Polyurea Greases Market Size, Share, Trends, Growth & Forecast 2034

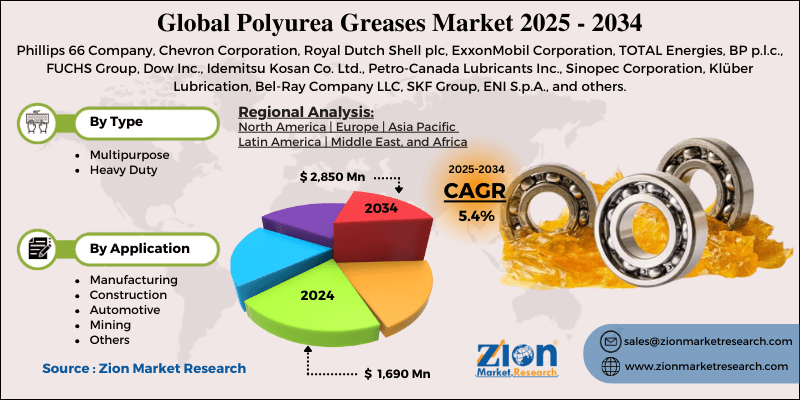

Polyurea Greases Market By Type (Multipurpose and Heavy Duty), By Application (Manufacturing, Construction, Automotive, Mining, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,690 Million | USD 2,850 Million | 5.4% | 2024 |

Polyurea Greases Industry Perspective:

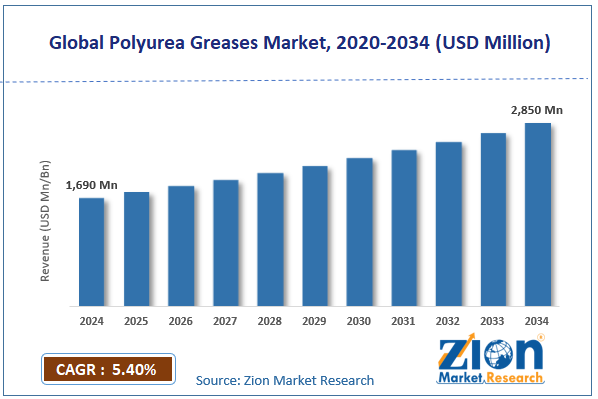

The global polyurea greases market size was worth around USD 1,690 million in 2024 and is predicted to grow to around USD 2,850 million by 2034, with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global polyurea greases market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- In terms of revenue, the global polyurea greases market size was valued at around USD 1,690 million in 2024 and is projected to reach USD 2,850 million by 2034.

- Increasing demand from the end-use sector is expected to drive the polyurea greases market over the forecast period.

- Based on the type, the multipurpose segment is expected to hold the largest market share over the forecast period.

- Based on the application, the automotive segment is expected to dominate the market over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Polyurea Greases Market: Overview

Polyurea greases are ash-free and metal soap-free, created through polymerization reactions. They are made by combining different isocyanates and amines with natural or synthetic base oils. Polyurea greases made in this manner typically operate at high temperatures. They are distinguished from other high-temperature greases by their performance characteristics, natural anti-oxidative qualities, excellent shear stability, and thixotropic features. One of the most essential characteristics of polyurea greases that sets them apart from other special grease types is their longevity, making them ideal for lifetime lubrication applications.

Due to production problems, raw material storage limitations, and technical infrastructure requirements, certain types of greases can only be produced in specially constructed facilities and laboratories. Many companies that market these greases manufacture nearly all of their goods in such specialized facilities. The polyurea greases market is being driven by several factors, including performance demands in harsh operating conditions, the need to reduce maintenance costs & downtime, the growth of key end-use sectors, and many others. However, the high production and procurement costs pose a major challenge to the industry's expansion.

Polyurea Greases Market Dynamics

Growth Drivers

Why does the high demand for high-performance lubricants drive the polyurea greases market growth?

The market for polyurea greases is growing quickly, as many sectors need high-performance lubricants. This growth is being fueled by the fact that polyurea greases are more thermally stable, water-resistant, and long-lasting than other types of grease. This makes them perfect for automotive, construction, heavy machinery, electric motors, and industrial uses that need reliability and long life. Polyurea greases are quite popular because they work really well in tough environments like high temperatures and heavy loads. They also save energy by minimizing friction and wear.

The market is growing as more people are moving to cities and more industries are moving to cities, especially in developing nations like the Asia-Pacific and Latin America. The automotive industry also wants cars that are more fuel-efficient and need less maintenance. Bio-based materials, electrically conductive formulations, and nano-additives are merely a few instances of new technologies that are expanding the range of things that can be done with them.

Restraints

Why do the high production and procurement costs hinder market growth?

Polyurea grease is more challenging and expensive to manufacture than conventional grease because it requires specialized raw materials, such as thickeners and additive precursors, which are often subject to higher tariffs and supply chain limitations. This makes transportation, buying raw materials, and following regionally specialized rules more expensive. To respond, businesses are investing in novel formulas that can replace expensive parts without compromising the product's performance. They are also diversifying their suppliers and moving their operations closer to home. Polyurea greases are more expensive than most regular greases because they are difficult to manufacture, which may deter people from using them, especially in industries and small to medium-sized businesses that are sensitive to pricing. Therefore, the aforementioned factor is hindering the polyurea grease industry.

Opportunities

Why do the rising product launches offer a potential opportunity for the polyurea greases industry's growth?

The increasing product launches are expected to offer a lucrative opportunity for the Polyurea Greases market. For instance, in September 2024, Memolub, a top company in automatic lubrication systems, launched its new sub-brand, CNC-LUB. These new products include prefilled grease cartridges that are specially made to make CNC machines work better. CNC-LUB cartridges are made to work well with the built-in lubrication systems of CNC machines. This makes them the best way to keep this high-precision equipment running smoothly and reliably. CNC-LUB greases are designed to keep critical moving parts, such as axes, slides, and worktables, lubricated, ensuring they operate smoothly at all times. CNC-LUB helps to lower downtime, improve tool accuracy, and extend the life of equipment by decreasing wear and tear.

The CNC-LUB PU LF 100/0 is the best product in this new line. It is a high-quality polyurea-based grease made just for the tough needs of modern CNC machines. CNC-LUB PU LF 100/0 is made to work with well-known CNC brands, including Mazak, Doosan, and Makino. It offers the best lubrication performance. Its complex formula includes highly refined mineral oil, polyurea thickener, and a unique mix of additives that provide several benefits, such as excellent anti-rust and anti-corrosion qualities, robust resistance to excessive pressure, and longer equipment life.

Challenges

Why does the limited availability of raw materials pose a major challenge to market expansion?

The polyurea greases market is experiencing difficulties due to an insufficient supply of essential raw ingredients, such as diisocyanates, diamines, and certain base oils, which are primarily derived from petrochemicals. These materials are needed to make thickening systems and performance additives. They provide excellent properties to the polyurea greases, which include they able to withstand high temperatures, staying stable in the presence of oxygen, and resisting water. Supply chain problems, fluctuating pricing for petrochemicals, and government restrictions on some chemicals can all make it difficult to get these raw materials on a frequent basis. This can change manufacturing schedules and prices.

Additionally, some of the raw materials used to produce polyurea grease are hazardous to health, safety, and the environment, which makes it more challenging to find suppliers and complicates the purchasing process. Since certain inputs are hard to find and only work for certain types of operations, they often have longer lead times, higher costs, and depend on a few big suppliers, which increases the risk of supply problems for businesses. This shortage also makes it harder to change the formula, which limits the range of new ideas and products in the polyurea greases market.

Polyurea Greases Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyurea Greases Market |

| Market Size in 2024 | USD 1,690 Million |

| Market Forecast in 2034 | USD 2,850 Million |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 213 |

| Key Companies Covered | Phillips 66 Company, Chevron Corporation, Royal Dutch Shell plc, ExxonMobil Corporation, TOTAL Energies, BP p.l.c., FUCHS Group, Dow Inc., Idemitsu Kosan Co. Ltd., Petro-Canada Lubricants Inc., Sinopec Corporation, Klüber Lubrication, Bel-Ray Company LLC, SKF Group, ENI S.p.A., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyurea Greases Market: Segmentation

The global polyurea greases industry is segmented based on type, application, and region.

Based on the type, the global polyurea greases market is bifurcated into multipurpose and heavy-duty. The multipurpose are expected to capture the largest market share over the projected period. Multipurpose polyurea greases are becoming increasingly popular because they work well in harsh settings, including high temperatures, heavy loads, and wet conditions. As the world becomes more industrialized and infrastructure expands, especially in developing countries, there is a growing need for high-performance lubricants that reduce maintenance costs and extend equipment lifespan. The automobile and manufacturing industries are also doing well because they are switching to technology that uses less energy and is better for the environment. Polyurea greases make cars and machines work better and use less gas.

Based on the application, the global polyurea greases industry is bifurcated into manufacturing, construction, automotive, mining, and other. The automotive segment holds the major market share. Rising car manufacturing numbers are driven by consumer demand and rules pushing for more fuel-efficient and environmentally friendly automobiles. Polyurea greases are preferred for their high thermal stability, oxidation resistance, and low noise levels. They are notably important in electric vehicles (EVs), where they lubricate e-motor bearings that run under conditions that necessitate greases with low oil bleed and high shear stability. Thus, the aforementioned factor fosters the segment expansion.

Polyurea Greases Market: Regional Analysis

Why does North America dominate the polyurea greases market over the projected period?

North America is expected to dominate the global polyurea greases market over the projected period. The market is growing due to the strong industrial base and better technology infrastructure. The region's strong manufacturing, automotive, and construction industries create an enormous demand for high-quality lubricants like polyurea grease. In addition, rigorous environmental rules in North America make businesses employ eco-friendly products, which increases the need for polyurea grease because it has a minimal environmental impact. The existence of key market leaders and continued investment in research and development also help the region stay on the leading edge. In the United States, where they are essential, the focus on innovation and the use of sophisticated lubricants in many high-demand industries is very important.

Additionally, the expansion of key market players' product portfolios influences industry growth. For instance, in March 2023, Chevron Corporation expanded its portfolio with the launch of new grease products. The company's new portfolio includes heavy-duty multi-purpose greases for extreme-pressure and other applications.

Polyurea Greases Market: Competitive Analysis

The global polyurea greases market is dominated by players like:

- Phillips 66 Company

- Chevron Corporation

- Royal Dutch Shell plc

- ExxonMobil Corporation

- TOTAL Energies

- BP p.l.c.

- FUCHS Group

- Dow Inc.

- Idemitsu Kosan Co. Ltd.

- Petro-Canada Lubricants Inc.

- Sinopec Corporation

- Klüber Lubrication

- Bel-Ray Company LLC

- SKF Group

- ENI S.p.A.

The global polyurea greases market is segmented as follows:

By Type

- Multipurpose

- Heavy Duty

By Application

- Manufacturing

- Construction

- Automotive

- Mining

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyurea greases are ash-free, metal soap-free, and created through polymerization reactions. They are made by combining different isocyanates and amines with natural or synthetic base oils.

The polyurea greases market is being driven by several factors, including performance demands in harsh operating conditions, the need to reduce maintenance costs & downtime, the growth of key end-use sectors, and many others.

The high production and procurement costs pose a major challenge to the industry's expansion.

Based on the application, the automotive segment is expected to dominate the industry growth during the projected period.

The increasing infrastructure development and growing R&D investment by the key market player are major impacting factors for the industry growth over the projected period.

According to the report, the global polyurea greases market size was worth around USD 1,690 million in 2024 and is predicted to grow to around USD 2,850 million by 2034.

The global polyurea greases market is expected to grow at a CAGR of 5.4% during the forecast period.

The global polyurea greases industry growth is expected to be driven by the North American region. It is currently the world’s highest-revenue-generating market, driven by the presence of major players and increasing demand from the end-use sector.

The global polyurea greases market is dominated by players like Phillips 66 Company, Chevron Corporation, Royal Dutch Shell plc, ExxonMobil Corporation, TOTAL Energies, BP p.l.c., FUCHS Group, Dow Inc., Idemitsu Kosan Co., Ltd., Petro-Canada Lubricants Inc., Sinopec Corporation, Klüber Lubrication, Bel-Ray Company, LLC, SKF Group, and ENI S.p.A., among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed