd (US), MacAndrews & Forbes Holdings Inc (Merisant) (US), Ecogreen Oleochemicals Pvt, among others.

The report explores crucial aspects of the alternative sweetener market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed