Global Agricultural Biologicals Testing Market Size, Share, Growth Analysis Report - Forecast 2034

Agricultural Biologicals Testing Market By Product Type (Bio pesticides, Bio fertilizers, Bio stimulants), By End-User (Government Agencies, Plant Breeders, Outsourced Contract Research Organization, Biological Product Manufacturers), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

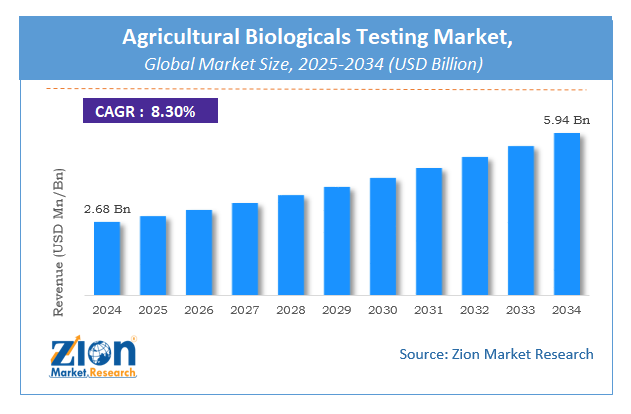

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.68 Billion | USD 5.94 Billion | 8.3% | 2024 |

Agricultural Biologicals Testing Market: Industry Perspective

The global agricultural biologicals testing market size was worth around USD 2.68 Billion in 2024 and is predicted to grow to around USD 5.94 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.3% between 2025 and 2034.

The report analyzes the global agricultural biologicals testing market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the agricultural biologicals testing industry.

Agricultural Biologicals Testing Market: Overview

Agricultural biologicals are chemical products wherein an active constituent is extracted from living organisms such as microorganisms, plants, and animals with or without modification. These active constituents are extracted from an organism instead of the whole organism. Agricultural biologicals can be also referred as herbals, organics, or botanicals.

Key Insights

- As per the analysis shared by our research analyst, the global agricultural biologicals testing market is estimated to grow annually at a CAGR of around 8.3% over the forecast period (2025-2034).

- Regarding revenue, the global agricultural biologicals testing market size was valued at around USD 2.68 Billion in 2024 and is projected to reach USD 5.94 Billion by 2034.

- The agricultural biologicals testing market is projected to grow at a significant rate due to rising demand for organic food, stringent regulatory standards, increasing adoption of sustainable farming practices, and growth in biopesticides and biofertilizers usage.

- Based on Product Type, the Bio pesticides segment is expected to lead the global market.

- On the basis of End-User, the Government Agencies segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Agricultural Biologicals Testing Market: Growth Factors

The global agricultural biological testing market is driving by increasing awareness about sustainable agriculture and rising popularity of the cultivation of the organic crop. In addition, implementation of stringent regulations set by the government in agriculture is expected to boost the global market. However, higher spending on R&D by biological product manufacturers may foster the global agricultural biologicals testing market growth in the near future. Increasing demand for agricultural biological testing to high production of organic crops is anticipated to boost growth in the future. Benefits provided by the agricultural biological as compared to traditional pesticides are large; hence, they are highly accepted in the global agricultural biological testing market.

Agricultural Biologicals Testing Market: Segmentation

The global agricultural biologicals testing market is categorized based on applications as analytical, field support, and regulatory. On the basis of end-user, the global market is classified as government agencies, biological product manufacturers, and others. Moreover, the global market is bifurcated based on product type as biofertilizers, biostimulants, and biopesticides. Of these, biopesticides are the dominating product type segment in the global agricultural biologicals testing market. Biopesticides are highly preferred against traditional agrochemicals, which are responsible for degradation of soil quality. Service providers of biopesticide testing ensure reliability and efficiency of the products.

Agricultural Biologicals Testing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agricultural Biologicals Testing Market |

| Market Size in 2024 | USD 2.68 Billion |

| Market Forecast in 2034 | USD 5.94 Billion |

| Growth Rate | CAGR of 8.3% |

| Number of Pages | 110 |

| Key Companies Covered | RJ Hill Laboratories Limited, Bionema Limited, Eurofins APAL Pty Ltd, Staphyt SA, Syntech Research Group, Eurofins Scientific, Anadiag Group, Laus GmbH, SGS SA, ALS Limited, and others. |

| Segments Covered | By Product Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agricultural Biologicals Testing Market: Regional Analysis

Europe contributed for the largest market chunk in the global agricultural biologicals testing the market. In addition, countries such as the U.K., Germany, Italy, and France are prominent consumers of the agricultural biologicals testing services for compliance requirements of biostimulants, biopesticides, and biofertilizers. North America shows significant growth in the global agricultural biologicals testing market. Moreover, Mexico, the U.S., and Canada have early accepted agricultural biological products and furnish to export markets. Increasing awareness among farmers about benefits of agricultural biological rather than traditional pesticides may foster the global market growth in this region. Asia Pacific region shows high growth potential, while untapped regions such as the Middle East and Africa offer new growth opportunities for market players. Furthermore, China and the U.S. are major producers of the biologicals and these are emerging as new markets for biopesticide testing.

Agricultural Biologicals Testing Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the agricultural biologicals testing market on a global and regional basis.

The global agricultural biologicals testing market is dominated by players like:

- RJ Hill Laboratories Limited

- Bionema Limited

- Eurofins APAL Pty Ltd

- Staphyt SA

- Syntech Research Group

- Eurofins Scientific

- Anadiag Group

- Laus GmbH

- SGS SA

- ALS Limited

The global agricultural biologicals testing market is segmented as follows;

By Product Type

- Bio pesticides

- Bio fertilizers

- Bio stimulants

By End-User

- Government Agencies

- Plant Breeders

- Outsourced Contract Research Organization

- Biological Product Manufacturers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Leading players in the global agricultural biologicals testing market include RJ Hill Laboratories Limited, Bionema Limited, Eurofins APAL Pty Ltd, Staphyt SA, Syntech Research Group, Eurofins Scientific, Anadiag Group, Laus GmbH, SGS SA, ALS Limited, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed