Sovereign Cloud Market Size, Share, Trends, Growth and Forecast 2034

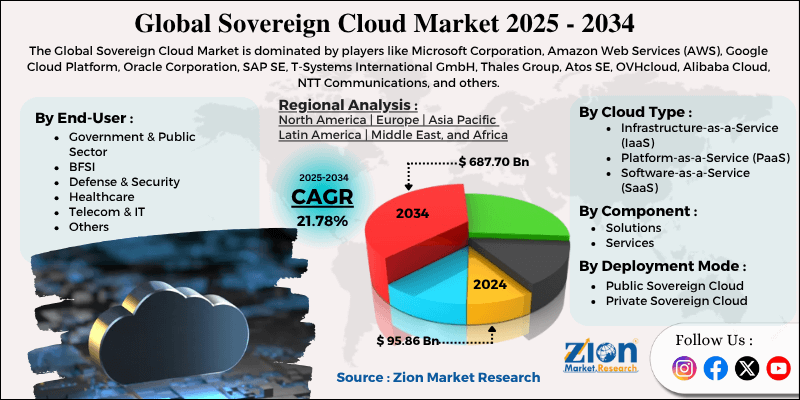

Sovereign Cloud Market by Component (Solutions and Services), Deployment Mode (Public Cloud, Private Cloud), Cloud Type (IaaS, PaaS, SaaS), End-User (Government & Public Sector, BFSI, Defense, Healthcare, Telecom & IT, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

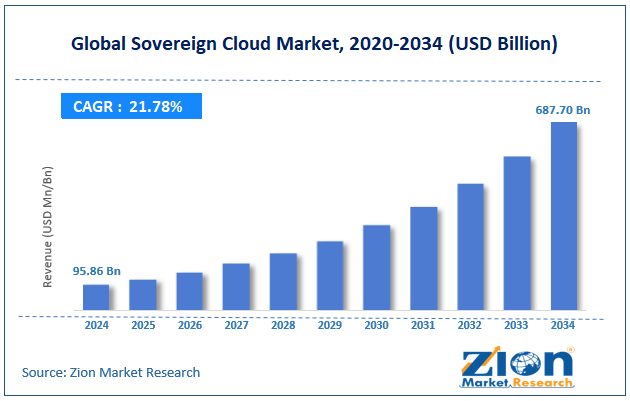

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 95.86 Billion | USD 687.70 Billion | 21.78% | 2024 |

Sovereign Cloud Industry Perspective:

With a compound annual growth rate (CAGR) of about 21.78% between 2025 and 2034, the size of the global sovereign cloud market, estimated at around USD 95.86 billion in 2024, is expected to increase to approximately USD 687.70 billion by 2034.

This report analyzes the sovereign cloud market’s growth drivers, restraints, and their impact on demand throughout the forecast period. Additionally, the report evaluates emerging global opportunities and regional dynamics in the sovereign cloud market.

Sovereign Cloud Market: Overview

The sovereign cloud market represents a growing segment within the broader cloud computing industry, centered on secure, compliant, and jurisdiction-bound data infrastructure. These solutions are developed to align with national data sovereignty laws, ensuring that data is stored and managed within a specific country's legal framework.

Growing geopolitical tensions, strict data privacy laws (like GDPR, CCPA, India’s DPDP), and increasing cybersecurity threats are key drivers accelerating the adoption of sovereign cloud platforms. Sovereign clouds are especially favored by governments, defense agencies, and regulated industries such as finance and healthcare, where trust, compliance, and operational control are mission-critical.

Leading technology providers are forming regional partnerships to deliver localized sovereign solutions, combining global capabilities with local data stewardship. As digital transformation accelerates globally, sovereign clouds are expected to play a critical role in ensuring secure, autonomous digital infrastructure.

Key Insights:

- As per the analysis shared by our research analyst, the global sovereign cloud market is expected to grow annually at a CAGR of around 21.78% over the forecast period (2025–2034).

- In terms of revenue, the global sovereign cloud market size was valued at approximately USD 95.86 billion in 2024 and is projected to reach USD 687.70 billion by 2034.

- The sovereign cloud market is projected to grow rapidly due to growing concerns over data sovereignty, foreign surveillance, and rising national-level regulations around digital privacy and control.

- Based on component, the solutions segment (especially IaaS) is growing at a high rate and is projected to dominate the global market as governments and enterprises invest in resilient cloud foundations.

- On the basis of end-user, the government & public sector segment is anticipated to command the largest market share, followed by BFSI and defense.

- Based on region, Europe is expected to dominate the global sovereign cloud market during the forecast period due to its robust regulatory framework, strong policy push for digital sovereignty, and state-supported cloud ecosystems like GAIA-X.

Sovereign Cloud Market: Growth Drivers

Increasing Data Sovereignty and Compliance Requirements

The increasing emphasis on data sovereignty and regulatory compliance is a key growth driver for the sovereign cloud market. Governments across the globe are enacting strict data protection laws, such as the General Data Protection Regulation (GDPR) in Europe, India's Digital Personal Data Protection Act (DPDP), and similar frameworks in countries like Brazil, China, and Australia. These regulations mandate that sensitive data be stored, processed, and governed within national borders and under local jurisdiction.

Sovereign cloud platforms are specifically designed to meet these requirements, offering localized data storage, secure access controls, and audit transparency. As digital transformation accelerates across the public and private sectors, organizations are increasingly opting for sovereign cloud solutions to avoid regulatory risks, protect citizen data, and ensure compliance with national laws, thereby fueling the market growth.

Geopolitical Tensions and Cybersecurity Concerns

Rising geopolitical tensions and cybersecurity threats are further propelling the demand for sovereign cloud infrastructure. As concerns grow around foreign surveillance, espionage, and data breaches involving foreign cloud providers, governments and enterprises are prioritizing digital autonomy and national security.

Sovereign cloud environments offer heightened data control, localized governance, and partnership models that prevent unauthorized access to critical infrastructure. This has led to the establishment of state-backed or certified cloud frameworks, such as France's SecNumCloud, Germany's GAIA-X, and India's MeghRaj. The increasing need for secure and resilient digital infrastructure is prompting countries to invest in sovereign clouds to safeguard strategic assets and critical information systems, driving robust growth across this sector.

Sovereign Cloud Market: Restraints

High Costs of Infrastructure and Limited Vendor Ecosystems

One of the primary restraints for the growth of the sovereign cloud industry is the high cost of infrastructure deployment and maintenance. Building and operating a sovereign cloud often requires significant upfront capital investment in localized data centers, cybersecurity systems, and compliance certification.

Additionally, sovereign clouds typically operate within restricted vendor ecosystems, leading to reduced flexibility, fewer service options, and potentially slower innovation compared to global hyperscalers. This can make it more expensive for organizations—especially small-to-medium enterprises (SMEs)—to adopt sovereign cloud services. Moreover, vendor lock-in concerns and the lack of globally scalable services in certain sovereign cloud environments may deter multinational enterprises from adopting these services on a full scale. These limitations pose challenges to the widespread and rapid market expansion.

Sovereign Cloud Market: Opportunities

Digital Transformation and Cloud Adoption in Emerging Economies.

The rising digital transformation initiatives in emerging markets present a significant opportunity for the sovereign cloud market. Countries in Asia-Pacific, Latin America, the Middle East, and Africa are increasingly investing in national cloud infrastructure to support public services, citizen identity programs, e-governance platforms, smart cities, and financial inclusion efforts. The emergence of local tech companies, growing internet penetration, and supportive government policies regarding data localization are catalyzing the demand for secure, sovereign cloud platforms in these regions.

As the middle class expands and digital consumption increases, so does the demand for trusted digital ecosystems. Vendors that can provide customized, compliant, and cost-effective sovereign cloud solutions will be well-positioned to capitalize on these untapped markets, creating long-term growth potential.

Sovereign Cloud Market: Challenges

Emergence of Decentralized and Edge Computing Models

The rapid emergence of alternative computing models such as edge computing, decentralized cloud architectures, and hybrid multi-cloud ecosystems presents a significant challenge to the growth of the traditional sovereign cloud market. Edge computing, in particular, allows for data processing closer to the data source, thereby improving latency and reducing reliance on centralized infrastructure.

As industries adopt IoT, real-time analytics, and mission-critical applications, some use cases may bypass centralized sovereign cloud deployments in favor of distributed or localized solutions. Moreover, multi-cloud and hybrid-cloud strategies—where organizations combine sovereign clouds with global public cloud providers—are gaining popularity to optimize cost, flexibility, and resilience.

Sovereign cloud providers must adapt by integrating interoperability, edge compatibility, and hybrid capabilities into their offerings to remain relevant in the face of these evolving architectures. The competition between sovereign cloud models and emerging computing paradigms is expected to intensify, requiring constant innovation and ecosystem collaboration.

Sovereign Cloud Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Sovereign Cloud Market |

| Market Size in 2024 | USD 95.86 Billion |

| Market Forecast in 2034 | USD 687.70 Billion |

| Growth Rate | CAGR of 21.78% |

| Number of Pages | 211 |

| Key Companies Covered | Microsoft Corporation, Amazon Web Services (AWS), Google Cloud Platform, Oracle Corporation, SAP SE, T-Systems International GmbH, Thales Group, Atos SE, OVHcloud, Alibaba Cloud, NTT Communications, and others. |

| Segments Covered | By Component, By Deployment Mode, By Cloud Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Sovereign Cloud Market: Segmentation Analysis

The global sovereign cloud market is segmented based on component, deployment mode, cloud type, end-user, and region.

Based on component, the sovereign cloud market is divided into Solutions and Services.

Among these, the Solutions segment currently holds the largest market share. These solutions encompass sovereign versions of Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) offerings that are purpose-built to comply with national data sovereignty and security regulations.

IaaS solutions dominate due to their foundational role in enabling secure computing, storage, and networking environments under local jurisdiction. They are particularly favored by public sector and critical infrastructure entities that require full control over their IT environments.

The Services segment—comprising consulting, implementation, managed services, and compliance support—is also growing steadily. This growth is driven by increasing demand for tailored deployment strategies, ongoing maintenance, and guidance around navigating complex data protection laws. Services are especially important for organizations in the early stages of digital sovereignty transformation.

Based on deployment mode, the market is bifurcated into Public Sovereign Cloud and Private Sovereign Cloud.

The Private Sovereign Cloud segment holds the larger share of the market, especially among governments, defense organizations, and highly regulated sectors. These deployments are often developed and operated by domestic or certified national providers, ensuring full control over infrastructure, personnel, and data access.

Public Sovereign Cloud offerings, often built in partnership with global hyperscalers and local telecom or tech firms, are gaining traction in countries where public-sector digital transformation requires scalable cloud solutions under national compliance frameworks. These deployments typically strike a balance between scalability and regulatory control, and are gaining adoption in larger cities and municipalities.

Based on cloud type, the sovereign cloud market is segmented into Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS).

Among these, IaaS currently dominates the market. It is essential for organizations aiming to build and manage their own secure IT environments, offering storage, processing, and networking capabilities that align with local laws and policies.

SaaS is also growing rapidly, especially in public administration, education, and citizen-facing services. Sovereign versions of CRM, ERP, and productivity tools are in high demand.

PaaS is gaining traction among developers in the government and defense sectors who require secure, compliant platforms for application development and deployment.

In terms of end-user segmentation, the market is segregated into Government & Public Sector, BFSI, Defense, Healthcare, Telecom & IT, and Others.

Of these, Government and Public Sector entities hold the largest share of the sovereign cloud market. These users require strict adherence to national data regulations, particularly for functions like e-governance, digital identity, taxation, and healthcare services.

BFSI (Banking, Financial Services, and Insurance) is the next largest segment, driven by growing concerns over financial data protection, anti-money laundering (AML) compliance, and customer data localization.

Defense and Security sectors are also major users of sovereign clouds, leveraging them for intelligence, surveillance, and mission-critical operations that demand maximum data protection.

Healthcare, with the rise of digital medical records and telehealth platforms, is another fast-growing sector within the market.

Telecom & IT companies are increasingly adopting sovereign cloud solutions to meet national regulations and to offer compliant services to end-users, especially in regulated markets.

Sovereign Cloud Market: Regional Analysis

Europe is Expected to Witness Significant Market Growth

Europe dominates the global sovereign cloud market, driven by a combination of strong regulatory frameworks, strategic public-private partnerships, and a proactive stance on digital sovereignty. Countries like Germany, France, the Netherlands, and the UK are at the forefront of sovereign cloud adoption due to strict data privacy laws, such as GDPR and national initiatives like GAIA-X and SecNumCloud. These initiatives aim to create secure, transparent, and interoperable cloud ecosystems, fully governed under European jurisdiction.

The region also benefits from significant government investments in secure digital infrastructure and collaborations with global cloud hyperscalers to offer localized sovereign solutions (e.g., Google Cloud with T-Systems, Microsoft with Orange and Thales). Moreover, increasing demand from the government, healthcare, BFSI, and defense sectors to store sensitive data within national borders is accelerating the growth of sovereign cloud platforms across Europe.

The Asia-Pacific and North America regions are experiencing rapid growth, driven by increasing cybersecurity threats, national data residency mandates, and expanding digital governance initiatives. In Asia-Pacific, countries like India, Japan, and Australia are building indigenous cloud platforms to support critical public services while ensuring control over citizen data.

Recent Development

- October 2023 – Google Cloud and T-Systems launched the Sovereign Cloud for Germany, ensuring compliance with German data sovereignty laws by offering locally managed cloud services operated entirely under German jurisdiction. This solution is tailored for public institutions and regulated industries.

- March 2024 – Microsoft and Orange (France) expanded their trusted cloud collaboration to deploy Azure’s sovereign cloud services for French public and private sector customers. This includes provisions for data residency, encrypted storage, and exclusive management by local personnel.

- May 2024 – OVHcloud announced the expansion of its SecNumCloud-certified offerings in France and Germany. These services are built to meet the highest data protection and sovereignty standards as outlined by the ANSSI (French cybersecurity authority).

Sovereign Cloud Market: Competitive Landscape

The major players operating in the Sovereign Cloud market include:

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google Cloud Platform

- Oracle Corporation

- SAP SE

- Atos SE

- T-Systems International GmbH

- Thales Group

- OVHcloud

- Alibaba Cloud

- NTT Communications Corporation

- CloudSigma AG

- INDIGO Cloud

- Scala Data Centers

The global automotive alloy market is segmented as follows:

By Component

- Solutions

- Services

By Deployment Mode

- Public Sovereign Cloud

- Private Sovereign Cloud

By Cloud Type

- Infrastructure-as-a-Service (IaaS)

- Platform-as-a-Service (PaaS)

- Software-as-a-Service (SaaS)

By End-User

- Government & Public Sector

- BFSI (Banking, Financial Services, and Insurance)

- Defense & Security

- Healthcare

- Telecom & IT

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A sovereign cloud is a cloud computing environment built to ensure that data is stored, managed, and processed within a specific country's legal jurisdiction. It is designed to comply with national data privacy laws and security regulations, protecting sensitive data from foreign access or surveillance. Sovereign clouds are typically used by governments and regulated industries to meet compliance requirements related to data residency, data governance, and digital sovereignty.

The global sovereign cloud market is expected to grow due to rising concerns around data sovereignty, cybersecurity, and compliance with national data protection laws such as GDPR, India's DPDP, and others. The increasing adoption of digital government services and the need for secure infrastructure are also major growth drivers.

According to research, the global sovereign cloud market size was estimated to be around USD 95.86 billion in 2024, and it is projected to grow to approximately USD 687.70 billion by 2034.

The compound annual growth rate (CAGR) of the sovereign cloud market is expected to be around 21.78% during the forecast period 2025 to 2034.

Europe is expected to contribute significantly to the sovereign cloud market due to its strict data protection regulations, robust cloud initiatives (e.g., GAIA-X, SecNumCloud), and growing demand from government and regulated industries.

The sovereign cloud market is led by companies including Microsoft Corporation, Amazon Web Services (AWS), Google Cloud Platform, Oracle Corporation, SAP SE, T-Systems International GmbH, Thales Group, Atos SE, OVHcloud, Alibaba Cloud, NTT Communications, and others.

The report offers an in-depth examination of the sovereign cloud industry, analyzing key market drivers, restraints, opportunities, and challenges. It provides detailed segmentation analysis, regional trends, competitive landscape, and forecasts from 2025 to 2034, offering valuable insights for stakeholders, policymakers, and cloud technology providers.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed