Lung Cancer Liquid Biopsy Market Size, Share, Growth, Forecast 2034

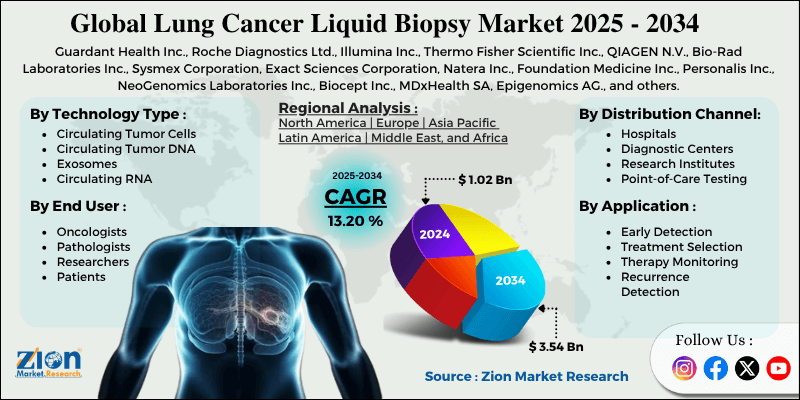

Lung Cancer Liquid Biopsy Market By Technology Type (Circulating Tumor Cells, Circulating Tumor DNA, Exosomes, and Circulating RNA), By Application (Early Detection, Treatment Selection, Therapy Monitoring, and Recurrence Detection), By Distribution Channel (Hospitals, Diagnostic Centers, Research Institutes, and Point-of-Care Testing), By End-User (Oncologists, Pathologists, Researchers, and Patients), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

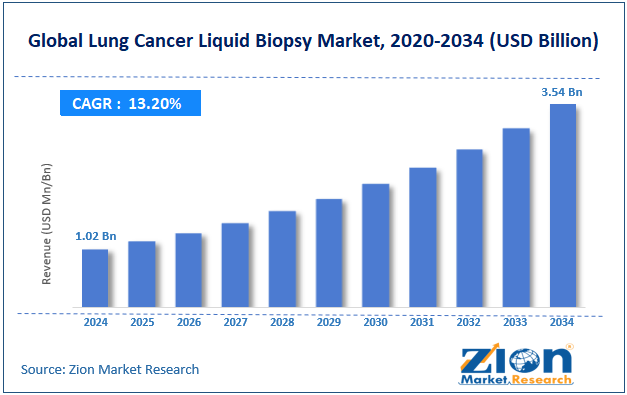

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.02 Billion | USD 3.54 Billion | 13.20% | 2024 |

Lung Cancer Liquid Biopsy Market Industry Perspective:

The global lung cancer liquid biopsy market was valued at approximately USD 1.02 billion in 2024 and is expected to reach around USD 3.54 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 13.20% between 2025 and 2034.

Lung Cancer Liquid Biopsy Market: Overview

Lung cancer liquid biopsy is a new and advanced way to detect cancer by studying cancer-related markers found in the blood, instead of doing painful tissue biopsies. This method finds tumor cells, DNA pieces from tumors, and other signs of cancer in the bloodstream, making it a less invasive option for diagnosis and follow-up. The liquid biopsy market includes modern tools that help find genetic changes, check how well treatments are working, and spot if the cancer comes back. Modern liquid biopsy systems use powerful gene sequencing, smart computer analysis, and advanced detection methods to find even tiny amounts of cancer markers in the blood.

The increasing prevalence of lung cancer worldwide and the growing demand for non-invasive diagnostic methods are expected to drive substantial growth in the lung cancer liquid biopsy market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global lung cancer liquid biopsy market is estimated to grow annually at a CAGR of around 13.20% over the forecast period (2025-2034)

- In terms of revenue, the global lung cancer liquid biopsy market size was valued at around USD 1.02 billion in 2024 and is projected to reach USD 3.54 billion by 2034.

- The lung cancer liquid biopsy market is projected to grow significantly due to the increasing adoption of precision medicine approaches and expanding applications in early cancer detection.

- Based on technology type, circulating tumor DNA leads the segment and will continue to dominate the global market.

- Based on the application, treatment selection is expected to lead the market.

- Based on the distribution channel, hospitals are anticipated to command the largest market share.

- Based on end-users, oncologists are expected to lead the market during the forecast period.

- Based on region, North America is projected to lead the global market during the forecast period.

Lung Cancer Liquid Biopsy Market: Growth Drivers

Increasing lung cancer prevalence

The lung cancer liquid biopsy market is growing quickly as healthcare providers around the world look for better ways to manage the increasing number of lung cancer cases and improve early detection. Traditional tissue biopsies often require surgery, which can be risky and may not be possible for all patients, especially those with other health problems or hard-to-reach tumors.

Liquid biopsy offers a safer option by using a simple blood test, making it easier and more comfortable for patients to get screened. The chance to find cancer in its early stages, when treatment works best, is leading more doctors and hospitals to use this method.

Advancements in precision medicine

The lung cancer liquid biopsy industry is growing due to major progress in precision medicine, which needs detailed genetic information to choose the right treatment. Modern cancer care focuses on finding the specific genetic changes behind each patient’s tumor to give more targeted and effective therapy.

Liquid biopsy allows complete genetic testing through blood samples, helping find useful mutations, signs of resistance, and how well treatments are working. Healthcare providers are now using liquid biopsy tools that can check many cancer markers at once and give real-time updates on how the tumor is changing.

Lung Cancer Liquid Biopsy Market: Restraints

High costs and reimbursement challenges

Despite the clinical benefits of liquid biopsy technology, the lung cancer liquid biopsy industry faces significant challenges related to high testing costs and complex reimbursement landscapes. These advanced tests need specialized laboratory machines, rare chemicals, and skilled staff, which makes each test more expensive than regular diagnostic methods.

Many healthcare systems and insurance companies struggle to support the higher initial costs, even though the tests can ultimately save money by improving treatment choices and reducing the need for surgery. In many developing countries, limited insurance coverage makes these tests too costly for patients and doctors. The results from genetic testing are also complex and must be reviewed by trained experts, adding more cost and limiting wider use.

Lung Cancer Liquid Biopsy Market: Opportunities

Expanding applications in treatment monitoring

The lung cancer liquid biopsy market has major opportunities due to its growing use in real-time treatment monitoring and pharmaceutical drug development. Liquid biopsy makes it possible to regularly track how patients respond to treatment and detect early signs of drug resistance, helping doctors adjust treatments before the disease worsens.

Drug companies are now using liquid biopsy in clinical trials to measure how well new drugs work and to choose the right patients for targeted therapies. The ability to find tiny traces of cancer after treatment opens up the chance to build follow-up programs that catch cancer returning earlier than traditional methods. As more targeted cancer drugs get approved, liquid biopsy is being used to find patients who are most likely to benefit from those treatments.

Lung Cancer Liquid Biopsy Market: Challenges

Technical limitations and standardization issues

The lung cancer liquid biopsy market still faces key challenges due to technical limits and the need for standard testing procedures across different platforms and medical laboratories. Tumor markers in the blood are found in very small amounts, so tests must be highly sensitive to distinguish accurate cancer signals from normal cell materials.

Differences in how samples are collected, stored, and handled can affect test results and lead to different outcomes in different hospitals. A lack of shared reference materials and quality control tools makes it hard to compare results between testing systems. Factors like the type of blood collection tube, how the sample is stored, and how quickly it is tested can change the accuracy of the result.

Lung Cancer Liquid Biopsy Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Lung Cancer Liquid Biopsy Market |

| Market Size in 2024 | USD 1.02 Billion |

| Market Forecast in 2034 | USD 3.54 Billion |

| Growth Rate | CAGR of 13.20% |

| Number of Pages | 215 |

| Key Companies Covered | Guardant Health Inc., Roche Diagnostics Ltd., Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., Bio-Rad Laboratories Inc., Sysmex Corporation, Exact Sciences Corporation, Natera Inc., Foundation Medicine Inc., Personalis Inc., NeoGenomics Laboratories Inc., Biocept Inc., MDxHealth SA, Epigenomics AG., and others. |

| Segments Covered | By Technology Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lung Cancer Liquid Biopsy Market: Segmentation

The global lung cancer liquid biopsy market is segmented into technology type, application, distribution channel, end-user, and region.

Based on technology type, the market is segregated into circulating tumor cells, circulating tumor DNA, exosomes, and circulating RNA. Circulating tumor DNA leads the market due to its stability in blood samples and ability to provide comprehensive genomic information for treatment selection and monitoring.

Based on application, the lung cancer liquid biopsy industry is classified into early detection, treatment selection, therapy monitoring, and recurrence detection. Treatment selection holds the largest market share due to increasing adoption of precision medicine approaches and the critical need for genetic profiling to guide targeted therapy decisions.

Based on the distribution channel, the lung cancer liquid biopsy market is divided into hospitals, diagnostic centers, research institutes, and point-of-care testing. Hospitals are expected to lead the market during the forecast period due to their established infrastructure and integration with comprehensive cancer care programs.

Based on the end-user, the market is segmented into oncologists, pathologists, researchers, and patients. Oncologists lead the market share due to their primary role in cancer diagnosis and treatment decision-making, and the growing demand for personalized treatment approaches.

Lung Cancer Liquid Biopsy Market: Regional Analysis

North America to lead the market

North America leads the global lung cancer liquid biopsy market due to strong healthcare systems, high use of new diagnostic tools, and solid government support for precision medicine. The region makes up about 45% of the global market, with the United States using the most liquid biopsy tests across all cancer types. Hospitals and clinics in North America are investing in new laboratories and building up their liquid biopsy services to meet growing needs.

The region also benefits from clear insurance policies that cover liquid biopsy tests when used in the right medical situations. Partnerships between biotechnology firms, research hospitals, and drug makers are speeding up the development and testing of new liquid biopsy technologies. Government programs that support cancer research and advanced medical care are helping the market grow by giving funding and regulatory backing.

Europe is expected to demonstrate strong growth.

Europe is seeing strong growth in the lung cancer liquid biopsy market because of its focus on scientific evidence and health technology reviews, which match well with the clinical proof needed for liquid biopsy use. European healthcare systems look for cost-effective methods and good long-term patient results, making them open to adopting liquid biopsy if it shows medical and financial value.

The European Union is also working to align rules across member countries, making it easier for new diagnostic tools to get approval while keeping quality high. Leading hospitals and research centers in Europe are conducting large-scale clinical studies to demonstrate the effectiveness of liquid biopsy and establish medical guidelines for its application. Government support for personal medicine and cancer research is helping build the systems needed to use liquid biopsy widely.

Recent Market Developments:

- In June 2025, Guardant Health launched an advanced liquid biopsy platform, the Guardant360, specifically designed for early-stage lung cancer detection, featuring enhanced sensitivity for detecting minimal residual disease in post-surgical patients.

- In April 2025, Roche Diagnostics received regulatory approval for its comprehensive liquid biopsy panel that can simultaneously analyze multiple biomarkers for lung cancer treatment selection and monitoring applications.

Lung Cancer Liquid Biopsy Market: Competitive Analysis

The global lung cancer liquid biopsy market is led by players like:

- Guardant Health Inc.

- Roche Diagnostics Ltd.

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Exact Sciences Corporation

- Natera Inc.

- Foundation Medicine Inc.

- Personalis Inc.

- NeoGenomics Laboratories Inc.

- Biocept Inc.

- MDxHealth SA

- Epigenomics AG.

The global lung cancer liquid biopsy market is segmented as follows:

By Technology Type

- Circulating Tumor Cells

- Circulating Tumor DNA

- Exosomes

- Circulating RNA

By Application

- Early Detection

- Treatment Selection

- Therapy Monitoring

- Recurrence Detection

By Distribution Channel

- Hospitals

- Diagnostic Centers

- Research Institutes

- Point-of-Care Testing

By End User

- Oncologists

- Pathologists

- Researchers

- Patients

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Lung cancer liquid biopsy is a new and advanced way to detect cancer by studying cancer-related markers found in the blood, instead of doing painful tissue biopsies.

The lung cancer liquid biopsy market is expected to be driven by increasing lung cancer prevalence, growing demand for non-invasive diagnostic methods, expanding applications in precision medicine, technological advancements in molecular diagnostics, and rising acceptance of liquid biopsy as a standard care tool.

According to our study, the global lung cancer liquid biopsy market was worth around USD 1.02 billion in 2024 and is predicted to grow to around USD 3.54 billion by 2034.

The CAGR value of the lung cancer liquid biopsy market is expected to be around 13.20% during 2025-2034.

The global lung cancer liquid biopsy market will register the highest revenue contribution from North America during the forecast period.

Key players in the lung cancer liquid biopsy market include Guardant Health Inc., Roche Diagnostics Ltd., Illumina Inc., Thermo Fisher Scientific Inc., QIAGEN N.V., Bio-Rad Laboratories Inc., Sysmex Corporation, Exact Sciences Corporation, Natera Inc., Foundation Medicine Inc., Personalis Inc., NeoGenomics Laboratories Inc., Biocept Inc., MDxHealth SA, and Epigenomics AG.

The report provides a comprehensive analysis of the lung cancer liquid biopsy market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, technology innovations, distribution strategies, and clinical applications that shape the modern healthcare and biotechnology ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed