High Temperature Resistance Market Size, Growth, Global Trends, Forecast 2034

High Temperature Resistance Market By Type (High-Temperature Coatings, High-Temperature Polymers, High-Temperature Insulation Materials, High-Temperature Alloys, and High-Temperature Ceramics), By Application (Aerospace, Automotive, Industrial Equipment, Electronics, Energy and Power Generation, Construction, Oil and Gas and Military, and Defense), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

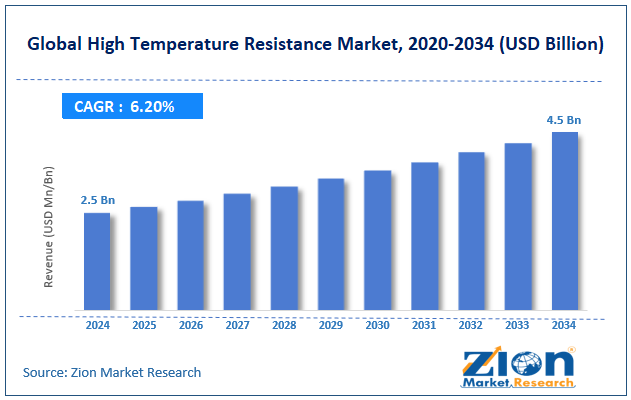

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.5 Billion | USD 4.5 Billion | 6.20% | 2024 |

High Temperature Resistance Industry Perspective:

The global high temperature resistance market size was worth around USD 2.5 billion in 2024 and is predicted to grow to around USD 4.5 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.2% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global high temperature resistance market is estimated to grow annually at a CAGR of around 6.2% over the forecast period (2025-2034).

- In terms of revenue, the global high temperature resistance market size was valued at around USD 2.5 billion in 2024 and is projected to reach USD 4.5 billion by 2034.

- The growing adoption of EVs globally is expected to drive the high temperature resistance market over the forecast period.

- Based on the type, the high-temperature coatings segment is expected to capture the largest market share over the projected period.

- Based on the application, the aerospace segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

High Temperature Resistance Market: Overview

When a material is exposed to high temperatures, it can still retain its basic technical, mechanical, and chemical properties. This is called high temperature resistance. This means that the material can handle very high temperatures without melting, burning, breaking down, or losing its strength, elasticity, hardness, or structural integrity. When the temperature is high enough, the properties of each substance change so much that it can no longer be used or is destroyed. This is an essential factor to consider when selecting materials for applications such as sealing technology, aerospace, furnace linings, or industrial objects that will be subjected to high temperatures, flames, or friction. Materials that can endure high temperatures remain robust, chemically stable, and thermally stable (resistant to changes in shape or size) even after prolonged exposure to heat. Some examples are refractory metals that melt at temperatures above 2000°C and composite materials made with stable fibers and matrix components that work well in very hot and very cold weather.

In general, high-temperature resistance is a material's ability to withstand the effects of heat and continue to perform well in challenging situations where heat is a significant problem.

High Temperature Resistance Market Dynamics

Growth Drivers

How does the expansion of aerospace & defense industries drive the high temperature resistance market growth?

The aerospace and military industries are growing, mainly because they need better high-temperature-resistant materials and alloys for harsh operating conditions. Jet engines, turbine blades, spacecraft components, hypersonic aircraft, missile systems, and armored vehicles all require materials that can withstand extreme temperatures, thermal stress, and oxidation. Nickel-based superalloys, ceramic matrix composites, refractory metals, and high-temperature polymers are continually being improved and adopted because people want materials that are lightweight, fuel-efficient, and durable. More people flying around the world, more money spent on the military, and discoveries in space exploration and hypersonic flight all underscore the need for materials that remain strong and stable at high temperatures.

Also, strict rules in the aerospace and military industries push producers to develop high-performance alloys and to develop new ways to make things, such as additive manufacturing and 3D printing of superalloys, which improve performance and efficiency. For instance, as per the data published by ITA, civil aviation is one of the fastest-growing sectors in India. India is projected to have more than 500 million domestic and international air travelers by 2030 and has the potential to become the world’s leading aviation market by 2047.

Restraints

High production cost impede market growth

High production costs are a significant obstacle to the high temperature resistance market growth because raw materials such as nickel, cobalt, and titanium, used in high-temperature-resistant materials, are costly. Producing these materials requires substantial energy, significantly increasing production costs. In addition, the prices of raw materials can change quickly, and supply chain issues may arise, especially for crucial metals sourced from countries with uncertain politics. This makes it hard to anticipate prices and availability.

Complex fabrication procedures, stringent industry testing and certification requirements (particularly in aerospace and defense), and the necessity for trained labor drive up overall production costs. These high prices limit general acceptance and scalability, particularly for smaller producers, and serve as hurdles to market entry and expansion. Environmental regulations requiring energy-efficient and low-emission manufacturing processes impose additional financial pressures on manufacturers.

Opportunities

Do the rising innovative product launches offer an opportunity for the high temperature resistance industry growth?

The increasing innovative product launch is expected to offer a potential opportunity to the high temperature resistance industry over the analysis period. For instance, in November 2025, at Formnext 2025 (Hall 11.0, booth C73) and Space Tech Expo (booth 602), TANIOBIS GmbH, a German materials manufacturer, will showcase its newest niobium alloy powders for high-temperature aerospace applications.

The company's niobium-based alloys were explicitly developed for additive manufacturing (AM) and are designed to remain mechanically stable at temperatures above 1,000°C. This makes them suitable for propulsion and thermal-protection components. As the aerospace industry worldwide focuses on secure, regionalized supply chains, niobium alloy powders offer a way to create lightweight, heat-resistant gear while using simpler machining methods and materials that take longer to arrive.

Challenges

Why does the lack of awareness pose a major challenge to the high temperature resistance market expansion?

A lack of knowledge in developing countries is a significant obstacle to the growth of the market for high-temperature-resistant materials. This is because it makes it harder for people to accept these materials, for technology to proliferate, and for businesses to invest in these sectors. When companies and people interested in growing markets don't know about the latest high-performance materials or how they can help, they tend to stick with older, less modern, and often cheaper solutions. This implies that the market takes longer to catch up, leading to lower demand and, in turn, less funding for the research, infrastructure, and training needed to deploy high-temperature materials on a large scale.

Local producers also can't make custom solutions, follow best practices, or satisfy stricter global requirements because they don't know about them. It also prevents industries from exploring novel uses for high-temperature materials in fields like aerospace, automotive, and energy, where they could improve performance and efficiency. Because of this lack of knowledge, consumers often have to buy from established markets, which drives up prices and makes the high temperature resistance market less competitive overall.

High Temperature Resistance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Temperature Resistance Market |

| Market Size in 2024 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 4.5 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 216 |

| Key Companies Covered | Caterpillar, Komatsu, Volvo Construction Equipment, Hyundai Construction Equipment / HD Hyundai Infracore, JCB, Hitachi Construction Machinery, CNH Industrial, SANY, Kobelco Construction Machinery, Bobcat, Terex, Wacker Neuson, Manitou Group, Yanmar, XCMG, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Temperature Resistance Market: Segmentation

The global high temperature resistance industry is segmented based on type, application, and region.

Based on the type, the global high temperature resistance market is bifurcated into high-temperature coatings, high-temperature polymers, high-temperature insulation materials, high-temperature alloys, and high-temperature ceramics. The high-temperature coatings segment is expected to capture the largest market share over the projected period. Increased industrial activity across sectors such as aerospace, automotive, petrochemicals, power generation, and manufacturing increases demand for high-temperature coatings. These coatings protect essential components from high temperatures, corrosion, and wear, extending equipment life and operating reliability.

Based on the application, the global high temperature resistance industry is bifurcated into aerospace, automotive, industrial equipment, electronics, energy and power generation, construction, oil and gas, and military and defense. The aerospace segment holds the major market share. The growing global need for commercial and military aircraft, including new aircraft programs and retrofitting older fleets, requires the development of high-performance, high-temperature coatings and materials to protect turbine engines, exhaust systems, and structural parts from extreme temperatures and oxidation.

High Temperature Resistance Market: Regional Analysis

Why does North America dominate the high temperature resistance market over the projected period?

The North America region is expected to dominate the high temperature resistance market. North America, especially the United States, has a strong industrial base that includes the aerospace, automotive, energy, electronics, and construction industries. These fields need advanced materials and coatings that can withstand high temperatures to improve performance, extend lifespan, and enhance safety under harsh conditions.

The area also benefits from ongoing research and development and new ideas in high-performance materials, such as polymers, composites, and coatings. This involves making eco-friendly, water-based, and thermal barrier coatings that meet strict environmental regulations and improve performance. Also, investments in renewable energy infrastructure and environmentally friendly business practices are driving demand for heat-resistant materials for wind turbines, solar panels, and energy storage.

High Temperature Resistance Market: Competitive Analysis

The global high temperature resistance market is dominated by players like:

- 3M

- Saint-Gobain

- DuPont de Nemours Inc.

- Honeywell International Inc.

- Morgan Advanced Materials

- RHI Magnesita

- Pyrotek Inc.

- ZIRCAR Ceramics Inc.

- Unifrax Corporation

- Ibiden Co. Ltd.

- Luyang Energy-Saving Materials Co. Ltd.

- Kyocera Corporation

- ANH Refractories Company

- Isolite Insulating Products Co. Ltd.

- and Mitsubishi Chemical Corporation

The global high temperature resistance market is segmented as follows:

By Type

- High-Temperature Coatings

- High-Temperature Polymers

- High-Temperature Insulation Materials

- High-Temperature Alloys

- High-Temperature Ceramics

By Application

- Aerospace

- Automotive

- Industrial Equipment

- Electronics

- Energy and Power Generation

- Construction

- Oil and Gas

- Military and Defense

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

When a material is exposed to high temperatures, it can still retain its basic technical, mechanical, and chemical properties. This is called high temperature resistance. This means that the material can handle very high temperatures without melting, burning, breaking down, or losing its strength, elasticity, hardness, or structural integrity.

The high temperature resistance market is being driven by several factors, including the expansion of aerospace & defense industries, growth of automotive & Electric Vehicle (EV) manufacturing, rising adoption of industrial furnaces & high-heat processing, surge in renewable energy technologies, electronics & semiconductor miniaturization, and growth in chemical, oil & gas, and petrochemical industries.

The high production cost and complex manufacturing process pose a major challenge to the high-temperature resistance industry expansion.

Based on the type, the high-temperature coatings segment is expected to dominate the high temperature resistance market growth during the projected period.

The growing investment in advanced technology poses a major impact factor for the high temperature resistance industry's growth over the projected period.

According to the report, the global high temperature resistance market size was worth around USD 2.5 billion in 2024 and is predicted to grow to around USD 4.5 billion by 2034.

The global high temperature resistance market is expected to grow at a CAGR of 6.2% during the forecast period.

The global high temperature resistance industry growth is expected to be driven by the North America region. It is currently the world’s highest-revenue-generating market, driven by a robust industrial base and technological innovation.

The global high temperature resistance market is dominated by players like 3M, Saint-Gobain, DuPont de Nemours Inc., Honeywell International Inc., Morgan Advanced Materials, RHI Magnesita, Pyrotek Inc., ZIRCAR Ceramics Inc., Unifrax Corporation, Ibiden Co. Ltd., Luyang Energy-Saving Materials Co. Ltd., Kyocera Corporation, ANH Refractories Company, Isolite Insulating Products Co. Ltd., and Mitsubishi Chemical Corporation, among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed