Milk Thistle Market Size, Share, Trends, Growth & Forecast 2034

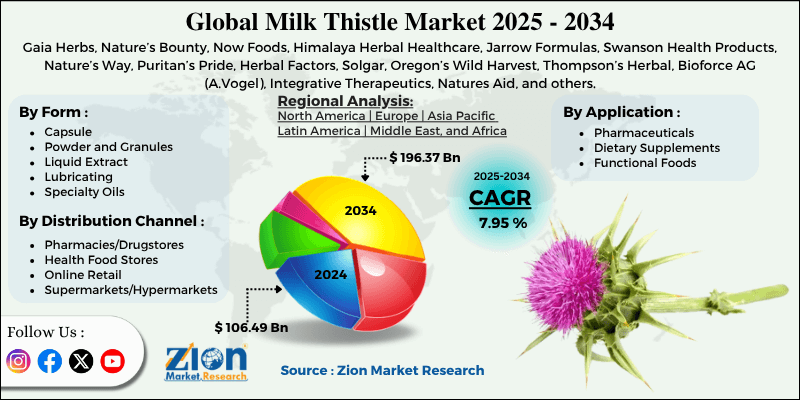

Milk Thistle Market By Form (Capsule, Powder and Granules, Liquid Extract, Lubricating, Specialty Oils, and Others), By Application (Pharmaceuticals, Dietary Supplements, Functional Foods, and Others), By Distribution Channel (Pharmacies/Drugstores, Health Food Stores, Online Retail, Supermarkets/Hypermarkets), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

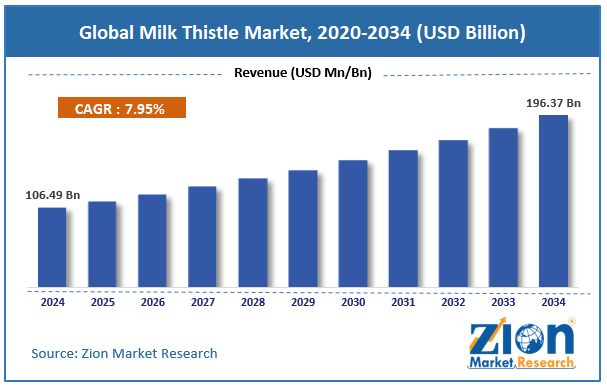

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 106.49 Billion | USD 196.37 Billion | 7.95% | 2024 |

Milk Thistle Industry Perspective:

The global milk thistle market size was approximately USD 106.49 billion in 2024 and is projected to reach around USD 196.37 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.95% between 2025 and 2034.

Milk Thistle Market: Overview

Milk thistle is a flowering plant widely recognized for its medicinal properties, especially in supporting liver health. The herb contains silymarin, a potent antioxidant compound that is known to reduce inflammation, protect liver cells from toxins, and promote regeneration. The global milk thistle market is projected to experience substantial growth, driven by increasing consumption of herbal supplements, the growing popularity of preventive healthcare, and a rise in demand for functional food and beverages. As consumer preference inclines towards chemical-free and natural health products, the demand for herbal supplements like milk thistle is increasing. According to the reports, the worldwide herbal supplements industry surpassed $150 million in 2023, propelling the adoption of milk thistle.

Moreover, preventive healthcare is on the rise, particularly among older adults, to maintain metabolic and liver health. Milk thistle's antioxidant properties support liver function and help detoxify the body, making it more suitable for wellness-focused individuals worldwide. Furthermore, producers are integrating milk thistle into teas, detox beverages, and nutrition bars to cater to consumers seeking daily liver support. The global functional food and beverage industry is projected to surpass $390 billion by 2030, presenting new opportunities for milk thistle.

Although drivers exist, the global market is challenged by factors like potential drug interactions and side effects, and limited awareness in developing economies. In developing economies in Southeast Asia and Africa, the understanding of the benefits of milk thistle remains poor. Without proper marketing or education, penetration in these large industries is still restricted. Milk thistle may interact with certain medications, including blood thinners, statins, and specific antidepressants. These interactions have led health professionals to be cautious about recommending it extensively without medical oversight.

Even so, the global milk thistle industry is well-positioned due to improvements in detox and functional beverages, as well as its integration into personalized nutrition programs. Milk thistle is gaining prominence in infused drinks, such as kombucha, ready-to-drink herbal shots, and detox teas. Wellness brands and startups are leveraging this trend to introduce milk thistle-centric health beverages. Additionally, the rise of personalized nutrition, which includes DNA-based health solutions, offers opportunities for milk thistle supplements tailored to individual liver function, oxidative stress reduction, and detoxification profiles.

Key Insights:

- As per the analysis shared by our research analyst, the global milk thistle market is estimated to grow annually at a CAGR of around 7.95% over the forecast period (2025-2034)

- In terms of revenue, the global milk thistle market size was valued at around USD 106.49 billion in 2024 and is projected to reach USD 196.37 billion by 2034.

- The milk thistle market is projected to grow significantly due to the increasing incidence of liver diseases, rising interest in organic and natural products, and favorable government regulations for herbal medicines.

- Based on form, the capsule segment is expected to lead the market, while the liquid extract segment is anticipated to experience significant growth.

- Based on application, the dietary supplements segment is the largest, while the pharmaceuticals segment is projected to experience substantial revenue growth over the forecast period.

- Based on the distribution channel, the pharmacies/drugstores segment is expected to lead the market compared to the online retail segment.

- Based on region, Europe is projected to dominate the global market during the estimated period, followed by North America.

Milk Thistle Market: Growth Drivers

Increased Regulatory Approvals and Clinical Research spur the market growth

Clinical trials exploring the safety and efficacy of milk thistle have increased over the past few years. The United States National Library of Medicine lists more than 75 active or completed trials comprising silymarin or milk thistle. Positive findings, particularly in managing alcohol-related liver damage and drug-induced hepatotoxicity, are aiding this therapeutic ranking.

The 2024 EFSA acceptance of silymarin-enriched supplements for specific liver health claims marks a significant milestone, providing European nutraceutical companies with the freedom to promote milk thistle more aggressively. This notably spurs the growth of the global milk thistle market.

How is the global milk thistle market fueled by the widening adoption in complementary and traditional medicine?

Traditional medicine systems, such as Traditional Chinese Medicine, Unani, and Ayurveda, have long endorsed milk thistle as a liver tonic. In China and India, two of the fastest-growing herbal medicine industries are being incorporated into wellness programs and official pharmacopeias.

In early 2025, the Indian Ministry of AYUSH announced new subsidies and initiatives to support the commercialization of herbal product formulations containing milk thistle.

Milk Thistle Market: Restraints

Which key factors are negatively impacting the growth of the global milk thistle market?

Herbal supplement regulation varies significantly worldwide, presenting barriers to industry entrants for milk thistle products. In nations such as Saudi Arabia, Japan, and South Korea, herbal products undergo lengthy approval procedures, face restricted health claims allowances, and incur stringent labeling compliance costs. These limitations increase compliance costs and prevent mid-sized and small companies from entering the industry.

For instance, the Saudi Food and Drug Authority (SFDA) prohibited the registration of five milk thistle-based supplements due to a lack of localized safety data and unverified health claims.

Milk Thistle Market: Opportunities

How does the expanding role in preventive healthcare and detox markets present an opportunity for milk thistle market growth?

With the growing global focus on preventive healthcare, people are highly preferring a cleaning regimen and natural liver detox, offering a key growth prospect for milk thistle-based products. Known for its antioxidant and hepatoprotective properties, milk thistle is incorporated mainly into liver cleanse kits, daily detox supplements, and herbal detox teas.

Brands like Gaia Herbs, NOW Foods, and Himalaya's Wellness have reported high sales of liver support supplements containing milk thistle over the past couple of years. This trend is further propelled by health practitioners and wellness influencers encouraging 'toxins flush' and 'liver reset' regimens on platforms like YouTube and Instagram. Hence, this expanding role presents a key opportunity for advancing the milk thistle industry.

Milk Thistle Market: Challenges

Raw material volatility and supply chain disruptions restrict the market growth

The cultivation of milk thistle is climate-sensitive, and extreme weather events in major growing regions, including Central Asia, India, and Eastern Europe, have impacted production. Moreover, drought conditions in Ukraine and Romania in 2023-24 resulted in a nearly 30% decline in raw seed production, leading to higher prices for silymarin extract.

Additionally, geopolitical tensions and rising transportation costs have strained global supply chains. According to the 2024 market report by HerbalGram, the average price of standardized silymarin extract increased by 18.6% YoY, affecting profit margins for the producers.

Milk Thistle Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Milk Thistle Market |

| Market Size in 2024 | USD 106.49 Billion |

| Market Forecast in 2034 | USD 196.37 Billion |

| Growth Rate | CAGR of 7.95% |

| Number of Pages | 214 |

| Key Companies Covered | Gaia Herbs, Nature’s Bounty, Now Foods, Himalaya Herbal Healthcare, Jarrow Formulas, Swanson Health Products, Nature’s Way, Puritan’s Pride, Herbal Factors, Solgar, Oregon’s Wild Harvest, Thompson’s Herbal, Bioforce AG (A.Vogel), Integrative Therapeutics, Natures Aid, and others. |

| Segments Covered | By Form, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Milk Thistle Market: Segmentation

The global milk thistle market is segmented based on form, application, distribution channel, and region.

Based on form, the global milk thistle industry is divided into capsule, powder and granules, liquid extract, lubricating, specialty oils, and others. The capsule segment holds a substantial market share due to its ease of consumption, accurate dosing, and extended shelf life. Consumers prefer capsules over other forms because they mask the plant's bitter taste and are suitable for daily supplementation. More than 60% of liver-support supplement sales in the United States were in capsule form, according to the 2024 report by HerbalGram. The pharmaceutical industry's growing focus on encapsulated nutraceuticals also contributes to its dominance.

Based on application, the global milk thistle market is segmented into pharmaceuticals, dietary supplements, functional foods, and others. The dietary supplements segment holds a leading share in the market, driven by growing awareness of detoxification and liver health. Milk thistle is a prominent ingredient in antioxidant supplements and liver-support formulations. In 2024, liver health supplements, fueled by milk thistle, registered for more than 35% of the United States' botanical supplement sales, according to Nutrition Business Journal. The growing consumer preference for preventive health and natural therapies significantly enhances this segment's prominence.

Based on distribution channel, the global market is segmented as pharmacies/drugstores, health food stores, online retail, and supermarkets/hypermarkets. The pharmacies/drugstores segment captured a substantial share of the market owing to strong consumer trust, accessibility, and regulatory oversight of certified health supplements. These channels offer pharmacist-approved and doctor-recommended products, mainly in North America and Europe. According to reports, more than 40% of herbal supplement sales, including those of milk thistle, occurred through pharmacies. Their ability to offer prescription-based and OTC liver health products contributes to their industry dominance.

Milk Thistle Market: Regional Analysis

Which major factors are helping Europe dominate the global milk thistle market?

Europe is likely to maintain its leadership in the milk thistle market due to its robust herbal medicine tradition, strong sustainable farming practices, high healthcare awareness, and an aging population. Europe has a long-standing cultural acceptance of botanical and herbal medicines, with milk thistle being a widely known natural remedy for liver health. The European Medicines Agency backs its use under the (THMPD) Traditional Herbal Medicinal Products Directive. Hence, milk thistle leverages from high prescription rates and wide consumer trust in nations like Italy, Germany, and Austria. Europe is also a forerunner in organic farming, which supports the ecological cultivation of milk thistle and promises a high-quality and consistent supply of raw materials.

Nations such as Poland, Germany, and Hungary are key producers of organically farmed milk thistle. The European Union's Common Agricultural Policy also promotes sustainable agriculture through various schemes. Europe holds one of the world's leading geriatric and health-conscious populations, with more than 20% of the EU populace aged 65 and above in 2023. This demographic is primarily concerned with digestion, liver function, and detoxification, which are key advantages of milk thistle, thereby driving continuous demand in the region.

North America continues to hold the second-highest share in the milk thistle industry, driven by high incidences of metabolic and liver disorders, strong consumer demand for herbal supplements, and easy online and retail product availability. North America experiences a rising burden of liver-associated issues like NAFLD, which affects approximately 30% of U.S residents, according to the American Liver Foundation. This has substantially fueled interest in liver supplements, such as milk thistle. Healthcare professionals and consumers equally view it as a preventive and natural option.

In 2023, the United States was the world's leading market for herbal supplements, estimated at over $ 11 billion, with consistent growth in plant-based remedies. Milk thistle ranks among the highest-selling liver health supplements. High disposable incomes, a focus on preventive healthcare, and increased awareness of wellness all contribute to the global industry's growth. Milk thistle is widely available in health food stores, such as The Vitamin Shoppe and GNC, as well as on key online platforms like Walmart.com, iHerb, and Amazon, and in drugstores. Online retail accounts for more than 35% of all supplement sales in the region, offering consumers easy and fast access.

Milk Thistle Market: Competitive Analysis

The leading players in the global milk thistle market are:

- Gaia Herbs

- Nature’s Bounty

- Now Foods

- Himalaya Herbal Healthcare

- Jarrow Formulas

- Swanson Health Products

- Nature’s Way

- Puritan’s Pride

- Herbal Factors

- Solgar

- Oregon’s Wild Harvest

- Thompson’s Herbal

- Bioforce AG (A.Vogel)

- Integrative Therapeutics

- Natures Aid

Milk Thistle Market: Key Market Trends

Expansion into skincare and functional beverages:

Milk thistle is incorporated into wellness shots, detox teas, and tropical skincare for its anti-inflammatory and antioxidant benefits. Wellness brands and startups are introducing products targeting anti-aging and liver health. This diversification is widening the industry beyond traditional supplements.

Clinical focus and scientific validation:

Ongoing clinical studies are validating the role of milk thistle in treating NAFLD, oxidative stress, and hepatitis, appealing interest from the pharmaceutical sector. This is shifting the perception of milk thistle from a traditional remedy to a clinically facilitated botanical with therapeutic properties.

The global milk thistle market is segmented as follows:

By Form

- Capsule

- Powder and Granules

- Liquid Extract

- Lubricating

- Specialty Oils

- Others

By Application

- Pharmaceuticals

- Dietary Supplements

- Functional Foods

- Others

By Distribution Channel

- Pharmacies/Drugstores

- Health Food Stores

- Online Retail

- Supermarkets/Hypermarkets

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Milk thistle is a flowering plant widely recognized for its medicinal properties, especially in supporting liver health. The herb contains silymarin, a potent antioxidant compound that is known to reduce inflammation, protect liver cells from toxins, and promote regeneration.

The global milk thistle market is projected to grow due to surging demand for herbal supplements, the expansion of direct-to-consumer channels and e-commerce, and the increasing adoption in pharmaceutical formulations.

According to study, the global milk thistle market size was worth around USD 106.49 billion in 2024 and is predicted to grow to around USD 196.37 billion by 2034.

The CAGR value of the milk thistle market is expected to be approximately 7.95% from 2025 to 2034.

Europe is witnessing the fastest progress in the milk thistle market, driven by robust demand for liver health supplements and high consumer preference for herbal remedies. The rising prevalence of liver-related conditions, combined with supportive regulatory frameworks, further boosts industry growth.

Technological advancements are fueling the milk thistle market by enhancing extraction techniques, which yield bioavailability and higher purity of silymarin.

Leading players in the milk thistle market are adopting strategies such as clean-label formulations, product innovation, and plant-based delivery systems to enhance their market presence. They also engage in partnerships, mergers, and global distribution expansion to amplify their market presence.

Macroeconomic factors, such as aging populations, rising disposable incomes, and increasing healthcare spending, will positively fuel the milk thistle market by boosting demand for preventive herbal supplements. However, global supply chain disruptions and inflationary pressures may pose short-term challenges to production and pricing.

The key players profiled in the global milk thistle market include Gaia Herbs, Nature’s Bounty, Now Foods, Himalaya Herbal Healthcare, Jarrow Formulas, Swanson Health Products, Nature’s Way, Puritan’s Pride, Herbal Factors, Solgar, Oregon’s Wild Harvest, Thompson’s Herbal, Bioforce AG (A.Vogel), Integrative Therapeutics, and Natures Aid.

The report examines key aspects of the milk thistle market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed