Molded Fiber Pulp Packaging Market Size, Share, Growth & Forecast 2034

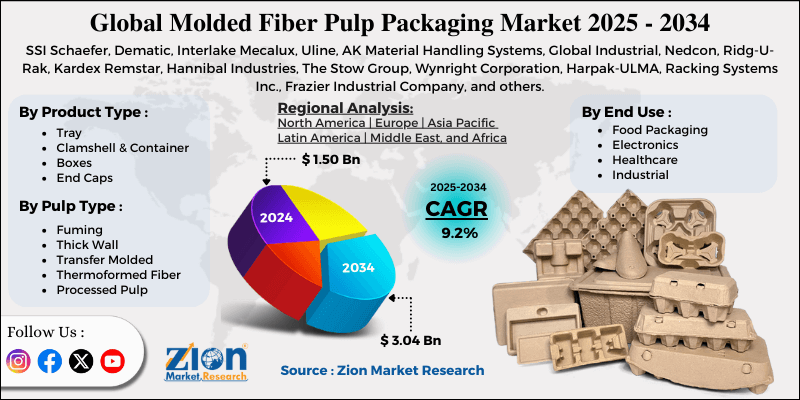

Molded Fiber Pulp Packaging Market By Product Type (Tray, Clamshell & Container, Boxes, End Caps, and Others), By Pulp Type (Fuming, Thick Wall, Transfer Molded, Thermoformed Fiber, Processed Pulp, and Others), By End-Use (Food Packaging, Electronics, Healthcare, Industrial, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

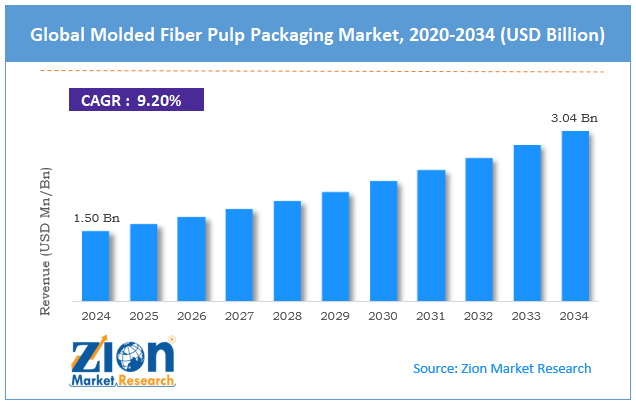

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.50 Billion | USD 3.04 Billion | 9.20% | 2024 |

Molded Fiber Pulp Packaging Industry Perspective:

The global molded fiber pulp packaging market size was approximately USD 1.50 billion in 2024 and is projected to reach around USD 3.04 billion by 2034, with a compound annual growth rate (CAGR) of approximately 9.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global molded fiber pulp packaging market is estimated to grow annually at a CAGR of around 9.20% over the forecast period (2025-2034)

- In terms of revenue, the global molded fiber pulp packaging market size was valued at around USD 1.50 billion in 2024 and is projected to reach USD 3.04 billion by 2034.

- The molded fiber pulp packaging market is projected to grow significantly due to increasing government regulations on plastic usage, the growth of the food and beverage industry, and the rise of the food delivery and e-commerce sectors.

- Based on product type, the tray segment is expected to lead the market, while the clamshell & container segment is expected to grow considerably.

- Based on pulp type, the transfer-molded segment is the dominant segment, while the thermoformed fiber segment is projected to experience significant revenue growth over the forecast period.

- Based on end use, the food packaging segment is expected to lead the market compared to the electronics segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Molded Fiber Pulp Packaging Market: Overview

Molded fiber pulp packaging is an environmentally friendly packaging solution made from recycled paper, natural fibers, or cardboard. It is known for being lightweight, biodegradable, and cost-efficient, serving as an ecological alternative to plastic packaging, which supports rising environmental regulations and user demand for sustainable packaging. The global molded fiber pulp packaging market is expected to expand rapidly, driven by the increasing demand for sustainable packaging, the growth of the food delivery sector, and the high water and energy consumption associated with production. Consumers are increasingly opting for environmentally friendly packaging options, particularly in the food, retail, and beverage sectors.

According to surveys, the largest share of buyers is willing to pay more for green packaging solutions. Moreover, the speedy growth of online food delivery and e-commerce has elevated the need for sustainable and secure packaging. Molded fiber pulp packaging provides protection and durability during transport while reducing its ecological impact. Although sustainable in end-use, molded fiber pulp manufacturing requires substantial amounts of water and energy, which raises concerns about its environmental impact during production. This may restrict companies focused on overall sustainability.

Despite the growth, the global market is impeded by factors such as restricted water resistance and varying prices of raw materials. Unlike plastic, molded fiber pulp is exposed to absorbing moisture unless treated with coatings. This limits its use for packaging highly perishable or liquid-based products. Producers need to invest in additional treatment, increasing costs. Additionally, the cost of recycled paper, a key input for molded fiber packaging, varies based on global recycling trends. Unexpected price hikes may raise product costs for manufacturers. This volatility offers challenges in profitability and pricing.

Nonetheless, the global molded fiber pulp packaging industry stands to gain from several key opportunities, including the increasing prominence of customized and premium packaging, as well as its adoption in the pharmaceutical and healthcare sectors. Brands are demanding packaging that conveys luxury and enhances the user experience. Molded fiber packaging can be customized with textures, shapes, and logos to attract premium markets. This trend presents growth opportunities in the electronics, cosmetics, and gifting sectors.

Additionally, medical devices and pharmaceutical products need protective and sterile packaging. Molded fiber pulp products offer environmentally friendly and cushioning disposal, increasing their suitability in the healthcare sector. Rising healthcare investments worldwide further fuel the demand.

Molded Fiber Pulp Packaging Market: Growth Drivers

How is the molded fiber pulp packaging market driven by technology improvements & production scalability?

Technological advancements in molded fiber production processes have enhanced both cost efficiency and product quality. Modern techniques, including enhanced mold precision, water-resistant coatings, and automated drying, have expanded the application potential of molded fiber packaging.

Investments from companies like UFP Technologies and Huhtamaki in high-capacity manufacturing plants underscore the push towards ecology. The incorporation of AI-based quality control and CNC mold fabrication has also fueled customization for the brands. These advancements have reduced per-unit costs and lead times, making molded fiber packaging a competitive substitute to conventional plastic solutions in mass production.

Foodservice & single-use food packaging demand notably propel the market growth

The evolving foodservice industry, comprising QSRs and online food delivery platforms, is a significant driver of the molded fiber pulp packaging market. With rising bans on plastic food containers in India, the EU, and a majority of the U.S. states, molded fiber trays, clamshells, and plates are gaining prominence.

Additionally, consumer surveys indicate that more than 65% of users prefer environmentally friendly packaging in the food service sector. Recent introductions of compostable molded fiber bowls by top QSR brands signify market adoption.

Molded Fiber Pulp Packaging Market: Restraints

Raw material availability and supply chain constraints hamper the market progress

The molded fiber pulp sector is primarily dependent on the availability of raw materials, including virgin pulp and recycled paper. Growing global pulp prices and variations in paper waste collection rates offer instability in production costs.

For example, in 2023, worldwide pulp prices increased by 15-20% due to supply chain disturbances and rising demand from Asia, which impacted profit margins for molded fiber producers. Furthermore, regional scarcities of high-class recovered paper further strain supply consistency.

Molded Fiber Pulp Packaging Market: Opportunities

How does the growing adoption of healthcare and medical devices create promising avenues for growth in the molded fiber pulp packaging industry?

Healthcare packaging is emerging as a lucrative domain for molded fiber pulp due to its safety and recyclability. Single-use molded pulp trays, sterile packaging solutions, and diagnostic kits are explored as substitutes for plastics. The COVID-19 pandemic has spurred the adoption of sustainable practices in the medical sector, with a majority of hospitals implementing environmentally friendly packaging policies. Recent capital investments by leading players in the development of molded fiber medical trays indicate a robust impetus in this segment, impacting the molded fiber pulp packaging industry.

Molded Fiber Pulp Packaging Market: Challenges

How high an initial investment for large-scale automation restricts the growth of the molded fiber pulp packaging market?

Modern molded fiber production facilities require automated drying systems, robotics, and advanced molds, which entail significant capital expenditures. Setting up a large-scale plant can cost between USD 3 million and USD 5 million, increasing the challenges for mid-sized and small players to enter the market. On the contrary, plastic packaging infrastructure is cost-effective and widely available. Without government incentives or significant investments, achieving cost competitiveness at scale remains a key challenge for small manufacturers and new entrants.

Molded Fiber Pulp Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Molded Fiber Pulp Packaging Market |

| Market Size in 2024 | USD 1.50 Billion |

| Market Forecast in 2034 | USD 3.04 Billion |

| Growth Rate | CAGR of 9.2% |

| Number of Pages | 214 |

| Key Companies Covered | SSI Schaefer, Dematic, Interlake Mecalux, Uline, AK Material Handling Systems, Global Industrial, Nedcon, Ridg-U-Rak, Kardex Remstar, Hannibal Industries, The Stow Group, Wynright Corporation, Harpak-ULMA, Racking Systems Inc., Frazier Industrial Company, and others. |

| Segments Covered | By Product Type, By Pulp Type, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Molded Fiber Pulp Packaging Market: Segmentation

The global molded fiber pulp packaging market is segmented by product type, pulp type, end use, and region.

Based on product type, the global molded fiber pulp packaging industry is divided into tray, clamshell & container, boxes, end caps, and others. The tray segment held a dominant share of the market, as it is extensively used for egg cartons, food serving applications, and fruit trays. These applications are attributed to their eco-friendliness and durability. The food & beverage sector highly depends on trays for safe storage and transport of perishable products. Their low price and compliance with sustainability norms make them a popular choice worldwide.

Based on pulp type, the global molded fiber pulp packaging market is segmented as fuming, thick wall, transfer molded, thermoformed fiber, processed pulp, and others. The transfer molded segment holds a leadership position in the market due to its extensive use in packaging electronics, eggs, industrial products, and fruits. It offers optimal strength and finish at an affordable price, increasing its preference and demand in food and beverage applications. The versatility of this pulp enables it to cater to diverse sectors, which keeps its demand consistent and substantial. Its eco-friendly nature and recyclability strengthen its industry dominance.

Based on end use, the global market is segmented into food packaging, electronics, healthcare, industrial, and others. The food packaging segment captures the maximum share of the market due to its broader use in beverage trays, egg cartons, clamshells, and takeaway containers. The growing demand for compostable and sustainable solutions in QSRs, retail packaging, and food delivery fuels its growth. Rising bans on plastic packaging worldwide also add to the segmental dominance.

Molded Fiber Pulp Packaging Market: Regional Analysis

What gives Asia Pacific a competitive edge in the global Molded Fiber Pulp Packaging Market?

The Asia Pacific is expected to maintain its leading position in the global molded fiber pulp packaging market, driven by its large consumer base, increasing environmental regulations, and the rapid expansion of food delivery services. APAC holds the leading population, fueling huge demand for food packaging solutions. Economies like India and China account for more than 40% of worldwide food consumption, thus increasing the need for sustainable packaging. This consumer demand substantially supports the dominance of molded fiber pulp products in the APAC region.

Furthermore, governments in the region, including those of India, China, and Indonesia, have implemented stringent bans on disposable plastics. These regulations serve as a central driving force in the region. Additionally, the APAC region is the fastest-growing e-commerce market. Platforms like Flipkart, Alibaba, and Shopee are surging the demand for sustainable protective packaging. The progressing food delivery market, estimated at USD 91 billion in China alone, drives the adoption.

Europe ranks as the second-largest region in the global molded fiber pulp packaging industry, driven by high consumer demand for sustainable products, strong adoption in the food & beverage sector, and government support for circular economy initiatives. European consumers are highly conscious of sustainability, with 72% willing to pay more for eco-friendly packaging according to Eurostat. This preference drives major retail and food brands to adopt molded fiber packaging. Growing awareness of climate impact is strengthening the market in countries such as Germany, France, and the UK.

Additionally, the region's growing food service sector is a key contributor to the adoption of molded fiber packaging. Takeaways and quick-service restaurants in nations like Spain and Italy are replacing plastic with fiber-based containers and trays. This trend ranks the region as a key driver of the industry. The European Union's Circular Economy Action Plan and Green Deal encourage the use of biodegradable and recyclable packaging. These initiatives aim to make all packaging recyclable or reusable by 2030, supporting the use of molded fiber pulp packaging.

Molded Fiber Pulp Packaging Market: Competitive Analysis

The leading players in the global molded fiber pulp packaging market are:

- SSI Schaefer

- Dematic

- Interlake Mecalux

- Uline

- AK Material Handling Systems

- Global Industrial

- Nedcon

- Ridg-U-Rak

- Kardex Remstar

- Hannibal Industries

- The Stow Group

- Wynright Corporation

- Harpak-ULMA

- Racking Systems Inc.

- Frazier Industrial Company

Molded Fiber Pulp Packaging Market: Key Market Trends

Adoption of grease-proof and water-resistant coatings:

Manufacturers are launching bio-based coatings to enhance the grease and water resistance of molded fiber packaging. This advancement increases its application in beverages, liquid food, and oily products, which were previously led by plastics. This trend is vital for penetrating the QSR and ready-to-eat meals segments.

Growing use in electronics and e-commerce packaging:

The growth in fragile electronics deliveries and e-commerce shipments has elevated the demand for sustainable protective packaging. Molded fiber pulp offers advanced cushioning, replacing traditional plastic foams such as expanded polystyrene. This trend supports sustainability commitments by technology companies and online retailers.

The global molded fiber pulp packaging market is segmented as follows:

By Product Type

- Tray

- Clamshell & Container

- Boxes

- End Caps

- Others

By Pulp Type

- Fuming

- Thick Wall

- Transfer Molded

- Thermoformed Fiber

- Processed Pulp

- Others

By End Use

- Food Packaging

- Electronics

- Healthcare

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Molded fiber pulp packaging is an environmentally friendly packaging solution made from recycled paper, natural fibers, or cardboard. It is known for being lightweight, biodegradable, and cost-efficient, serving as an ecological alternative to plastic packaging, which supports rising environmental regulations and user demand for sustainable packaging.

The global molded fiber pulp packaging market is projected to grow due to growing adoption of molded fiber in protective packaging, advancements in pulp molding processes, and the rising demand for biodegradable and recyclable packaging materials.

According to study, the global molded fiber pulp packaging market size was worth around USD 1.50 billion in 2024 and is predicted to grow to around USD 3.04 billion by 2034.

The CAGR value of the molded fiber pulp packaging market is expected to be approximately 9.20% from 2025 to 2034.

Significant growth opportunities in the fiber pulp packaging market will come from e-commerce, food packaging, healthcare, electronics, and quick-service restaurants (QSR) applications.

Technological advancements in precision molding, thermoforming, and bio-based coatings are enhancing the aesthetics, durability, and moisture resistance of fiber pulp packaging, driving its broader adoption.

Market trends and consumer preferences are shifting toward premium, eco-friendly, and customizable packaging solutions, with a substantial demand for sustainable alternatives to plastic across the electronics, e-commerce, and food sectors.

Asia Pacific is expected to lead the global molded fiber pulp packaging market during the forecast period.

The key players profiled in the global molded fiber pulp packaging market include SSI Schaefer, Dematic, Interlake Mecalux, Uline, AK Material Handling Systems, Global Industrial, Nedcon, Ridg-U-Rak, Kardex Remstar, Hannibal Industries, The Stow Group, Wynright Corporation, Harpak-ULMA, Racking Systems Inc., and Frazier Industrial Company.

The report examines key aspects of the molded fiber pulp packaging market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed