Hydrocarbon Analyzers Market Size, Share, Trends, Growth & Forecast 2034

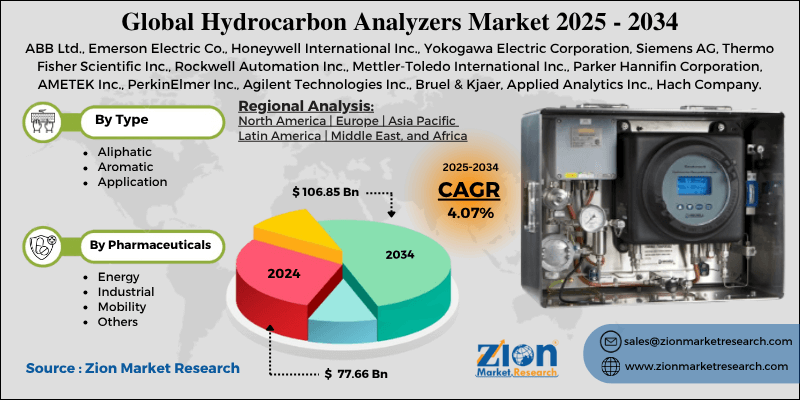

Hydrocarbon Analyzers Market By Type (Aliphatic, Aromatic, Application), By Pharmaceuticals (Energy, Industrial, Mobility, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

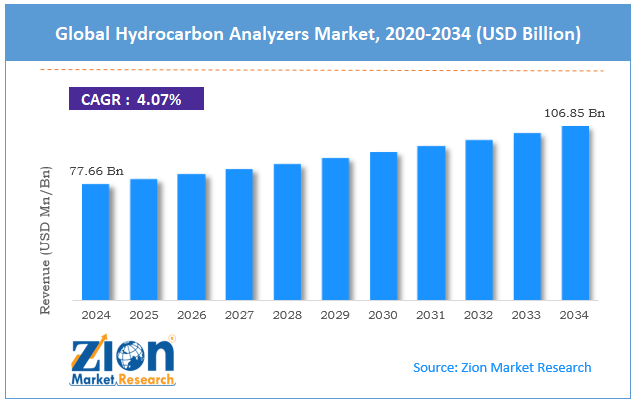

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 77.66 Billion | USD 106.85 Billion | 4.07% | 2024 |

Hydrocarbon Analyzers Industry Perspective:

The global hydrocarbon analyzers market size was worth around USD 77.66 billion in 2024 and is predicted to grow to around USD 106.85 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.07% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global hydrocarbon analyzers market is estimated to grow annually at a CAGR of around 4.07% over the forecast period (2025-2034)

- In terms of revenue, the global hydrocarbon analyzers market size was valued at around USD 77.66 billion in 2024 and is projected to reach USD 106.85 billion by 2034.

- The hydrocarbon analyzers market is projected to grow significantly due to increasing oil and gas exploration and production activities, the growing adoption of advanced analytical technologies, and the need for real-time and on-site hydrocarbon detection.

- Based on type, the aromatic segment is expected to lead the market, while the aliphatic segment is expected to grow considerably.

- Based on pharmaceuticals, the energy segment is the dominating segment, while the industrial segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Hydrocarbon Analyzers Market: Overview

Hydrocarbon analyzers are dedicated instruments that detect, measure, and analyze hydrocarbons in liquids, gases, and industrial emissions. They play a key role in petrochemical processing, environmental monitoring, and energy production by assuring regulatory compliance, enhancing safety, and advancing processes. The global hydrocarbon analyzers market is poised for notable growth due to increasing oil & gas production activities, a rising focus on industrial safety, and technological improvements. Expanding downstream and upstream operations, especially in the Middle East and North America, fuel the demand for hydrocarbon detection. Analyzers help optimize petrochemical and refinery processes. Real-time monitoring promises operational safety and efficiency.

Moreover, hydrocarbon analyzers prevent hazardous accidents and detect leaks in refineries, storage facilities, and chemical plants. Industries are actively investing in safety monitoring solutions to protect assets and employees. This emphasis is augmenting industry adoption worldwide. Furthermore, modern analyzers comprise online monitoring, portable devices, and high-sensitivity detection techniques like NDIR, GC, and FID. These advancements reduce response time and improve accuracy. Companies adopting modernized solutions gain a competitive benefit.

Nevertheless, the global market faces limitations due to factors such as complex maintenance requirements, the need for a skilled workforce, and interference from other gases. Analyzers need frequent calibration, technical maintenance, and cleaning to maintain accuracy. Downtime during servicing may impact industrial operations. Maintenance adds to the overall ownership cost. Operating analyzers and interpreting results demand proficient and trained personnel. Industries in regions with limited expertise face difficulties in adopting new technologies. Workforce restrictions may hamper broader deployment.

Also, some analyzers may offer inaccurate readings because of interference from other chemical compounds in the environment. This decreases reliability for accurate monitoring. Industries may need extra calibration or equipment. Still, the global hydrocarbon analyzers industry benefits from several favorable factors, such as adoption in the renewable energy sector, the development of compact and portable analyzers, and integration with IoT & cloud solutions. Alternative hydrocarbon-based fuels and biofuels are gaining prominence worldwide. Analyzers are required for emission analysis and quality monitoring. The renewable energy industry opens fresh avenues for hydrocarbon detection solutions.

Furthermore, the demand is surging for user-friendly and portable analyzers ideal for emergency monitoring and field operations. Compact designs reduce installation complexity and operational costs. Manufacturers can tap into on-site inspection sectors. Also, smart analyzers offering remote access, real-time reporting, and predictive analytics fuel industrial automation. Cloud-enabled solutions improve data sharing, storage, and decision-making. This trend motivates new business models in monitoring services.

Hydrocarbon Analyzers Market Dynamics

Growth Drivers

How is the hydrocarbon analyzers market driven by the integration of online and real-time monitoring systems?

The move from manual sampling to continuous and online hydrocarbon monitoring is a key industry driver. Real-time analyzers enable instant detection of leaks, process deviations, or contamination, reducing losses and ecological risks. For example, ABB's Process Analytics Online Hydrocarbon Analyzer was recently adopted by many European refineries to mitigate operational risk, improve continuous monitoring, and lower maintenance costs. This trend aligns with digital initiatives in the chemical, oil, and gas industries, where IoT integration and predictive analytics improve process efficiency. The rising preference for online monitoring is driving the replacement of conventional analyzers.

How are technological improvements in analyzer equipment considerably fueling the hydrocarbon analyzers market?

Modern hydrocarbon analyzers now feature advanced technologies like GC-MS, PID, and FTIR, which offer faster response times and higher sensitivity. In 2024, Yokogawa launched its novel AQ6357 Portable Hydrocarbon Analyzer, capable of detecting trace hydrocarbons in real-time, underscoring the trend towards miniaturized yet highly accurate devices. These advancements enable operators to perform automated and continuous monitoring, decreasing human error and operational downtime. As industries adopt AI-powered and IoT-enabled analyzers, the hydrocarbon analyzers market has experienced accelerated growth.

Restraints

Maintenance issues and instrument downtime negatively impact the market progress

Hydrocarbon analyzers, especially high-precision and online models, need regular calibration, maintenance, and cleaning. According to the reports from 2024, unplanned downtime in analyzers may result in production losses of 2-5% in refineries, equivalent to millions in revenue every year. News from European refineries highlights instances where analyzer failures led to momentary shutdowns, affecting supply timelines. Frequent replacement and servicing of consumables like sensors and detectors add to operational pressure. These maintenance challenges substantially hamper the broader continuous deployment.

Opportunities

How is the increasing focus on safety and risk mitigation creating advantageous conditions for the development of the hydrocarbon analyzers market?

Industries are prioritizing process reliability and safety, creating demand for high-precision hydrocarbon analyzers. A 2024 report indicated that hydrocarbon leak detection systems can decrease mishap-associated losses by nearly 30%, incentivizing companies to upgrade monitoring infrastructure. Recent news reports that the United States refineries are actively investing in portable analyzers to comply with EPA and OSHA safety guidelines. Improved safety adoption is fueling recurring maintenance contracts and analyzer sales. Companies providing exhaustive solutions combining analytics and detection gain a competitive advantage, positively impacting the growth of the hydrocarbon analyzers industry.

Challenges

Volatility in oil & gas prices restricts the market growth

Varying crude oil prices notably impact petrochemical and refinery investments, which ultimately affect hydrocarbon analyzer demand. Oil prices varied between USD 6 and USD 90 per barrel in the first half of 2025, according to OPEC's 2025 report. Sudden price declines usually delay capital expenditure on analyzer installations. News reports indicate that many refineries are delaying analyzer upgrades due to budget cuts amidst low oil prices. This volatility creates uncertainty and limits long-term industry planning.

Hydrocarbon Analyzers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hydrocarbon Analyzers Market |

| Market Size in 2024 | USD 77.66 Billion |

| Market Forecast in 2034 | USD 106.85 Billion |

| Growth Rate | CAGR of 4.07% |

| Number of Pages | 217 |

| Key Companies Covered | ABB Ltd., Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Siemens AG, Thermo Fisher Scientific Inc., Rockwell Automation Inc., Mettler-Toledo International Inc., Parker Hannifin Corporation, AMETEK Inc., PerkinElmer Inc., Agilent Technologies Inc., Bruel & Kjaer, Applied Analytics Inc., Hach Company, and others. |

| Segments Covered | By Type, By Pharmaceuticals, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hydrocarbon Analyzers Market: Segmentation

The global hydrocarbon analyzers market is segmented based on type, pharmaceuticals, and region.

Based on type, the global hydrocarbon analyzers industry is divided into aliphatic, aromatic, and application. The aromatic segment registers a substantial share of the market because of its crucial role in detecting BTEX compounds like xylene, ethylbenzene, and toluene, which are common in industrial and petrochemical emissions. These compounds are highly regulated because of their environmental impact and toxicity, fueling the demand for precise monitoring solutions. Aromatic analyzers are extensively used in chemical plants, refineries, and environmental monitoring stations to ensure compliance. Their high sensitivity and accuracy make them an ideal choice for industries prioritizing regulatory and safety adherence.

On the other hand, the aliphatic segment held a second-leading rank in the market since it is largely used for measuring saturated hydrocarbons like propane, butane, and ethane. These analyzers are vital for process optimization, fuel quality monitoring, and energy efficiency in the oil & gas, chemical industries, and petrochemical sectors. Adoption is rising because of the role of these technologies in emissions control, operational safety, and leak detection. The segment benefits from the growing demand for real-time monitoring in both downstream and upstream operations, as well as surging industrialization.

Based on pharmaceuticals, the global hydrocarbon analyzers market is segmented into energy, industrial, mobility, and others. The energy segment holds a dominating share of the market because of its broader use in power generation, oil & gas, and refinery operations. Hydrocarbon analyzers are vital for optimizing combustion, monitoring emissions, and ensuring safety in these high-risk environments. Strict environmental regulations and the need for process efficacy further drive adoption in this domain. Real-time monitoring capabilities make analyzers paramount for maintaining regulatory compliance and operational continuity in energy facilities.

Conversely, the industrial segment holds a second position in the market, encompassing petrochemical processing, chemical manufacturing, and other manufacturing units. Hydrocarbon analyzers help detect leaks, monitor VOC emissions, and ensure quality control in industrial operations. Rising industrialization, mainly in the Middle East and the Asia Pacific, fuels the market demand. Process optimization, safety standards, and sustainability initiatives motivate industries to invest in reliable analyzers.

Hydrocarbon Analyzers Market: Regional Analysis

What gives North America a competitive edge in the global Hydrocarbon Analyzers Market?

North America is projected to maintain its dominant position in the global hydrocarbon analyzers market owing to the strong oil & gas industry presence, strict environmental norms, and advanced industrial infrastructure. North America, especially Canada and the United States, houses a large number of downstream and upstream oil & gas operations.

In 2024, the United States generated more than 11 million barrels of crude oil per day, fueling the demand for hydrocarbon analyzers in petrochemical plants and refineries. Real-time monitoring promises operational efficiency, regulatory compliance, and leak detection in these high-output facilities. Regulatory bodies like the EPA enforce stringent VOC and hydrocarbon emission norms in the energy and industrial sectors. Companies should continuously monitor emissions to avoid penalties, creating significant demand for precise hydrocarbon analyzers. Compliance initiatives also propel the adoption of advanced analyzers with real-time data reporting.

Additionally, North America holds a well-developed industrial infrastructure with mature refineries, energy facilities, and chemical plants. These facilities usually need integrated monitoring systems, comprising hydrocarbon analyzers, for process safety and optimization. Advanced infrastructure allows easy deployment and scaling of monitoring solutions.

Europe maintains its position as the second-leading region in the global hydrocarbon analyzers industry due to the well-developed oil & gas petrochemical industries, adoption of advanced industrial technologies, and rising focus on workplace and safety standards. Europe houses a well-developed oil & gas industry, especially in economies like the Netherlands, Norway, and the UK, along with large petrochemical hubs in Belgium and Germany. Hydrocarbon analyzers are extensively used in chemical plants and refineries for process optimization, safety monitoring, and leak detection. The stable industrial base promises continuous demand for improved analyzers.

Moreover, European industries focus smart tracking, automation, and IoT-enabled systems. Hydrocarbon analyzers integrated with industrial automation enhance real-time predictive maintenance and data tracking. This technological adoption augments industry development than the regions with less-digitalized industrial infrastructure.

Furthermore, strict European workplace safety regulations and industrial standards need precise monitoring of hazardous and flammable hydrocarbons. Companies deploy analyzers to prevent accidents, assure employee safety, and maintain regulatory and insurance compliance. This awareness fuels sustained adoption of reliable monitoring solutions.

Hydrocarbon Analyzers Market: Competitive Analysis

The leading players in the global hydrocarbon analyzers market are:

- ABB Ltd.

- Emerson Electric Co.

- Honeywell International Inc.

- Yokogawa Electric Corporation

- Siemens AG

- Thermo Fisher Scientific Inc.

- Rockwell Automation Inc.

- Mettler-Toledo International Inc.

- Parker Hannifin Corporation

- AMETEK Inc.

- PerkinElmer Inc.

- Agilent Technologies Inc.

- Bruel & Kjaer

- Applied Analytics Inc.

- Hach Company

Hydrocarbon Analyzers Market: Key Market Trends

Development of compact and portable analyzers:

There is a rising demand for lightweight, portable, and user-friendly hydrocarbon analyzers for emergency applications and field inspections. These compact devices offer speedy measurements without needing complex installation. They allow on-site monitoring in chemical plants, refineries, and environmental assessments, growing industry accessibility.

Adoption of advanced detection techniques:

Technological advancements like gas chromatography (GC), non-dispersive infrared (NDIR), and flame ionization detection methods enhance detection precision, speed, and sensitivity. Industries prefer analyzers with improved methods for precise monitoring in complex environmental processes, assuring process efficiency and safety.

The global hydrocarbon analyzers market is segmented as follows:

By Type

- Aliphatic

- Aromatic

- Application

By Pharmaceuticals

- Energy

- Industrial

- Mobility

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Hydrocarbon analyzers are dedicated instruments that detect, measure, and analyze hydrocarbons in liquids, gases, and industrial emissions. They play a key role in petrochemical processing, environmental monitoring, and energy production by assuring regulatory compliance, enhancing safety, and advancing processes.

The global hydrocarbon analyzers market is projected to grow due to escalating demand for environmental monitoring and emissions control, strict government regulations on air quality and industrial emissions, and technological advancements in sensor and analyzer systems.

According to study, the global hydrocarbon analyzers market size was worth around USD 77.66 billion in 2024 and is predicted to grow to around USD 106.85 billion by 2034.

The CAGR value of the hydrocarbon analyzers market is expected to be around 4.07% during 2025-2034.

The value chain of the global hydrocarbon analyzers industry includes component manufacturing, raw material sourcing, distribution and sales, analyzer assembly, and after-sales service & support.

Stringent environmental regulations on VOCs and hydrocarbon emissions, global sustainability initiatives, and workplace safety standards are key factors affecting market growth.

The energy segment holds a leading share because hydrocarbon analyzers are extensively used in power generation, oil & gas, and refinery operations for process optimization, emission monitoring, and safety compliance.

North America is expected to lead the global hydrocarbon analyzers market during the forecast period.

The key players profiled in the global hydrocarbon analyzers market include ABB Ltd., Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Siemens AG, Thermo Fisher Scientific Inc., Rockwell Automation, Inc., Mettler-Toledo International Inc., Parker Hannifin Corporation, AMETEK, Inc., PerkinElmer, Inc., Agilent Technologies, Inc., Bruel & Kjaer, Applied Analytics, Inc., and Hach Company.

The report examines key aspects of the hydrocarbon analyzers market, providing a detailed analysis of current growth factors and restraints, along with future opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed