Utility Vehicle Terrain Market Size, Share, Trends, Growth 2034

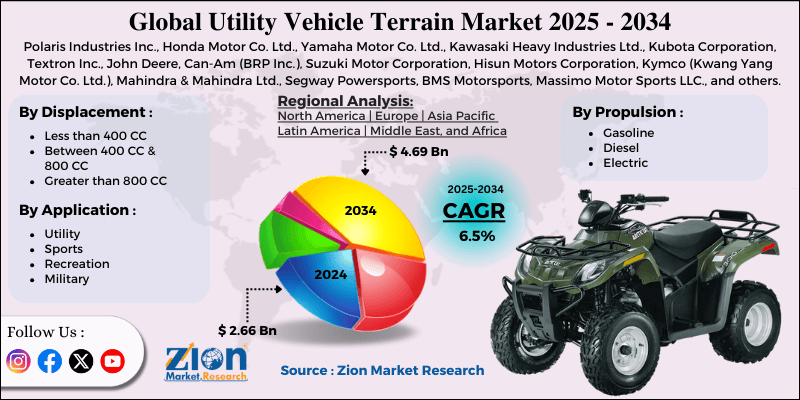

Utility Vehicle Terrain Market By Displacement (Less than 400 CC, Between 400 CC and 800 CC, Greater than 800 CC), By Propulsion (Gasoline, Diesel, Electric), By Application (Utility, Sports, Recreation, Military), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

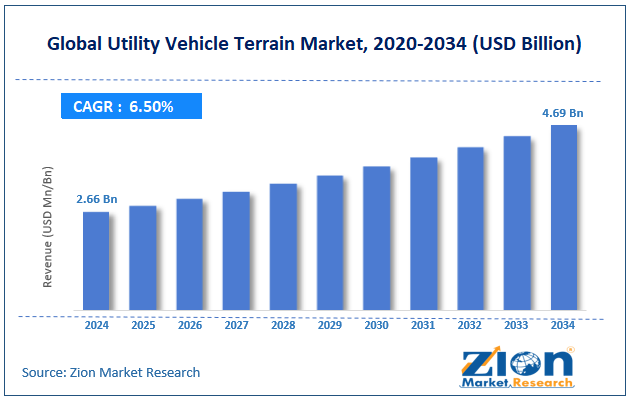

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.66 Billion | USD 4.69 Billion | 6.50% | 2024 |

Utility Vehicle Terrain Industry Perspective:

The global utility vehicle terrain market size was approximately USD 2.66 billion in 2024 and is projected to reach around USD 4.69 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global utility vehicle terrain market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034)

- In terms of revenue, the global utility vehicle terrain market size was valued at around USD 2.66 billion in 2024 and is projected to reach USD 4.69 billion by 2034.

- The utility vehicle terrain market is projected to grow significantly due to the rising adoption in farming and agricultural operations, the increasing demand for military and defense applications, and the growing disposable income and lifestyle changes.

- Based on displacement, the utility segment is expected to lead the market, while the recreation segment is anticipated to experience significant growth.

- Based on propulsion, the gasoline segment is the dominant segment, while the diesel segment is projected to witness substantial revenue growth over the forecast period.

- Based on the application, the segment between 400 CC and 800 CC is expected to lead the market compared to the segment greater than 800 CC.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Utility Vehicle Terrain Market: Overview

Utility terrain vehicles (UTVs) are off-road vehicles designed for heavy-duty tasks, rugged terrains, and recreational use. They feature a high payload capacity, seating for multiple passengers, and improved stability compared to ATVs, which increases their popularity in construction, military, agriculture, and adventure sports. The global utility vehicle terrain market is projected to witness substantial growth, driven by the increasing demand for agricultural applications, the expansion of the construction & mining industries, and technological advancements. Farmers are increasingly turning to utility terrain vehicles for their versatility in transporting crops, fertilizers, supplies, and other essential items. In comparison to tractors, UTVs are more maneuverable, smaller, and better suited for uneven farm terrains. The steady move towards agricultural mechanization is majorly fueling the adoption of UTV across the globe. The construction and mining sectors are utilizing UTVs for site inspections, crew transportation, and material hauling. Their ability to handle rugged terrains and confined areas offers a practical benefit. This industrial demand augments the sales of UTVs beyond farming and recreational sectors.

Moreover, manufacturers are improving UTVs with GPS, roll cages, advanced braking systems, and telematics. The launch of hybrid and electric UTVs is also transforming the industry with eco-friendly choices. These advancements not only enhance safety but also appeal to tech enthusiasts.

Although drivers exist, the global market is challenged by factors such as environmental concerns and the risk of injuries and accidents. Gasoline-powered UTVs release greenhouse gases and contribute to noise pollution. With growing scrutiny of ecological practices, customary UTVs experience adoption barriers. This creates pressure for manufacturers to develop and promote green solutions. Additionally, despite the addition of safety features, UTV-associated accidents remain frequent, particularly in recreational settings. These incidents ruin the industry's image and bring negative publicity. Consumer safety concerns and insurance liabilities may hamper demand growth.

Even so, the global utility vehicle terrain industry is well-positioned due to the electrification of UTVs and the development of smart and connected UTVs. The shift towards hybrid and electric vehicles presents significant opportunities in the global market. Manufacturers emphasize environmentally-friendly models with global emission reduction objectives. This trend may open up new markets for eco-conscious consumers. Likewise, integrating AI, IoT, and telematics in UTVs presents opportunities for more effective fleet management. These features allow enhanced safety monitoring and predictive maintenance. Connected UTVs appeal to defense and industrial users who prefer efficiency.

Utility Vehicle Terrain Market: Growth Drivers

How are booming off-road rental services and eco-tourism boosting the utility vehicle terrain market growth?

Eco-tourism destinations are primarily investing in UTV rental fleets to attract adventure seekers. According to UNWTO 2024, global eco-tourism progressed by 12% in 2023, with robust contributions from Latin America and Southeast Asia. Leading brands, such as Polaris and Can-Am, reported associations with tour operators in Mexico and Costa Rica to supply vehicles for eco-adventure parks. The affordability of renting these vehicles over owning them also appeals to the young demographic. This rental-based model not only fuels sales but also widens the worldwide exposure of UTVs to developing markets.

Electrification of UTVs and technological improvements are favorably impacting the market progress

The integration of electric drivetrains, connectivity features, and advanced GPS systems is transforming the utility vehicle terrain market. In 2023, Polaris introduced its RANGER XP Kinetic, the first all-electric UTV, which has generated robust demand from both utility and recreational users. BloombergNEF industry data suggests that electric off-road vehicle adoption may grow at a 14% CAGR by 2030. Sustainability policies in North America and Europe support the attraction of zero-emission vehicles. Users are also inclined towards lower-maintenance and quieter rides, increasing the prominence of electrification.

Utility Vehicle Terrain Market: Restraints

How are accident risks and safety concerns limiting the progress of the utility vehicle terrain market?

UTVs are associated with safety challenges due to their high speeds, rollovers, and the rugged terrain in which they operate. The U.S. Consumer Product Safety Commission (CPSC) reported more than 13,000 emergency cases, including UTV-related injuries, in 2023, with young and child riders at higher risk.

In July 2024, Polaris recalled numerous Ranger and RZR models due to concerns about crashes and fires, underscoring persistent safety issues. These accidents lead to stringent scrutiny from the public and regulators due to negative public perception. Safety concerns not only hamper consumer adoption but also increase risks for manufacturers.

Utility Vehicle Terrain Market: Opportunities

How does the integration of advanced technology offer advantageous conditions for the utility vehicle terrain market development?

UTVs are increasingly incorporating advanced features, including telematics, GPS navigation, AI-based safety systems, and enhanced suspension systems. Polaris' (2023) RANGER XP Kinetic and Can-Am Defender models comprise digital dashboards and connectivity, appealing to the tech-savvy groups.

According to the reports, vehicles with advanced tech features may register 15-20% higher sales. Constant advancements in smart features give manufacturers a competitive edge. This evolution may increase demand among commercial and recreational users, affecting the global utility vehicle terrain industry.

Utility Vehicle Terrain Market: Challenges

Infrastructure and terrain limitations restrict the market growth

UTVs rely on accessible off-road trails, recreational areas, and rural roads to enhance their utility. In a few regions, limited trial networks, harsh terrains, and poor infrastructure may limit usage. Reports indicate that more than 60% of rural areas in the APAC region lack proper off-road paths, restricting the deployment of UTVs. This slows down the purchasing process for potential users and hampers their satisfaction. Enhancing local infrastructure is largely beyond manufacturers' control, which increases the intricacies of industry growth.

Utility Vehicle Terrain Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Utility Vehicle Terrain Market |

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2034 | USD 4.69 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 212 |

| Key Companies Covered | Polaris Industries Inc., Honda Motor Co. Ltd., Yamaha Motor Co. Ltd., Kawasaki Heavy Industries Ltd., Kubota Corporation, Textron Inc., John Deere, Can-Am (BRP Inc.), Suzuki Motor Corporation, Hisun Motors Corporation, Kymco (Kwang Yang Motor Co. Ltd.), Mahindra & Mahindra Ltd., Segway Powersports, BMS Motorsports, Massimo Motor Sports LLC., and others. |

| Segments Covered | By Displacement, By Propulsion, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Utility Vehicle Terrain Market: Segmentation

The global utility vehicle terrain market is segmented based on displacement, propulsion, application, and region.

Based on displacement, the global utility vehicle terrain industry is categorized into three segments: less than 400 CC, between 400 CC and 800 CC, and greater than 800 CC. The 'between 400 CC and 800 CC segment held a dominating share of the market since these vehicles offer the best balance of affordability, power, and versatility for utility and recreational purposes. The segment with volumes greater than 800 CC ranks second, driven by demand in heavy-duty applications such as large-scale, military, adventure racing, and defense, where high durability and torque are essential. The less than 400 holds a smaller share, typically reserved for light-duty and entry-level users.

Based on propulsion, the global utility vehicle terrain market is segmented into gasoline, diesel, and electric. The gasoline segment holds a remarkable market share, as gasoline-based UTVs lead in utility and recreational applications. This is because of their extensive availability of fuel, strong performance, and affordability. The diesel segment is the second-largest, driven by demand in construction, agriculture, and defense, where high durability, torque, and fuel efficiency are highly valued. The electric segment is still in development but is gaining traction due to rising concerns about sustainability and technological advancements.

Based on application, the global market is segmented into utility, sports, recreation, and military. The utility segment captured the largest share of the market, as UTVs are widely used in forestry, construction, and agriculture for hauling, transportation, and towing tasks. The recreation segment holds a second rank, backed by the demand for off-road adventures, leisure activities, and hunting among outdoor enthusiasts. The military and sports segment also has a noticeable share, but it remains small due to niche demand.

Utility Vehicle Terrain Market: Regional Analysis

Why does North America hold a dominant position in the global Utility Vehicle Terrain Market?

North America is likely to sustain its leadership in the utility vehicle terrain market due to strong recreational demand, industrial and agricultural applications, and high consumer affordability. North America registers for more than 50% of the worldwide off-road vehicle sales, fueled by camping, hunting, and off-road racing. UTVs are highly popular in Canada and the U.S. because of a prominent off-road and outdoor culture. This lifestyle-based demand continuously ranks the regional dominance.

Moreover, Canada and the United States have mechanized farming practices, where UTVs are widely used for hauling equipment, supplies, and fertilizers. According to the USDA, United States farms encompass more than 895 million acres, offering primary demand for utility-focused UTVs. Industrial applications in forestry and construction also propel their adoption.

The region’s high disposable income supports professional and recreational purchases. In 2024, the U.S. GDP per capita hit $80,000, allowing users to afford premium models. This purchasing power fuels sales than other regions.

Europe continues to hold the second-highest share in the utility vehicle terrain industry, driven by the expanding recreational sector, agricultural mechanization, and increasing forestry and industrial use. Europe has a growing off-road recreation industry, mainly in the UK, Germany, and France.

In 2023, the European all-terrain and utility industry exceeded $2.5 billion, with UTVs adding to a more substantial share. Off-road clubs, adventure tourism, and motorsports are propelling continuous demand. Additionally, UTVs are primarily used on European farms for transporting feed, fertilizers, and tools.

With more than 157 million hectares of utilized agricultural land in the European Union, the region heavily depends on effective mechanized vehicles. Compact UTVs are particularly prominent on smaller European farms compared to large tractors. Europe's robust construction and forestry sectors facilitate the adoption of UTVs for site mobility and hauling. In 2024, the European construction industry was estimated to be worth USD 2 trillion, creating significant demand for utility vehicles. UTVs are favored for their ability to access narrow and rough worksites.

Utility Vehicle Terrain Market: Competitive Analysis

The leading players in the global utility vehicle terrain market are:

- Polaris Industries Inc.

- Honda Motor Co. Ltd.

- Yamaha Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Kubota Corporation

- Textron Inc.

- John Deere

- Can-Am (BRP Inc.)

- Suzuki Motor Corporation

- Hisun Motors Corporation

- Kymco (Kwang Yang Motor Co. Ltd.)

- Mahindra & Mahindra Ltd.

- Segway Powersports

- BMS Motorsports

- Massimo Motor Sports LLC.

Utility Vehicle Terrain Market: Key Market Trends

Increasing demand for recreational UTVs:

Recreational use is speedily increasing as users prefer off-road adventures, motorsports, and hunting. Growing disposable income and adventure tourism are propelling the worldwide demand. Manufacturers are actively designing sportier models with advanced safety features and higher speeds.

Integration of smart technologies:

Modern UTVs are largely embedded with telematics, GPS, connectivity features, and digital dashboards. These upgrades enhance navigation, safety monitoring, and fleet management. Smart UTVs are mainly gaining appeal in agriculture, industrial, and defense applications.

The global utility vehicle terrain market is segmented as follows:

By Displacement

- Less than 400 CC

- Between 400 CC and 800 CC

- Greater than 800 CC

By Propulsion

- Gasoline

- Diesel

- Electric

By Application

- Utility

- Sports

- Recreation

- Military

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Utility terrain vehicles (UTVs) are off-road vehicles designed for heavy-duty tasks, rugged terrains, and recreational use. They feature a high payload capacity, seating for multiple passengers, and improved stability compared to ATVs, which increases their popularity in construction, military, agriculture, and adventure sports.

The global utility vehicle terrain market is projected to grow due to the rising popularity of adventure tourism, increasing demand for off-road recreational activities, and the growth of rural transportation needs.

According to study, the global utility vehicle terrain market size was worth around USD 2.66 billion in 2024 and is predicted to grow to around USD 4.69 billion by 2034.

The CAGR value of the utility vehicle terrain market is expected to be around 6.5% during 2025-2034.

The significant challenges restraining the growth of the Utility Terrain Vehicle (UTV) market include strict safety and emission norms, high initial costs, accident risks, environmental concerns, and competition from pickup trucks and ATVs.

Market trends and consumer preferences in the Utility Terrain Vehicle (UTV) market are shifting toward recreational off-road use, electrification, smart connectivity features, demand for customized and versatile models, and increased accessibility through rental services.

North America is expected to lead the global utility vehicle terrain market during the forecast period.

The key players profiled in the global utility vehicle terrain market include Polaris Industries Inc., Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kawasaki Heavy Industries, Ltd., Kubota Corporation, Textron Inc., John Deere, Can-Am (BRP Inc.), Suzuki Motor Corporation, Hisun Motors Corporation, Kymco (Kwang Yang Motor Co., Ltd.), Mahindra & Mahindra Ltd., Segway Powersports, BMS Motorsports, and Massimo Motor Sports, LLC.

Leading UTV players are expanding their presence through market expansion, electrification, integration of smart technology, strategic partnerships, and enhanced aftermarket services

The report examines key aspects of the utility vehicle terrain market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed