Plastic Coating Market Size, Share, Growth Report 2032

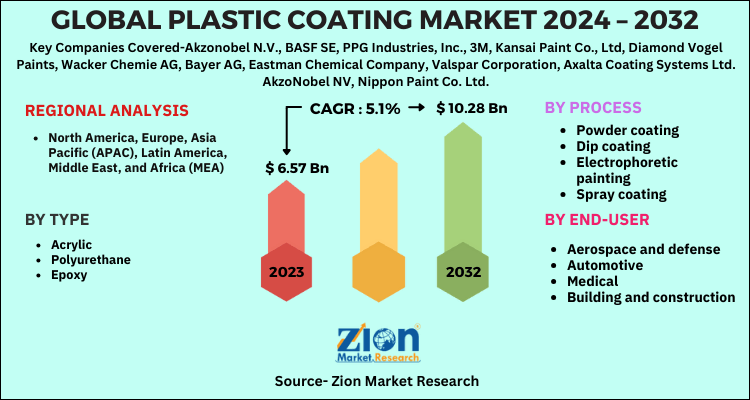

Plastic Coating Market By Type (Acrylic, Polyurethane, Epoxy, Others), By Process (Powder Coating, Dip Coating, Electrophoretic Painting, Spray Coating, Others), By End-User (Aerospace And Defense, Automotive, Medical, Building And Construction, Others), and By Region - Global Industry Analysis, Size, Share, Growth, Latest Trends, Regional Outlook, and Forecast 2024 - 2032

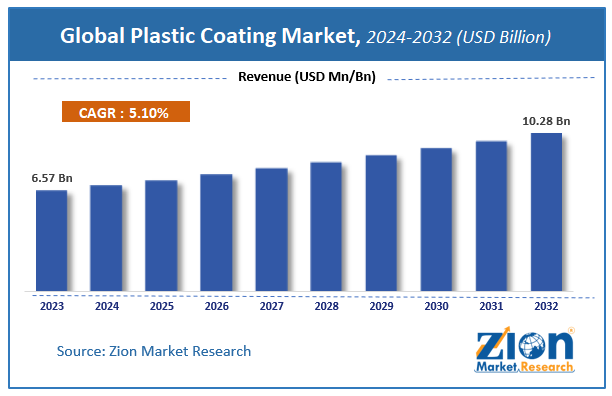

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.57 Billion | USD 10.28 Billion | 5.1% | 2023 |

Plastic Coating Market Insights

Zion Market Research has published a report on the global Plastic Coating Market, estimating its value at USD 6.57 Billion in 2023, with projections indicating that it will reach USD 10.28 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 5.1% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Plastic Coating Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Market Overview

Plastic coatings are utilized in various applications in several sectors like oil & gas, building & construction, automotive, electronics, aerospace, and defense. Some Functional uses of plastic coatings include corrosion inhibition, thermal resistance, abrasion resistance, chemical resistance, UV resistance, lubrication, mechanical property enhancement, surface finish, and esthetics. Implementation of an upper number of environmentally-friendly regulations is predicted to encourage manufacturers within the coatings industry to choose water-based plastic coatings. The plastic coating market has witnessed significant growth owing to rising demand for the industry. Moreover, the increasing demand from the development sector provides an enormous market opportunity for the key players operating within the plastic coatings market. However, the decline in the automotive industry is projected to hamper the general growth of the plastic coatings market.

With the presence of an outsized pool of participants, the worldwide plastic coating market is displaying a highly competitive business landscape. Players are focusing aggressively on innovation, also as on including advanced technologies in their existing products. Over the approaching years, they're also expected to require partnerships, and mergers & acquisitions as their key strategy for business development. During a major relief to the plastic coating market, researchers at the Georgia Institute of Technology found that when plant cellulose is combined with chitin, the hard substance or substrate that creates up clamshells of shellfish also as exoskeletons of lobsters, it produced recyclable plastic coatings.

The coating is the process in which the surface is covered using suitable substrate. Plastic coating possesses several properties such as resistance from corrosion and heat. The plastic coating is widely used in aerospace, building, and construction, medical and automobile industry. Plastic coatings are majorly used in the automobile industry or coating the battery trays, seat springs radiator grilles, brackets, door handles, filler pipes, and seat belt loops. The plastic coating is easy to use and cost efficient.

Growth Factors

Wide product demands from the automotive & construction sectors alongside user-friendly & features are anticipated to reinforce the plastic coating market trends over subsequent few years,” says the author of this study. aside from this, the plastic coating is more durable & efficient as compared to its traditional counterparts and has the power to reinforce the performance. Rapid urbanization witnessed in developing countries and high product demand in these economies is projected to spur the expansion of the plastic coating market over the following years. Adverse effects on the ecology due to VOC emissions, however, can hinder the progression of the plastic coating market within the near future. Nevertheless, current research activities on developing bio-based coatings are forecast to make lucrative growth avenues for the business over the next few years, thereby normalizing the impact of hindrances on the plastic coating market.

The increasing trend for eco-friendly coatings is likely to drive the plastic coating market. Moreover, rising demand from end-user industry such as automotive, building & construction is expected to trigger the growth of plastic coating market in the coming years. The plastic coating is more durable and efficient with enhanced performance as compared to conventional coating. Therefore, plastic coating finds its application in several industries such as in automotive industry which is expected to drive the market growth in the coming years. Growing industrial sector is expected to spur the growth of the market in the coming years. However, stringent regulations imposed by the governing bodies on VOC emissions may impede the growth of the plastic coating market. Nevertheless, ongoing research for bio-based coatings along with growing demand for plastic coating from the emerging countries is likely to positively impact on plastic coating market in the coming years.

Plastic Coating Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Coating Market |

| Market Size in 2023 | USD 6.57 Billion |

| Market Forecast in 2032 | USD 10.28 Billion |

| Growth Rate | CAGR of 5.1% |

| Number of Pages | 140 |

| Key Companies Covered | Akzonobel N.V., BASF SE, PPG Industries, Inc., 3M, Kansai Paint Co., Ltd, Diamond Vogel Paints, Wacker Chemie AG, Bayer AG, Eastman Chemical Company, Valspar Corporation, Axalta Coating Systems Ltd. AkzoNobel NV, Nippon Paint Co. Ltd. |

| Segments Covered | By Type, By end-user, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

The Plastic Coating market is segmented based on type, process, end-user, and region. Based on types, the plastic coating market can be segmented as acrylic, polyurethane, epoxy, and other types. The plastic coating includes the process such as powder coating, dip coating, electrophoretic painting, spray coating, and another process. Numerous end users for plastic coating are aerospace and defense, automotive, medical, building and construction, and other end-user.

Based on type, the polyurethane segment contributed the second-highest share to the plastic coatings market, in terms useful in 2018. For coating applications, a cross-linked film is preferred over thermoplastic urethanes. The polyurethane coating resins market is very hooked into the expansion of markets for automotive, floors, boats, and metal objects. Two features of polyurethane coating resins that are often considered disadvantages are its high cost, and handling of probably hazardous isocyanates that are used as curing agents for manufacturing. Superior performance and therefore the ability to cure at lower baking temperatures make polyurethane a serious plastic coating material in various end-use applications.

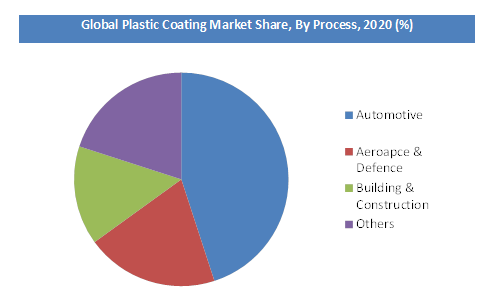

Major end-use industries for the plastic coatings market include automotive and aerospace & defense industries. Within the automotive industry, plastic coatings are utilized in battery trays, seat springs and brackets, radiator grilles, filler pipes, door handles, and safety belt loops, among others. Plastic coating provides various advantages, like impact, heat, resistance from corrosion, and wear. Additionally, it's cost-effective and straightforward to use. Increased use of plastic coatings in automotive manufacturing and growing concern regarding carbon emissions are predicted to boost the plastic coatings market during the forecast period.

On the basis of types, the plastic coating market can be segmented as acrylic, polyurethane, epoxy and other types. Polyurethane plastic coatings possess high strength, abrasion resistance, flexibility, and moisture resistance. Therefore, polyurethane plastic accounted for almost one-third of the total market share in 2015. The plastic coating includes processes such as powder coating, dip coating, electrophoretic painting, spray coating, and another process. Dip Coating is the largest revenue generating segment owing to the ease of application and cost effective coating. Numerous end users for plastic coating are aerospace and defense, automotive, medical, building and construction and another end user. Automotive was the leading segment of the plastic coating market in 2015 with significant market share. The plastic coating offers durability, functionality and performance benefits in the automotive industry.

Europe held the largest market share for plastic coating followed by North America in 2015. Escalating investment in Europe by the leading automotive manufacturers along with growing automotive OEM market is likely to boost the plastic coatings market in the forecast period. Asia Pacific is witnessing predominant growth for the plastic coating in recent times and is to gain traction in the forecast period. A large number of consumers from India and China along with rapidly growing coating industry, in turn, is expected to result in the growth of plastic coating market. Increasing government initiatives to uphold the development in the manufacturing sectors is expected to aid the growth of plastic coatings market in this region. Latin America is likely to witness decent growth in the forecast period. The Middle East and Africa is anticipated to exhibit moderate growth over the coming years.

Key Market Players & Competitive Landscape

Some of the global major players in the plastic coating are:

- Akzonobel N.V.

- BASF SE

- PPG Industries, Inc.

- 3M

- Kansai Paint Co., Ltd

- Diamond Vogel Paints

- Wacker Chemie AG

- Bayer AG

- Eastman Chemical Company

- Valspar Corporation

- Axalta Coating Systems Ltd.

- AkzoNobel NV

- Nippon Paint Co. Ltd. among others.

The global Plastic Coating market is segmented as follows:

By Type

- Acrylic

- Polyurethane

- Epoxy

- Others

By Process

- Powder coating

- Dip coating

- Electrophoretic painting

- Spray coating

- Others

By End-User

- Aerospace and defense

- Automotive

- Medical

- Building and construction

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed