Matchmaking Market Size, Growth, Global Trends, Forecast 2034

Matchmaking Market By Service Type (Online Matchmaking, Traditional Matchmaking, Mobile App-Based Matchmaking, Video Matchmaking, AI-Powered Matchmaking, and Others), By End-User (Singles, Divorced Individuals, Widowed Individuals, LGBTQ+ Community, Senior Citizens, Young Professionals), By Platform (Web-Based, Mobile Applications, Desktop Applications, Hybrid Platforms), By Pricing Model (Subscription-Based, Freemium, Pay-Per-Match, Premium Services, One-Time Fee), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

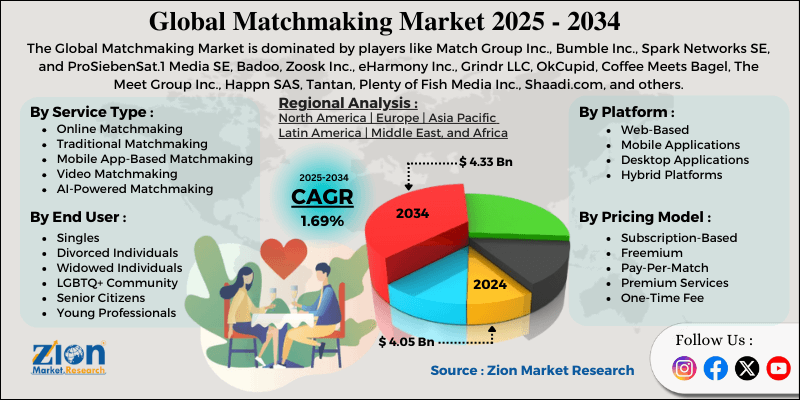

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 4.05 Billion | USD 4.33 Billion | 1.69% | 2024 |

Matchmaking Industry Perspective:

The global matchmaking market size was worth approximately USD 4.05 billion in 2024 and is projected to grow to around USD 4.33 billion by 2034, with a compound annual growth rate (CAGR) of roughly 1.69% between 2025 and 2034.

Matchmaking Market: Overview

Matchmaking services connect people seeking romantic relationships or marriage partners through organized systems and personalized assistance. These services range from traditional matchmakers who personally interview clients and suggest compatible matches to modern digital platforms that use algorithms and data analysis to pair individuals. Professional matchmakers consider factors like personality traits, lifestyle preferences, educational background, family values, and long-term goals when creating matches. Online matchmaking platforms allow users to create detailed profiles, browse potential partners, and communicate through messaging systems. Artificial intelligence technology now helps analyze user behavior, preferences, and interaction patterns to suggest better matches over time. Traditional matchmaking services still operate in many cultures, where families and professional matchmakers arrange meetings between compatible individuals.

Some services focus on specific communities, religions, or ethnic groups, while others serve general populations. Premium matchmaking services offer personalized attention, background verification, and exclusive networking events for clients willing to pay higher fees. The industry serves various age groups, from young professionals seeking partners to senior citizens looking for companionship after loss or divorce. As technology improves and social attitudes evolve, matchmaking platforms continue to develop new features to help people find meaningful connections.

The growing acceptance of digital platforms for relationship-building is expected to drive growth in the matchmaking market over the forecast period.

Key Insights

- As per the analysis shared by our research analyst, the global matchmaking market is estimated to grow annually at a CAGR of around 1.69% over the forecast period (2025-2034).

- In terms of revenue, the global matchmaking market size was valued at approximately USD 4.05 billion in 2024 and is projected to reach USD 4.33 billion by 2034.

- The matchmaking market is projected to grow significantly due to the increasing acceptance of online dating platforms and the rising number of singles seeking meaningful relationships worldwide.

- Based on service type, the mobile app-based matchmaking segment is expected to lead the matchmaking market, while the AI-powered matchmaking segment is anticipated to experience significant growth.

- Based on end-user, the singles segment is expected to lead the matchmaking market, while the senior citizens segment is anticipated to witness notable growth.

- Based on the platform, the mobile applications segment is the dominating segment, while the hybrid platforms segment is projected to witness sizeable revenue over the forecast period.

- Based on the pricing model, the subscription-based segment is expected to lead the market compared to the pay-per-match segment.

- Based on region, North America is projected to dominate the global matchmaking market during the estimated period, followed by the Asia Pacific.

Matchmaking Market Dynamics

Growth Drivers

How are changing social dynamics and increasing urbanization driving the matchmaking market growth?

The matchmaking market is expanding rapidly as modern lifestyles and urban living patterns create new challenges for people seeking romantic partners. Urban areas have high concentrations of working professionals who dedicate long hours to their careers, leaving limited time for traditional socializing and meeting potential partners through everyday activities. The breakdown of extended family structures in cities reduces opportunities for family-arranged introductions that were common in previous generations. Young professionals moving to new cities for career opportunities find it particularly difficult to build meaningful social connections quickly.

The rise of remote work and digital communication has further reduced face-to-face interactions in professional and social settings. Many people feel uncomfortable approaching strangers in public spaces due to social norms and personal safety concerns. Traditional meeting places like community centers, religious institutions, and neighborhood gatherings have become less central to social life in urban environments. Cultural shifts toward individual choice in partner selection have increased demand for services that offer more options and greater control over the matching process.

Technological advancements and personalization in matchmaking services

The global matchmaking market is experiencing strong growth as technology enables more sophisticated and personalized approaches to connecting compatible individuals. Advanced algorithms analyze vast amounts of user data to identify patterns and preferences that improve match quality beyond simple demographic filtering. Machine learning systems continuously improve their recommendations by studying which matches lead to successful conversations and relationships. Natural language processing technology examines how people communicate in their profiles and messages to assess personality compatibility.

Behavioral analysis tracks how users interact with the platform, noting which profiles they spend the most time on, which types of photos attract the most attention, and which conversation starters receive the most responses. Facial recognition technology can match people who have similar physical preferences or identify attractive features based on user behavior. Video verification features help confirm user identities and reduce the prevalence of fake profiles, thereby building trust in the platform. Safety features like background checks, photo verification, and reporting systems make users feel more secure when meeting strangers. Premium services offer professional photography, profile writing assistance, and dating coaches to improve user success rates.

Restraints

Privacy concerns and security issues affecting user trust

A significant challenge for the matchmaking market is the growing concern about personal data privacy and security vulnerabilities that can discourage potential users from joining platforms or sharing detailed information. Matchmaking services collect sensitive personal information, including full names, ages, addresses, phone numbers, email addresses, photos, employment details, income levels, relationship histories, and intimate preferences. Data breaches at major dating platforms have exposed millions of user profiles, causing embarrassment and potentially dangerous situations for affected individuals. Fake profiles created by scammers use stolen photos and false information to manipulate genuine users emotionally and financially.

Location tracking features that help connect nearby users also raise concerns about stalking and unwanted contact from rejected matches. Third-party data sharing practices by some platforms allow advertisers and partners to access user information without clear consent. Inadequate age verification systems occasionally allow minors to access platforms designed for adults, creating legal and safety issues. Users from conservative cultures or professions risk social or career consequences if their use of matchmaking services becomes public knowledge.

Opportunities

How is the expanding market for niche and specialized matchmaking services creating new opportunities?

The matchmaking industry is finding substantial growth opportunities as demand increases for specialized services targeting specific demographics, interests, and relationship goals. Religious matchmaking platforms serve communities where faith plays a central role in partner selection. Ethnic and cultural matchmaking services connect people who prioritize shared heritage, language, and traditions in their relationships. Professional matchmaking for high-net-worth individuals offers confidential services, including thorough background checks, personal introductions, and curated matches. Senior matchmaking platforms address the unique needs of older adults seeking companionship, second marriages, or relationships after the loss of a spouse. LGBTQ+ matchmaking services create safe spaces for sexual and gender minorities to connect without fear of discrimination.

Niche interest platforms match people based on specific hobbies, lifestyles, or values, such as fitness enthusiasts, pet lovers, travelers, or environmentally conscious individuals. Disability-friendly matchmaking services accommodate users with physical, mental, or developmental disabilities, offering accessible features and understanding communities. Academic and intellectual matchmaking platforms pair people based on educational achievement, career ambition, and intellectual compatibility. Matchmaking for specific professions like doctors, lawyers, or military personnel addresses the unique challenges these careers create for relationship formation.

Challenges

How are market saturation and user fatigue creating challenges for the matchmaking industry?

The matchmaking industry faces significant obstacles from intense competition and user exhaustion that affect both customer acquisition and retention rates. Hundreds of matchmaking applications and websites now compete for users, making it difficult for individual platforms to stand out and attract new members. Many users download multiple matchmaking applications simultaneously, dividing their attention and reducing engagement with any single platform. The abundance of choices can overwhelm users, leading to decision fatigue where having too many options makes it harder to commit to any particular match. Users often experience burnout from repeatedly creating profiles, engaging in small talk with numerous matches, and going on disappointing first dates.

The paradox of choice means users constantly wonder if a better match might be just one more swipe away, reducing commitment to developing existing connections. Many people become discouraged after weeks or months without finding suitable partners, leading them to abandon platforms entirely. Negative experiences like ghosting, where matches suddenly stop communicating without explanation, damage user confidence in the process. The superficial nature of quick judgments based primarily on photos can leave users feeling dehumanized and commodified. Gender imbalances on many platforms create frustration, with men often struggling to receive responses while women feel overwhelmed by excessive attention.

Matchmaking Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Matchmaking Market |

| Market Size in 2024 | USD 4.05 Billion |

| Market Forecast in 2034 | USD 4.33 Billion |

| Growth Rate | CAGR of 1.69% |

| Number of Pages | 213 |

| Key Companies Covered | Match Group Inc., Bumble Inc., Spark Networks SE, and ProSiebenSat.1 Media SE, Badoo, Zoosk Inc., eHarmony Inc., Grindr LLC, OkCupid, Coffee Meets Bagel, The Meet Group Inc., Happn SAS, Tantan, Plenty of Fish Media Inc., Shaadi.com, and others. |

| Segments Covered | By Service Type, By End-User, By Platform, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Matchmaking Market: Segmentation

The global matchmaking market is segmented based on service type, end-user, platform, pricing model, and region.

Based on service type, the global matchmaking industry is segregated into online matchmaking, traditional matchmaking, mobile app-based matchmaking, video matchmaking, AI-powered matchmaking, and others. Mobile app-based matchmaking leads the market due to the convenience of accessing services anywhere, push notifications that maintain user engagement, and the preference of younger demographics for mobile-first experiences.

Based on end user, the industry is segmented into singles, divorced individuals, widowed individuals, the LGBTQ+ community, senior citizens, and young professionals. Singles lead the market due to their large demographic size, active search for partners, and openness to technology-based solutions for relationship formation.

Based on platform, the global matchmaking market is classified into web-based, mobile applications, desktop applications, and hybrid platforms. Mobile applications are expected to lead the market during the forecast period due to their accessibility, user-friendly interfaces, integration with social media and other smartphone functions, and alignment with modern consumer preferences for on-demand services.

Based on the pricing model, the global market is divided into subscription-based, freemium, pay-per-match, premium services, and one-time fees. Subscription-based services hold the largest market share due to the steady revenue stream they provide, the psychological commitment subscriptions create for active platform use, and the proven success of this model across digital services.

Matchmaking Market: Regional Analysis

What factors are contributing to North America's dominance in the global matchmaking market?

North America leads the matchmaking market due to high internet penetration, widespread smartphone adoption, cultural acceptance of online dating, and a large population of singles actively seeking partners. The United States has one of the highest rates of online dating usage in the world, with millions of people using multiple platforms simultaneously. The region pioneered many innovations in digital matchmaking, establishing early brand recognition and user bases that continue to dominate.

High disposable incomes allow consumers to spend on premium matchmaking services, background checks, and additional features that enhance their experience. The fast-paced professional culture leaves people with limited time for traditional dating methods, making convenient digital solutions particularly appealing. Urban concentration in major cities like New York, Los Angeles, Chicago, and Toronto creates dense populations of singles looking for efficient ways to meet compatible partners.

Cultural diversity in North American cities drives demand for both general and niche matchmaking services targeting specific ethnic, religious, and interest groups. The region has strong venture capital investment in technology startups, providing funding for innovative matchmaking platforms to develop and scale. Reduced social stigma around online dating means people from all age groups and backgrounds feel comfortable using these services openly. The high divorce rate creates a substantial market of divorced individuals seeking second marriages or new relationships. Delayed marriage ages, with many people focusing on education and careers before settling down, expand the pool of singles using matchmaking services. Strong legal frameworks protect user data and establish clear regulations for matchmaking businesses.

The Asia Pacific is experiencing significant growth.

Asia Pacific is seeing rapid expansion in the matchmaking market as internet access spreads, smartphone ownership increases, and younger generations embrace digital solutions for relationship formation. India has a massive demand for both traditional arranged marriage services and modern dating applications, blending cultural practices with technological innovation. The country's large youth population, growing middle class, and increasing urban migration create enormous demand for matchmaking services that can connect people across geographic distances. China's matchmaking industry serves hundreds of millions of singles, with parents often actively involved in finding partners for their adult children through both traditional matchmakers and modern platforms.

Cultural emphasis on marriage and family formation drives strong demand for services that facilitate these important life milestones. Japan and South Korea have high technology adoption rates and sophisticated matchmaking industries that incorporate advanced features like AI analysis and virtual meetings. The prevalence of arranged marriages in many Asian cultures has created acceptance of third-party assistance in partner selection, making the transition to digital matchmaking platforms more natural.

Growing economic prosperity allows more people to afford paid matchmaking services beyond free basic features. Changing attitudes among younger generations who want more personal choice in partner selection, while still respecting family input, create demand for services that balance tradition with modern preferences. Gender imbalances in countries like China and India, caused by historical preferences for male children, create competitive dating markets where services providing access to potential partners have high value. Extended work hours in many Asian countries leave professionals with little time for traditional courtship. Rising education levels, particularly among women, create populations seeking partners with compatible intellectual and professional backgrounds.

Recent Market Developments

- In February 2025, Match Group announced the integration of advanced AI verification systems across all its platforms to enhance user safety and reduce fake profiles through real-time identity authentication.

- In August 2025, Matrimony.com, the parent company of Bharat Matrimony, partnered with Truecaller to enhance its matchmaking services.

Matchmaking Market: Competitive Analysis

The leading players in the global matchmaking market are:

- Match Group Inc.

- Bumble Inc.

- Spark Networks SE

- and ProSiebenSat.1 Media SE

- Badoo

- Zoosk Inc.

- eHarmony Inc.

- Grindr LLC

- OkCupid

- Coffee Meets Bagel

- The Meet Group Inc.

- Happn SAS

- Tantan

- Plenty of Fish Media Inc.

- Shaadi.com

The global matchmaking market is segmented as follows:

By Service Type

- Online Matchmaking

- Traditional Matchmaking

- Mobile App-Based Matchmaking

- Video Matchmaking

- AI-Powered Matchmaking

- Others

By End User

- Singles

- Divorced Individuals

- Widowed Individuals

- LGBTQ+ Community

- Senior Citizens

- Young Professionals

By Platform

- Web-Based

- Mobile Applications

- Desktop Applications

- Hybrid Platforms

By Pricing Model

- Subscription-Based

- Freemium

- Pay-Per-Match

- Premium Services

- One-Time Fee

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed