Thioglycolate Market Size, Share, Trends, Growth & Forecast 2034

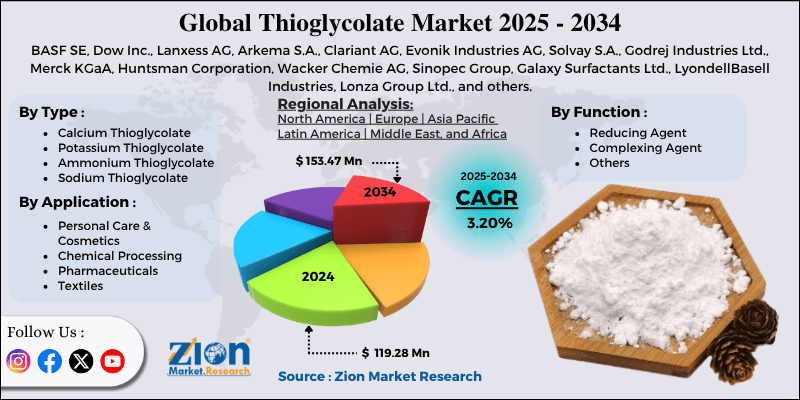

Thioglycolate Market By Type (Calcium Thioglycolate, Potassium Thioglycolate, Ammonium Thioglycolate, Sodium Thioglycolate, and Others), By Function (Reducing Agent, Complexing Agent, and Others), By Application (Personal Care & Cosmetics, Chemical Processing, Pharmaceuticals, Textiles, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

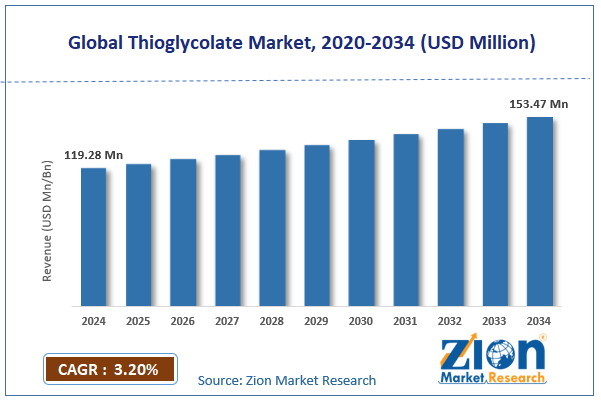

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 119.28 Million | USD 153.47 Million | 3.20% | 2024 |

Thioglycolate Industry Perspective:

The global thioglycolate market size was approximately USD 119.28 million in 2024 and is projected to reach around USD 153.47 million by 2034, with a compound annual growth rate (CAGR) of approximately 3.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global thioglycolate market is estimated to grow annually at a CAGR of around 3.20% over the forecast period (2025-2034)

- In terms of revenue, the global thioglycolate market size was valued at around USD 119.28 million in 2024 and is projected to reach USD 153.47 million by 2034.

- The thioglycolate market is projected to grow significantly due to the rising usage in hair care products, particularly depilatories and relaxers, the growth of the chemical manufacturing sector in emerging economies, and increasing R&D activities in cosmetic formulations.

- Based on type, the calcium thioglycolate segment is expected to lead the market, while the potassium thioglycolate segment is expected to grow considerably.

- Based on function, the reducing agent segment is the dominant segment, while the complexing agent segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the personal care & cosmetics segment is expected to lead the market compared to the chemical processing segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Thioglycolate Market: Overview

Thioglycolate is a sulfur-containing organic compound mainly used as a key ingredient in the production of thioglycolate acid derivatives, which hold applications in pharmaceuticals, cosmetics, and chemical industries. It is largely used in hair care products, primarily for depilation and perming, due to its ability to break down disulfide bonds in keratin. The global thioglycolate market is projected to experience substantial growth, driven by increasing demand in the personal care industry, expanding industrial applications, and growing pharmaceutical applications. The worldwide awareness of beauty trends and personal grooming has increased the demand for thioglycolate, particularly in depilation and hair-perming products. Consumers in regions such as North America and the Asia Pacific are seeking effective hair care solutions, which is increasing the demand for thioglycolate and boosting its significance.

Moreover, thioglycolate is widely used in industrial processes, including electroplating, metal cleaning, and polymer synthesis. The rapid industrialization in developing economies is creating new opportunities for thioglycolate adoption in manufacturing industries. Furthermore, thioglycolate serves as a vital intermediate in the production of different pharmaceutical formulations. Comprising dermatological products and antioxidants. Growing healthcare expenditures and the rising demand for specialty drugs are boosting its adoption in pharmaceutical applications.

Although drivers exist, the global market is challenged by factors such as growing health concerns, chemical sensitivity, and strict regulations. Exposure to thioglycolate can cause allergic reactions or skin irritation in some consumers. This restricts its use in sensitive segments, especially in personal care products. Increasing awareness of such health risks may hamper the industry's growth. Likewise, stringent regulations on chemical content in industrial and cosmetic products, particularly in regions such as the EU, pose challenges for producers. Compliance with these regulations raises product costs and restricts flexibility. Regulatory barriers may slow the industry's growth in some regions.

Even so, the global thioglycolate industry is well-positioned due to ongoing research and development in cosmetic innovations, as well as the expansion of pharmaceutical applications. Developing low-odor, more effective, and gentler thioglycolate-based hair care products can appeal to a larger consumer base. Constant research in formulation advancements improves product appeal. Innovation offers an avenue for premium product development and high revenues. Additionally, thioglycolate’s role as a chemical intermediate in pharmaceuticals offers unexplored potential. Dermatological products and novel drug formulations may increase the industry penetration. The pharmaceutical segment provides long-term growth opportunities for the industry.

Thioglycolate Market Dynamics

Growth Drivers

How is the growing popularity of DIY hair care products impacting the thioglycolate market?

DIY hair care solutions have increased, driven by social media trends, Instagram influencers, and YouTube tutorials that promote at-home hair treatments. Thioglycolate-based products, such as curl relaxers and perming kits, have experienced a surge in consumer adoption due to their cost-effectiveness and convenience. According to Euromonitor, in 2025, DIY hair care products accounted for nearly 22% of the worldwide hair care product industry, representing a substantial 8% rise from 2023. This growth is prompting manufacturers to supply thioglycolate in consumer-friendly and stable formulations. This trend is robust in Europe and North America, where sustainable and DIY hair solutions are trending.

How are technological advancements in formulations driving the growth of the thioglycolate market?

Advancements in thioglycolate formulations are improving stability, product safety, and efficacy. Modern formulations reduce skin irritation and the harsh odor historically associated with thioglycolate, appealing to a broader consumer base. A 2025 press release from BASF highlighted the introduction of a new low-odor and high-performing thioglycolate derivative, available in both at-home kits and professional salons. These technological improvements are not only increasing industry accessibility but also motivating repeat use among consumers seeking safe chemical hair treatments. Regulatory approval for enhanced formulations further backs the worldwide adoption of the thioglycolate market.

Restraints

Availability of alternative ingredients unfavorably impacts the market progress

Emerging substitutes to thioglycolate, like lanthionine, cysteine, and other less harmful hair-styling agents, are gaining prominence. These substitutes offer similar curling or straightening effects with less irritation. According to Mintel, the sales of thioglycolate hair-perming products increased by 14% in Europe and North America, representing a shift in consumer preference. Leading cosmetic brands are actively reformulating products to reduce or replace thioglycolate content. This rising substitution potential restricts the growth of conventional thioglycolate products in the industry.

Opportunities

How does the rising popularity of male grooming products offer advantageous conditions for the development of the thioglycolate market?

The male grooming industry is experiencing rapid growth, with chemical hair treatments primarily targeting male users. According to the 2025 reports, the global male grooming industry is expected to reach USD 90 billion by 2030, growing at a 5.8% CAGR. Thioglycolate-based hair-styling products designed for men, like straightening and perming solutions, denote an underexploited segment of the thioglycolate industry. Marketing campaigns emphasizing male styling trends can unveil fresh revenue opportunities. This demographic move creates a niche growth domain for thioglycolate manufacturers.

Challenges

Environmental impact and negative consumer perception restrict the market growth

Growing awareness of environmental responsibility and sustainability is impacting consumer choices. Thioglycolate’s chemical waste can have an ecological impact if not disposed of properly. In 2025, South Korea's report underscored fines imposed on salons for improperly handling wastewater containing thioglycolate. The rising eco-consciousness and the demand for green alternatives may restrict the industry's growth. Manufacturers face significant regulatory and reputational risks if they fail to comply with environmental regulations. Effective eco-friendly initiatives and green marketing are crucial for maintaining consumer trust.

Thioglycolate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thioglycolate Market |

| Market Size in 2024 | USD 119.28 Million |

| Market Forecast in 2034 | USD 153.47 Million |

| Growth Rate | CAGR of 3.20% |

| Number of Pages | 213 |

| Key Companies Covered | BASF SE, Dow Inc., Lanxess AG, Arkema S.A., Clariant AG, Evonik Industries AG, Solvay S.A., Godrej Industries Ltd., Merck KGaA, Huntsman Corporation, Wacker Chemie AG, Sinopec Group, Galaxy Surfactants Ltd., LyondellBasell Industries, Lonza Group Ltd., and others. |

| Segments Covered | By Type, By Function, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thioglycolate Market: Segmentation

The global thioglycolate market is segmented based on type, function, application, and region.

Based on type, the global thioglycolate industry is divided into calcium thioglycolate, potassium thioglycolate, ammonium thioglycolate, sodium thioglycolate, and others. The calcium thioglycolate segment holds a dominating share of the market due to its broader use in personal care products. It is especially preferred in hair relaxers, depilatories, and other hair care formulations for its efficacy in breaking down keratin. Moreover, it has applications in industrial processes, such as corrosion inhibition and metal cleaning, which further boost its demand. Its effectiveness and versatility make it the leading segment in the industry.

Based on function, the global thioglycolate market is segmented into reducing agent, complexing agent, and others. The reducing agent segment is the dominant segment in the market due to its wide use in breaking disulfide bonds in hair care products. It is crucial in applications such as hair relaxing, hair perming, and depilatories, which increases its substantial demand in the personal care market. Industrially, it also serves as a reducing agent in chemical synthesis and metal treatment, thus driving the demand. Its broad applications and versatility in the industrial fuel its segmental dominance.

Based on application, the global market is segmented into personal care & cosmetics, chemical processing, pharmaceuticals, textiles, and others. The personal care & cosmetics segment held a leadership position in the market due to its broader use in hair perming, depilatory, and relaxing products. Growing consumer awareness of beauty trends and beauty grooming has significantly increased the demand for these products. The segment also benefits from ongoing advancements in formulations, which include gentler and low-odor variants of thioglycolate. Its high adoption rate in both developed and developing markets strengthens its dominant position.

Thioglycolate Market: Regional Analysis

What gives North America a competitive edge in the global Thioglycolate Market?

North America is likely to sustain its leadership in the thioglycolate market due to high demand in cosmetics and personal care, established industrial applications, and advanced research & innovation. North America boasts a larger and more developed cosmetics and personal care industry, driven by growing demand for hair care products, including relaxers, perms, and depilatories. Consumers prioritize performance and quality, which drives the adoption of thioglycolate-based formulations. The strong personal care industry significantly contributes to the regional dominance.

Moreover, thioglycolate is widely used in chemical processing, polymer synthesis, and metal treatment in North America. Well-developed industrial infrastructure and high manufacturing activity raise thioglycolate consumption. Industrial adoption balances personal care usage, strengthening the industry dominance. Furthermore, the region’s focus on R&D allows the creation of low-odor, safer, and more effective thioglycolate formulations. Advancement strengthens North America’s dominating position in the industry.

Europe continues to hold the second-highest share in the thioglycolate industry, driven by strong demand for personal care and cosmetics, as well as industrial and chemical applications, with a focus on sustainable products and innovation. Europe boasts a well-established personal care and cosmetics industry, with economies such as the UK, Germany, and France leading the way in hair care products. Rising consumer preference for hair perming, depilatory, and relaxing products fuels the consumption of thioglycolate. Growing awareness of beauty adds significantly to the regional industry's share. Thioglycolate is extensively used in chemical processing, polymer synthesis, and metal treatments in European industries.

Economies with advanced manufacturing sectors depend on thioglycolate as a key intermediate. Industrial adoption supports steady industry growth, strengthening the regional contribution. Additionally, European consumers vastly prefer eco-friendly, low-odor, and safer thioglycolate formulations. R&D efforts by regional players target innovative and sustainable solutions. This trend drives the adoption in industrial and personal care applications.

Thioglycolate Market: Competitive Analysis

The leading players in the global thioglycolate market are:

- BASF SE

- Dow Inc.

- Lanxess AG

- Arkema S.A.

- Clariant AG

- Evonik Industries AG

- Solvay S.A.

- Godrej Industries Ltd.

- Merck KGaA

- Huntsman Corporation

- Wacker Chemie AG

- Sinopec Group

- Galaxy Surfactants Ltd.

- LyondellBasell Industries

- Lonza Group Ltd.

Thioglycolate Market: Key Market Trends

Shift towards gentle and low-odor formulations:

Manufacturers are developing thioglycolate-based products with reduced milder effects and reduced odor to improve user experience. Consumers are increasingly preferring gentler and safer hair care products, particularly in depilatory and perm products. This trend fuels advancement and broader adoption in the personal care segment.

Growth in chemical and industrial applications:

Thioglycolate is mainly used in corrosion inhibition, metal treatment, and polymer synthesis industries. Companies are enhancing industrial processes to enhance efficacy and decrease costs. Industrial adoption continues to offer a stable growth base for the industry.

Shift toward eco-friendly formulations:

Consumers and regulators are seeking less toxic and more sustainable alternatives to chemicals. Therefore, manufacturers are investing in low-odor, bio-based thioglycolates that comply with FDA and REACH standards. This move enables companies to reduce their environmental impact while maintaining performance in industrial and cosmetic applications.

The global thioglycolate market is segmented as follows:

By Type

- Calcium Thioglycolate

- Potassium Thioglycolate

- Ammonium Thioglycolate

- Sodium Thioglycolate

- Others

By Function

- Reducing Agent

- Complexing Agent

- Others

By Application

- Personal Care & Cosmetics

- Chemical Processing

- Pharmaceuticals

- Textiles

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Thioglycolate is a sulfur-containing organic compound mainly used as a key ingredient in the production of thioglycolate acid derivatives, which hold applications in pharmaceuticals, cosmetics, and chemical industries. It is primarily used in hair care products, mainly for depilation and perming, due to its ability to break down disulfide bonds in keratin.

What key factors are expected to influence the growth of the thioglycolate market from 2025 to 2034?

The global thioglycolate market is projected to grow due to rising demand from the personal care and cosmetics industries, a growing preference for chemical-based personal grooming solutions, and advancements in formulation technology for safer thioglycolate products.

According to study, the global thioglycolate market size was worth around USD 119.28 million in 2024 and is predicted to grow to around USD 153.47 million by 2034.

The CAGR value of the thioglycolate market is expected to be approximately 3.20% from 2025 to 2034.

Emerging trends and innovations in the thioglycolate market include the development of eco-friendly, low-odor, and gentler formulations for industrial and personal care applications.

Technological advancements are enabling the development of more efficient, safer, and environmentally friendly thioglycolate formulations, thereby boosting product adoption across both industrial and personal care sectors.

Macroeconomic factors, such as rising industrial growth, disposable income, and urbanization, are expected to drive increased demand for thioglycolate in both industrial and personal care applications.

North America is expected to lead the global thioglycolate market during the forecast period.

The key players profiled in the global thioglycolate market include BASF SE, Dow Inc., Lanxess AG, Arkema S.A., Clariant AG, Evonik Industries AG, Solvay S.A., Godrej Industries Ltd., Merck KGaA, Huntsman Corporation, Wacker Chemie AG, Sinopec Group, Galaxy Surfactants Ltd., LyondellBasell Industries, and Lonza Group Ltd.

The report examines key aspects of the thioglycolate market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed