Reusable Blood Hemodialyzer Market Size, Trends, Forecast 2034

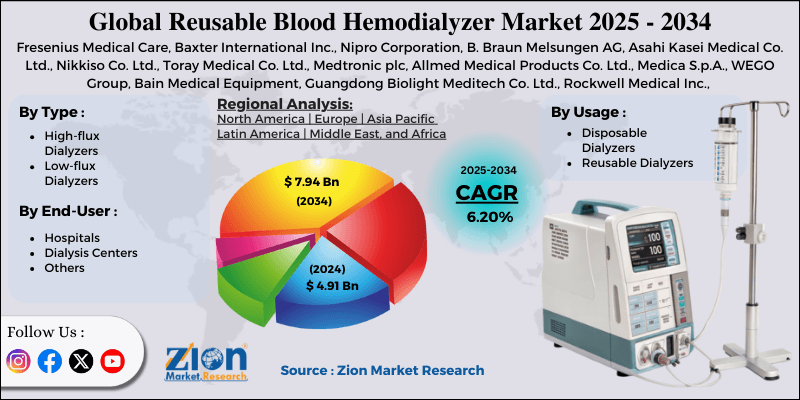

Reusable Blood Hemodialyzer Market By Type (High-flux Dialyzers, Low-flux Dialyzers), By Usage (Disposable Dialyzers, Reusable Dialyzers), By End-User (Hospitals, Dialysis Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

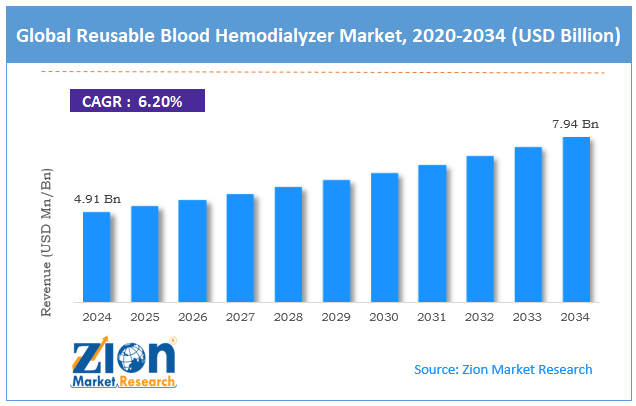

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.91 Billion | USD 7.94 Billion | 6.20% | 2024 |

Reusable Blood Hemodialyzer Industry Perspective:

The global reusable blood hemodialyzer market size was approximately USD 4.91 billion in 2024 and is projected to reach around USD 7.94 billion by 2034, with a compound annual growth rate (CAGR) of approximately 6.20% between 2025 and 2034.

Reusable Blood Hemodialyzer Market: Overview

A reusable blood hemodialyzer is a medical device used in dialysis to filter toxins, waste, and excess fluid from a patient's blood with kidney failure. This device is specifically designed for repeated disinfection and cleaning, typically performed 30-40 times, depending on patient conditions and clinical protocols. The global reusable blood hemodialyzer market is expected to expand rapidly, driven by the increasing incidence of kidney diseases, the cost-effectiveness of reusable dialyzers, and the growing population of dialysis patients. Chronic kidney disease cases surpass 850 million individuals, according to the Global Burden of Disease Study 2023. As kidney-associated diseases intensify, the demand for hemodialysis treatment, particularly in low-resource areas, drives the need for cost-efficient reusable hemodialyzers. Moreover, reusable dialyzers are notably low-priced per session than the disposable alternatives.

In regions like Southeast Asia, hospital settings account for up to 60% of savings with usable units, increasing their appeal for high-volume dialysis centers. In addition, the World Health Organization mentions a 57% yearly rise in patients needing dialysis, fueled by an aging population, hypertension, and diabetes. This growing patient pool demands affordable and scalable treatment options, particularly those that utilize reusable models.

Despite the growth, the global market is hindered by factors such as cross-contamination and infection risk, as well as significant upfront investment in reprocessing machines. Extended reuse beyond suggested cycles and improper sterilization may increase the risk of infections. This increases hesitancy among professionals in some markets, especially where disinfection compliance is not up to the mark.

Additionally, healthcare providers should invest in staff training and dedicated reprocessing equipment. This initial cost may be a deterrent for rural hospitals and smaller clinics. Nonetheless, the global reusable blood hemodialyzer industry stands to gain from several key opportunities, including technological advancements in sterilization systems, AI-based reuse tracking systems, and sustainability-focused procurement by hospitals.

Emergency technologies may improve safety and support broader adoption of reuse practices. Medical device companies and startups are introducing AI-based tools to monitor disinfection performance and dialyzer use cycles, thereby enhancing safety and reducing errors, which in turn fuels provider confidence in reuse. Furthermore, hospitals aiming for green certifications, such as LEED, are more likely to procure reusable medical products. This trend is projected to support the use of reusable hemodialyzers in eco-conscious healthcare networks.

Key Insights:

- As per the analysis shared by our research analyst, the global reusable blood hemodialyzer market is estimated to grow annually at a CAGR of around 6.20% over the forecast period (2025-2034)

- In terms of revenue, the global reusable blood hemodialyzer market size was valued at around USD 4.91 billion in 2024 and is projected to reach USD 7.94 billion by 2034.

- The reusable blood hemodialyzer market is projected to grow significantly owing to the rising cases of chronic kidney disease, favorable reimbursement policies for dialysis, and the growth of dialysis infrastructure in emerging regions.

- Based on type, the high-flux dialyzers segment is expected to lead the market, while the low-flux dialyzers segment is expected to grow considerably.

- Based on usage, the disposable dialyzers segment is the largest, while the reusable dialyzers segment is projected to experience substantial revenue growth over the forecast period.

- Based on end-user, the dialysis centers segment is expected to lead the market compared to the hospitals segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Asia Pacific.

Reusable Blood Hemodialyzer Market: Growth Drivers

Rising preference for high-flux dialyzers in chronic care drives market growth

High-flux dialyzers, which are primarily used in reusable systems, are preferred mainly for their improved clearance of middle-molecule toxins, which enhances the patient's quality of life and survival.

The reusable segment is strong within the high-flux domain owing to the materials that retain membrane integrity via multiple uses. This fuels strong adoption among renal care providers and nephrologists, particularly in settings where cost savings and long-term patient retention are prioritized.

Technological improvements in dialyzer reprocessing systems have remarkably fuels the market growth

Technological advancements in dialyzer preprocessing have notably improved the efficiency and safety of reuse protocols, helping to overcome historical concerns regarding membrane degradation and infection risks. The launch of automated dialyzer reprocessors has enhanced documentation and sterilization consistency, promising high standards of traceability and hygiene, which in turn boosts the reusable blood hemodialyzer market.

In Quarter 1 2025, Fresenius Medical Care introduced an upgraded version of its automated reprocessing system, 'Renal Guard X,' that adopts real-time membrane integrity testing and advanced sensor-based monitoring. This advancement enables up to 20 safe reuse cycles, boosting user confidence.

Reusable Blood Hemodialyzer Market: Restraints

High initial investment in training and reprocessing equipment negatively impacts market progress

Although reusable dialyzers decrease long-term costs, the upfront capital costs, technician training, sterilization units, and water treatment systems remain significant. These capital expenses are a significant obstacle, particularly for standalone rural healthcare centers and dialysis clinics operating on limited budgets, thereby restricting the expansion of the reusable blood hemodialyzer industry.

A 2024 WHO report on universal dialysis noted that nearly 70% of new dialysis units in Southeast Asia and Sub-Saharan Africa opted for disposable dialyzers due to a lack of funds for reuse-associated infrastructure.

Reusable Blood Hemodialyzer Market: Opportunities

Rising demand in resource-limited and rural settings to fuel the market growth

With underserved and rural regions experiencing restricted access to continuous dialysis, there is a surging demand for scalable and low-cost solutions. Reusable dialyzers offer a cost-effective alternative to high-priced disposable models in these settings, particularly when combined with solar-compatible and compact reprocessing units.

A 2024 study in The Lancet Global Health presented that reusable dialyzers reduced the cost per dialysis session by 55% in rural settings in Bangladesh, Kenya, and Nepal. As global governments and NGOs prioritize rural dialysis coverage, manufacturers of reusable dialyzers may offer a solution suite tailored to these markets, representing a significant unexplored opportunity in the global reusable blood hemodialyzer industry.

Reusable Blood Hemodialyzer Market: Challenges

Persistent physician and patient safety concerns restrict the growth of the market

Nonetheless, despite decades of clinical validation, concerns about the safety of dialyzer reuse persist among nephrologists and patients. Several still associate reuse with elevated infection risks, inconsistent treatment quality, and reduced dialyzer efficacy.

Sporadic media reports further augment these concerns. For example, a 2024 news article in Brazil underscored a regional hospital's suspension of reuse after a series of pyrogenic reactions, despite the direct cause never being defined. Cases like this discourage adoption and add to the skepticism in safety-conscious healthcare systems.

Reusable Blood Hemodialyzer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Reusable Blood Hemodialyzer Market |

| Market Size in 2024 | USD 4.91 Billion |

| Market Forecast in 2034 | USD 7.94 Billion |

| Growth Rate | CAGR of 6.20% |

| Number of Pages | 212 |

| Key Companies Covered | Fresenius Medical Care, Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Asahi Kasei Medical Co. Ltd., Nikkiso Co. Ltd., Toray Medical Co. Ltd., Medtronic plc, Allmed Medical Products Co. Ltd., Medica S.p.A., WEGO Group, Bain Medical Equipment, Guangdong Biolight Meditech Co. Ltd., Rockwell Medical Inc., Kawasumi Laboratories Inc., and others. |

| Segments Covered | By Type, By Usage, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reusable Blood Hemodialyzer Market: Segmentation

The global reusable blood hemodialyzer market is segmented based on type, usage, end-user, and region.

Based on type, the global reusable blood hemodialyzer industry is divided into high-flux dialyzers and low-flux dialyzers. The high-flux dialyzers are the prominent segment due to their higher efficiency in removing middle molecules, such as β2-microglobulin, which is linked to dialysis-associated amyloidosis. They offer enhanced clinical outcomes, better patient comfort, and reduced treatment time. High-flux models are adopted in developing and developed regions as health professionals shift towards improved dialysis methods.

Based on usage, the global reusable blood hemodialyzer market is segmented into disposable dialyzers and reusable dialyzers. The disposable dialyzers segment is remarkably leading, particularly in North America, parts of East Asia, and Europe. These regions prioritize patient safety, infection control, and regulatory compliance, which fuels the adoption of disposable dialyzers. The worldwide trend of reducing cross-contamination and enhancing clinical outcomes has led to a surge in the adoption of these technologies. Disposable dialyzers account for nearly 55% of the global market share by value, primarily due to their broader use and higher costs in premium healthcare systems.

Based on end-user, the global market is segmented into hospitals, dialysis centers, and others. The dialysis centers segment registered a substantial market share. These centers are professionals in renal care and operate at a high volume of dialysis regularly, increasing the feasibility and cost-effectiveness of reusable dialyzers. Reuse helps these centers handle operational costs without compromising treatment capacity. In nations like China, India, and Brazil, standalone dialysis centers are increasing rapidly through private-public collaborations, thereby driving demand.

Reusable Blood Hemodialyzer Market: Regional Analysis

North America to witness significant growth over the forecast period

North America is expected to maintain its leading position in the global reusable blood hemodialyzer market due to high incidences of kidney diseases, a strong presence of key dialysis providers, and well-established reuse regulations and infrastructure. North America holds the leading cases of chronic kidney disease and end-stage renal disease. More than 8,10,000 residents live with end-stage renal disease, with approximately 5,00,000 needing dialysis, according to the U.S. Renal Data System. This high patient population consistently drives the demand for hemodialyzers, including reusable types, in specific settings.

North America is home to global dialysis companies like DaVita Inc. and Fresenius Medical Care North America, which operate thousands of casualty dialysis centers. These large providers apply cost-optimization tactics, with reusable dialyzers that are clinically suitable. This influence and scale add notably to North American industry dominance.

Moreover, the United States has well-defined reuse practices, supported by CMS and AAMI rules, which promise safety through tracking and advanced sterilization systems. Facilities using reusable dialyzers adhere to stringent guidelines, enabling safe multiple uses without compromising patient outcomes. This infrastructure backs continued adoption in some clinical contexts.

The Asia Pacific ranks as the second-largest region in the global reusable blood hemodialyzer industry, driven by strong demand for cost-effective dialysis solutions, government initiatives supporting dialysis access, and the rapid expansion of dialysis clinics and chains. Several nations in the region experience healthcare budget restrictions, compelling providers to adopt cost-effective models.

Reusable dialyzers may decrease treatment costs by 60% than disposable options, increasing suitability for high-volume rural clinics and public hospitals in Indonesia, the Philippines, and India. Governments are also actively growing access via national health schemes. Similar programs in Bangladesh and Thailand are experiencing a surge in the adoption of affordable, reusable tools.

Furthermore, APAC is experiencing a rise in private dialysis clinics owing to medical privatization and urbanization. Chains like DaVita Care and NephroPlus are scaling operations using reusable dialyzers to reduce operational costs. This trend is mainly stronger in tier-3 and tier-2 cities.

Reusable Blood Hemodialyzer Market: Competitive Analysis

The leading players in the global reusable blood hemodialyzer market are:

- Fresenius Medical Care

- Baxter International Inc.

- Nipro Corporation

- B. Braun Melsungen AG

- Asahi Kasei Medical Co. Ltd.

- Nikkiso Co. Ltd.

- Toray Medical Co. Ltd.

- Medtronic plc

- Allmed Medical Products Co. Ltd.

- Medica S.p.A.

- WEGO Group

- Bain Medical Equipment

- Guangdong Biolight Meditech Co. Ltd.

- Rockwell Medical Inc.

- Kawasumi Laboratories Inc.

Reusable Blood Hemodialyzer Market: Key Market Trends

Integration of automation in dialyzer reprocessing:

Dialysis centers are actively adopting automated reprocessing systems to enhance efficiency and safety in cleaning reusable systems. These machines promise consistent sterilization, track the number of reuses per unit, and reduce human error. This trend boosts confidence in reusable systems and backs regulatory compliance.

Sustainability-driven procurement by health professionals:

With the growing focus on ecological responsibility, dialysis chains and hospitals are increasingly opting for reusable dialyzers to reduce medical waste. Every reuse prevents a disposable device from entering landfills, thereby aligning with universal sustainability objectives. This trend is mainly strong in India, Europe, and eco-practiced healthcare systems.

The global reusable blood hemodialyzer market is segmented as follows:

By Type

- High-flux Dialyzers

- Low-flux Dialyzers

By Usage

- Disposable Dialyzers

- Reusable Dialyzers

By End-User

- Hospitals

- Dialysis Centers

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A reusable blood hemodialyzer is a medical device used in dialysis to filter toxins, waste, and excess fluid from a patient's blood with kidney failure. This device is specifically designed for repeated disinfection and cleaning, typically performed 30-40 times, depending on patient conditions and clinical protocols.

The global reusable blood hemodialyzer market is projected to grow due to the growing geriatric population, a majority of whom demand dialysis, increasing healthcare infrastructure in emerging countries, and a shift towards eco-friendly and sustainable dialysis products.

According to study, the global reusable blood hemodialyzer market size was worth around USD 4.91 billion in 2024 and is predicted to grow to around USD 7.94 billion by 2034.

The CAGR value of the reusable blood hemodialyzer market is expected to be approximately 6.20% from 2025 to 2034.

North America is expected to lead the global reusable blood hemodialyzer market during the forecast period.

The key players profiled in the global reusable blood hemodialyzer market include Fresenius Medical Care, Baxter International Inc., Nipro Corporation, B. Braun Melsungen AG, Asahi Kasei Medical Co., Ltd., Nikkiso Co., Ltd., Toray Medical Co., Ltd., Medtronic plc, Allmed Medical Products Co., Ltd., Medica S.p.A., WEGO Group, Bain Medical Equipment, Guangdong Biolight Meditech Co., Ltd., Rockwell Medical Inc., and Kawasumi Laboratories, Inc.

The report examines key aspects of the reusable blood hemodialyzer market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed