Global Print Management Market Size, Share, Growth Analysis Report - Forecast 2034

Print Management Market By Component (Software, Services), By Deployment Mode (Cloud-based, On-premise), By End-user Industry (BFSI, IT & Telecommunication, Healthcare, Retail, Media & Entertainment, Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

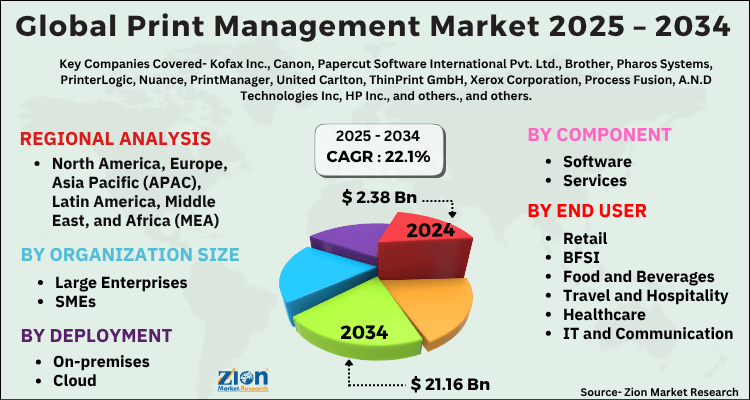

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.38 Billion | USD 21.16 Billion | 22.1% | 2024 |

Print Management Market: Industry Perspective

The global print management market size was worth around USD 2.38 Billion in 2024 and is predicted to grow to around USD 21.16 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 22.1% between 2025 and 2034.

The report analyzes the global print management market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the print management industry.

Print Management Market: Overview

Print management is the practice of efficiently and successfully managing and optimizing printing processes and equipment. Print management software is a tool that most firms use to manage their printing equipment more efficiently. They also let businesses monitor, operate, and manage their whole fleet of printers with a single application edge, all while reducing printing expenses. Paper, printouts, toner, and ink costs are going up, which is driving up demand for print management software. All of these procedures—distribution, mailing, offset printing, and quick printing—are supported by the curriculum. Networked methods or printers are now regulated differently as a result of the growing usage of print management software. Service providers are also distributing various value-added frameworks to improve user capacity, such as network security, user authentication, information governance, and data and document security.

Key Insights

- As per the analysis shared by our research analyst, the global print management market is estimated to grow annually at a CAGR of around 22.1% over the forecast period (2025-2034).

- Regarding revenue, the global print management market size was valued at around USD 2.38 Billion in 2024 and is projected to reach USD 21.16 Billion by 2034.

- The print management market is projected to grow at a significant rate due to Rising need to reduce printing costs and improve document security drives demand. Cloud-based solutions and digital transformation trends support growth.

- Based on Component, the Software segment is expected to lead the global market.

- On the basis of Deployment Mode, the Cloud-based segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user Industry, the BFSI segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Print Management Market: Growth Drivers

An increase in big data platform usage drives market growth

Big data platforms are being used by many businesses to get an advantage over competitors. Big data is the term for extremely large data sets that require processing with more sophisticated technologies to provide insightful information. These sets cannot be organized and stored in a standard manner. As data expands in quantity, businesses are finding it more and more difficult to gather, handle, evaluate, and process it with standard computer methods. Therefore, 42% of organizations can finance a big data strategy in less than a year. Businesses using big data platforms are adopting print services to streamline workflows, save expenses, and increase employee productivity. Print management software helps businesses use optical character recognition (OCR) to more efficiently sort and organize important papers. Furthermore, printing software provides enhanced security features that help protect critical data from network attacks. Because of all the benefits it provides, companies aiming to employ big data platforms are using printing software more frequently, which is expected to further drive print management industry development.

Print Management Market: Restraints

High cost and integration challenge hampers market growth

The initial expenses of deploying print management solutions, such as software, hardware, and training, might be too expensive for certain firms, particularly smaller ones with restricted resources. In addition, integrating print management solutions with existing IT infrastructure, such as document management systems and other corporate applications, can be difficult. Compatibility concerns may develop, making it difficult to achieve seamless integration. Thus, this is expected to hamper the print management market expansion during the forecast period.

Print Management Market: Opportunities

Strategies to reduce workplace paper use offer an attractive opportunity for market expansion

Organizations are increasingly embracing one or more green projects, owing to the favorable benefits that green initiatives may have on their consumers and their bottom line. Furthermore, many firms are focusing on reducing office paper consumption as a quick, easy, and effective approach to meet more ambitious sustainability goals. For example, according to one study, a business generates 7.8 metric tons of garbage each year on average. Paper is one of the wastes that accounts for over 40% of garbage. According to the report, corporations could save about $1 billion if they cut their paper waste by just 1%, thus many organizations are exploring methods to do so. Because of print management software, businesses may continue to progress in terms of efficiency. Rather than merely giving one or two temporary paper-saving solutions, it enables organizations of any size to eliminate print servers, automate print management, and permanently reduce consumables consumption.

Furthermore, adopting printing software allows businesses to manage their printer fleet proactively, allowing them to implement initiatives that reduce their carbon footprint. The adoption of printing services is also expected to rise in the next years, owing to a considerable shift toward robotics and automation, which has resulted in the expansion of digitalization initiatives.

Print Management Market: Challenges

Security concern poses a major challenge to market growth

While increased security is a driving force behind the adoption of print management systems, worries about the protection of sensitive data in the cloud or during print processes may act as an obstacle. To acquire universal adoption of print management systems, organizations must overcome these challenges. Thus, security concern is expected to be a major challenge for the print management industry expansion.

Print Management Market: Segmentation

The global Print Management industry is segmented based on the component, deployment, organization size, end user, and region.

Based on the component, the global print management market is bifurcated into software and services. The software segment is expected to dominate the market growth during the forecast period. The segment expansion is attributed to the growing product launch. For instance, in April 2023, Xerox revealed new and improved solutions to boost hybrid workers' productivity and security. These include cutting-edge technology developed for any business to improve user experience, make the office a more productive workplace, and increase security wherever work takes place.

Based on the deployment, the global print management industry is bifurcated into on-premises and cloud. The cloud segment is expected to grow at the highest CAGR during the forecast period. With cloud-based print management solutions, businesses may use a centralized cloud platform to manage their print infrastructure. As a result, on-premises servers are no longer necessary, and resources may be scaled according to demand with flexibility. In addition, implementing print management via the cloud helps lower the initial expenses related to on-premises equipment. Businesses can use the infrastructure of the cloud provider, which might result in savings on hardware, maintenance, and support. Thus, these benefits drive the market expansion.

Based on the organization size, the global print management market is bifurcated into large enterprises and SMEs. The large enterprises segment is expected to hold the largest market share over the forecast period. Large enterprises frequently print large amounts of material, which results in high prices. These businesses may use cost-control strategies including print quotas, rules-based printing, and cost tracking due to print management technologies. This aids in maximizing the costs associated with printing. In addition, security is a critical concern for large enterprises, especially when dealing with sensitive information. Print Management solutions for large enterprises often include robust security features such as secure print release, user authentication, and encryption to protect confidential documents.

Based on the end user, the global industry is bifurcated into retail, BFSI, food and beverages, travel and hospitality, healthcare, IT and communication, and others. The retail segment is expected to hold a maximum market share during the forecast period. Retailers frequently need effective print management solutions, such as order confirmation and receipt printing, for point-of-sale (POS) systems. By helping to streamline these procedures, print management systems guarantee that transaction-related papers are printed accurately and on time. Thus, this is expected to propel the print management industry.

Print Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Print Management Market |

| Market Size in 2024 | USD 2.38 Billion |

| Market Forecast in 2034 | USD 21.16 Billion |

| Growth Rate | CAGR of 22.1% |

| Number of Pages | 220 |

| Key Companies Covered | Kofax Inc., Canon, Papercut Software International Pvt. Ltd., Brother, Pharos Systems, PrinterLogic, Nuance, PrintManager, United Carlton, ThinPrint GmbH, Xerox Corporation, Process Fusion, A.N.D Technologies Inc, HP Inc., and others., and others. |

| Segments Covered | By Component, By Deployment Mode, By End-user Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Print Management Market: Regional Analysis

North America is expected to hold a significant market share during the forecast period

North America is expected to hold a significant print management market share during the forecast period. In terms of acceptance and technical improvements, North America is a region that is expanding quickly within the global printing software industry. It has a reasonably priced printing software solution and a well-equipped infrastructure. In addition, the United States' vast industrial base, government programs encouraging innovation, and high purchasing power are all contributing factors to the enormous market share. The United States accounts for the majority of North America's growth. Print management systems are often used by big data solutions companies to save expenses, enhance workflows, and increase employee productivity. Due to the widespread use of managed print services by the government and healthcare sectors in the United States, North America is predicted to hold the largest market share in 2022. Demand is expected to be fueled by anticipated acquisitions and recently launched initiatives to increase public awareness of managed print services. The growing need for cloud-based managed print services in North America is driving the market's expansion.

Print Management Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the print management market on a global and regional basis.

The global print management market is dominated by players like:

- Kofax Inc.

- Canon

- Papercut Software International Pvt. Ltd.

- Brother

- Pharos Systems

- PrinterLogic

- Nuance

- PrintManager

- United Carlton

- ThinPrint GmbH

- Xerox Corporation

- Process Fusion

- A.N.D Technologies Inc

- HP Inc.

- and others.

The global Print Management market is segmented as follows:

By Component

- Software

- Services

By Deployment

- On-premises

- Cloud

By Organization Size

- Large Enterprises

- SMEs

By End User

- Retail

- BFSI

- Food and Beverages

- Travel and Hospitality

- Healthcare

- IT and Communication

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global print management market is expected to grow due to Rising need to reduce printing costs and improve document security drives demand. Cloud-based solutions and digital transformation trends support growth.

According to a study, the global print management market size was worth around USD 2.38 Billion in 2024 and is expected to reach USD 21.16 Billion by 2034.

The global print management market is expected to grow at a CAGR of 22.1% during the forecast period.

North America is expected to dominate the print management market over the forecast period.

Leading players in the global print management market include Kofax Inc., Canon, Papercut Software International Pvt. Ltd., Brother, Pharos Systems, PrinterLogic, Nuance, PrintManager, United Carlton, ThinPrint GmbH, Xerox Corporation, Process Fusion, A.N.D Technologies Inc, HP Inc., and others., among others.

The report explores crucial aspects of the print management market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed