Air Cargo Security And Screening Systems Market Size, Share and Forecast 2032

Air Cargo Security And Screening Systems Market by Technology (Explosive Detection Systems, Explosive Trace Detection Systems, Metal Detection Systems, Non-Computed Tomography (Non-CT) Transmission X-ray Devices),: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

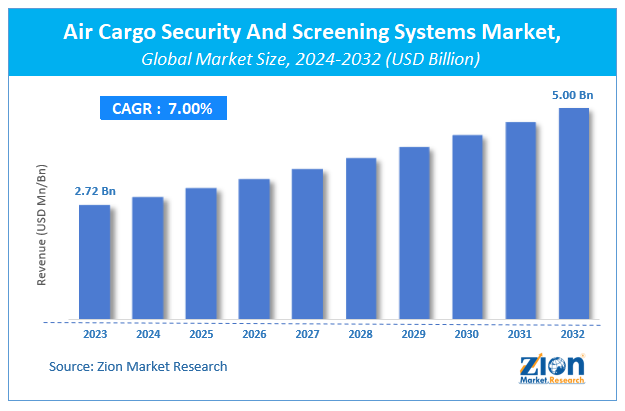

| USD 2.72 Billion | USD 5.00 Billion | 7% | 2023 |

Air Cargo Security And Screening Systems Market Insights

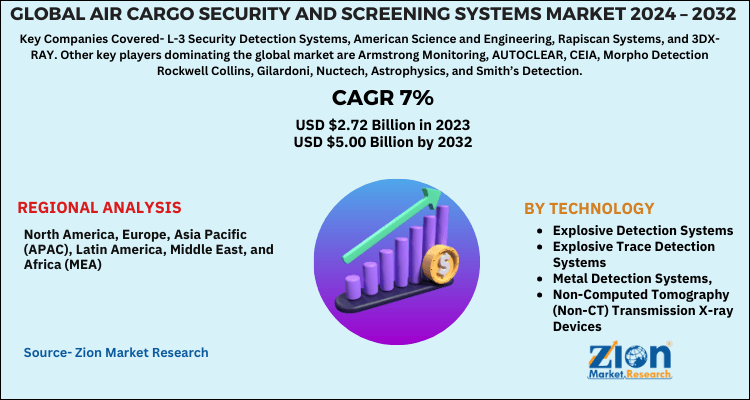

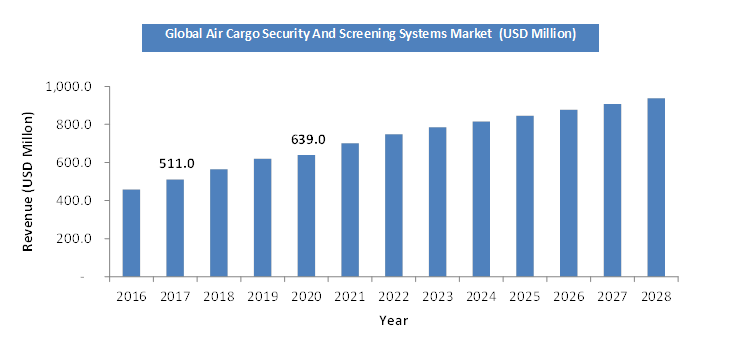

Zion Market Research has published a report on the global Air Cargo Security And Screening Systems Market, estimating its value at USD 2.72 Billion in 2023, with projections indicating that it will reach USD 5.00 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 7% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Air Cargo Security And Screening Systems Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Air Cargo Security And Screening Systems Market: Overview

Security checks of cargo consignments were before done manually by the appointed security guards at the airport. It had been carried to verify the cargo isn't carrying any hazardous thing or anything which isn't allowed by global air cargo laws. When the number of cargos at the airport was less, things might be done manually.

Owing to globalization, the entry of a larger number of air service providers, traffic got increased and therefore the flow of cargo consignments at the airport started growing. To handle the rising flow and to scrutinize the cargo consignment efficiently, accurately, and quicker, the airport started installing Air Cargo Security and Screening Systems at airports. With the assistance of those systems, cargos are often scanned with no mistakes, and the size of the cargo is no anymore a constraint. Major systems presently used screenings supported X-rays, ETD, and EDS technologies.

Earlier, when the lifestyle and speed of day-to-day business transactions were comparatively slow, advanced and computer-based technology to scan cargo wasn't needed. But now, life has become faster, businesses haven't any time to waste, everything is demanded in the maximum amount lesser time as possible. additionally, the planet is consistently under the threat of security breaches, and attacks from anti-social elements; in such situations, airports are demanding more efficient machinery to scan cargo. Advanced functions with the accurate and faster scanning process, with cost-effective prices, are qualities every airport security is demanding for. These are the factors boosting the expansion of the worldwide air cargo security and screening systems market. However, the lack of invention in this market is creating a disturbance in its long-term growth.

COVID-19 Impact Analysis

The COVID-19 outbreak has hit airports hard which could stall development in emerging markets.

As a result, aviation has fallen sharply, which has prompted airlines to chop capacity. Many are closed by governments to contain the spread of the virus. The result's a pointy fall in revenues. Given the importance of airports to the economic development of cities, countries, and regions, the broader impact of COVID-19 on the worldwide economy is gigantic.

Air Cargo Security And Screening Systems Market: Growth Factors

The thriving of e-commerce thanks to online shopping has increased the air cargo volume over the past few years. this is often expected to get demand for advanced screening systems at airports to handle cargo of varied sizes and sorts. Also, with the expansion in air cargo, several airports within the world are constructing dedicated air cargo terminals which is predicted to further propel the demand for air cargo screening systems within the coming years. The air cargo industry may be a considerable target for terror attacks and within the past few attempts are made to ship explosive materials which have raised concerns and have resulted in further tightening of the regulations in terms of screening. Stringent regulations associated with the screening of air cargo by TSA and other regulatory bodies in the EU have forced several airports to reinforce their existing cargo screening systems.

Air Cargo Security And Screening Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Air Cargo Security And Screening Systems Market |

| Market Size in 2023 | USD 2.72 Billion |

| Market Forecast in 2032 | USD 5.00 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 120 |

| Key Companies Covered | L-3 Security Detection Systems, American Science and Engineering, Rapiscan Systems, and 3DX-RAY. Other key players dominating the global market are Armstrong Monitoring, AUTOCLEAR, CEIA, Morpho Detection Rockwell Collins, Gilardoni, Nuctech, Astrophysics, and Smith’s Detection. |

| Segments Covered | By Technology and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

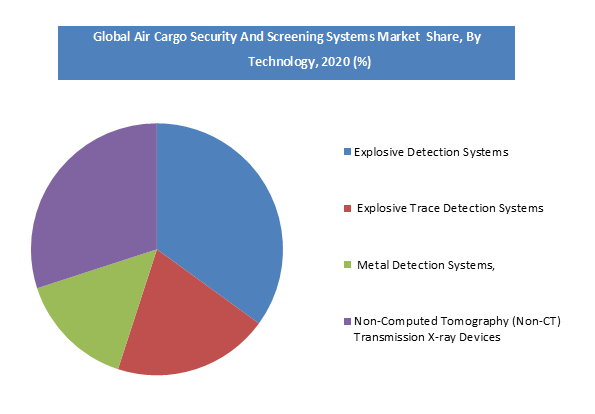

Technology Segment Analysis Preview

Non-Computed Tomography (Non-CT) Transmission X-ray Devices trace detectors (ETD) are explosive detection equipment ready to detect Non-Computed Tomography (Non-CT) Transmission X-ray Devices of small magnitudes. Devices almost like ETDs also are wont to detect narcotics. the fashionable screening methods of today are proficient and powerful in screening high volumes of cargo. Explosive Trace Detection systems dominated the market in 2019, thanks to their capability to detect minute objects and narcotics. ETD’s are utilized in many airports as this technology is employed to detain people handling narcotics and Non-Computed Tomography (Non-CT) Transmission X-ray Devices and to spot traffickers of prohibited material. A shift toward cost-effectiveness and innovation in technologies and reliable explosive and narcotics trace detection devices are likely to make more opportunities in the market. Hence, investment in such technologies is expected to propel the growth of the segment in the coming years.

Air Cargo Security And Screening Systems Market: Regional Segment Analysis Preview

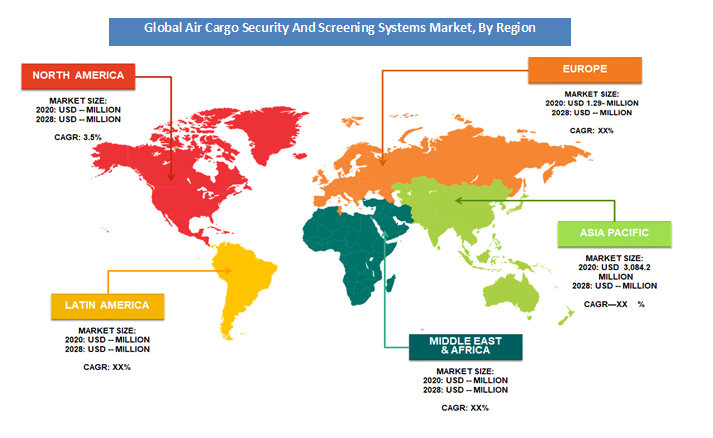

North America is dominating the global air cargo security and screening systems market owing to its developed economy and worldwide business spread. This trend is followed by the Asia Pacific and is anticipated to witness high growth owing to rising trade activities and industrialization in this region.

Air Cargo Security And Screening Systems Market: Key Players & Competitive Landscape

The key companies operating in the air cargo security and screening systems market include-

- L-3 Security Detection Systems

- American Science and Engineering

- Rapiscan Systems

- 3DX-RAY

- Armstrong Monitoring

- AUTOCLEAR

- CEIA

- Morpho Detection Rockwell Collins

- Gilardoni

- Nuctech

- Astrophysics

- Smith’s Detection.

The global Air Cargo Security And Screening Systems Market are segmented as follows:

By Technology

- Explosive Detection Systems

- Explosive Trace Detection Systems

- Metal Detection Systems,

- Non-Computed Tomography (Non-CT) Transmission X-ray Devices

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of The Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Air Cargo Security And Screening Systems Market market size valued at US$ 2.72 Billion in 2023

What will be the size of the global Air Cargo Security And Screening Systems Market in 2024 to 2032?

Air Cargo Security And Screening Systems Market market size valued at US$ 2.72 Billion in 2023, set to reach US$ 5.00 Billion by 2032 at a CAGR of about 7% from 2024 to 2032.

Some of the key factors driving the global Air Cargo Security And Screening Systems Market growth are, Advanced functions with the accurate and faster scanning process, with cost-effective prices, are qualities every airport security is demanding for.

North America region held a substantial share of the Air Cargo Security And Screening Systems Market in 2024.

The key companies operating in air cargo security and screening systems market include L-3 Security Detection Systems, American Science and Engineering, Rapiscan Systems, 3DX-RAY. Other key players dominating the global market are Armstrong Monitoring, AUTOCLEAR, CEIA, Morpho Detection Rockwell Collins, Gilardoni, Nuctech, Astrophysics, and Smith’s Detection.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed