Global Agriculture Drone Market Size, Share, Growth Analysis Report - Forecast 2034

Agriculture Drone Market By Type (Fixed Wing, Rotary Wing), By Component (Hardware, Software, Services), By Farming Environment (Indoor Farming, Outdoor Farming), By Application (Crop Management, Field Mapping, Crop Spraying, Livestock Monitoring, Variable Rate Application (VRA), Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

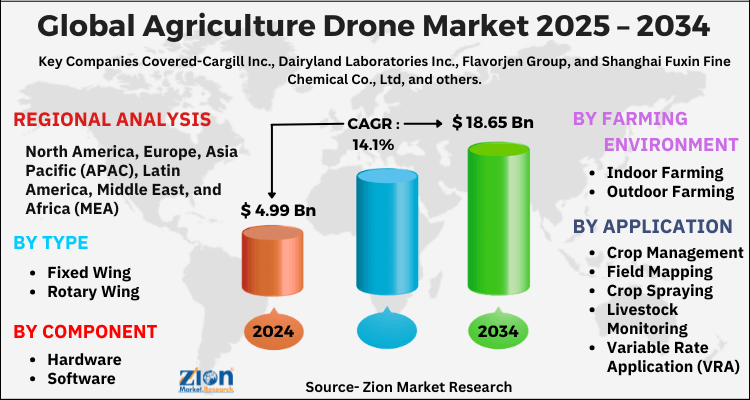

| USD 4.99 Billion | USD 18.65 Billion | 14.1% | 2024 |

Agriculture Drone Market: Industry Perspective

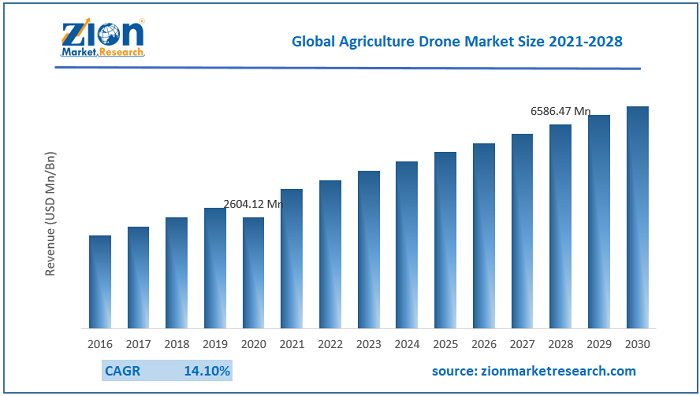

The global agriculture drone market size was worth around USD 4.99 Billion in 2024 and is predicted to grow to around USD 18.65 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 14.1% between 2025 and 2034. The report analyzes the global agriculture drone market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the agriculture drone industry.

Global Agriculture Drone Market Overview

An agricultural drone is an aerial device used to help optimize agriculture proceeds, increase crop production and check for further growth. In-built sensors provide a better view of the fields, to the farmer. Due to increasing technological advancements, agricultural drones have gained fame over the years. These are also known as unmanned aerial vehicles (UAV) that aids the farmer with necessary information about the agricultural land. Growing awareness and compulsion to shift over to smart agriculture has supported the agricultural drone market.

Backed by revolutionary technicalities and the extensive use of high-quality cameras, this agricultural drone allows the farmer to be aware of the land’s water and nutrient requirements. Furthermore, the demand for this product has paved way for increased investments in R&D for developing more sophisticated products which are farmer-friendly. All these factors have caused emerging startups to invest wisely in this market and have proved to be lucrative.

Key Insights

- As per the analysis shared by our research analyst, the global agriculture drone market is estimated to grow annually at a CAGR of around 14.1% over the forecast period (2025-2034).

- Regarding revenue, the global agriculture drone market size was valued at around USD 4.99 Billion in 2024 and is projected to reach USD 18.65 Billion by 2034.

- The agriculture drone market is projected to grow at a significant rate due to the need for precision farming, increased automation in agriculture, and rising adoption of smart farming technologies.

- Based on Type, the Fixed Wing segment is expected to lead the global market.

- On the basis of Component, the Hardware segment is growing at a high rate and will continue to dominate the global market.

- Based on the Farming Environment, the Indoor Farming segment is projected to swipe the largest market share.

- By Application, the Crop Management segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Agriculture Drone Market Size: Growth Factors

The need for coping up with the change in technology, lack of labor, and efficiency requirements has worked in favor of the agricultural drone market. Features like in-built sensors, automated GPS, and 3D mapping of the field have proven to be the driving factors of the market. At present, there is a need to do precision agriculture where the farmer is required to observe, measure, and respond to crop production. This can be achieved most efficiently only with the help of agriculture drones that provide reliable information regarding the land’s requirements.

Due to unpredictable climatic changes and increasing environmental pollution, the farmer is required to be more conscious and cater to the needs of the land as and when required. To make this most effective, agriculture drones with RGB cameras, GPS systems, and 3D prints are the most sought-after product causing the agriculture drone market to be the most beneficial in the near future. These trends are expected to continue and propel the growth of the agriculture drone market size in the coming years.

Agriculture drone can be used in soil and field analysis, planting, crop spraying, crop monitoring, irrigation and others. Data generated by drones can help farmers to gain a more accurate & detailed view that how their crops are responding to their management strategies which may lead to the most effective use of limited resources. Different types of drones help to elevate agricultural efficiency.

Increasing applications of drone in agriculture sectors have influenced the industry to invest significantly in funding UAV-based startups. Also, increasing funding from venture-based firms for agricultural drones is fueling the market growth. However, lack of trained pilots and stringent regulations may restrain the growth of agricultural drones market over the forecast period.

Product Segment Analysis Preview

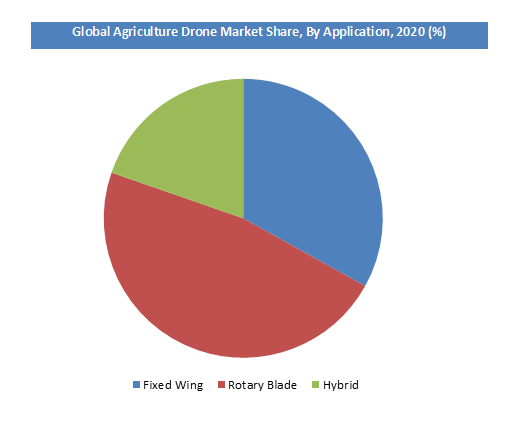

On the basis of Product, the market is segmented into fixed-wing, rotary blade, and hybrid. The rotary wing segment holds a clear dominance and is expected to lead in the coming years as well. Using the multi-rotors, rotary wing drones do not depend on extra space for flight and landing.

Although, the hybrid UAVs are expected to be profitable, owing to the capability of covering long distances over the fields. Altogether, the multiplication of economical navigation which includes inspection and mapping, has helped the farmers with extensive and increased crop production.

Application Type Segment Analysis Preview

The market is broken down into field mapping & monitoring, crop scouting, variable rate application, and others. While, the most important part of farming is to find the right soil for plantation, and hence, the field mapping and monitoring holds an edge over the other application types in the agriculture drone market. With a RGB camera, the UAVs can cover long distances to access the right spot for planting and sowing seeds.

Due to the growing concerns of pest infestations and diseases caused by it, the crop scouting segment is forecasted to grow in the following years. Pest management is pivotal as it can ruin the entire plantation, if proper care is not given. There is a constant concern regarding over-spraying fertilizers, making the soil inhospitable or unhealthy and Crop scouting UAVs are expected to eradicate these concerns in the forecasted period.

Agriculture Drone Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agriculture Drone Market |

| Market Size in 2024 | USD 4.99 Billion |

| Market Forecast in 2034 | USD 18.65 Billion |

| Growth Rate | CAGR of 14.1% |

| Number of Pages | 140 |

| Key Companies Covered | Cargill Inc., Dairyland Laboratories Inc., Flavorjen Group, and Shanghai Fuxin Fine Chemical Co., Ltd, and others. |

| Segments Covered | By Type, By Component, By Farming Environment, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

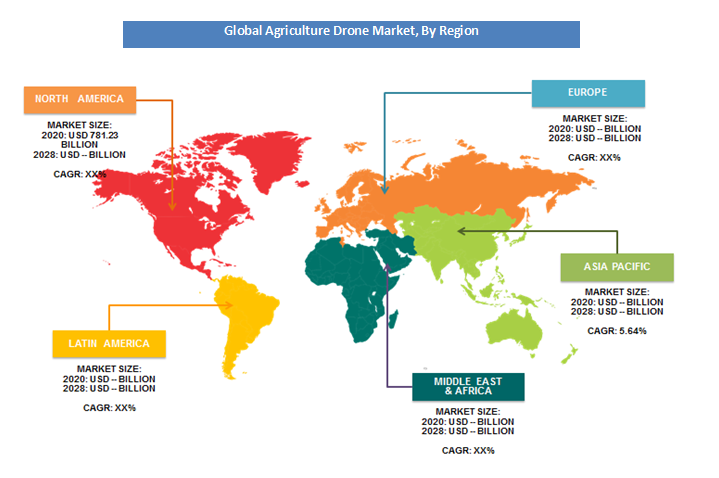

Agriculture Drone Market Regional Analysis Preview

Geographically, North America is the most advantageous region due to its government support through the Department of Transportation (DOT) and the Federal Aviation Administration (FAA). Numerous businesses in North America are involved in commercial agriculture, and the region is dependent on it. Not forgetting the promising manufacturing companies dispersed throughout the United States and Canada, which play a crucial role in maintaining North America's dominance over the rest of the world in the agriculture drone market.

Whilst, Europe is expected to be most viable in the future, owing to the raising awareness of smart agriculture and need to improve crop production. Asia Pacific is also expected to perform better in the future having major agricultural production.

North America dominated the global agriculture drone market due to high production and increasing applications in the agriculture sectors. Europe commercial drone market is expected to grow considerably in the forecast years owing to the relaxations in regulations and increasing applications in law enforcement and agricultural applications.

Agriculture Drone Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the agriculture drone market on a global and regional basis.

Some of key players in the Global Agriculture Drone Market are

- DJI

- Precision Hawk

- Trimble Inc

- Parrot

- 3DR

- AeroVironment, Inc

- Yamaha Motor Corp

- DroneDeploy

- AgEagle Aerial Systems Inc

- OPTiM Corp

- SenseFLY

- Pix4D

- Sentera Inc

- SlantRange

- ATMOS UAV

- Delair

- Nileworks Inc

The global agriculture drone market is segmented as follows:

By Product

- Hardware

- Fixed Wing

- Rotary Blade

- Hybrid

- Software

- Data Management

- Imaging Software

- Data Analysis

- Others

By Component

- Controller System

- Propulsion Systems

- Camera Systems

- Navigation System

- Batteries

- Others

By Application Type

- Field Mapping

- Variable Rate Application (VRA)

- Crop Scouting

- Crop Spraying

- Livestock

- Agriculture Photography

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed