Global Rail Welding Machines Market Size, Share, Growth Analysis Report - Forecast 2034

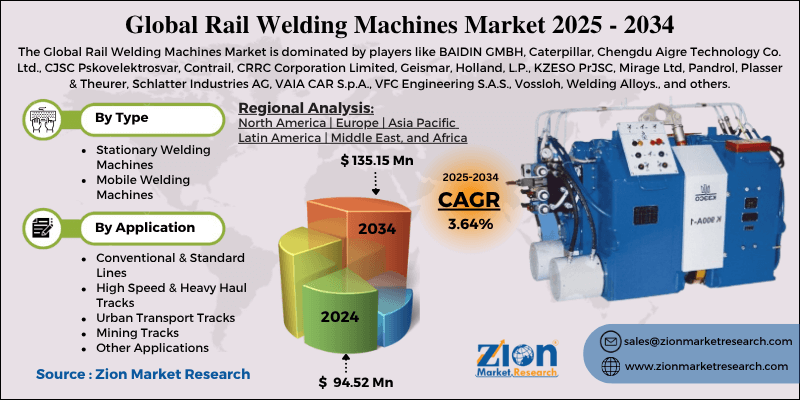

Rail Welding Machines Market By Type (Stationary Welding Machines, Mobile Welding Machines), By Application (Conventional & Standard Lines, High Speed & Heavy Haul Tracks, Urban Transport Tracks, Mining Tracks, Other Applications), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 94.52 Million | USD 135.15 Million | 3.64% | 2024 |

Rail Welding Machines Market: Industry Perspective

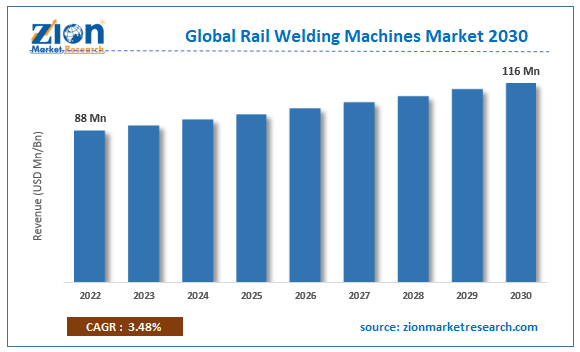

The global rail welding machines market size was worth around USD 94.52 Million in 2024 and is predicted to grow to around USD 135.15 Million by 2034 with a compound annual growth rate (CAGR) of roughly 3.64% between 2025 and 2034. The report analyzes the global rail welding machines market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the rail welding machines industry.

Rail Welding Machines Market: Overview

Rail welding machines are used to weld rail tracks & turnout joints. These machines are majorly based on flash-butt welding technology. In the flash-butt welding method, electric power is used between the end surfaces of the rails being joined, the free rail is moved forward & backward at low speed, and flash & arc are produced by the resistance & local heating caused by the contact of the rail ends. The contact flash generation process is repeated till a melt layer is formed on the entire joint surface, then after one rail end is pressed to obtain perfect homogenous joints. Flash-butt welding method provides raw characteristics like standalone tracks to the joint surfaces. Flash-butt welding has the highest welding efficiency among all rail welding methods. Other welding methods include gas pressure welding, enclosed arc welding, aluminothermic welding, and others.

Currently, both mobile & stationary welding machines are used by railway infrastructure firms. Stationary machines are widely used for joining short & long rails. Stationary welding machines are mostly used at rail welding plants. Whereas mobile welding systems are self-propelled, generally, truck-based rail vehicles or container systems on which welding machines are fitted. These wagons can be moved from one welding position to another. Continuous welded rail offers a smooth & continuous track length for efficient railway activities. Rising expansion in railway networks, across the globe, is expected to enhance the growth of the rail welding machines industry.

Key Insights

- As per the analysis shared by our research analyst, the global rail welding machines market is estimated to grow annually at a CAGR of around 3.64% over the forecast period (2025-2034).

- Regarding revenue, the global rail welding machines market size was valued at around USD 94.52 Million in 2024 and is projected to reach USD 135.15 Million by 2034.

- The rail welding machines market is projected to grow at a significant rate due to rising investments in railway infrastructure, increasing demand for high-speed rail networks, and advancements in welding technologies for improved efficiency and safety.

- Based on Type, the Stationary Welding Machines segment is expected to lead the global market.

- On the basis of Application, the Conventional & Standard Lines segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Rail Welding Machines Market: Dynamics

Key Growth Drivers:

The rail welding machines market is propelled by global investments in railway infrastructure and modernization projects, including high-speed rail and urban transit expansions, which increase demand for reliable rail-joining equipment. Ongoing replacement and maintenance of aging rail networks in developed regions drive steady recurring purchases of welding machines and consumables. Technological improvements—such as automated flash-butt and aluminothermic welding systems, robotics, and machine-mounted diagnostics—improve weld quality and productivity, encouraging adoption. Rising freight volumes and the push for safer, continuous welded rail (CWR) to reduce maintenance and derailment risk further stimulate market growth.

Restraints:

High capital expenditure for advanced rail welding systems and the considerable cost of skilled labor for operation and maintenance limit adoption, especially among smaller rail operators and in developing economies. The long lifecycle and robustness of existing welding equipment can reduce replacement frequency, slowing market turnover. Strict safety and environmental regulations increase compliance costs for manufacturers and end-users, while logistical challenges in deploying heavy welding machinery in remote or difficult-to-access track locations hamper swift market penetration.

Opportunities:

There is significant opportunity in retrofitting and upgrading legacy rail networks with automated and portable welding solutions that lower on-site labor needs and increase speed of repairs. Growing emphasis on predictive and condition-based maintenance opens markets for welding machines with embedded sensors and IoT connectivity that integrate into asset-management systems. Expansion of metropolitan rail projects and new greenfield rail corridors in Asia-Pacific, Africa, and Latin America presents fresh procurement demand. Additionally, after-sales services, training programs, and consumable supplies offer recurring revenue streams for manufacturers.

Challenges:

The market faces challenges from workforce shortages of trained welding technicians and weld-quality inspectors, which can delay project timelines and affect equipment utilization. Ensuring consistent weld quality across diverse environmental and track conditions remains difficult and can lead to liability concerns for suppliers. Intense competition and price pressure from low-cost manufacturers may compress margins, while geopolitical factors and fluctuating infrastructure budgets can cause procurement uncertainty. Finally, integrating new welding technologies into established maintenance workflows requires organizational change and capital planning that some operators may resist.

Rail Welding Machines Market: Segmentation

The global rail welding machines market is segmented based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on type, the global market segments are stationary welding machines & mobile welding machines. Currently, the global rail welding machines market is dominated by mobile welding machines, considering their ease of applicability at different locations. Mobile welding machine comprises rail welding equipment fitted on a truck-based rail-road vehicle. These rail welding machines perform tasks at higher rates & good efficiency. Some of the key providers of mobile rail welding machines are Holland, L.P., Plasser & Theurer, Caterpillar (Progress Rail), and others.

Based on application, the global market segments are conventional & standard lines, high-speed & heavy haul tracks, urban transport tracks, mining tracks, and other applications. Currently, the rail welding machines industry is dominated by the conventional & standard lines segment. Conventional & standard lines are the most widely used railway network across the globe. Most of the conventional rail routes are situated in North America, Europe, China, India, Russia, and Japan, as per IEA. However, in the coming years, high-speed & heavy-haul tracks are expected to acquire significant market share, owing to the increasing investments in high-speed train infrastructures.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Rail Welding Machines Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Rail Welding Machines Market |

| Market Size in 2024 | USD 94.52 Million |

| Market Forecast in 2034 | USD 135.15 Million |

| Growth Rate | CAGR of 3.64% |

| Number of Pages | 218 |

| Key Companies Covered | BAIDIN GMBH, Caterpillar, Chengdu Aigre Technology Co. Ltd., CJSC Pskovelektrosvar, Contrail, CRRC Corporation Limited, Geismar, Holland, L.P., KZESO PrJSC, Mirage Ltd, Pandrol, Plasser & Theurer, Schlatter Industries AG, VAIA CAR S.p.A., VFC Engineering S.A.S., Vossloh, Welding Alloys., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Rail Welding Machines Market: Regional Analysis

From 2025 to 2034 the rail welding machines market will remain regionally diverse, with Asia-Pacific leading growth driven by large-scale rail expansion, high-speed rail projects and strong investment in track renewal in China, India and Southeast Asia; Europe will register steady demand as rail operators focus on network modernization, stringent safety and emissions rules, and maintenance of aging infrastructure—boosting replacement and automated welding solutions; North America will grow more moderately on the back of freight corridor upgrades, urban transit renewals and adoption of mobile, robotic welding systems for faster maintenance; Latin America will see incremental gains tied to targeted infrastructure projects and budgetary constraints that slow broad deployment; and the Middle East & Africa will record selective uptake linked to new rail corridors, energy sector projects and international development funding, though adoption may be tempered by funding cycles and supply-chain challenges, while across all regions demand will be shaped by automation, digital monitoring integration, and a shift toward faster, more reliable welding technologies.

Rail Welding Machines Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the rail welding machines market on a global and regional basis.

The global rail welding machines market is dominated by players like:

- BAIDIN GMBH

- Caterpillar

- Chengdu Aigre Technology Co. Ltd.

- CJSC Pskovelektrosvar

- Contrail

- CRRC Corporation Limited

- Geismar

- Holland, L.P.

- KZESO PrJSC

- Mirage Ltd

- Pandrol

- Plasser & Theurer

- Schlatter Industries AG

- VAIA CAR S.p.A.

- VFC Engineering S.A.S.

- Vossloh

- Welding Alloys

The global rail welding machines market is segmented as follows:

By Type

- Stationary Welding Machines

- Mobile Welding Machines

By Application

- Conventional & Standard Lines

- High Speed & Heavy Haul Tracks

- Urban Transport Tracks

- Mining Tracks

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rail welding machines are used to weld rail tracks & turnout joints. These machines are majorly based on flash-butt welding technology. Other welding methods include gas pressure welding, enclosed arc welding, aluminothermic welding, etc. Mobile & stationary welding machines are used to perform rail welding tasks.

The global rail welding machines market is expected to grow due to increasing worldwide investments in railway infrastructure expansion and modernization, rising demand for high-speed and heavy-haul rail networks, and growing adoption of advanced technologies like automation and digitalization for enhanced efficiency and safety in welding processes.

According to a study, the global rail welding machines market size was worth around USD 94.52 Million in 2024 and is expected to reach USD 135.15 Million by 2034.

The global rail welding machines market is expected to grow at a CAGR of 3.64% during the forecast period.

North America is expected to dominate the rail welding machines market over the forecast period.

Leading players in the global rail welding machines market include BAIDIN GMBH, Caterpillar, Chengdu Aigre Technology Co. Ltd., CJSC Pskovelektrosvar, Contrail, CRRC Corporation Limited, Geismar, Holland, L.P., KZESO PrJSC, Mirage Ltd, Pandrol, Plasser & Theurer, Schlatter Industries AG, VAIA CAR S.p.A., VFC Engineering S.A.S., Vossloh, Welding Alloys., among others.

The report explores crucial aspects of the rail welding machines market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed