Li-ion Battery Recycling Market Size, Share, Trends, Growth 2034

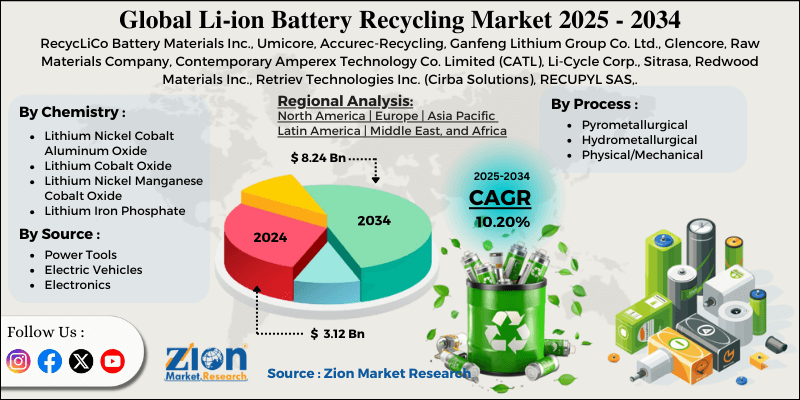

Li-ion Battery Recycling Market By Chemistry (Lithium Nickel Cobalt Aluminum Oxide, Lithium Cobalt Oxide, Lithium Nickel Manganese Cobalt Oxide, Lithium Iron Phosphate, and Others), By Source (Power Tools, Electric Vehicles, Electronics, and Others), By Process (Pyrometallurgical, Hydrometallurgical, and Physical/Mechanical), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

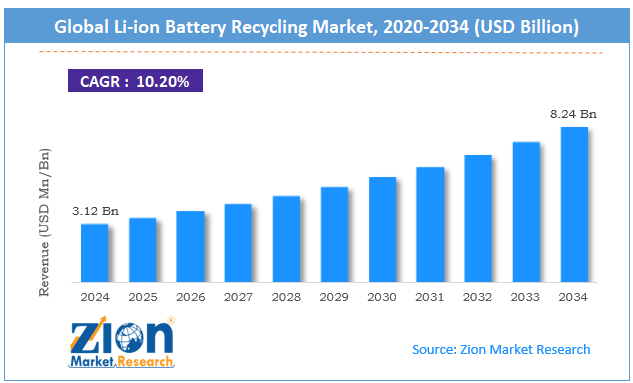

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.12 Billion | USD 8.24 Billion | 10.20% | 24 |

Li-ion Battery Recycling Industry Perspective:

The global Li-ion battery recycling market size was worth around USD 3.12 billion in 2024 and is predicted to grow to around USD 8.24 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.20% between 2025 and 2034.

Li-ion Battery Recycling Market: Overview

Lithium-ion (Li-ion) battery recycling is the process of recovering useful and valuable materials from used batteries. Li-ion battery recycling procedures aim to reduce the environmental impact of excessive use of lithium-ion-powered battery storage solutions.

In addition, recycling used Li-ion batteries assists in procuring essential materials that can be further used in the production and development of novel clean energy solutions. Lithium-ion battery recycling is a key process in achieving a circular economy by helping market players reduce waste and recover valuable materials.

According to industry research, irresponsible li-ion battery disposables can lead to several types of negative environmental impacts, including safety hazards. Government regulations concerning the recycling of used Li-ion batteries have intensified globally, further creating demand for cost-effective and robust recycling processes.

During the forecast period, the industry for Li-ion battery recycling is expected to generate significant revenue due to the growing demand and application of lithium-ion batteries across major end-user industries. A key growth barrier for the market players will be in the form of the high cost of initial investment and the lack of standard recycling procedures.

Key Insights:

- As per the analysis shared by our research analyst, the global Li-ion battery recycling market is estimated to grow annually at a CAGR of around 10.20% over the forecast period (2025-2034)

- In terms of revenue, the global Li-ion battery recycling market size was valued at around USD 3.12 billion in 2024 and is projected to reach USD 8.24 billion by 2034.

- The Li-ion battery recycling market is projected to grow at a significant rate due to the increasing demand for Li-ion batteries for electric vehicles (EVs)

- Based on the chemistry, the lithium cobalt oxide segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the process, the hydrometallurgical segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Li-ion Battery Recycling Market: Growth Drivers

Increasing demand for Li-ion batteries for electric vehicles (EVs) to propel the market expansion rate

The global Li-ion battery recycling market is expected to grow due to the increasing demand for energy storage solutions in the electric vehicle industry. Most modern EVs are currently powered by high-performance lithium-ion batteries. Electric vehicles are considered the future of the automotive industry due to several benefits offered by EVs over traditionally used fuel-run vehicles.

In addition, EV battery makers are working on developing longer-lasting and fast-charging lithium-ion batteries to further mitigate the current concerns limiting EV adoption among end-users.

Regional governments and private companies have undertaken several novel projects to improve charging infrastructure for heavy and light vehicles, encouraging potential automobile buyers to consider investing in electric vehicles.

According to official reports, 2024 encouraged a surge of over 23% in demand for EVs as compared to 2023, and the future outlook is projected to deliver similar statistics. It will also lead to increased demand for lithium-ion batteries, encouraging more investments in developing lithium-ion battery recycling processes.

Increased support from the government and strict regulatory mandates to promote industry expansion

The recycling process for lithium-ion batteries is expected to gain traction in the coming years due to the increased support from regional governments and environmental regulating agencies. Extensive waste generated from used lithium-ion batteries is known to have several environmental impacts. Improper disposal of used batteries can lead to soil and water contamination as chemicals from the batteries can enter the soil or water bodies nearby.

Additionally, lithium-ion batteries also pose the risk of fire hazard, causing regional governments to promote the adoption of novel solutions available in the global Li-ion battery recycling industry.

For instance, in September 2022, the US witnessed the launch of the Strategic EV Management Act, which is expected to promote optimal reuse and recycling of end-of-life EV batteries in federal vehicles.

Li-ion Battery Recycling Market: Restraints

High cost of recycling and limited returns affect market revenue in the long run

The global Li-ion battery recycling industry is projected to be restricted by the high cost of investment required for setting up a recycling infrastructure. The use of advanced recycling technologies and research & development (R&D) expenditures are the significant components of expenses associated with Li-ion recycling processes.

Furthermore, the return on investment (ROI) in the industry is significantly low due to reduced profit margins for recycled battery providers. These factors could significantly impact the overall revenue the industry will generate in the coming years.

Li-ion Battery Recycling Market: Opportunities

Rising launch of new engineering solutions allowing efficient Li-ion recycling to generate growth opportunities

The global Li-ion battery recycling market is expected to generate growth opportunities due to the rising introduction of new technologies. These engineering solutions aim to improve the efficiency of existing Li-ion battery recycling.

For instance, in April 2024, Green Li-ion, a leading lithium-ion battery recycling technology company, launched its first commercial-grade facility to produce battery-grade materials and contribute to the fight for sustainability.

According to official reports, the facility will be the first of its kind in the North American market. Green Li-ion will be using patented Green-hydro rejuvenation™ technology for producing multiple cathodes.

Green-hydro rejuvenation uses a highly advanced hydrometallurgical approach that directly converts spent batteries into battery-grade precursor cathode active material (pCAM) and will not require further processing.

In January 2025, BatX Energies Pvt. Ltd launched the Critical Minerals Extraction plant (HUB-1) in the UP state of the Indian region. The facility uses BatX’s proprietary chemical process to extract high-purity critical materials for battery production. The optimal recycling of lithium-ion battery waste in the facility will include manufacturing rejects from emerging gigafactories.

Li-ion Battery Recycling Market: Challenges

Lack of standard recycling rules and a limited number of players to challenge market expansion

The global Li-ion battery recycling industry is expected to be challenged by the lack of standard recycling rules governing the global ecosystem for obtaining valuable materials from spent batteries. It can create growth barriers for market players trying to enter new regions.

In addition, the number of players currently in the industry is limited, restricting the overall reach of the services and also affecting the real growth potential of the industry.

Li-ion Battery Recycling Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Li-ion Battery Recycling Market |

| Market Size in 2024 | USD 3.12 Billion |

| Market Forecast in 2034 | USD 8.24 Billion |

| Growth Rate | CAGR of 10.20% |

| Number of Pages | 214 |

| Key Companies Covered | RecycLiCo Battery Materials Inc., Umicore, Accurec-Recycling, Ganfeng Lithium Group Co. Ltd., Glencore, Raw Materials Company, Contemporary Amperex Technology Co. Limited (CATL), Li-Cycle Corp., Sitrasa, Redwood Materials Inc., Retriev Technologies Inc. (Cirba Solutions), RECUPYL SAS, American Battery Technology Company (ABTC), Neometals, Ecobat., and others. |

| Segments Covered | By Chemistry, By Source, By Process, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Li-ion Battery Recycling Market: Segmentation

The global Li-ion battery recycling market is segmented based on chemistry, source, process, and region.

Based on the chemistry, the global market segments are lithium nickel cobalt aluminum oxide, lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium iron phosphate, and others. In 2024, the highest revenue was generated by the lithium cobalt oxide segment due to the presence of a large production base of the battery variants.

Additionally, the growing demand for cobalt as an expensive and valuable material may further propel the segmental growth rate. In 2024, more than 289,000 metric tons of cobalt were produced worldwide.

Based on the source, the global Li-ion battery recycling industry is divided into power tools, electric vehicles, electronics, and others.

Based on the process, the global market segments are pyrometallurgical, hydrometallurgical, and physical/mechanical. In 2024, the hydrometallurgical segment was the leading revenue generator, dominating nearly 86% of the segmental revenue. The relatively simple procedure and the environmentally friendly outcomes of hydrometallurgical processes will fuel segmental expansion in the coming years.

Li-ion Battery Recycling Market: Regional Analysis

Asia-Pacific to continue leading the market with a high revenue rate

The global Li-ion battery recycling market will be led by Asia-Pacific during the forecast period. China is currently the dominant nation in terms of regional revenue, driven by the presence of a robust lithium-ion battery recycling infrastructure.

In March 2025, reports emerged suggesting that a new Li-ion battery recycling facility in the Jiangxi area of China has completed construction and is set to become operational in the coming months.

The unit was built with an investment of ¥128.11 million and currently has a processing capacity of 20,000 tons/year of used batteries. Europe is projected to generate significant revenue driven by several favorable factors.

Europe is home to some of the leading Li-ion battery recycling service providers. In February 2022, Belgian-French company Umicore signed a strategic agreement with Automotive Cells Company (ACC) to deliver new battery recycling services. These systems will be integrated into ACC’s Nersac-based plant. The increased consumption of Li-ion battery storage systems across Europe and its major industries, such as consumer electronics and the automotive sectors, has fueled regional demand.

Li-ion Battery Recycling Market: Competitive Analysis

The global Li-ion battery recycling market is led by players like:

- RecycLiCo Battery Materials Inc.

- Umicore

- Accurec-Recycling

- Ganfeng Lithium Group Co. Ltd.

- Glencore

- Raw Materials Company

- Contemporary Amperex Technology Co. Limited (CATL)

- Li-Cycle Corp.

- Sitrasa

- Redwood Materials Inc.

- Retriev Technologies Inc. (Cirba Solutions)

- RECUPYL SAS

- American Battery Technology Company (ABTC)

- Neometals

- Ecobat

The global Li-ion battery recycling market is segmented as follows:

By Chemistry

- Lithium Nickel Cobalt Aluminum Oxide

- Lithium Cobalt Oxide

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Iron Phosphate

- Others

By Source

- Power Tools

- Electric Vehicles

- Electronics

- Others

By Process

- Pyrometallurgical

- Hydrometallurgical

- Physical/Mechanical

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Lithium-ion (Li-ion) battery recycling is the process of recovering useful and valuable materials from used batteries.

The global Li-ion battery recycling market is expected to grow due to the increasing demand for energy storage solutions in the electric vehicle industry.

According to study, the global Li-ion battery recycling market size was worth around USD 3.12 billion in 2024 and is predicted to grow to around USD 8.24 billion by 2034.

The CAGR value of the Li-ion battery recycling market is expected to be around 10.20% during 2025-2034.

The global Li-ion battery recycling market will be led by Asia-Pacific during the forecast period.

The global Li-ion battery recycling market is led by players like RecycLiCo Battery Materials Inc., Umicore, Accurec-Recycling, Ganfeng Lithium Group Co., Ltd., Glencore, Raw Materials Company, Contemporary Amperex Technology Co., Limited (CATL), Li-Cycle Corp., Sitrasa, Redwood Materials, Inc., Retriev Technologies, Inc. (Cirba Solutions), RECUPYL SAS, American Battery Technology Company (ABTC), Neometals, and Ecobat.

The report explores crucial aspects of the Li-ion battery recycling market, including a detailed discussion of existing growth factors and restraints, while browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed