Wall Panels Market Size, Share, Trends, Growth & Forecast 2034

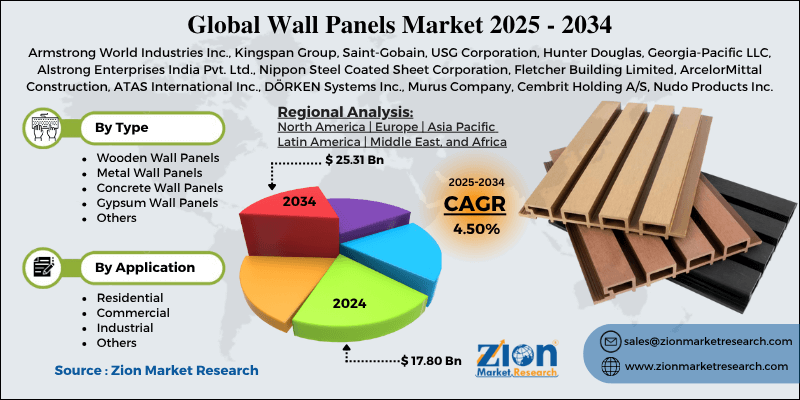

Wall Panels Market By Type (Wooden Wall Panels, Metal Wall Panels, Concrete Wall Panels, Gypsum Wall Panels, and Others), By Application (Residential, Commercial, Industrial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

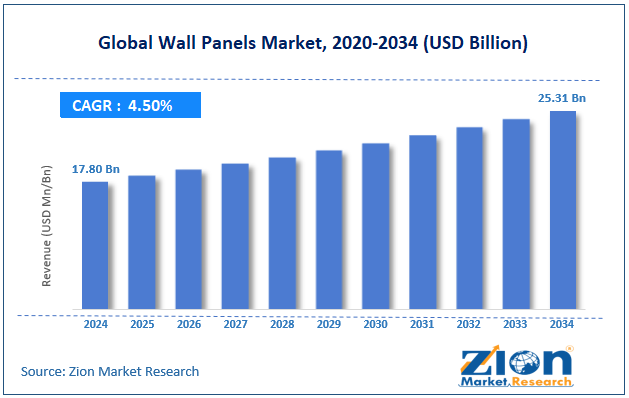

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.80 Billion | USD 25.31 Billion | 4.50% | 2024 |

Wall Panels Industry Perspective:

The global wall panels market size was approximately USD 17.80 billion in 2024 and is projected to reach around USD 25.31 billion by 2034, with a compound annual growth rate (CAGR) of approximately 4.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global wall panels market is estimated to grow annually at a CAGR of around 4.50% over the forecast period (2025-2034)

- In terms of revenue, the global wall panels market size was valued at around USD 17.80 billion in 2024 and is projected to reach USD 25.31 billion by 2034.

- The wall panels market is projected to grow significantly due to the rising demand for sustainable and energy-efficient building materials, the growing adoption of prefabricated construction methods, and advancements in wall panel design and manufacturing technologies.

- Based on type, the gypsum wall panels segment is expected to lead the market, while the wooden wall panels segment is expected to grow considerably.

- Based on the application, the residential segment is the dominant segment, while the commercial segment is projected to witness substantial revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Wall Panels Market: Overview

Wall panels are prefabricated building components used to enhance the aesthetics, insulation, and functionality of interior and exterior walls. They are made from various materials, including metal, wood, fiber, PVC, and composite panels, offering ease of installation, low maintenance, durability, acoustic insulation, and enhanced thermal insulation, while adding a modern architectural appeal. The global wall panels market is poised for significant growth, driven by infrastructure development, rapid urbanization, a growing emphasis on insulation and energy efficiency, as well as an increase in commercial and residential construction. The rise in global urbanization is driving large-scale construction projects, which in turn is impacting the demand for modern building materials, such as wall panels. This trend surges the adoption of prefabricated and modular wall panels for more efficient and faster construction.

Moreover, the rising awareness of energy conservation has driven demand for wall panels with enhanced thermal insulation. Energy-efficient buildings can decrease cooling costs and heating by up to 30%, increasing the appeal of insulated wall panels and supporting green building certifications.

Furthermore, the growing real estate sector, primarily in North America and the Asia Pacific, is significantly contributing to the industry's growth. An increasing number of housing projects, renovation activities, and commercial complexes are augmenting the installation of wall panels. Governments are also investing in affordable housing programs and smart cities.

Nevertheless, the global market faces limitations due to factors such as high initial installation costs and fluctuations in raw material prices. Despite long-term benefits, wall panels usually have higher upfront costs than conventional wall materials. The cost of prefabrication technology and advanced materials may hamper small-scale builders. This restricts the adoption, mainly in cost-sensitive markets.

Likewise, the cost of raw materials, such as resins, metals, and composites, can vary due to global supply chain disruptions. These variations impact profit margins and manufacturing costs. Producers experience intricacies in maintaining stable pricing for end consumers.

Still, the global wall panels industry benefits from several favorable factors, including the rising demand for recyclable and environmentally friendly panels, as well as smart and interactive wall panels. The worldwide shift towards sustainability creates robust opportunities for panels made from wood composites, recycled metals, and bio-resins. Green building mandates and eco-certifications will fuel the adoption. Companies that emphasize low-carbon production may gain a competitive advantage. Additionally, the integration of smart technologies and IoT into panels, such as sound control or lighting sensors, is a growing trend. Smart wall systems can enhance user experience and improve energy management.

Wall Panels Market: Growth Drivers

Growth Drivers

How do rising renovation and remodeling activities drive the wall panels market?

The growth in home improvement and renovation projects in emerging and developed regions is escalating the demand for wall panels, thus driving the development of the wall panels market. Consumers are increasingly seeking visually appealing, quick-install, and cost-efficient interior solutions for upgrading existing spaces.

According to the reports, global spending on home renovation surged by 14% in 2024, fueled by post-pandemic and millennial remodeling trends. Wall panels, mainly acoustic and decorative variants, are popular in retail interiors, refurbishments, and residential facelifts.

How are improvements in design and material technology notably driving the growth of the wall panels market?

Technological advancements in materials science have led to the development of high-performance composite wall panels that offer fire resistance, superior aesthetics, and durability. Modern panels now integrate 3D textures, self-cleaning surfaces, and anti-microbial coatings, improving design appeal and functionality.

Major manufacturers, such as CertainTeed and Armstrong World Industries, are heavily investing in R&D for nanomaterial-based panels that enhance environmental resistance and longevity. These technological leaps are ranking wall panels as a premium solution in residential and commercial frameworks.

Restraints

Challenges in installation and a skilled workforce unfavorably impact the market progress

Proper installation of wall panels requires trained labor to promise aesthetics, durability, and performance. Nonetheless, the lack of skilled installers in numerous regions acts as a key constraint. According to the 2025 reports, nearly 30% of construction projects in Arica and the Asia Pacific experienced delays due to a lack of knowledge and proficiency in insulated or modular panel systems.

Incorrect installation may result in structural issues, reduced thermal efficiency, and water leakage, further discouraging adoption. Companies like Saint-Gobain have recently introduced training programs, but the gap between industry demand and skilled labor availability remains concerning.

Opportunities

How are technological advancements and smart panels offering advantageous conditions for the development of the wall panels market?

The incorporation of technology in wall panels offers a lucrative opportunity for advancement in the wall panels industry. Smart wall panels with temperature regulation, integrated lighting, and moisture detection are gaining popularity, particularly in commercial offices and premium residential properties.

According to the 2025 research, the adoption of smart building materials, including wall panels, increased by 18% year-over-year. Associations, such as Nichiha’s 2025 introduction of IoT-based panels in Japan, demonstrate how manufacturers can leverage technology to differentiate their products. This trend is projected to fuel premium market segments worldwide.

Challenges

Raw material shortage and disturbances in the supply chain restrict the market growth

Global supply chain instability remains a significant challenge for wall panel manufacturers. The lack of crucial raw materials, such as polymers, steel, and aluminum, during 2024-2025 resulted in a price hike of nearly 15%, as per 2025 data.

Moreover, shipping delays and geopolitical stresses disturb timely project execution. Companies like Saint-Gobain and Kingspan reported delayed shipments in Quarter 1 due to a lack of raw materials. These disturbances may restrict production, slow industry growth, and increase costs, especially for large-scale construction projects.

Wall Panels Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wall Panels Market |

| Market Size in 2024 | USD 17.80 Billion |

| Market Forecast in 2034 | USD 25.31 Billion |

| Growth Rate | CAGR of 4.50% |

| Number of Pages | 214 |

| Key Companies Covered | Armstrong World Industries Inc., Kingspan Group, Saint-Gobain, USG Corporation, Hunter Douglas, Georgia-Pacific LLC, Alstrong Enterprises India Pvt. Ltd., Nippon Steel Coated Sheet Corporation, Fletcher Building Limited, ArcelorMittal Construction, ATAS International Inc., DÖRKEN Systems Inc., Murus Company, Cembrit Holding A/S, Nudo Products Inc., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Wall Panels Market: Segmentation

The global wall panel market is segmented by type, application, and region.

Based on type, the global wall panels industry is divided into wooden wall panels, metal wall panels, concrete wall panels, gypsum wall panels, and others. The gypsum wall panels segment dominated the market owing to their affordability, ease of installation, and lightweight structure, increasing their suitability for modern construction projects. Their sound-insulating and fire-resistant properties increase their preference in commercial and residential buildings. Rapid urbanization and the increasing number of renovation activities are driving the broader adoption of these technologies worldwide.

On the other hand, the wooden wall panels segment held a second rank due to their natural texture and superior aesthetic appeal, which improves interior design in premium spaces. These panels offer excellent acoustic and thermal insulation, increasing their suitability for hospitality, office, and residential applications. Rising consumer preference for sustainable and eco-friendly wood materials is propelling their demand in the developed regions.

Based on application, the global wall panels market is segmented into residential, commercial, industrial, and others. The residential segment holds a leading position due to growing urban housing demand, increasing home renovation activities, and rapid global population growth. Wall panels are broadly used in residential interiors for insulation, aesthetic enhancement, and easy maintenance. The rising awareness of sustainable and energy-efficient housing solutions further supports the segment's growth.

Conversely, the commercial segment holds a second-leading rank, fueled by the speedy construction of hotels, offices, educational institutions, and shopping complexes. These spaces increasingly require modern, visually appealing, and durable wall solutions to enhance energy efficiency and interior ambiance. The adoption of decorative and prefabricated panels is increasing in retail and corporate spaces due to their reduced maintenance requirements and faster installation.

Wall Panels Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Wall Panels Market?

The Asia Pacific is projected to maintain its dominant position in the global wall panels market, driven by population growth, rapid urbanization, a booming real estate and construction sector, and government initiatives and smart city projects. The Asia Pacific region holds the fastest urbanization rates worldwide, with more than 50% of the population projected to live in urban and metropolitan cities by 2025, and this is anticipated to increase to 60% by 2035.

Rapid urban development drives high demand for commercial and residential construction, leading to increased use of wall panels. Economies such as Indonesia, China, and India are undertaking large-scale infrastructure and housing projects, driving industry growth. Moreover, the region's construction market is growing at a 6-7% CAGR, propelled by the growing middle-class incomes and industrialization. High-rise residential complexes, retail infrastructure, and offices are driving the adoption of wooden, metal, and gypsum wall panels.

For instance, China alone registers for more than 40% of APAC's wall panel consumption, denoting massive construction activity. Additionally, governments in the APAC region are heavily investing in affordable housing, smart city projects, and urban redevelopment, with a focus on energy-efficient building materials. By 2030, India's 'Housing for All' initiative aims to construct 100 million new homes, generating substantial demand for prefabricated wall solutions. Likewise, China's urban planning policies promote green buildings with insulated wall panels.

North America maintains its position as the second-largest region in the global wall panels industry, driven by robust residential construction activity, expanding commercial infrastructure, and a growing emphasis on green and energy-efficient buildings. North America continues to experience robust residential construction, driven by population growth and urban expansion. The United States alone is expected to see more than 1.4 million new housing starts in 2025, driving demand for exterior and interior wall panels. A growing number of renovation and remodeling projects also support the adoption of gypsum, composite, and wooden panels.

Furthermore, the commercial industry, comprising hotels, offices, and retail complexes, is gradually growing in North America. The region's commercial construction sector is valued at USD 1.2 trillion in 2025, creating significant demand for aesthetically appealing and durable wall panels. Decorative and prefabricated panels are progressively used for cost-effective and fast installations in these projects.

The region focuses on energy-efficient construction, with buildings accounting for approximately 40% of the country's overall energy consumption. Wall panels with acoustic properties and thermal insulation are favored to meet Energy Star and LEED standards. Building codes and government incentives that encourage the use of sustainable materials are fueling the higher adoption of insulated wall panels.

Wall Panels Market: Competitive Analysis

The leading players in the global wall panels market are:

- Armstrong World Industries Inc.

- Kingspan Group

- Saint-Gobain

- USG Corporation

- Hunter Douglas

- Georgia-Pacific LLC

- Alstrong Enterprises India Pvt. Ltd.

- Nippon Steel Coated Sheet Corporation

- Fletcher Building Limited

- ArcelorMittal Construction

- ATAS International Inc.

- DÖRKEN Systems Inc.

- Murus Company

- Cembrit Holding A/S

- Nudo Products Inc.

Wall Panels Market: Key Market Trends

Adoption of modular and prefabricated wall panels:

Modular and prefabricated wall panels are progressively favored for cost efficiency and faster installation. They are extensively used in commercial and residential modular projects to decrease construction and labor time. Ready-to-install panels are gaining popularity in speedily urbanizing regions like APAC.

Integration of functional and smart wall panels:

Wall panels are evolving to incorporate smart features such as built-in lighting, acoustic control, and IoT connectivity. These multifunctional panels enhance energy efficiency, comfort, and interactivity in modern buildings. This trend is exceptionally robust in residential and high-end commercial projects.

The global wall panels market is segmented as follows:

By Type

- Wooden Wall Panels

- Metal Wall Panels

- Concrete Wall Panels

- Gypsum Wall Panels

- Others

By Application

- Residential

- Commercial

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Wall panels are prefabricated building components used to enhance the aesthetics, insulation, and functionality of interior and exterior walls. They are made from various materials, including metal, wood, fiber, PVC, and composite panels, offering ease of installation, low maintenance, durability, acoustic insulation, and enhanced thermal insulation, while adding a modern architectural appeal.

The global wall panels market is projected to grow due to rapid urbanization and infrastructure development, the growth of green construction trends and smart buildings, and a surge in demand for aesthetically pleasing interior and exterior solutions.

According to study, the global wall panels market size was worth around USD 17.80 billion in 2024 and is predicted to grow to around USD 25.31 billion by 2034.

The CAGR value of the wall panels market is expected to be approximately 4.50% from 2025 to 2034.

Stringent environmental regulations, restrictions on non-recyclable or high-VOC materials, and green building codes are impacting the growth of the wall panels market.

Opportunities exist in mergers, joint ventures, and collaborations for eco-friendly, prefabricated, and smart wall panel solutions.

Asia Pacific is expected to lead the global wall panels market during the forecast period.

The key players profiled in the global wall panels market include Armstrong World Industries, Inc., Kingspan Group, Saint-Gobain, USG Corporation, Hunter Douglas, Georgia-Pacific LLC, Alstrong Enterprises India Pvt. Ltd., Nippon Steel Coated Sheet Corporation, Fletcher Building Limited, ArcelorMittal Construction, ATAS International, Inc., DÖRKEN Systems Inc., Murus Company, Cembrit Holding A/S, and Nudo Products, Inc.

Leading players are adopting mergers & acquisitions, product innovation, partnerships with construction firms, and geographic expansion to expand market presence.

The report examines key aspects of the wall panels market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed