Oral Antidiabetic Drugs Market Size, Share, And Growth Report 2032

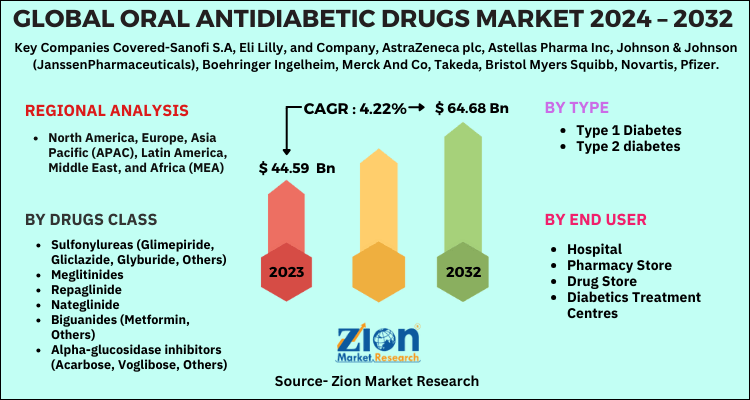

Oral Antidiabetic Drugs Market By Drugs Class (Sulfonylureas (Glimepiride, Gliclazide, Glyburide, Others), Meglitinides, Repaglinide, Nateglinide, Biguanides (Metformin, Others), Alpha-glucosidase inhibitors (Acarbose, Voglibose, Others), Others, By Type (Type 1 Diabetes, Type 2 diabetes), By End User (Hospital, Pharmacy Store, Drug Store, Diabetics Treatment Centres, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

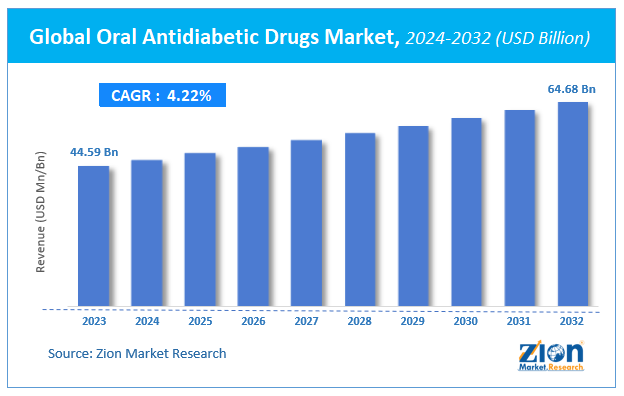

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 44.59 Billion | USD 64.68 Billion | 4.22% | 2023 |

Oral Antidiabetic Drugs Market Size

According to a report from Zion Market Research, the global Oral Antidiabetic Drugs Market was valued at USD 44.59 Billion in 2023 and is projected to hit USD 64.68 Billion by 2032, with a compound annual growth rate (CAGR) of 4.22% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Oral Antidiabetic Drugs Market industry over the next decade.

Oral antidiabetic Drugs Market Overview

Diabetes is a chronic disease that occurs when the pancreas does not produce enough insulin or when the body cannot effectively use the insulin. Hyperglycemia, or raised blood sugar, is a common effect of uncontrolled diabetes and over time leads to serious damage to many of the body's systems, especially the nerves and blood vessels. Owing to the presence of a large base of participants the Oral antidiabetic drugs Market is expected to boost the Market. Some of the major players in the oral antidiabetic drugs market are Sanofi S.A., Eli Lilly, and Company, AstraZeneca plc, Astellas Pharma Inc., Johnson & Johnson (JanssenPharmaceuticals), Boehringer Ingelheim, Merck And Co., Takeda, Bristol Myers Squibb, Novartis, Pfizer. Nowadays, due to the innovation of new drugs and advanced technology, and ease to use, it is expected to enhance the growth of the market.

COVID-19 Impact Analysis

Coronavirus viral spreading (COVID-19) has positively impacted the worldwide demand for the Oral antidiabetic drugs Market. Owing to the COVID-19 lockdown in various countries, the demand for drugs for chronic diseases have been increased. The people having medications for chronic diseases have managed to store the drugs for overall the period of lockdown. Due to the COVID-19 lockdown, the physical activities of peoples have decreased which have led to an increase in Diabetes, obesity, and various diseases. Hence the base of the participants of diabetic patients is increasing which can be the diver for the Oral antidiabetic drugs Market over the forecast period.

Oral Antidiabetic Drugs Market: Growth Factors

According to the World Health Organization (WHO), the rising number of incidences of diabetes is one of the important drivers for the diabetes drug market. In addition, research & development initiatives, technological advancements, and improved healthcare facilities are the key factors fueling the growth of the market. Changing lifestyle and the adoption of fast food that has resulted in the high prevalence of obesity is expected to fuel the demand of the market. Owing to the presence of a large base of participants the Oral antidiabetic drugs Market is expected to boost the market. Owing to the busy lifestyle and rising demand for fast-food is resulting diabetes is expected to Increase the demand for anti-diabetic drugs over the forecast period. Also, increasing cases of type2 diabetes among the population due to lack of physical activity is predicted to increase the demand for anti-diabetic drugs. The growing use of artificial sweeteners Such as aspartame in food materials, as a substitute for sugar, is anticipated to have a positive impact on the growth of the Oral antidiabetic drugs Market.

However, a stringent regulatory environment and a time-consuming approval process are the major restraining factors that are hampering the growth of the diabetes drug market. Due to the high cost, a large population cannot afford the treatment and is depending on generic drugs, ultimately affecting the growth of the overall market.

Oral Antidiabetic Drugs Market: Segmentation

Based on the oral drugs, the market is segmented into alpha-glucosidase inhibitors, biguanides, bile acid sequestrants, DPP-4 inhibitors, meglitinides and d-phenylalanine derivatives, sulfonylureas, and others., Biguanides is expected to hold a major market share owing to their help to lower blood glucose levels throughout the day.

On the basis of type, the market is segmented into type 1diabetes and type 2 diabetes. Type 2 is expected to hold a major market share owing to 90 to 95% of people suffering from type 2diabetes. Owing to the presence of a large base of participants this segment is expected to dominate the oral antidiabetic drugs market.

Oral Antidiabetic Drugs Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Oral Antidiabetic Drugs Market |

| Market Size in 2023 | USD 44.59 Billion |

| Market Forecast in 2032 | USD 64.68 Billion |

| Growth Rate | CAGR of 4.22% |

| Number of Pages | 150 |

| Key Companies Covered | Sanofi S.A, Eli Lilly, and Company, AstraZeneca plc, Astellas Pharma Inc, Johnson & Johnson (JanssenPharmaceuticals), Boehringer Ingelheim, Merck And Co, Takeda, Bristol Myers Squibb, Novartis, Pfizer |

| Segments Covered | By Drugs Class, By Type, By End User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

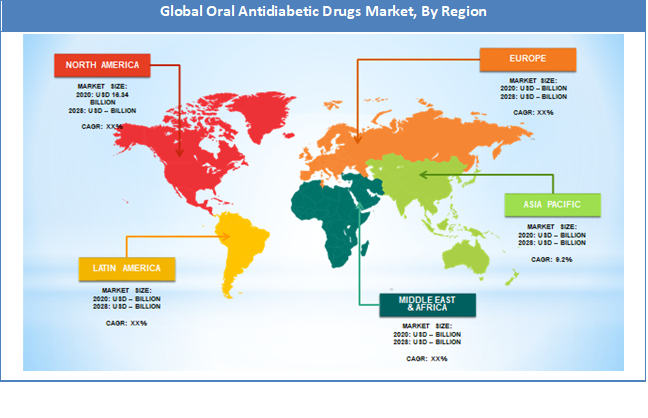

Oral Antidiabetic Drugs Market: Regional Analysis

North America is expected to hold a major market share in the global diabetes care market. This is attributed to, the increasing prevalence of genetic and chronic diseases. Furthermore increasing population of obesity is a leading cause of diabetes prevalence is boosting the growth of the market.

Europe is expected to second leading region in the global diabetes care market. This is attributed to the increasing prevalence of diabetes diseases on account of increasing environmental pollution and genetic disorders.

The Asia Pacific is expected to fastest growing market due to the presence of huge opportunities for the development of the market. This is attributed to the increasing prevalence of genetic diseases driving the growth of the diabetes care market. Additionally, government support for diabetes care patients is supporting the growth of the diabetes care market. Constructive government schemes such as Ayushman Bharat-National Health Protection Mission, and Indradhanus will also contribute to driving the demand; ultimately contributing to the market growth.

Oral Antidiabetic Drugs Market: Competitive Players

Some of the key players in the oral antidiabetic drugs market are,

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca plc

- Astellas Pharma Inc.

- Johnson & Johnson (Janssen Pharmaceuticals)

- Boehringer Ingelheim

- Merck And Co.

- Takeda

- Bristol Myers Squibb

- Novartis

- Pfizer

The Oral antidiabetic drugs Market is segmented as follows:

By Drugs Class

- Sulfonylureas (Glimepiride, Gliclazide, Glyburide, Others)

- Meglitinides

- Repaglinide

- Nateglinide

- Biguanides (Metformin, Others)

- Alpha-glucosidase inhibitors (Acarbose, Voglibose, Others)

- Others

By Type

- Type 1 Diabetes

- Type 2 diabetes

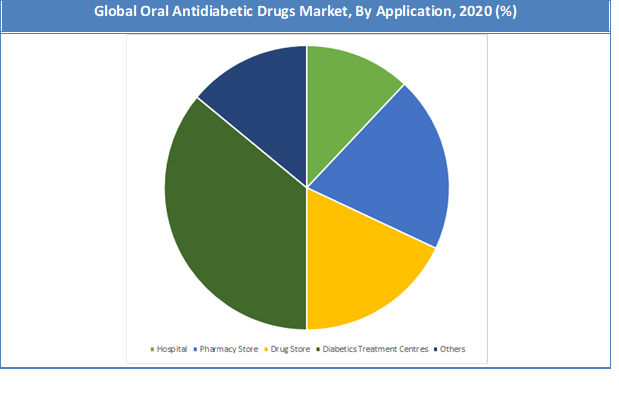

By End User

- Hospital

- Pharmacy Store

- Drug Store

- Diabetics Treatment Centres

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Oral antidiabetic drugs are medications taken by mouth to help manage blood sugar levels in individuals with type 2 diabetes. They work through various mechanisms, such as increasing insulin sensitivity, reducing glucose production in the liver, or enhancing insulin secretion.

According to study, the Oral Antidiabetic Drugs Market size was worth around USD 44.59 billion in 2023 and is predicted to grow to around USD 64.68 billion by 2032.

The CAGR value of Oral Antidiabetic Drugs Market is expected to be around 4.22% during 2024-2032.

North America has been leading the Oral Antidiabetic Drugs Market and is anticipated to continue on the dominant position in the years to come.

The Oral Antidiabetic Drugs Market is led by players like Sanofi S.A, Eli Lilly, and Company, AstraZeneca plc, Astellas Pharma Inc, Johnson & Johnson (JanssenPharmaceuticals), Boehringer Ingelheim, Merck And Co, Takeda, Bristol Myers Squibb, Novartis, Pfizer.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed