Marine Vessel Energy Efficiency Market Size, Share, Trends, Growth 2034

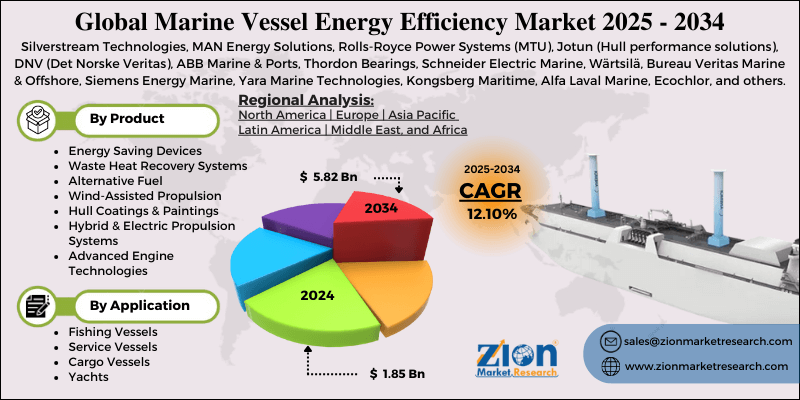

Marine Vessel Energy Efficiency Market By Product Type (Energy Saving Devices, Waste Heat Recovery Systems, Alternative Fuel, Wind-Assisted Propulsion, Hull Coatings & Paintings, Hybrid & Electric Propulsion Systems, Advanced Engine Technologies, and Others), By Application (Fishing Vessels, Service Vessels, Cargo Vessels, Yachts, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

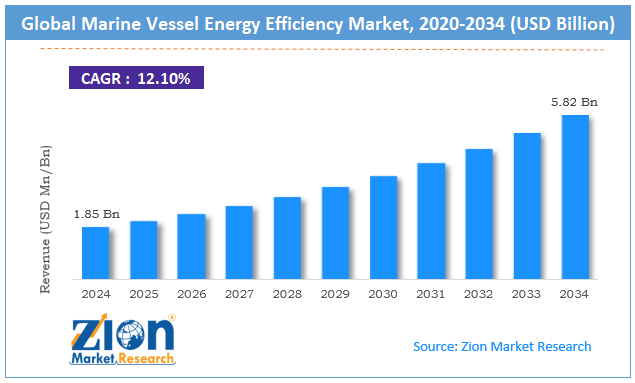

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.85 Billion | USD 5.82 Billion | 12.10% | 2024 |

Marine Vessel Energy Efficiency Industry Perspective:

The global marine vessel energy efficiency market size was worth around USD 1.85 billion in 2024 and is predicted to grow to around USD 5.82 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.10% between 2025 and 2034.

Marine Vessel Energy Efficiency Market: Overview

Marine vessel energy efficiency refers to a wide range of protocols and technologies used to improve the fuel efficiency of ships. These solutions are critical to helping maritime companies achieve decarbonization goals and also improve the fuel usage of maritime vehicles.

Some of the critical factors that determine marine vessel energy efficiency include the overall design of the structure, operational procedures, and integration of the latest energy-optimizing technologies.

In addition to this, the energy efficiency industry in marine vessels is governed by strict government regulations and international laws concerning the rising impact of carbonization caused by the maritime sector.

During the forecast period, demand for next-generation and highly effective energy efficiency procedures specially drafted for the maritime sector is expected to grow rapidly. The growing environmental impact of marine vessel operations across water bodies has become evident, leading to increased use of energy efficiency solutions.

Moreover, growing regulatory pressure on industry players will further foster more avenues for extended growth in the coming years. A major growth restraint in the industry is the high cost of technology development and implementation, impacting overall revenue.

Key Insights:

- As per the analysis shared by our research analyst, the global marine vessel energy efficiency market is estimated to grow annually at a CAGR of around 12.10% over the forecast period (2025-2034)

- In terms of revenue, the global marine vessel energy efficiency market size was valued at around USD 1.85 billion in 2024 and is projected to reach USD 5.82 billion by 2034.

- The marine vessel energy efficiency market is projected to grow at a significant rate due to the growing maritime activities and their impact on ecological systems.

- Based on the product type, the alternative fuel segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the cargo vessels segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Marine Vessel Energy Efficiency Market: Growth Drivers

Growing maritime activities and their impact on ecological systems to fuel the market growth rate

The global marine vessel energy efficiency market is expected to be driven by the rising rate of maritime activities worldwide. The industry is one of the largest environmental polluters, especially affecting the quality of the marine ecosystem. The global shipping industry is the most dominant means of cargo transport, connecting different parts of the world. In addition to this, other forms of popular maritime activities include fishing and aquaculture, maritime tourism, and passenger transport.

According to official reports, more than 15 new cruise ships are expected to enter service in 2025. Around 8 of these ships will weigh over 100,000 tonnes. One of the largest cruise ships currently operational is the Icon of the Seas, which extends up to 365 meters from bow to stern. Additionally, government support for the global maritime sector has played a crucial role in helping the industry thrive.

However, the surge in marine activities has led to extensive damage to the existing coastal regions. As per the International Union for Conservation of Nature (IUCN), more than 3 million sunken ships are currently abandoned in the ocean. 8,500 of these ships are classified as potentially polluting wrecks. The growing need to reduce the environmental impact of maritime operations will fuel the market growth rate in the future.

Increasing government and regulatory pressure to decarbonize the maritime sector will propel industry revenue

Regulatory pressure on the maritime industry has been mounting in the last few years. The industry has been compelled to integrate energy efficiency solutions to achieve expected decarbonization goals in the future. Regulations such as FuelEU Maritime and the European Union Emissions Trading System (EU ETS) have led to maritime companies being charged for emissions.

More such regulations are expected to be implemented by the International Maritime Organization (IMO) by 2027. These regulations are driving shipping companies to reduce carbon emissions on an urgent basis.

According to recent statistics, the international shipping industry is expected to reduce carbon emissions by 40% by 2030. Such measures are likely to promote revenue in the global marine vessel energy efficiency market.

Marine Vessel Energy Efficiency Market: Restraints

High expenditure associated with solution development and implementation will limit market expansion

The global marine vessel energy efficiency industry is expected to be restricted by the high cost of developing energy-optimizing solutions. For instance, the installation of modern energy-efficient ship propellers or fins can cost between USD 100,000 and USD 500,000.

The cost may further amplify in case of the installation of other energy-saving systems, such as hull coatings and wind-assisted propulsion. The increasing price of technology development will impact the overall revenue generated by the market players.

Marine Vessel Energy Efficiency Market: Opportunities

Innovative strategies adopted by market players to generate growth opportunities in the long run

The global marine vessel energy efficiency market is expected to generate growth opportunities due to the rising adoption of innovative strategies by market players. For instance, in February 2025, Maersk announced the new name for its 11th dual-fuel methanol container vessel launched in India. The marine vehicle is called Albert Maersk and can operate on methanol.

According to official reports, the shipping industry is registering increased attention toward methane-powered vessels since they are more eco-friendly and cause reduced emissions of harmful gases such as nitrogen oxides.

In March 2025, Det Norske Veritas (DNV), a global quality assurance and risk management firm, announced the launch of its recent report titled Energy Efficiency Measures and Technologies – Key Solutions and Strategies for Maritime’s Decarbonization Journey.

The report consists of a comprehensive list of modern and highly effective measures that shipping companies can undertake to improve the energy efficiency of their vessels. Some of the solutions explored in the report include the use of biofuels, carbon-neutral powering solutions, fuel cells, onboard carbon capture, and nuclear propulsion.

In September 2024, Amogy, a leading provider of ammonia-to-power solutions, announced that the world’s first ammonia-powered, carbon-free maritime vessel had completed its first voyage successfully.

Marine Vessel Energy Efficiency Market: Challenges

Dynamic regulations remain a critical challenge for the market players

The global marine vessel energy efficiency industry is expected to be challenged by evolving and deviant regulatory guidelines. Frameworks designed to monitor the energy efficiency of marine vessels may change from one region to another.

In addition, as regional visions related to decarbonization change, the industry players can expect higher evolution in frameworks for energy optimization. These factors are likely to impact the overall revenue in the market during the forecast period.

Marine Vessel Energy Efficiency Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Marine Vessel Energy Efficiency Market |

| Market Size in 2024 | USD 1.85 Billion |

| Market Forecast in 2034 | USD 5.82 Billion |

| Growth Rate | CAGR of 12.10% |

| Number of Pages | 212 |

| Key Companies Covered | Silverstream Technologies, MAN Energy Solutions, Rolls-Royce Power Systems (MTU), Jotun (Hull performance solutions), DNV (Det Norske Veritas), ABB Marine & Ports, Thordon Bearings, Schneider Electric Marine, Wärtsilä, Bureau Veritas Marine & Offshore, Siemens Energy Marine, Yara Marine Technologies, Kongsberg Maritime, Alfa Laval Marine, Ecochlor, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Marine Vessel Energy Efficiency Market: Segmentation

The global marine vessel energy efficiency market is segmented based on product type, application, and region.

Based on the product type, the global market segments are energy-saving devices, waste heat recovery systems, alternative fuel, wind-assisted propulsion, hull coatings & paintings, hybrid & electric propulsion systems, advanced engine technologies, and others. In 2024, the highest demand was listed in the alternative fuel segment. In recent times, more companies are inclining toward environmentally friendly fuel that does not compromise vessel performance. Additionally, using novel hybrid & electric propulsion systems may generate more revenue in the coming years. The average cost of a hybrid propulsion system may reach up to USD 10 million, depending on the features of the tool.

Based on the application, the marine vessel energy efficiency industry divisions are fishing vessels, service vessels, cargo vessels, yachts, and others. In 2024, the most dominant segment was cargo vessels. According to the World Economic Forum, more than 90% of the world’s commodity transportation is carried out by sea routes. The growing rate of international trade of commodities is expected to fuel segmental revenue during the projection period. Fishing vessels are expected to generate considerable CAGR in the future, according to research.

Marine Vessel Energy Efficiency Market: Regional Analysis

Asia-Pacific to register dominance in the market during the projection period

The global marine vessel energy efficiency market will be led by Asia-Pacific during the forecast period. China, India, South Korea, Japan, Indonesia, and others will emerge as some of the largest regional market growth propellers. China, for instance, is currently home to the world’s largest number of ships. The Chinese fleet of marine ships currently stands at over 9000 units.

Furthermore, Asia-Pacific is one of the most crucial regions in terms of global trade in terms of export and imports of agricultural goods, chemicals & materials, automotive parts, consumer electronics, and textile products. South Korea, on the other hand, is the world’s most important shipbuilding country, serving regional and international clients.

In July 2024, Nippon Paint Marine, a Japanese company specializing in marine coatings, announced that its breakthrough product, FASTAR, had been used on over 1000 vessels since its launch in 2021. The coating provides better hull performance and efficient vessel operations. The novel resin technology also reduced fuel consumption according to official reports.

In February 2025, China launched a highly powerful methanol-diesel-powered ship engine. The unit built by China State Shipbuilding Corporation Limited (CSSC) has a maximum designed power output of up to 64,500 kilowatts.

Marine Vessel Energy Efficiency Market: Competitive Analysis

The global marine vessel energy efficiency market is led by players like:

- Silverstream Technologies

- MAN Energy Solutions

- Rolls-Royce Power Systems (MTU)

- Jotun (Hull performance solutions)

- DNV (Det Norske Veritas)

- ABB Marine & Ports

- Thordon Bearings

- Schneider Electric Marine

- Wärtsilä

- Bureau Veritas Marine & Offshore

- Siemens Energy Marine

- Yara Marine Technologies

- Kongsberg Maritime

- Alfa Laval Marine

- Ecochlor

The global marine vessel energy efficiency market is segmented as follows:

By Product Type

- Energy Saving Devices

- Waste Heat Recovery Systems

- Alternative Fuel

- Wind-Assisted Propulsion

- Hull Coatings & Paintings

- Hybrid & Electric Propulsion Systems

- Advanced Engine Technologies

- Others

By Application

- Fishing Vessels

- Service Vessels

- Cargo Vessels

- Yachts

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Marine vessel energy efficiency refers to a wide range of protocols and technologies used to improve the fuel efficiency of ships.

The global marine vessel energy efficiency market is expected to be driven by the rising rate of maritime activities worldwide.

According to study, the global marine vessel energy efficiency market size was worth around USD 1.85 billion in 2024 and is predicted to grow to around USD 5.82 billion by 2034.

The CAGR value of the marine vessel energy efficiency market is expected to be around 12.10% during 2025-2034.

The global marine vessel energy efficiency market will be led by Asia-Pacific during the forecast period.

The global marine vessel energy efficiency market is led by players like Silverstream Technologies, MAN Energy Solutions, Rolls-Royce Power Systems (MTU), Jotun (Hull performance solutions), DNV (Det Norske Veritas), ABB Marine & Ports, Thordon Bearings, Schneider Electric Marine, Wärtsilä, Bureau Veritas Marine & Offshore, Siemens Energy Marine, Yara Marine Technologies, Kongsberg Maritime, Alfa Laval Marine, and Ecochlor.

The report explores crucial aspects of the marine vessel energy efficiency market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed