Workforce Analytics Market Size, Share, Analysis, Trends, Growth, 2032

Workforce Analytics Market By Deployment Mode (On Premises and Cloud), By Verticals (BFSI, Government, Retail, Healthcare, Manufacturing and Others) - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2024 - 2032-

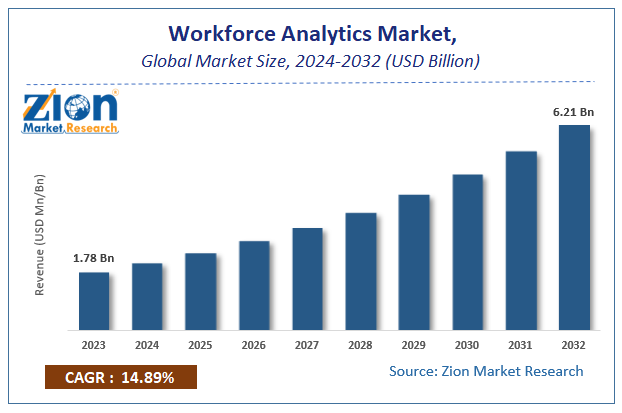

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.78 Billion | USD 6.21 Billion | 14.89% | 2023 |

Workforce Analytics Market Insights

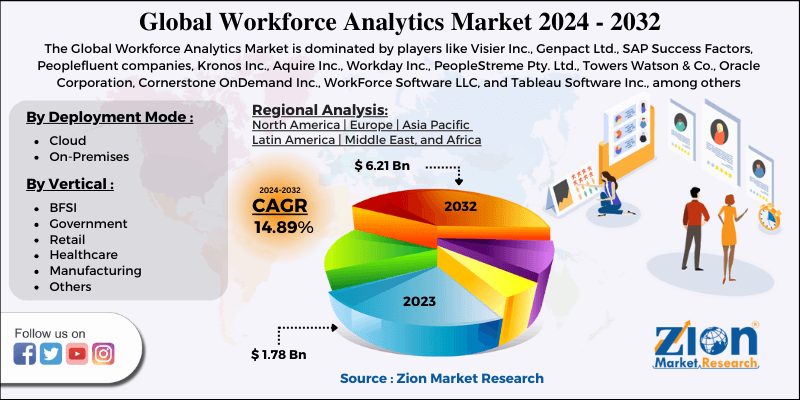

Zion Market Research has published a report on the global Workforce Analytics Market, estimating its value at USD 1.78 Billion in 2023, with projections indicating that it will reach USD 6.21 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 14.89% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Workforce Analytics Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Workforce Analytics Market: Overview

In the recent years the rapid increase in the demand of the advanced analytical tools and analytics applications as the enterprises face the immense challenge of analysing the large amount of HR data structure in real life.

Workforce analytics is to study the behaviours of people (candidates, employees) and to analyse them to improve people and business performance. This is studied by analysing the people (candidates, employees) data using statistical methods and software in order to make better workforce decisions. The workforce market covers applications such as performance and talent management, workforce planning, compensation management, learning management, recruitment, and employee collaboration and engagement. The growing trends in analytics and big data would greatly increase the demand for workforce analytics. With data privacy and integrity on the rise, countries have adopted various regulations in order to prevent huge data and economic losses. For instance, the GDPR policy adopted in European region mandates the need to focus on data privacy and its storage within the country.

Workforce Analytics Market: COVID-19 Impact Analysis

COVID-19 is an global public emergency which have led us to serious implications for all the sectors as it has deepen the growth to a significant level and Workforce analytics market wasn’t an exception. This can be the restrain with long-term effects having impact on the industry growth over the forecast period. During COVID 19 the demand for the computer networks, storage, applications or resources accessed via the internet has greatly increased. In COVID-19 lockdown in various countries people are having work from home which have greatly increased the demands for internet applications. Now a days, the demand for the cloud based solution is increasing tremendously. Increasing demand of cloud based solution will support the workforce analytics market.

The lockdown in the COVID-19 which have led us to serious implications for all the sectors however, the end of the lockdown is anticipated to bring this industry significantly higher consumer traffic.

Workforce Analytics Market: Growth factors

The rapid urbanization and globalization across the world, the organization requires flexibility, innovation, speed, and talent to differentiate itself from other firms. This needs have led to focus on workforce strategies and on the various investment done on employees which increase the business growth. Owing to the increase in the automation in the workplaces, and increase in adoption of the workforce analytics it is anticipated to grow the market of workforce analytics. The growing trends in analytics and big data would greatly increase the demand for workforce analytics.

Now a days, the demand for the cloud based solution is increasing tremendously. Increasing demand of cloud based solution will support the workforce analytics market. The inability of standard performance indicators to track human capital performance is expected to increase the market of workforce analytics. However, the High cost associated with the training, may hinder the growth of market.

Workforce Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Workforce Analytics Market |

| Market Size in 2023 | USD 1.78 Billion |

| Market Forecast in 2032 | USD 6.21 Billion |

| Growth Rate | CAGR of 14.89% |

| Number of Pages | 150 |

| Key Companies Covered | Visier Inc., Genpact Ltd., SAP Success Factors, Peoplefluent companies, Kronos Inc., Aquire Inc., Workday Inc., PeopleStreme Pty. Ltd., Towers Watson & Co., Oracle Corporation, Cornerstone OnDemand Inc., WorkForce Software LLC, and Tableau Software Inc., among others |

| Segments Covered | By Deployment Mode, By Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cloud Based to dominate the global market based on Deployment

Continuously development in the technology has led to the adoption of the Cloud based solutions. Various advantages such as easy to access and reach the customers makes it most preferred options. Many companies are continuously developing new approach and models to improve the business model so as to expand the business across the globe.

Cloud based deployment is set to achieve a roaring growth within the market scope, specifically within the current scenario, where organization and firms are operating on work from home policy, thereby leading to a lucrative double digit growth for the cloud technology. Within the time period from January 2020 to current time scenario, the cloud technology has raised to a growth rate of 130% Y-O-Y with all software and applications transitioning to cloud based model for easy and effective access.

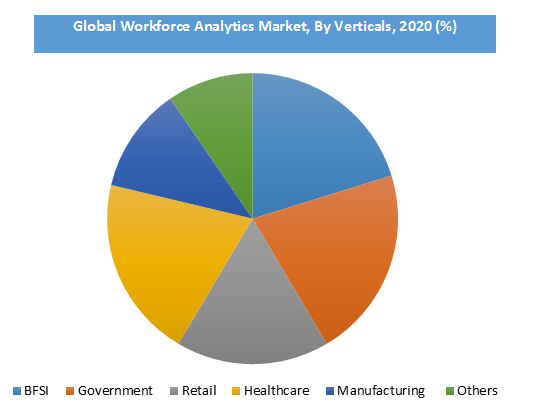

BFSI to hold Major share

On the basis application, the global market is segment into BFSI, government, retail, healthcare, manufacturing and others. BFSI holds the major share in the market owing to the huge adoption in the sectors. The expectations of and demands on human resources (HR) professionals within financial services have changed significantly in the past decade. Increasing and introduction of the new technologies have changed the transform the scenario. The retail industry is expected to be the fastest-growing application sector owing to the rising implementation of the workforce information system to automate the key human resource-related processes.

Regional Segment Analysis

Over the forecast period Asia Pacific is expected to expand Workforce Analytics Market at the fastest CAGR of 20.3%. Owing to the fastest growing economies such as China, India, and Japan, the asia pacific is expected to expand vastly. The unmet demand and the widespread deployment of the workforce analytics platform in the BFSI sector is expected to boost market growth.

Also, owing to government's initiative, such as Startup India, to inspire entrepreneurship within the country, is also driving the market. Furthermore, the ability of the workforce analytics to make more fact based human resource Decisions is creating the positive impact on the market which can be the factor responsible for the growth of the market.

Over the forecast period due to presence of large number of analytics vendors, North America is expected to have the largest market share and dominate the workforce analytics market from 2024 to 2032.

Workforce Analytics Market: Competitive Landscape

Some of the major companies operating in the global workforce analytics market are

- Visier Inc.

- Genpact Ltd.

- SAP Success Factors

- Peoplefluent companies

- Kronos Inc.

- Aquire Inc.

- Workday Inc.

- PeopleStreme Pty. Ltd.

- Towers Watson & Co.

- Oracle Corporation

- Cornerstone OnDemand Inc.

- WorkForce Software LLC

- Tableau Software Inc.

- among others.

The detailed description of players includes parameters such as company overview, financial overview, business, and recent developments and SWOT analysis of the company.

This report segments the global workforce analytics market as follows:

Global Workforce Analytics Market: Deployment Mode Segment Analysis

- Cloud

- On-Premises

Global Workforce Analytics Market: Vertical Segment Analysis

- BFSI

- Government

- Retail

- Healthcare

- Manufacturing

- Others

Global Workforce Analytics Market: Region Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

List of Contents

Market InsightsMarket:Overview Market:COVID-19 Impact AnalysisMarket:Growth factorsReport ScopeCloud Based to dominate the global market based on Deployment BFSI to hold Major shareRegional Segment AnalysisCompetitive LandscapeThis report segments the global workforce analytics market as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed