Packaging Automation Market Size, Share, Trends, Growth and Forecast 2032

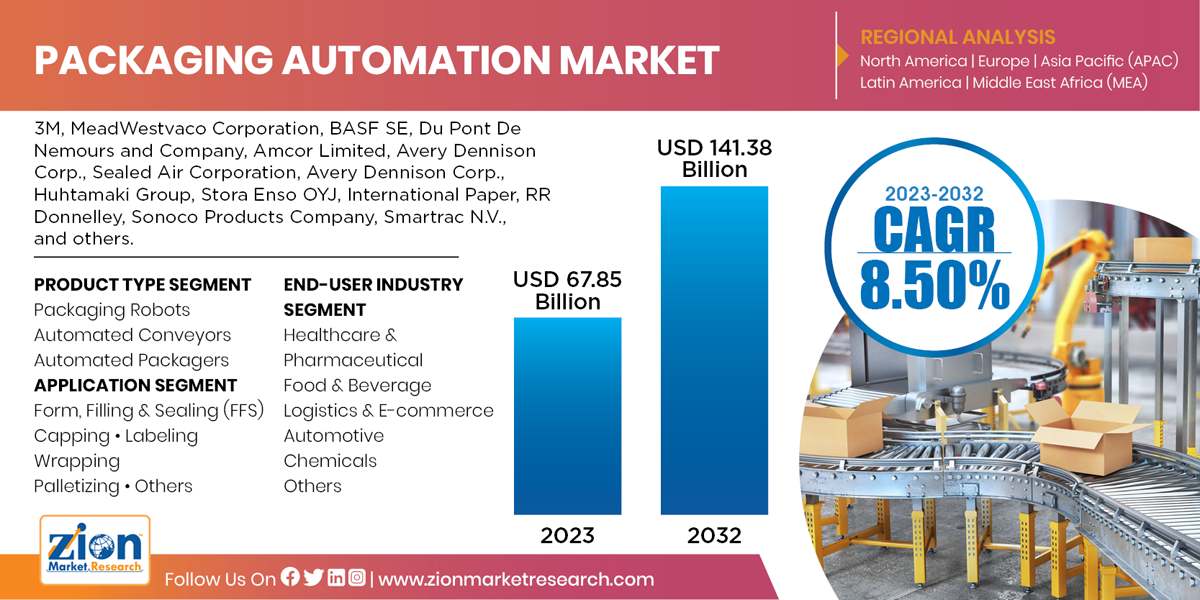

Packaging Automation Market by Product Type (Packaging Robots, Automated Conveyors, and Automated Packagers), by Application (Form, Filling & Sealing (FFS), Capping, Labeling, Wrapping, Palletizing, and Others), and by End-User Industry (Healthcare & Pharmaceutical, Food & Beverage, Logistics & E-commerce, Automotive, Chemicals, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 67.85 Billion | USD 141.38 Billion | 8.50% | 2023 |

Packaging Automation Industry Perspective:

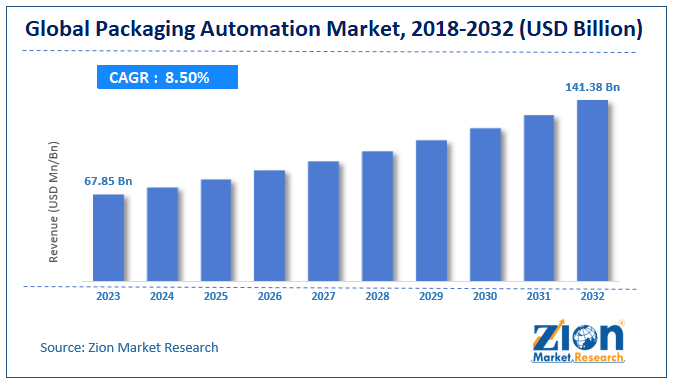

The global Packaging Automation Market size was worth around USD 67.85 Billion in 2023 and is predicted to grow to around USD 141.38 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.50% between 2024 and 2032. The report covers forecast and analysis for the packaging automation market on a global and regional level. The study provides historical data from 2017 to 2023 along with a forecast from 2023 to 2032 based on revenue (USD Billion).

Key Insights

- As per the analysis shared by our research analyst, the packaging automation market is anticipated to grow at a CAGR of 8.50% during the forecast period.

- The global packaging automation market was estimated to be worth approximately USD 67.85 billion in 2023 and is projected to reach a value of USD 141.38 billion by 2032.

- The growth of the packaging automation market is being driven by increasing demand for faster, more efficient, and cost-effective packaging solutions across industries such as food & beverages, pharmaceuticals, cosmetics, and consumer goods.

- Based on the product type, the packaging robots segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the form, filling & sealing (FFS) segment is projected to swipe the largest market share.

- In terms of end-user industry, the healthcare & pharmaceutical segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Packaging Automation Market: Overview

Packaging plays a key role in the marketing of a product, as it is one of the most significant factors that determine the sales of the product. Advancement in packaging automated solutions has been emerging as an important factor due to rising popularity of shelf service marketing which results in effective & speedy packaging process by manufacturers with minimal manual interventions. These solutions have major applications in wide range of packaging processes such as product shipment, product sorting, product storage, and product handling. Growing demand from packaging manufacturers to speed up packaging process to meet consumer demands is the major factor expected to drive the packaging automation market growth over the forecast period.

Automation is mostly used in the packaging industry to improve labor productivity, ensure the quality of packaging, and also to decrease storage and packaging cost. Safety regulations are the foremost concern among manufacturers particularly in the food and beverage and healthcare industries. Regulations associated with safety can also adhere to the developing applications which include automated reporting capabilities that aid in generating brief reports for each line of packaging. The packaging also helps to protect the products from dust, physical damage, and various other factors. In order to gain maximum profits, cost-cutting is a major factor in the light of intense competition coupled with increased globalization of manufacturing. However, the requirement of high level of maintenance and high capital cost for automated packaging systems is expected to restrain industry growth in the future years.

The study includes drivers and restraints for the packaging automation market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the packaging automation market on a global level.

In order to give the users of this report a comprehensive view on the packaging automation market, we have included competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein product type segment, application segment, and end-user industry segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new technology launch, agreements, partnerships, collaborations & joint ventures, research & development, technology and regional expansion of major participants involved in the market on the global and regional basis. Moreover, the study covers price trend analysis, product type portfolio of various companies according to the region.

Packaging Automation Market: Segmentation

The study provides a decisive view on the packaging automation market by segmenting the market based on product type, application, end-user industry, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2018 to 2024.

Based on product type, the market is segmented into packaging robots, automated conveyors, and automated packagers.

On the basis of application, the market is segmented into form, filling & sealing (FFS), capping, labeling, wrapping, palletizing, and others.

Based on end-user industry, the market is segmented into healthcare & pharmaceutical, food & beverage, logistics & e-commerce, automotive, chemicals, and others.

Recent Development

- In August 2024, the IMA Group acquired Sarong's Packaging Machinery and Packaging Materials divisions. This strategic acquisition created IMA Sarong, a new entity that significantly strengthened IMA's presence in the pharma and consumer-goods sectors by broadening its product range and service reach, fully integrating packaging machinery and materials under one roof.

- In March 2024, Martin Automatic announced the development of automated converting equipment. The new equipment directly addresses industry challenges like workforce shortages and high-quality demands by reducing the need for manual labor and minimizing production errors, thereby ensuring greater operational flexibility for customers.

- In March 2024, Tension Packaging and Automation announced the upcoming launch of its fitPACK 500 right-sized packaging system. The new system, unveiled at MODEX 2024, is designed to significantly enhance efficiency, reduce waste, and cut costs for e-commerce and pharmacy operations by creating right-sized packaging.

- In May 2025, ProMach acquired DJS Systems. This acquisition expanded ProMach's market reach into high-speed automation solutions for the disposable food packaging industry.

Packaging Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaging Automation Market Size Report |

| Market Size in 2023 | USD 67.85 Billion |

| Market Forecast in 2032 | USD 141.38 Billion |

| Growth Rate | CAGR of 8.50% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | 3M, MeadWestvaco Corporation, BASF SE, Du Pont De Nemours and Company, Amcor Limited, Avery Dennison Corp., Sealed Air Corporation, Avery Dennison Corp., Huhtamaki Group, Stora Enso OYJ, International Paper, RR Donnelley, Sonoco Products Company, Smartrac N.V., and others. |

| Segments Covered | By Product Type ,By Application , By End-User Industry, and By region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaging Automation Market: Regional Analysis

The regional segmentation includes the historic and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This segmentation includes demand for packaging automation market based on all segments in all the regions and countries.

Europe held major revenue share of the global packaging automation market in 2023 and the region is anticipated to continue with its regional supremacy over the forecast period. The growth of this regional market is attributed due to the presence of major companies in the region that are engaged in offering user-friendly, cost-effective, and advanced packaging automation solutions. The Asia Pacific is projected to provide significant opportunities for packaging automation. The region is the hub for food and beverages, healthcare, and automotive industries, which will increase demand for advanced packaging solutions.

Key Market Players & Competitive Landscape

The report also includes detailed profiles of end players such as -

- 3M

- MeadWestvaco Corporation

- BASF SE

- Du Pont De Nemours and Company

- Amcor Limited

- Avery Dennison Corp.

- Sealed Air Corporation

- Avery Dennison Corp.

- Huhtamaki Group

- Stora Enso OYJ

- International Paper

- RR Donnelley

- Sonoco Products Company

- Smartrac N.V.

- others.

This report segments the global packaging automation market as follows:

Global Packaging Automation Market: Product Type Segment Analysis

- Packaging Robots

- Automated Conveyors

- Automated Packagers

Global Packaging Automation Market: Application Segment Analysis

- Form, Filling & Sealing (FFS)

- Capping

- Labeling

- Wrapping

- Palletizing

- Others

Global Packaging Automation Market: End-User Industry Segment Analysis

- Healthcare & Pharmaceutical

- Food & Beverage

- Logistics & E-commerce

- Automotive

- Chemicals

- Others

Global Packaging Automation Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Packaging Automation Market size was worth around USD 67.85 Billion in 2023 and is predicted to grow to around USD 141.38 Billion by 2032

compound annual growth rate (CAGR) of roughly 8.50% between 2024 and 2032

The largest share of the Packaging Automation Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

3M, MeadWestvaco Corporation, BASF SE, Du Pont De Nemours and Company, Amcor Limited, Avery Dennison Corp., Sealed Air Corporation, Avery Dennison Corp., Huhtamaki Group, Stora Enso OYJ, International Paper, RR Donnelley, Sonoco Products Company, Smartrac N.V., and others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed