Professional Indemnity Insurance Market Size and Forecast 2034

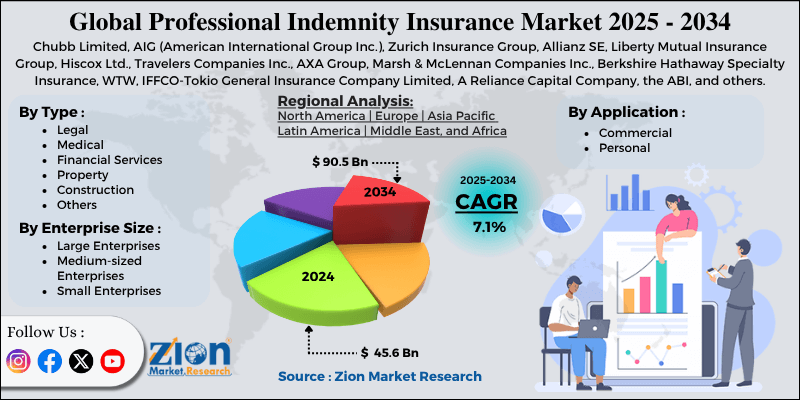

Professional Indemnity Insurance Market By Type (Legal, Medical, Financial Services, Property, Construction and Others), By Enterprise Size (Large Enterprises, Medium-sized Enterprises and Small Enterprises), By Application (Commercial and Personal) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

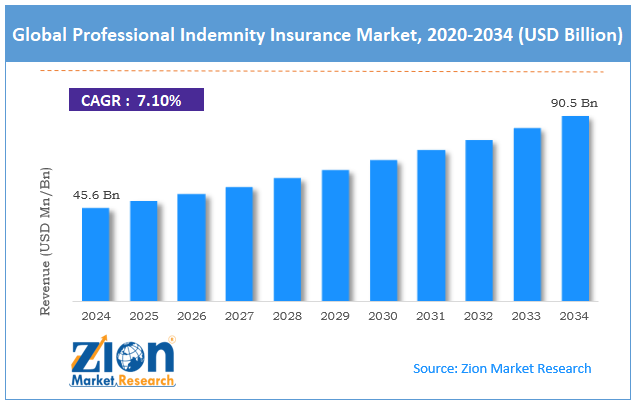

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.6 Billion | USD 90.5 Billion | 7.10% | 2024 |

Professional Indemnity Insurance Industry Perspective:

The global professional indemnity insurance market size was worth around USD 45.6 billion in 2024 and is predicted to grow to around USD 90.5 billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.1% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global professional indemnity insurance market is estimated to grow annually at a CAGR of around 7.1% over the forecast period (2025-2034).

- In terms of revenue, the global professional indemnity insurance market size was valued at around USD 45.6 billion in 2024 and is projected to reach USD 90.5 billion by 2034.

- The increasing growth in professional services & SMEs is expected to drive the professional indemnity insurance market over the forecast period.

- Based on the type, the financial services segment is expected to capture the largest market share over the projected period.

- Based on the enterprise size, the large enterprises segment is expected to capture the largest market share over the projected period.

- Based on the application, the commercial segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Professional Indemnity Insurance Market: Overview

Professional indemnity (PI) insurance protects professionals from financial losses and legal fees if someone claims they were irresponsible, made a mistake, or failed to perform their duties correctly. It provides coverage for legal defense costs and damages given to a client, thereby preserving a professional's business assets and reputation. This sort of insurance is required for professionals such as doctors, lawyers, and consultants, and is frequently mandated by professional associations or government organizations. The market is expanding for a variety of reasons, including rising legal and litigation risk, more regulatory and compliance requirements, increased demand for professional services, increased cross-border exposure, and others. However, the increasing frequency, intensity, and litigation tail risks of claims present a substantial obstacle to business growth.

Professional Indemnity Insurance Market Dynamics

Growth Drivers

Why rising legal/litigation risk drives the market growth?

The professional indemnity insurance market is evolving as lawsuits and legal action become more likely. This makes it easier and more common to sue professionals. Professionals in fields like law, healthcare, and finance are far more likely to be sued for mistakes, omissions, or alleged negligence in their work as clients learn more about their rights and regulators pay closer attention. Professional indemnity insurance is essential for safeguarding people and businesses from significant financial losses and business interruptions, as it reduces the risk of expensive legal defense costs, settlements, and reputational damage.

Restraints

Why does the rising claim frequency, severity and litigation tail risks impede market growth?

The increasing number, intensity, and litigation of claims tail risks make it exceptionally difficult for the professional indemnity insurance market to grow. As the number of claims rises, insurers have to pay out more frequently, which strains their finances and reduces their profits. Also, when claims occur more regularly, insurers raise premiums and tighten underwriting requirements. This makes coverage more expensive and more complicated for professionals to get.

In addition, claim amounts are rising, especially for significant or catastrophic losses. This is due to inflation, rising settlement demands, and rising defense costs. Tail risks also make insurers less sure about what will happen and raise the price of coverage. This leads to more careful underwriting and higher premiums. Because of this, the industry's growth is facing significant challenges.

Opportunities

How does the growing product launch offer a potential opportunity for the industry growth?

The growing product launch is expected to offer a lucrative opportunity to the professional indemnity insurance market. For instance, in April 2025, Willis, a WTW firm, launched a new Professional Indemnity product, ProXS, which can hold up to CCY40m. The new facility is intended to provide professional groups with more comprehensive and affordable coverage. The ProXS solution is one of a kind and includes panels from both the Lloyds and commercial markets. The pre-agreed discount premiums ensure that clients get the best deal on the market for their risk-reduction needs.

ProXS offers custom coverage options just for professional firms, so they can adjust their growth plans in a business climate that is hard to foresee. The ProXS system also makes it easier to make changes in the middle of the term, giving flexible coverage quickly and easily, without the everyday problems and delays. It also lets one keep the policy for up to 18 months longer.

Challenges

Why does the performance limitations & reliability concerns pose a major challenge to market expansion?

Underwriting and pricing concerns for complex jobs are a significant obstacle to the expansion of the professional indemnity insurance market, as they make things more unpredictable, create problems for insurers that need to take on more risk, and limit their capacity. Different expertise, project types, and evolving best practices mean that complex fields such as law, engineering, architecture, fintech, and new technology have varying levels of risk. This makes it hard for insurers to estimate claim likelihood and costs, leading to unclear pricing, under-reserving, or overpricing that may turn customers off.

Also, new risks that arise quickly (such as cyber incidents, AI-driven liability, or ESG exposures) don't have historical claim data, which is an integral part of pricing. Insurers don't want to expand into these areas because there isn't enough high-quality data or models, which increases the likelihood that prices will be wrong and claims will be made in the future.

Professional Indemnity Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Professional Indemnity Insurance Market |

| Market Size in 2024 | USD 45.6 Billion |

| Market Forecast in 2034 | USD 90.5 Billion |

| Growth Rate | CAGR of 7.1% |

| Number of Pages | 217 |

| Key Companies Covered | Chubb Limited, AIG (American International Group Inc.), Zurich Insurance Group, Allianz SE, Liberty Mutual Insurance Group, Hiscox Ltd., Travelers Companies Inc., AXA Group, Marsh & McLennan Companies Inc., Berkshire Hathaway Specialty Insurance, WTW, IFFCO-Tokio General Insurance Company Limited, A Reliance Capital Company, the ABI, and others. |

| Segments Covered | By Type, By Enterprise Size, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Professional Indemnity Insurance Market: Segmentation

The global professional indemnity insurance industry is segmented based on type, enterprise size, application and region.

Based on the type, the global professional indemnity insurance market is bifurcated into legal, medical, financial services, property, construction and others. The financial services segment is expected to capture the largest market share over the projected period. More complicated financial products, more government oversight, and more lawsuits, especially high-value ones, are all making people want more coverage. This leads to the market to grow and insurers to collect more premiums.

Based on the enterprise size, the global professional indemnity insurance industry is bifurcated into large enterprises, medium-sized enterprises and small enterprises. The large enterprises segment holds the major market share. Large enterprises operate in many countries, service sectors, and typically complex contractual frameworks, increasing the number and severity of possible claims. As a result, they necessitate high policy limits and specialist indemnity coverage, resulting in large premium volumes.

Based on the application, the global professional indemnity insurance market is bifurcated into commercial and personal. The commercial segment dominates the market. Commercial businesses confront tougher laws to safeguard stakeholders and consumers, demanding comprehensive professional indemnity coverage to limit potential legal exposures. Thus, driving the market growth.

Regional Analysis

Why does North America dominate the market over the projected period?

North America region is expected to dominate the professional indemnity insurance market. The region has the world's largest economy, and professional industries, including healthcare, legal services, banking, and technology, are subject to stringent rules and significant fees for liability lawsuits. These factors make professional indemnity insurance quite popular.

Additionally, changes in laws across states and provinces make professional behavior and accountability stricter, increasing companies' likelihood of having full PII coverage to avoid expensive claims. Also, the rising number of complex professional negligence claims and class actions, along with inflation's effects on litigation incentives, are increasing liability risks and insurance costs.

Professional Indemnity Insurance Market: Competitive Analysis

The global professional indemnity insurance market is dominated by players like:

- Chubb Limited

- AIG (American International Group Inc.)

- Zurich Insurance Group

- Allianz SE

- Liberty Mutual Insurance Group

- Hiscox Ltd.

- Travelers Companies Inc.

- AXA Group

- Marsh & McLennan Companies Inc.

- Berkshire Hathaway Specialty Insurance

- WTW

- IFFCO-Tokio General Insurance Company Limited

- A Reliance Capital Company

- ABI

The global professional indemnity insurance market is segmented as follows:

By Type

- Legal

- Medical

- Financial Services

- Property

- Construction

- Others

By Enterprise Size

- Large Enterprises

- Medium-sized Enterprises

- Small Enterprises

By Application

- Commercial

- Personal

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Professional indemnity (PI) insurance protects professionals from financial losses and legal fees if someone claims they were irresponsible, made a mistake, or failed to perform their duties correctly.

The professional indemnity insurance market is expanding for a variety of reasons, including rising legal and litigation risk, more regulatory and compliance requirements, increased demand for professional services, increased cross-border exposure, and others.

What are the major challenges restraining the growth of the professional indemnity insurance market?

The increasing frequency, intensity, and litigation tail risks of claims present a substantial obstacle to professional indemnity insurance business growth.

Based on the application, the commercial segment is expected to dominate the professional indemnity insurance market growth during the projected period.

The increasing product launch and rising investyment pose a major impact factor for the professional indemnity insurance industry's growth over the projected period.

According to the report, the global professional indemnity insurance market size was worth around USD 45.6 billion in 2024 and is predicted to grow to around USD 90.5 billion by 2034.

The global professional indemnity insurance market is expected to grow at a CAGR of 7.1% during the forecast period.

The global professional indemnity insurance industry growth is expected to be driven by North America region. It is currently the world’s highest revenue-generating market due to the robust economic conditions and legal environment and increasing regulatory scrutiny and compliance requirements.

The global professional indemnity insurance market is dominated by players like Chubb Limited, AIG (American International Group Inc.), Zurich Insurance Group, Allianz SE, Liberty Mutual Insurance Group, Hiscox Ltd., Travelers Companies Inc., AXA Group, Marsh & McLennan Companies Inc., Berkshire Hathaway Specialty Insurance, WTW, IFFCO-Tokio General Insurance Company Limited, A Reliance Capital Company and the ABI, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed