Rigid Polyurethane Foam Market Size, Share, Trends, Growth & Forecast 2034

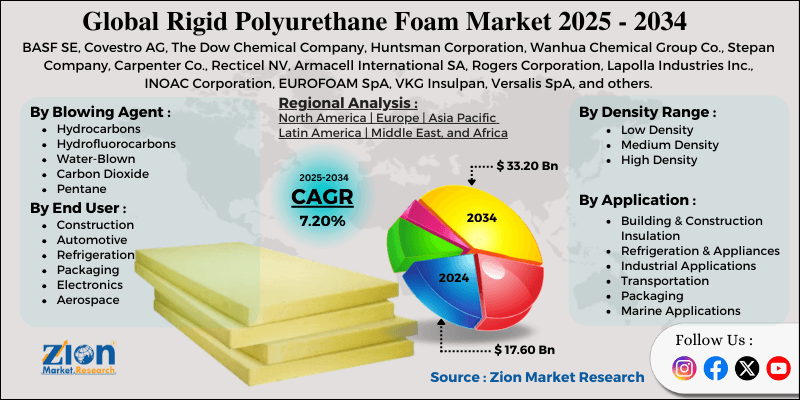

Rigid Polyurethane Foam Market By Blowing Agent (Hydrocarbons, Hydrofluorocarbons, Water-Blown, Carbon Dioxide, Pentane, and Others), By Application (Building and Construction Insulation, Refrigeration and Appliances, Industrial Applications, Transportation, Packaging, Marine Applications), By End-Use Industry (Construction, Automotive, Refrigeration, Packaging, Electronics, Aerospace), By Density Range (Low Density, Medium Density, High Density), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

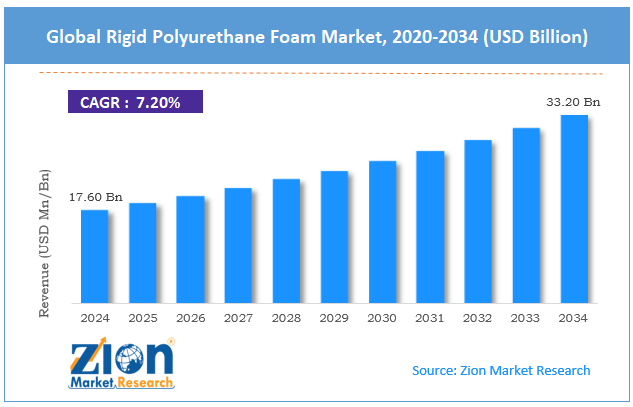

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 17.60 Billion | USD 33.20 Billion | 7.20% | 2024 |

Rigid Polyurethane Foam Industry Perspective:

The global rigid polyurethane foam market size was worth approximately USD 17.60 billion in 2024 and is projected to grow to around USD 33.20 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.20% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global rigid polyurethane foam market is estimated to grow annually at a CAGR of around 7.20% over the forecast period (2025-2034).

- In terms of revenue, the global rigid polyurethane foam market size was valued at approximately USD 17.60 billion in 2024 and is projected to reach USD 33.20 billion by 2034.

- The rigid polyurethane foam market is projected to grow significantly due to increasing demand for energy-efficient insulation materials, growth in construction activities, and expanding refrigeration and cold chain infrastructure worldwide.

- Based on blowing agent, the hydrocarbons segment is expected to lead the rigid polyurethane foam market, while the water-blown segment is anticipated to experience significant growth.

- Based on application, the building and construction insulation segment is expected to lead the rigid polyurethane foam market, while the refrigeration and appliances segment is anticipated to witness notable growth.

- Based on end-use industry, the construction segment is the dominating segment, while the automotive segment is projected to witness sizeable revenue over the forecast period.

- Based on the density range, the medium density segment is expected to lead the market compared to the high density segment.

- Based on region, Asia Pacific is projected to dominate the global rigid polyurethane foam market during the estimated period, followed by North America.

Rigid Polyurethane Foam Market: Overview

Rigid polyurethane foam is a type of plastic material made of tiny closed cells that provide excellent insulation and strong structural support, making it widely useful across many industries. It is created when polyol and isocyanate chemicals react with catalysts, blowing agents, and other additives to form a firm foam structure that traps gas inside the cells, allowing the material to reduce heat transfer effectively. The foam can be produced in different densities, from lightweight types used in insulation panels to higher-density versions that add strength in composite products. It is commonly used in building construction to insulate walls, roofs, floors, and foundations, and in the refrigeration sector for refrigerators, freezers, cold storage units, and refrigerated transport. It is also applied in appliances such as water heaters and air conditioners, in vehicles for insulation and noise reduction, in packaging to protect sensitive items, and in pipelines to maintain temperature. Its key advantages include strong insulation performance, moisture resistance, stability, and the ability to bond to various surfaces.

The increasing emphasis on energy efficiency in buildings and stringent environmental regulations are expected to drive growth in the rigid polyurethane foam market throughout the forecast period.

Rigid Polyurethane Foam Market Dynamics

Growth Drivers

Energy efficiency regulations and sustainability goals

The rigid polyurethane foam market is growing quickly as governments introduce stricter building codes and energy-efficiency rules worldwide. Building energy regulations require higher insulation levels for new construction and major renovations, making rigid polyurethane foam a preferred option. The European Union promotes strong carbon neutrality goals, pushing member states toward better building performance using efficient insulation materials. North American programs like ENERGY STAR and LEED awards encourage the wider use of high-performance insulation materials in modern structures.

Paris Agreement commitments inspire countries to support energy-efficient construction as a central approach for meeting long-term climate targets. Utility companies in many regions offer rebates and incentives for installing premium insulation products using rigid polyurethane foam solutions. Rising energy expenses encourage building owners to invest in improved insulation, lowering heating and cooling costs over extended periods. Corporate sustainability goals motivate commercial developers to choose materials offering low operational energy use and consistent thermal efficiency.

How is expanding refrigeration and cold-chain infrastructure driving the rigid polyurethane foam market growth?

The global rigid polyurethane foam market expands steadily as refrigeration systems and cold chain logistics grow to support modern food distribution and healthcare needs worldwide. Population growth and urbanization increase demand for refrigerated storage, transport systems, and retail display equipment across many regions. Rising household incomes in developing economies encourage greater adoption of refrigerators and freezers, boosting overall appliance manufacturing. International food trade growth requires robust cold chain networks to maintain product quality during long-distance transport from farms to consumers.

Fresh produce, dairy goods, meat products, seafood, and prepared meals depend on reliable refrigeration supported by rigid polyurethane foam insulation. Pharmaceutical sectors require precise, temperature-controlled storage and distribution solutions for vaccines, biologics, and other sensitive medications.

Recent global health challenges emphasized the importance of vaccine cold chains, driving investment in advanced refrigeration systems worldwide. Online grocery services are expanding rapidly in urban markets, increasing demand for refrigerated vehicles and temperature-controlled fulfillment centers. Restaurants and food service businesses rely on commercial refrigeration insulated with rigid polyurethane foam technology.

Restraints

What environmental concerns are limiting the rigid polyurethane foam market?

A major challenge for the rigid polyurethane foam industry is the environmental impacts linked with specific blowing agents. Hydrofluorocarbon blowing agents create effective foam structures but carry high global warming potential, contributing to climate concerns. Hydrocarbon blowing agents introduce flammability issues demanding specialized handling procedures and strict safety measures during manufacturing and installation. Isocyanate chemicals used in foam production create worker health risks requiring protective equipment and effective workplace ventilation systems.

Curing processes may release compounds influencing indoor air quality unless proper management practices ensure safe building conditions. Some formulations contain flame retardants, raising environmental concerns due to their persistence, bioaccumulation, and limited long-term disposal options. Recycling rigid polyurethane foam remains difficult because the material resists decomposition and may release harmful substances during incorrect incineration. Increasing regulatory scrutiny and public concerns encourage the development of safer formulations, improved application methods, and better end-of-life strategies.

Opportunities

Innovation in bio-based and sustainable formulations

The rigid polyurethane foam industry is gaining strong growth opportunities through the development of bio-based polyols created from renewable and recycled resources. Bio-based polyols from vegetable oils, agricultural byproducts, and recovered materials can replace petroleum-based polyols in many foam formulations. Soybean oil polyols have already shown commercial success, with products offering high bio-content while maintaining dependable performance properties across diverse applications. Ongoing research explores polyols made from castor oil, palm oil, rapeseed oil, and other plant sources available in various global regions.

Using renewable feedstocks reduces reliance on fossil fuels and helps lower the overall carbon footprint of rigid foam products. Consumer interest in sustainable building materials increases demand for bio-based insulation solutions offering simple environmental benefits. Green building programs like LEED award additional points for materials containing recycled or renewable content.

Government procurement policies increasingly support environmentally responsible products, creating new openings in public construction projects. Some bio-based foam formulations provide improved fire resistance or reduced emissions compared with traditional alternatives. Advancing technologies allow higher bio-content without compromising thermal performance or long-term dimensional stability.

Challenges

How are raw material price volatility and supply chain disruptions creating challenges for the rigid polyurethane foam industry?

The rigid polyurethane foam market faces challenges driven by unstable raw material prices and disruptions across chemical supply networks. Foam production relies on isocyanates and polyols from petroleum sources, making overall costs responsive to shifting crude oil values. Crude oil fluctuations influence petrochemical pathways, generating significant variability in essential material expenses for foam manufacturers worldwide across markets. Specialty chemicals used as catalysts, surfactants, and additives come from limited suppliers, increasing vulnerability during supply constraints in manufacturing.

Natural disasters, transportation issues, plant shutdowns, and geopolitical tensions can suddenly restrict material availability, creating challenges for industry stability. Trade disputes and tariffs between major economies periodically raise fundamental input costs while limiting access to essential imported materials. Environmental regulations restricting specific chemicals require manufacturers to undertake costly reformulation efforts, often using alternative ingredients with higher production costs. Limited chemical production capacity creates tight supply conditions, leaving smaller producers to struggle with procurement while maintaining consistent output.

Rigid Polyurethane Foam Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rigid Polyurethane Foam Market |

| Market Size in 2024 | USD 17.60 Billion |

| Market Forecast in 2034 | USD 33.20 Billion |

| Growth Rate | CAGR of 7.20% |

| Number of Pages | 214 |

| Key Companies Covered | BASF SE, Covestro AG, The Dow Chemical Company, Huntsman Corporation, Wanhua Chemical Group Co., Stepan Company, Carpenter Co., Recticel NV, Armacell International SA, Rogers Corporation, Lapolla Industries Inc., INOAC Corporation, EUROFOAM SpA, VKG Insulpan, Versalis SpA, and others. |

| Segments Covered | By Blowing Agent, By Application, By End-Use Industry, By Density Range, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rigid Polyurethane Foam Market: Segmentation

The global rigid polyurethane foam market is segmented based on blowing agent, application, end-use industry, density range, and region.

Based on blowing agent, the global rigid polyurethane foam industry is classified into hydrocarbons, hydrofluorocarbons, water-blown, carbon dioxide, pentane, and others. Hydrocarbons lead the market due to their excellent thermal insulation properties and widespread acceptance in regions transitioning away from ozone-depleting and high-GWP blowing agents.

Based on application, the industry is categorized into building and construction insulation, refrigeration and appliances, industrial applications, transportation, packaging, and marine applications. Building and construction insulation leads the market due to the massive scale of global construction activity, and the superior thermal performance of rigid polyurethane foam for wall, roof, and foundation applications.

Based on end-use industry, the global rigid polyurethane foam market is divided into construction, automotive, refrigeration, packaging, electronics, and aerospace. Construction is expected to lead the market during the forecast period due to ongoing infrastructure development and the material's ability to meet diverse building insulation needs across residential, commercial, and industrial segments.

Based on density range, the global market is segregated into low-density, medium-density, and high-density. Medium density holds the largest market share due to the optimal balance between insulation performance, structural strength, material cost, and versatility across multiple applications, including building insulation and refrigeration equipment.

Rigid Polyurethane Foam Market: Regional Analysis

Asia Pacific's dominance in the global market is driven by multiple key growth factors.

Asia Pacific leads the rigid polyurethane foam market because rapid industrialization, strong construction activity, expanding middle-class populations, and growing manufacturing capabilities support extensive regional demand. China dominates regional consumption since enormous construction volumes across residential, commercial, and infrastructure sectors require substantial quantities of reliable insulation materials. The nation’s long-term urbanization programs continue to relocate large rural populations into cities, creating a continuous demand for new, energy-efficient buildings. Government policies promoting improved building efficiency encourage widespread adoption of rigid polyurethane foam across major construction projects.

India experiences similar growth patterns driven by rising urban populations, active infrastructure development, and increasing construction across residential and commercial markets. Rising incomes across the Asia Pacific increase household appliance ownership, boosting refrigerator and air conditioner production using rigid foam insulation. The region functions as a global manufacturing hub for appliances, electronics, and automotive components, frequently incorporating rigid polyurethane foam across multiple applications.

Hot, humid climates across the region support strong demand for air conditioning and refrigeration systems requiring effective insulation. Growing cold chain networks support expanding food processing and distribution industries across multiple economies. The region’s large food and beverage sector increases demand for refrigerated storage and transportation equipment, supporting regional supply chains. Expanding chemical manufacturing capacity boosts polyurethane production capabilities, improving local raw material availability and reducing overall costs.

Why is North America experiencing significant growth in the rigid polyurethane foam market?

North America is experiencing strong growth in the rigid polyurethane foam market, driven by strict energy regulations, aging buildings, expanding cold storage needs, and steady technological progress. The United States continues to adopt tighter building energy codes requiring higher insulation levels, with many states choosing standards that exceed national guidelines. The shift toward net-zero energy buildings in commercial and institutional sectors increases demand for insulation materials offering high thermal performance and long-term durability.

Renovation and retrofitting of older structures create major opportunities, as much of the regional building stock requires efficiency upgrades. Commercial property owners face rising pressure from investors, tenants, and policies to reduce energy consumption and overall carbon emissions. Growth in online retail and food delivery services is driving the expansion of refrigerated warehouse construction and cold chain logistics networks across the region. Climate concerns encourage regulatory action alongside voluntary corporate commitments focused on reducing energy use in buildings.

Spray foam insulation gains popularity in residential markets due to its strong air-sealing abilities and dependable thermal performance. The automotive industry’s transition toward electric vehicles creates new uses for lightweight, thermally efficient materials, including rigid polyurethane foam. Regional appliance manufacturers continue to enhance energy efficiency to meet ENERGY STAR and other performance standards. Technological advances support the development of rigid foam solutions offering lower environmental impact and improved functional properties across applications.

Recent Market Developments

- In July 2025, BASF SE introduced a next-generation rigid polyurethane foam system featuring bio-based polyols and substantially reduced global warming potential.

Rigid Polyurethane Foam Market: Competitive Analysis

The leading players in the global rigid polyurethane foam market are:

- BASF SE

- Covestro AG

- The Dow Chemical Company

- Huntsman Corporation

- Wanhua Chemical Group Co.

- Stepan Company

- Carpenter Co.

- Recticel NV

- Armacell International SA

- Rogers Corporation

- Lapolla Industries Inc.

- INOAC Corporation

- EUROFOAM SpA

- VKG Insulpan

- Versalis SpA

The global rigid polyurethane foam market is segmented as follows:

By Blowing Agent

- Hydrocarbons

- Hydrofluorocarbons

- Water-Blown

- Carbon Dioxide

- Pentane

- Others

By Application

- Building and Construction Insulation

- Refrigeration and Appliances

- Industrial Applications

- Transportation

- Packaging

- Marine Applications

By End-Use Industry

- Construction

- Automotive

- Refrigeration

- Packaging

- Electronics

- Aerospace

By Density Range

- Low Density

- Medium Density

- High Density

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed