Industrial Sulfuric Acid Market Size, Share, Growth & Forecast 2034

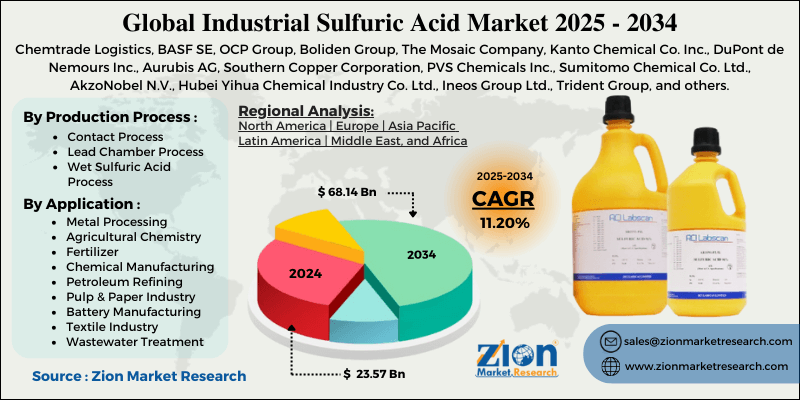

Industrial Sulfuric Acid Market By Production Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, and Others), By Application (Metal Processing, Agricultural Chemistry, Fertilizer, Chemical Manufacturing, Metal Processing & Mining, Petroleum Refining, Pulp & Paper Industry, Battery Manufacturing, Textile Industry, Wastewater Treatment, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 23.37 Billion | USD 68.14 Billion | 11.20% | 2024 |

Industrial Sulfuric Acid Industry Perspective:

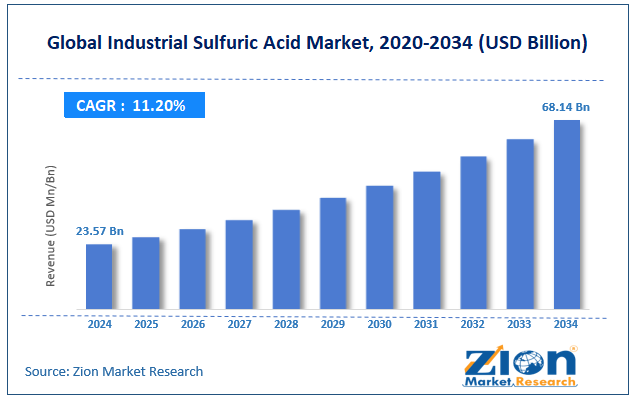

The global industrial sulfuric acid market size was worth around USD 23.57 billion in 2024 and is predicted to grow to around USD 68.14 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial sulfuric acid market is estimated to grow annually at a CAGR of around 11.20% over the forecast period (2025-2034)

- In terms of revenue, the global industrial sulfuric acid market size was valued at around USD 23.57 billion in 2024 and is projected to reach USD 68.14 billion by 2034.

- The industrial sulfuric acid market is projected to grow at a significant rate due to the growing applications in lead-acid battery production.

- Based on the production process, the contact process segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the fertilizer segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Industrial Sulfuric Acid Market: Overview

Industrial sulfuric acid (H2SO4) is a widely used colorless, mineral liquid with extensive applications across industries. The key elements of industrial sulfuric acid are oxygen, sulfur, and hydrogen. It is used in the production of an extensive range of chemical compounds. According to industry analysis, sulfuric acid has a diverse set of applications in industrial settings. It is used for the production of different goods and products. It is a common ingredient found in all industrial facilities and laboratories. The top uses of industrial sulfuric acid are reported in metal processing, chemical production, battery manufacturing, agriculture & fertilizer, and use in industrial or domestic cleaning products. Industrial-grade sulfuric acid possesses several lucrative chemical properties, contributing to steady growth in industrial revenue. For instance, H2SO4 is a strong acid and disassociates easily when mixed with water.

Furthermore, it is also used as a corrosive material during metal production. Other properties include excellent oxidizing ability and an effective role as a dehydrating agent. The global demand for industrial sulfuric acid is expected to continue growing due to the rising production of lead-acid batteries and semiconductor production.

However, the industry growth rate may be affected by the health and environmental hazards associated with the use of sulfuric acid. Additionally, strict rules and regulations governing the market may also impede market expansion in the long run.

Industrial Sulfuric Acid Market Dynamics

Growth Drivers

Will the growing applications in lead-acid battery production fuel the industrial sulfuric acid market revenue during the forecast period?

The global industrial sulfuric acid market is expected to be driven by the rising applications of the liquid material in the production of lead-acid batteries. According to industry analysis, sulfuric acid acts as the electrolyte in lead-acid batteries and hence is a critical component of the battery manufacturing industry. Lead-acid batteries remain the widely used form of rechargeable electrochemical batteries for small to medium-sized energy storage solutions. The popularity of lead-acid batteries is a result of multiple factors, such as low cost of production, higher safety, and easy recharge.

Furthermore, lead-acid batteries are relatively easier to recycle compared to some of the other alternatives. Research indicates an increase in the applications of lead-acid batteries in vehicle Starting, Lighting, and Ignition (SLI), as the batteries can generate high currents required to keep the internal combustion engine (ICE) running. Lead-acid batteries are also widely popular as power supply solutions in data centers while serving the telecommunications sector.

Rising expansion of the semiconductor industry to promote market growth trends in the future

Industrial-grade sulfuric acid has witnessed increased demand due to its growing use in the semiconductor manufacturing sector. High-purity sulfuric acid is used across different production lines in semiconductor manufacturing. For instance, the liquid is used for preparing and cleaning the wafer surface by removing contaminants.

In May 2025, BASF, one of the world’s leading chemical & materials companies, announced the expansion of its semiconductor-grade sulfuric acid production capacity, thus helping the global industrial sulfuring acid market grow. The company will build a new plant in Germany, which will be essential for keeping up with growing investments in Europe for the production of advanced semiconductor chips. Countries across the globe are focusing on improving regional production of next-generation semiconductors and reducing their reliance on Asian countries for semiconductor production and supply. This will result in greater use of industrial-grade sulfuric acid in the coming years.

Restraints

Do health and environmental risks associated with H2SO4 affect the industrial sulfuric acid market revenue?

The global industrial sulfuric acid industry is expected to be restricted due to the health and environmental risks associated with the liquid. Sulfuric acid is highly corrosive in all concentrations. If the acid comes in contact with human skin in its purest form, it can lead to severe thermal and chemical burns.

Furthermore, it can also lead to permanent blindness if sulfuric acid comes in contact with the eyes. Strict safety protocols must be followed when handling industrial-grade sulfuric acid. The acid must also be stored in non-reactive glass materials to avoid serious harm to the personnel handling the liquid. Additionally, sulfuric acid has severe environmental impacts, including water and soil pollution, further raising concerns over excessive use of the acid across various industries.

Opportunities

How does growing focus on the use of sustainable solutions generate growth opportunities for the industrial sulfuric acid industry?

The global industrial sulfuric acid market is expected to generate growth opportunities due to the rising focus on using sustainable solutions in the industry. For instance, market players are working on recycling industrial sulfur, creating scope for a more effective circular economy in the market.

In August 2024, American Industrial Partners (AIP) announced the acquisition of Veolia North America’s sulfuric acid regeneration business. The move has enabled AIP to oversee Voelia’s key business operations, including sulfur gas recovery, sulfuric acid & potassium hydroxide regeneration, and the production of products derived from sulfur.

Consistent demand for the acid in metal processing is expected to register an advanced CAGR during the projection duration

Growing infrastructure development projects worldwide will create demand for advanced metals. Industrial sulfuric acid is a critical element used in metal processing, which could prove beneficial for the industry players in the long run. Emerging economies witnessing higher industrialization rates will emerge as critical growth drivers for industrial sulfuric acid during the forecast period.

Challenges

Regulatory challenges and supply chain disruptions to impact market expansion in the future

The global industrial sulfuric acid industry is expected to be challenged by the regulatory hurdles faced by industry players. The chemical hazards and environmental impact of the chemical, along with cases of potential misuse, have caused the industry to be heavily monitored by regional governments. Additionally, the growing rise of supply chain disruptions against the backdrop of intensifying geopolitics may affect market revenue during the projection duration.

Industrial Sulfuric Acid Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Sulfuric Acid Market |

| Market Size in 2024 | USD 23.57 Billion |

| Market Forecast in 2034 | USD 68.14 Billion |

| Growth Rate | CAGR of 11.20% |

| Number of Pages | 215 |

| Key Companies Covered | Chemtrade Logistics, BASF SE, OCP Group, Boliden Group, The Mosaic Company, Kanto Chemical Co. Inc., DuPont de Nemours Inc., Aurubis AG, Southern Copper Corporation, PVS Chemicals Inc., Sumitomo Chemical Co. Ltd., AkzoNobel N.V., Hubei Yihua Chemical Industry Co. Ltd., Ineos Group Ltd., Trident Group, and others. |

| Segments Covered | By Production Process, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Sulfuric Acid Market: Segmentation

The global industrial sulfuric acid market is segmented based on product process, application, and region.

Based on the production process, the global market divisions are contact process, lead chamber process, wet sulfuric acid process, and others. In 2024, the highest growth was listed in the contact process, which dominated nearly 89.05% of the total revenue. The process is used for the production of highly pure sulfuric acid with a concentration ranging between 98% to 99%. Growing demand for high-purity sulfuric acid in industrial settings will promote segmental expansion during the forecast period.

Based on the application, the global industry divisions are metal processing, agricultural chemistry, fertilizer, chemical manufacturing, metal processing & mining, petroleum refining, pulp & paper industry, battery manufacturing, textile industry, wastewater treatment, and others. In 2024, the fertilizer segment experienced the highest growth, accounting for nearly 55% of the global revenue. Sulfuric acid is the precursor required for the production of phosphoric acid, which is an essential element of key fertilizers. The chemical manufacturing segment may contribute to 18% of the global revenue during the forecast period.

Industrial Sulfuric Acid Market: Regional Analysis

What factors will assist Asia-Pacific in dominating the industrial sulfuric acid market during the forecast period?

The global industrial sulfuric acid market will be led by Asia-Pacific during the forecast period. China, India, Russia, and Japan will emerge as critical regional market growth drivers. China is the world’s leading producer of industrial-grade sulfuric acid. According to industry reports, China’s sulfuric acid production grew by more than 1.29% in 2022 as compared to 2021. The country has a robust chemical manufacturing ecosystem, and it is the world’s largest supplier of critical chemicals and materials. Furthermore, China has rapidly expanded its business operations and customer base to other emerging economies in a bid to accelerate its economic growth during the forecast period.

In July 2021, Zhejiang Jiahua Energy Chemical Industry Co., Ltd., along with its fully owned subsidiary Zhejiang Jiafu New Material Technology Co., Ltd., signed an agreement with BASF for expanding the production of electronic-grade sulfuric in China. India, on the other hand, is a leading producer of industrial-grade acids, thus helping the region maintain its dominance. The regional revenue further benefits from rising end-user applications of industrial sulfuric acid. The growing rate of infrastructure development projects across major Asian countries, along with the rising production of lead-acid batteries, will amplify regional market expansion.

Industrial Sulfuric Acid Market: Competitive Analysis

The global industrial sulfuric acid market is led by players like:

- Chemtrade Logistics

- BASF SE

- OCP Group

- Boliden Group

- The Mosaic Company

- Kanto Chemical Co. Inc.

- DuPont de Nemours Inc.

- Aurubis AG

- Southern Copper Corporation

- PVS Chemicals Inc.

- Sumitomo Chemical Co. Ltd.

- AkzoNobel N.V.

- Hubei Yihua Chemical Industry Co. Ltd.

- Ineos Group Ltd.

- Trident Group

The global industrial sulfuric acid market is segmented as follows:

By Production Process

- Contact Process

- Lead Chamber Process

- Wet Sulfuric Acid Process

- Others

By Application

- Metal Processing

- Agricultural Chemistry

- Fertilizer

- Chemical Manufacturing

- Metal Processing & Mining

- Petroleum Refining

- Pulp & Paper Industry

- Battery Manufacturing

- Textile Industry

- Wastewater Treatment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial sulfuric acid (H2SO4) is a widely used colorless, mineral liquid with extensive applications across industries.

The global industrial sulfuric acid market is expected to be driven by the rising applications of the liquid material in the production of lead-acid batteries.

According to study, the global industrial sulfuric acid market size was worth around USD 23.57 billion in 2024 and is predicted to grow to around USD 68.14 billion by 2034.

The CAGR value of the industrial sulfuric acid market is expected to be around 11.20% during 2025-2034.

The global industrial sulfuric acid market will be led by Asia-Pacific during the forecast period.

The global industrial sulfuric acid market is led by players like Chemtrade Logistics, BASF SE, OCP Group, Boliden Group, The Mosaic Company, Kanto Chemical Co., Inc., DuPont de Nemours, Inc., Aurubis AG, Southern Copper Corporation, PVS Chemicals Inc., Sumitomo Chemical Co., Ltd., AkzoNobel N.V., Hubei Yihua Chemical Industry Co., Ltd., Ineos Group Ltd., and Trident Group.

The report explores crucial aspects of the industrial sulfuric acid market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed