Polycrystalline Diamond PDC Market Size, Share, Trends, Growth 2034

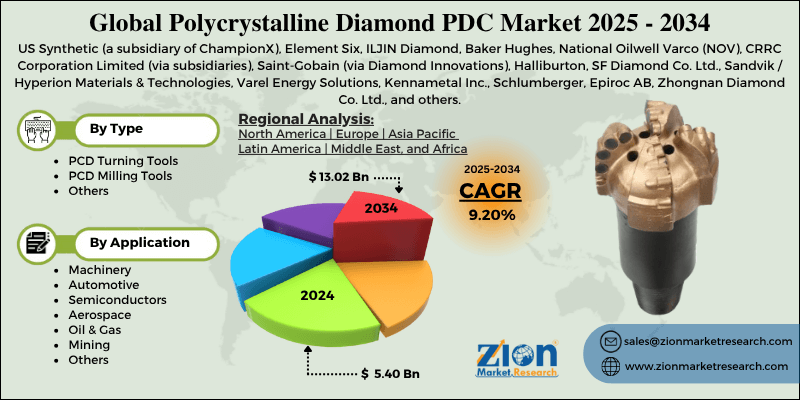

Polycrystalline Diamond PDC Market By Type (PCD Turning Tools, PCD Milling Tools, and Others), By Application (Machinery, Automotive, Semiconductors, Aerospace, Oil & Gas, Mining, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

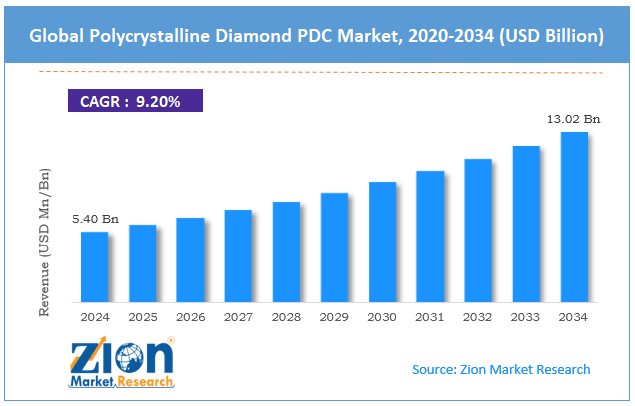

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.40 Billion | USD 13.02 Billion | 9.20% | 2024 |

Polycrystalline Diamond PDC Industry Perspective:

The global polycrystalline diamond PDC market size was worth around USD 5.40 billion in 2024 and is predicted to grow to around USD 13.02 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global polycrystalline diamond PDC market is estimated to grow annually at a CAGR of around 9.20% over the forecast period (2025-2034)

- In terms of revenue, the global polycrystalline diamond PDC market size was valued at around USD 5.40 billion in 2024 and is projected to reach USD 13.02 billion by 2034.

- The polycrystalline diamond market is projected to grow at a significant rate due to the growing expansion of the oil & gas sector.

- Based on the type, the PCD milling tools segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the oil & gas segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Polycrystalline Diamond PDC Market: Overview

A polycrystalline diamond compact (PDC) refers to a new-age synthetic diamond product used for cutting and machining challenging materials such as rocks, ceramics, composites, and non-ferrous metals. PDC is produced by sintering fine diamonds under extremely high temperature and pressure. The PDC production process further includes the use of a carbide substrate such as tungsten carbide. Synthetic diamond discs used in polycrystalline diamond compact are known as cutters. They are capable of cutting or shearing through a rock using an ongoing scraping motion. PDC is a highly wear-resistant and hard material as it leverages the toughness of carbide along with the hardness of diamond particles. A polycrystalline diamond compact generally consists of two layers, the top and bottom counterparts. The top consists of polycrystalline diamond, while the bottom is made of carbide substrate. The key applications of polycrystalline diamond compact are registered in the mining and oil & gas industries.

Additionally, the civil engineering and construction sectors are also significant revenue generators for the industry players. During the forecast period, more investments can be expected in the market as end-user demand continues to evolve. However, the high cost of PDC and competition from alternative solutions may impact the market growth rate.

Polycrystalline Diamond PDC Market Dynamics

Growth Drivers

Will the growing expansion of the oil & gas sector promote the polycrystalline diamond market revenue during the forecast period?

The global polycrystalline diamond PDC market is expected to grow due to the rising expansion of the oil & gas industry worldwide. PDC is a highly popular material used in oil drilling operations as it can be used against otherwise challenging elements. PDC cutters are extremely hard and wear-resistant. Hence, the material is considered an ideal choice for shearing through rock without any damage to the drilling equipment. In addition, the use of PDC for oil-related drilling can reduce the overall operational cost of the project, as the drilling solution is highly effective and requires minimal maintenance. The growing expansion of the oil & gas sector worldwide will promote increased use of polycrystalline diamond compact in the coming years. Energy demand across the globe is growing at an unprecedented rate. Factors such as rapid industrialization, urbanization, and globalization are fueling the energy consumption rate.

On the other hand, geopolitical relationships continue to evolve, affecting the smooth supply of oil and other energy resources. The ongoing Russia-Ukraine war, for instance, has led to extreme price volatility in the oil sector. These factors are working coherently to encourage market players to expand their business operations and fill the demand and supply gap in the industry.

Surging demand in the aviation and aerospace sectors is expected to promote revenue for PDC

Polycrystalline diamond compact is widely used in the thriving aviation and aerospace sectors. These industries have a high demand for precision tools as well as industrial equipment that can resist extreme environmental conditions, such as high pressure and temperature.

In addition to this, precision tools are essential while constructing an aircraft or a space shuttle to ensure that the structural integrity of the vehicles remains uncompromised. The increasing investments in the aviation sector, especially in the form of a rising number of commercial aircraft, will be essential for the overall use of PDC in the coming years. Moreover, the global polycrystalline diamond PDC market is expected to benefit as the space race among global economies continues to intensify.

Restraints

High cost of the material and supply chain volatility limit market expansion

The global polycrystalline diamond PDC industry is projected to be restricted due to the high cost of the material. Polycrystalline diamond compacts are produced using fine diamond and carbide substrates, among other elements. The use of rare and exclusive raw materials in PDC production increases the overall cost of the material.

Additionally, increasing supply chain volatility, especially regarding high-quality diamonds, may further impact the overall PDC production rate globally. PDC production is a complex process that requires skilled professionals. Lack of availability of sufficient experts also contributes to the overall price of the final good.

Opportunities

Rising launch of new and advanced PDC to generate growth opportunities for industry leaders

The global polycrystalline diamond PDC market is expected to generate growth opportunities due to the rising launch of next-generation materials with exceptional performance. For instance, in July 2022, Halliburton Company announced the launch of a new Hedron™ platform of fixed cutter polycrystalline diamond compact (PDC) drill bits. These solutions leverage the most recent technology and also offer the industry’s first customization process to meet the application-specific requirements of end-users.

As per the company claims, Hedron drill bits are the smartest and toughest solutions currently available in the market. In April 2021, ReedHycalog, the drilling and evaluation technology unit of NOV, launched ION+ polycrystalline diamond compact PDC cutter technology for the global market. The PDC solution remains sharp for a longer duration and also amplifies the penetration rate when dealing with extremely challenging formations. The company also offers an extensive range of cutter grades, promoting higher manufacturing pressures, refined diamond feeds, and non-planar interfaces.

Challenges

Do regulatory concerns and technical limitations challenge the polycrystalline diamond market growth trends?

The global polycrystalline diamond PDC industry is projected to be challenged by the regulatory concerns affecting the market growth trends. Drilling tools are subject to approval from regulatory bodies, which may impact smooth market expansion in the coming years.

In addition to this, PDCs have shown certain technical limitations, such as thermal degradation when exposed to temperatures over 700°C. Moreover, the considerable level of brittleness displayed by PDCs may also impact the overall market adoption rate in the future.

Polycrystalline Diamond PDC Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polycrystalline Diamond PDC Market |

| Market Size in 2024 | USD 5.40 Billion |

| Market Forecast in 2034 | USD 13.02 Billion |

| Growth Rate | CAGR of 9.20% |

| Number of Pages | 214 |

| Key Companies Covered | US Synthetic (a subsidiary of ChampionX), Element Six, ILJIN Diamond, Baker Hughes, National Oilwell Varco (NOV), CRRC Corporation Limited (via subsidiaries), Saint-Gobain (via Diamond Innovations), Halliburton, SF Diamond Co. Ltd., Sandvik / Hyperion Materials & Technologies, Varel Energy Solutions, Kennametal Inc., Schlumberger, Epiroc AB, Zhongnan Diamond Co. Ltd., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polycrystalline Diamond PDC Market: Segmentation

The global polycrystalline diamond PDC market is segmented based on type, application, and region.

Based on the type, the global market segments are PCD turning tools, PCD milling tools, and others. In 2024, more than 50% of the total revenue was led by PCD milling tools, as they have shown better attributes compared to their counterparts. The high wear resistance displayed by PCD milling tools makes them highly sought after among several end-user industries. Furthermore, they offer faster feed rates and machining velocities and have shorter cycle times.

Based on the application, the global market divisions are machinery, automotive, semiconductors, aerospace, oil & gas, mining, and others. In 2024, the oil and gas industry was the highest revenue-generating segment, accounting for nearly 59% of the total, due to higher demand for materials in rotary drilling across various reservoir types. PDC drilling bits limit overhead expenditure on drilling solutions due to their higher performance efficiency. Moreover, growing energy demands will create increased segmental revenue in the future.

Polycrystalline Diamond PDC Market: Regional Analysis

What factors will aid North America to take the lead in the polycrystalline diamond market?

The global polycrystalline diamond PDC market will be led by North America during the forecast period. The US is projected to dominate the regional market, primarily driven by the presence of key players in the country. The US is home to influential PDC producers such as Ulterra Drilling Technologies, Halliburton, and ReedHycalog, among many others. The increasing adoption of PDC by end-users in North America will drive regional revenue growth. Moreover, North America is rapidly expanding its oil & gas industry, with the US and Canada investing in domestic and international oil exploration projects, facilitating demand for next-generation PDCs.

Asia-Pacific is another thriving region in the polycrystalline diamond industry, with China leading the region. Growth in Asia-Pacific is the result of higher applications of the material in the automotive sector, as electric vehicle production in the region reaches new heights. Moreover, rapid advancements in the aerospace industries across China, India, and South Korea will promote improved use of PDCs in the coming years. Furthermore, polycrystalline diamond compacts are widely applied in the regional building & construction sector due to the higher precision offered by the tools.

Polycrystalline Diamond PDC Market: Competitive Analysis

The global polycrystalline diamond PDC market is led by players like:

- US Synthetic (a subsidiary of ChampionX)

- Element Six

- ILJIN Diamond

- Baker Hughes

- National Oilwell Varco (NOV)

- CRRC Corporation Limited (via subsidiaries)

- Saint-Gobain (via Diamond Innovations)

- Halliburton

- SF Diamond Co. Ltd.

- Sandvik / Hyperion Materials & Technologies

- Varel Energy Solutions

- Kennametal Inc.

- Schlumberger

- Epiroc AB

- Zhongnan Diamond Co. Ltd.

The global polycrystalline diamond PDC market is segmented as follows:

By Type

- PCD Turning Tools

- PCD Milling Tools

- Others

By Application

- Machinery

- Automotive

- Semiconductors

- Aerospace

- Oil & Gas

- Mining

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polycrystalline diamond compact (PDC) refers to a new-age synthetic diamond product used for cutting and machining challenging materials such as rocks, ceramics, composites, and non-ferrous metals.

The global polycrystalline diamond PDC market is expected to grow due to the rising expansion of the oil & gas industry worldwide.

According to study, the global polycrystalline diamond PDC market size was worth around USD 5.40 billion in 2024 and is predicted to grow to around USD 13.02 billion by 2034.

The CAGR value of the polycrystalline diamond PDC market is expected to be around 9.20% during 2025-2034.

The global polycrystalline diamond PDC market will be led by North America during the forecast period.

The global polycrystalline diamond PDC market is led by players like US Synthetic (a subsidiary of ChampionX), Element Six, ILJIN Diamond, Baker Hughes, National Oilwell Varco (NOV), CRRC Corporation Limited (via subsidiaries), Saint-Gobain (via Diamond Innovations), Halliburton, SF Diamond Co., Ltd., Sandvik / Hyperion Materials & Technologies, Varel Energy Solutions, Kennametal Inc., Schlumberger, Epiroc AB, and Zhongnan Diamond Co., Ltd.

The report explores crucial aspects of the polycrystalline diamond PDC market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed