India Data Center Market Size, Share, Growth, Trends, Forecast 2034

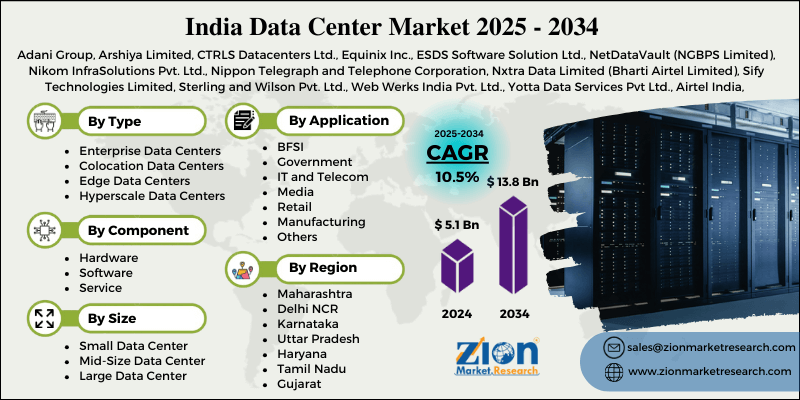

India Data Center Market By Type (Enterprise Data Centers, Colocation Data Centers, Edge Data Centers, and Hyperscale Data Centers), By Component (Hardware, Software, and Service), By Size (Small Data Center, Mid-Size Data Center, and Large Data Center), By Application (Banking Financial Services & Insurance (BFSI), Government, IT and Telecom, Media, Retail, Manufacturing, and Others), and By Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

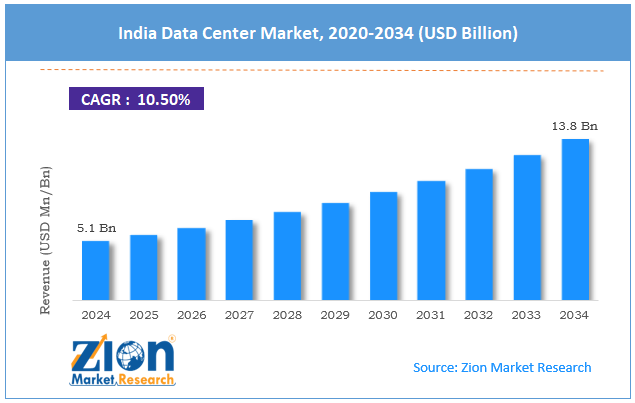

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.1 Billion | USD 13.8 Billion | 10.5% | 2024 |

India Data Center Market Industry Perspective:

India data center market size was worth around USD 5.1 billion in 2024 and is predicted to grow to around USD 13.8 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.5% between 2025 and 2034. India's data center market is experiencing rapid growth, driven by factors such as digital transformation, increased internet penetration, and government initiatives promoting data localization.

Key Insights

- As per the analysis shared by our research analyst, the India data center market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2025-2034).

- In terms of revenue, India data center market size was valued at around USD 5.1 billion in 2024 and is projected to reach USD 13.8 billion by 2034.

- The increasing investment in AI data centers drives the India data center industry over the forecast period.

- Based on the type, the enterprise data centers segment is expected to hold the largest market share over the forecast period.

- Based on the component, the hardware segment is expected to dominate the market over the projected period.

- Based on the size, the small data center segment is expected to capture a significant revenue share during the anticipated period.

- Based on the application, the IT and Telecom segment is expected to capture a significant revenue share during the anticipated period.

- Based on region, Maharashtra is expected to dominate the market during the forecast period.

India Data Center Market: Overview

Data centers are critical infrastructure components that support the storage, processing, and dissemination of vast amounts of data. In India, the demand for data centers is escalating due to the proliferation of digital services, cloud computing, and the adoption of technologies like artificial intelligence (AI) and the Internet of Things (IoT).

A data center is a facility that holds an organization's critical IT infrastructure, which includes servers, storage systems, and networking equipment. A data center is a crucial place where data is gathered, processed, stored, and shared. Data centers are very important for daily operations, as they keep the organization running by having strong environmental controls, security measures, power redundancy, and constant monitoring. The Indian data center market is growing due to the increasing number of internet users, the growing popularity of AI, Big Data, and the Internet of Things (IoT), supportive government regulations, and a focus on sustainability and efficiency. But a lack of competent staff is expected to impact the Indian data center market.

India Data Center Market: Growth Drivers

How is the rise of AI, Big Data & IoT propelling the expansion of the India data center market?

The Indian data center industry has been growing rapidly since the Internet of Things (IoT), Big Data, and AI. Data centers are in high demand because of the workloads of artificial intelligence (AI), which necessitate up-to-date computing equipment like GPU clusters. This tendency is accelerating, as the Indian government is working on projects like the India AI mission and putting funds into AI technologies. The explosion of data from internet utilization, digital technology adoption, 5G rollout, cloud computing, and IoT devices is also making it very important to have this facility for managing a high volume of data.

For instance, the Department of Telecommunications states that as of July 30, 2023, there were 3,08,466 5G sites/BTS in India. Additionally, major cities like Mumbai, Chennai, Hyderabad, and Bengaluru are significant centers due to their robust infrastructure, highly skilled workforce, and proximity to where undersea cables terminate.

India Data Center Market: Restraints

Why are high energy costs & power reliability hindering the India data center market growth?

The Indian data center sector is growing quickly, but it has a lot of problems, as energy prices are high and power is not always stable, especially as AI workloads develop. AI workloads demand a lot of energy. AI servers can use up to ten times as much power as regular servers, as they are always training and making decisions. India's data center capacity is predicted to grow from about 960 MW presently to more than 9.2 GW by 2030. This will cause electricity demand to rise nine times. This increase might mean that data centers use roughly 3% of India's electricity by 2030, up from less than 1% presently.

AI devices can use up to 40% of total energy, and the costs of cooling them down add to the load on power use. In addition, data centers in Mumbai, Hyderabad, Delhi NCR, Bangalore, and Chennai utilize a lot of energy. Each data center uses as much power as an aluminum smelter or 100,000 residences. This clustering puts a lot of stress on local power systems; thus, having power available is very important for keeping operations running. Therefore, the high energy cost and power reliability might pose a major challenge for the India data center market.

India Data Center Market: Opportunities

How does the rising investment in data center facilities offer a potential opportunity for India data center industry?

The Indian data center market is experiencing significant investment growth, driven by rising demand for cloud services, AI workloads, and edge computing infrastructure. For instance, ST Telemedia Global Data Centers (India) (STT GDC India), a major AI-ready data center provider in India, plans to transform the data center landscape in Eastern India with the opening of its cutting-edge facility in New Town, Kolkata. This next-generation campus, spanning 5.59 acres, is designed to meet the growing need for AI computing through high-density rack configurations, superior cooling technologies, and a flexible, modular architecture. It connects with the country's bigger economic aims of promoting digitally enabled growth and expanding access to sustainable digital infrastructure.

The new-age data center facility has received the famous TIA-942 Rated-3 Design certification, demonstrating its dedication to world-class infrastructure and reliability. The campus significantly contributes to the development of digital infrastructure in the country's east, with a scalable capacity of up to 25 MW in terms of overall IT load. It has forward-thinking power architecture, including an N+2C design for reliability and a radial N+N layout for main power incomers, which ensures dedicated feeder availability. The campus uses TYPE-TESTED Compact Substations and LV DGs, which establish new benchmarks for power reliability and effectiveness.

India Data Center Market: Challenges

Why do high Capital Expenditure (CapEx) and Operational Costs (OpEx) pose a major challenge to market expansion?

It usually costs between ₹50 crore and ₹70 crore to build a data center in India, not including land and cloud fees. Approximately 20% of the funds are allocated to real estate, while the remaining funds are allocated to plumbing, electrical, and mechanical infrastructure. The cost of building data centers went up by 5–10% each year between FY21 and FY25. India's capital spending on data centers is estimated to go over $20 billion by 2030. This will let the capacity grow from 1.3 GW in 2024 to 5 GW or more by 2030. Most of the capital spent on new buildings goes to big hyperscale facilities.

Also, excessive energy use drives up operational expenses, especially as AI workloads and processing needs grow. Cooling takes up a large part of electricity use. Compared to other APAC regions, power tariffs in India are still competitive, but they constitute a big part of OpEx. Recurring costs include staffing, maintenance, and network connectivity. Sustainability programs and the use of renewable energy can reduce long-term costs, but they require upfront expenditures on technology and infrastructure. Thus, the high Capital Expenditure (CapEx) and Operational Costs (OpEx) pose a significant obstacle to the India data center industry.

India Data Center Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Data Center Market |

| Market Size in 2024 | 5.1 Bn |

| Market Forecast in 2034 | 13.8 Bn |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 215 |

| Key Companies Covered | Adani Group, Arshiya Limited, CTRLS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd., Nippon Telegraph and Telephone Corporation, Nxtra Data Limited (Bharti Airtel Limited), Sify Technologies Limited, Sterling and Wilson Pvt. Ltd., Web Werks India Pvt. Ltd., Yotta Data Services Pvt Ltd., Airtel India, CtrlS Datacenters Ltd., Digital Connexion, Datacenters.com, Sify Technologies, and others. |

| Segments Covered | By Type, By Component, By Size, By Application, and By Region |

| States Covered in India | Maharashtra, Delhi NCR, Karnataka, Uttar Pradesh, Haryana, Tamil Nadu, Gujarat, and Others |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Data Center Market: Segmentation

India data center industry is segmented based on type, component, size, application, and region.

Based on the type, India data center market is bifurcated into enterprise data centers, colocation data centers, edge data centers, and hyperscale data centers. The enterprise data centers are expected to dominate the market over the forecast period. Enterprise data centers are typically designed to meet the demands of a single business, featuring custom infrastructure tailored to handle their specific data and processing requirements. Companies often create and run their own data centers, which gives them full control over how data is handled and kept safe. The market is important in India because big companies and government organizations like to keep sensitive data in-house.

Based on the component, India data center industry is bifurcated into hardware, software, and service. The hardware segment captures the largest revenue share in the market. The growth is driven by the essential requirement for robust physical infrastructure. It consists of servers, network equipment, cooling systems, and storage devices, which are necessary for the effective functioning of data centers.

Based on the size, India data center market is bifurcated into small data center, mid-size data center, and large data center. The small data center segment is expected to hold a strong market share over the analysis period. The rise of AI, Big Data, and IoT raises the demand for distributed data processing capability outside of hyperscale facilities. Small data centers meet these needs by lowering data transfer times and bandwidth costs, increasing demand for their services, and consequently revenue.

Based on the application, India data center industry is bifurcated into Banking Financial Services & Insurance (BFSI), government, IT and telecom, media, retail, manufacturing, and others. The IT and telecom segment holds a prominent market share over the projected period. The highest market share is attributed to the significant increase in data traffic, driven by the growing number of smartphone users, the expanding online population, and the rapid adoption of cloud services across the board. The Internet and Mobile Association of India (IAMAI) estimates that by 2025, 56% of Indians who get online will live in rural regions.

India Data Center Market: Regional Analysis

Why does Maharashtra dominate the India data center market over the projected period??

Maharashtra is expected to dominate the market over the forecast period. The Maharashtra data center market in India was booming due to the government's increased investment in digital transformation, the growing adoption of cloud computing by a larger number of individuals, and the rapid expansion of the e-commerce industry. Companies that run data centers are also collaborating with schools in Maharashtra to teach people to operate in Web 3.0. Their goal is to work together on projects that will help the industry with research, education, and skill development, as well as give people in the Web 3.0 environment the tools they need to do so effectively.

Also, the growing investment in the area drives the market growth. For instance, in March 2025, NTT DATA, a global leader in digital business and technology services, took a number of strategic steps to show that it is still committed to the Indian market. The company also stated that its Malaysia, India, and Singapore Transit (MIST) submarine cable line would go live in June 2025. MIST is an 8,100-kilometre cable that can handle more than 200 terabits per second (Tbps). It is one of the biggest cables in Asia, linking Malaysia, India, Singapore, and Thailand. NTT DATA's first cable system that directly connects to and from India. This will improve global connectivity and offer important infrastructure for India's rapidly growing digital economy. In February 2023, MIST was connected to NTT DATA's Mumbai landing station. In May 2023, it was connected to the Chennai landing station.

India Data Center Market: Competitive Analysis

India data center market is dominated by players like:

- Adani Group

- Arshiya Limited

- CTRLS Datacenters Ltd.

- Equinix Inc.

- ESDS Software Solution Ltd.

- NetDataVault (NGBPS Limited)

- Nikom InfraSolutions Pvt. Ltd.

- Nippon Telegraph and Telephone Corporation

- Nxtra Data Limited (Bharti Airtel Limited)

- Sify Technologies Limited

- Sterling and Wilson Pvt. Ltd.

- Web Werks India Pvt. Ltd.

- Yotta Data Services Pvt Ltd.

- Airtel India

- CtrlS Datacenters Ltd.

- Digital Connexion

- Datacenters.com

- Sify Technologies

India data center market is segmented as follows:

By Type

- Enterprise Data Centers

- Colocation Data Centers

- Edge Data Centers

- Hyperscale Data Centers

By Component

- Hardware

- Software

- Service

By Size

- Small Data Center

- Mid-Size Data Center

- Large Data Center

By Application

- Banking Financial Services & Insurance (BFSI)

- Government

- IT and Telecom

- Media

- Retail

- Manufacturing

- Others

By Region (States covered in India)

- Maharashtra

- Delhi NCR

- Karnataka

- Uttar Pradesh

- Haryana

- Tamil Nadu

- Gujarat

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

A data center is a facility that holds an organization's critical IT infrastructure, which includes servers, storage systems, and networking equipment.

The India data center market is growing because larger numbers of individuals are using the internet and mobile data, AI, Big Data, and the Internet of Things (IoT) are becoming more popular, supportive government regulation, and there is a focus on sustainability and efficiency.

The major challenge for the India data center market is the high capital expenditure and operational cost.

Based on the application, the IT and telecom segment is expected to dominate the industry growth during the projected period.

The increasing investment in AI data center facility and the growing number of IoT devices are impacting the industry growth over the projected period.

According to the report, India data center market size was worth around USD 5.1 billion in 2024 and is predicted to grow to around USD 13.8 billion by 2034.

India data center market is expected to grow at a CAGR of 10.5% during the forecast period.

India data center industry growth is expected to be driven by the Maharashtra region. It is currently the world’s highest revenue-generating market due to the capital city of India and increasing investment in data center facilities.

India Data Center market is dominated by players like Adani Group, Arshiya Limited, CTRLS Datacenters Ltd., Equinix Inc., ESDS Software Solution Ltd., NetDataVault (NGBPS Limited), Nikom InfraSolutions Pvt. Ltd., Nippon Telegraph and Telephone Corporation, Nxtra Data Limited (Bharti Airtel Limited), Sify Technologies Limited, Sterling and Wilson Pvt. Ltd., Web Werks India Pvt. Ltd., Yotta Data Services Pvt Ltd., Airtel India, CtrlS Datacenters Ltd., Digital Connexion, Datacenters.com, and Sify Technologies, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed